PPP Loan Paperwork Requirements

Introduction to PPP Loan Paperwork Requirements

The Paycheck Protection Program (PPP) is a loan program established by the US government to help small businesses and other eligible entities affected by the COVID-19 pandemic. The program is designed to provide forgivable loans to cover payroll costs, rent, utilities, and other expenses. To apply for a PPP loan, businesses must meet specific requirements and submit various documents. In this article, we will discuss the PPP loan paperwork requirements and provide guidance on the application process.

Eligibility Requirements

To be eligible for a PPP loan, businesses must meet certain requirements, including: * Being a small business, nonprofit organization, veterans organization, or tribal business with 500 or fewer employees * Being in operation on February 15, 2020 * Having paid employees or independent contractors * Having been affected by the COVID-19 pandemic

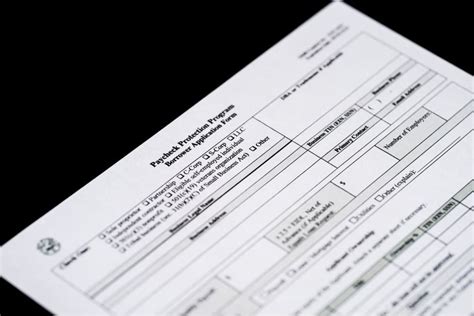

Required Documents

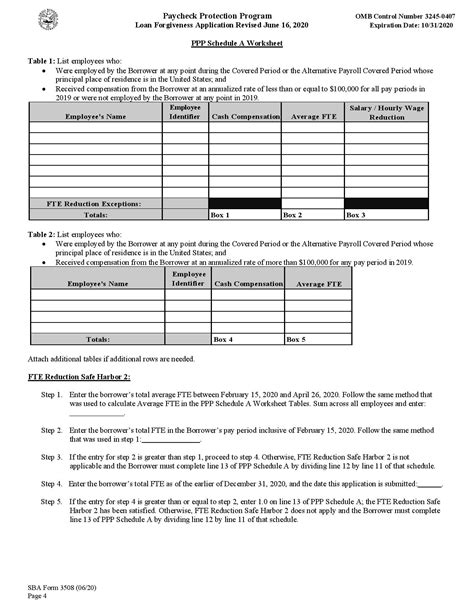

To apply for a PPP loan, businesses will need to submit the following documents: * Business license: A copy of the business license or certificate of good standing * Articles of incorporation: A copy of the articles of incorporation or organization * Payroll records: Payroll records for the past 12 months, including: + Payroll tax filings (Form 941) + Pay stubs + W-2 forms + Cancelled checks or bank statements * Identification documents: Identification documents for all owners with a 20% or greater ownership stake, including: + Driver’s license + Passport + Social Security card * Financial statements: Financial statements, including: + Balance sheet + Income statement + Cash flow statement

Additional Requirements

In addition to the required documents, businesses may need to provide additional information, including: * Number of employees: The number of employees on the payroll * Average monthly payroll costs: The average monthly payroll costs for the past 12 months * Business purpose: A statement describing the business purpose and how the loan funds will be used

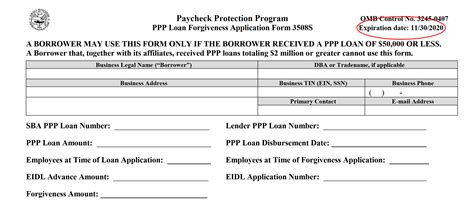

Application Process

The application process for a PPP loan involves the following steps: 1. Find a lender: Find a lender that is participating in the PPP program 2. Gather documents: Gather all required documents and information 3. Submit application: Submit the application and supporting documents to the lender 4. Review and approval: The lender will review the application and approve or deny the loan 5. Loan disbursement: If approved, the loan funds will be disbursed to the business

💡 Note: Businesses should carefully review the application and ensure that all information is accurate and complete to avoid delays or denial of the loan.

Forgiveness Requirements

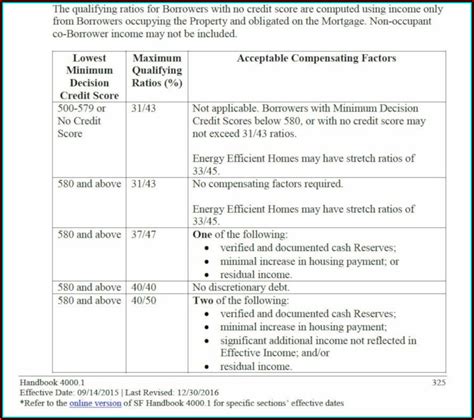

To be eligible for loan forgiveness, businesses must meet certain requirements, including: * Use of loan funds: Using at least 60% of the loan funds for payroll costs * Maintaining employees: Maintaining the same number of employees as before the pandemic * Payment of interest: Paying interest on the loan at a rate of 1%

Conclusion and Next Steps

In summary, the PPP loan paperwork requirements involve submitting various documents and information to demonstrate eligibility and need for the loan. Businesses should carefully review the application and ensure that all information is accurate and complete to avoid delays or denial of the loan. By following the steps outlined in this article, businesses can navigate the application process and take advantage of this valuable resource to support their operations during the pandemic.

What is the purpose of the PPP loan program?

+

The purpose of the PPP loan program is to provide forgivable loans to small businesses and other eligible entities to cover payroll costs, rent, utilities, and other expenses during the COVID-19 pandemic.

What are the eligibility requirements for a PPP loan?

+

To be eligible for a PPP loan, businesses must meet certain requirements, including being a small business, nonprofit organization, veterans organization, or tribal business with 500 or fewer employees, being in operation on February 15, 2020, having paid employees or independent contractors, and having been affected by the COVID-19 pandemic.

What documents are required to apply for a PPP loan?

+

To apply for a PPP loan, businesses will need to submit various documents, including business license, articles of incorporation, payroll records, identification documents, and financial statements.