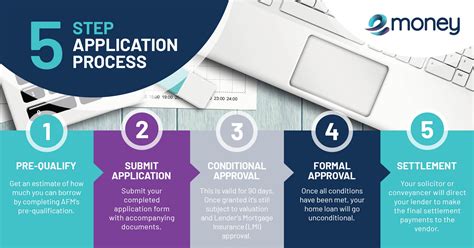

5 Steps to Mortgage Approval

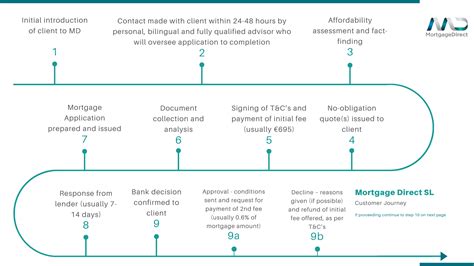

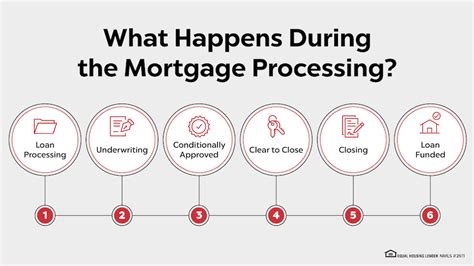

Understanding the Mortgage Approval Process

The mortgage approval process can be complex and overwhelming, especially for first-time homebuyers. However, breaking down the process into manageable steps can make it easier to navigate. In this article, we will explore the 5 key steps to mortgage approval, providing you with a clear understanding of what to expect and how to prepare.

Step 1: Checking Your Credit Score

Your credit score plays a significant role in determining your eligibility for a mortgage. Lenders use credit scores to assess the risk of lending to you, and a good credit score can help you qualify for better interest rates. To check your credit score, you can: * Request a free credit report from the three major credit reporting agencies (Experian, TransUnion, and Equifax) * Use online credit scoring tools, such as Credit Karma or Credit Sesame * Review your credit report for errors or discrepancies and dispute them if necessary

Step 2: Gathering Financial Documents

To apply for a mortgage, you will need to provide various financial documents to your lender. These may include: * Pay stubs and W-2 forms to verify your income * Bank statements to show your savings and assets * Tax returns to demonstrate your financial stability * Identification documents, such as a driver’s license or passport * Proof of employment, such as a letter from your employer

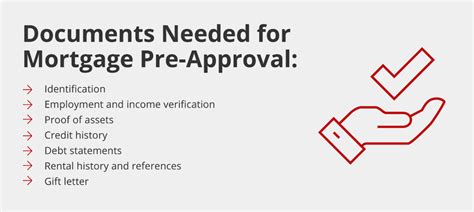

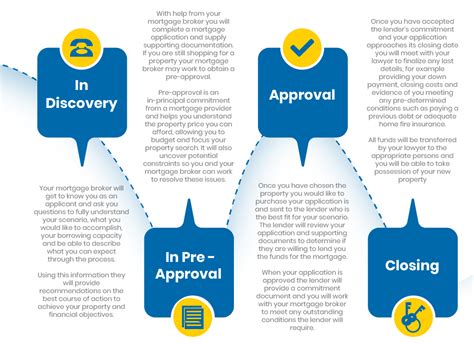

Step 3: Getting Pre-Approved for a Mortgage

Getting pre-approved for a mortgage can give you an edge when shopping for a home. Pre-approval involves a lender reviewing your financial information and providing a preliminary commitment to lend you a certain amount. To get pre-approved, you will need to: * Contact a lender and provide your financial documents * Discuss your mortgage options and choose a loan program * Receive a pre-approval letter stating the approved loan amount and interest rate

Step 4: Applying for a Mortgage

Once you have found a home and your offer has been accepted, you will need to submit a formal mortgage application. This will involve providing additional documentation, such as: * Appraisal reports to verify the value of the property * Title reports to ensure the property is free of liens and encumbrances * Inspection reports to identify any potential issues with the property * Finalized loan terms, including the interest rate and repayment schedule

Step 5: Closing the Deal

The final step in the mortgage approval process is closing the deal. This involves: * Reviewing and signing the final loan documents * Transferring the ownership of the property * Receiving the keys to your new home * Making your first mortgage payment, which may include setting up automatic payments

📝 Note: It's essential to carefully review your loan documents and ask questions if you're unsure about any aspect of the mortgage process.

In the end, securing a mortgage requires patience, persistence, and attention to detail. By following these 5 steps and staying informed throughout the process, you can increase your chances of success and make your dream of homeownership a reality. The mortgage approval process may seem daunting, but with the right guidance and preparation, you can navigate it with confidence and achieve your goals.

What is the minimum credit score required for a mortgage?

+

The minimum credit score required for a mortgage varies depending on the lender and loan program. However, most lenders require a credit score of at least 620 for a conventional loan and 580 for an FHA loan.

How long does the mortgage approval process typically take?

+

The mortgage approval process can take anywhere from 30 to 60 days, depending on the complexity of the loan and the efficiency of the lender.

Can I get a mortgage with a low down payment?

+

Yes, there are several loan programs that allow for low down payments, such as FHA loans, VA loans, and USDA loans. Some conventional loan programs also offer low down payment options.