5 Tax Papers

Understanding the Importance of Tax Papers

When it comes to managing finances, one of the most critical aspects is handling tax papers. Tax papers refer to the documents and forms required for filing tax returns, which include but are not limited to, income statements, expense reports, and tax deduction claims. These papers are essential for both individuals and businesses as they serve as proof of income, expenses, and tax payments. In this article, we will explore the five key tax papers that everyone should be aware of.

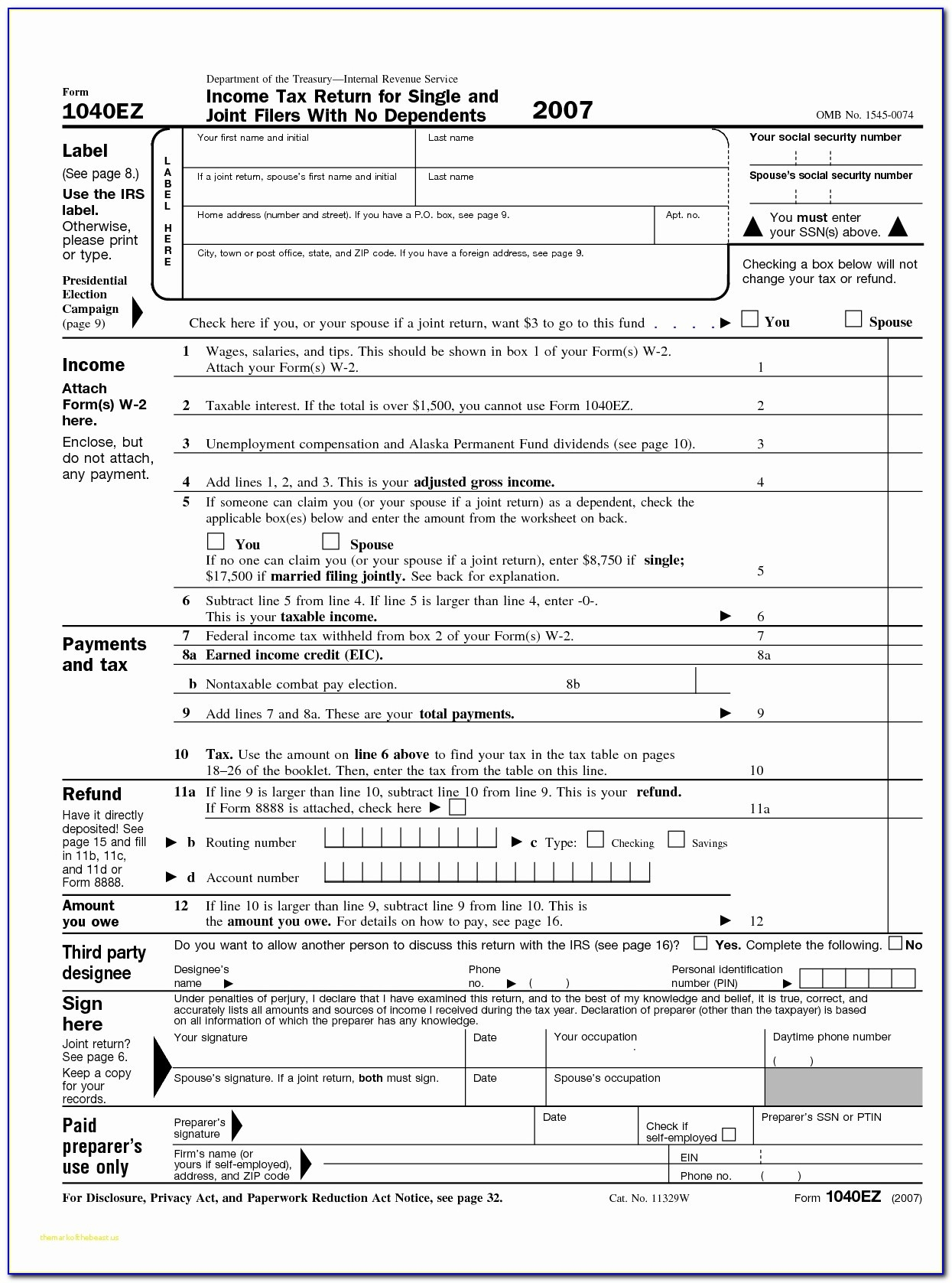

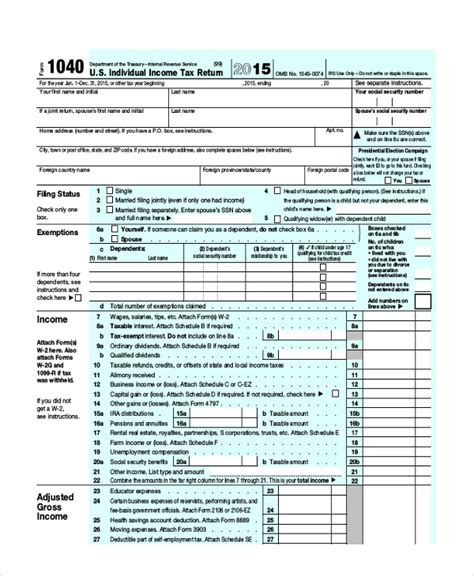

1. W-2 Form: Wage and Tax Statement

The W-2 form, also known as the Wage and Tax Statement, is a crucial tax paper issued by employers to their employees. This form provides details about the employee’s income and the amount of taxes withheld from their paycheck. The information included in the W-2 form is necessary for filing individual tax returns. Employees typically receive their W-2 forms by January 31st of each year, and it is essential to review the form carefully for any errors or discrepancies.

2. 1099 Form: Miscellaneous Income

The 1099 form is used to report miscellaneous income, such as freelance work, consulting fees, or rent income. This form is issued by the payer to the recipient, and it provides details about the amount of money paid and the type of income. There are various types of 1099 forms, including 1099-MISC, 1099-INT, and 1099-DIV, each serving a specific purpose. Individuals who receive 1099 forms must report the income on their tax returns and pay any applicable taxes.

3. Schedule C: Business Income and Expenses

Schedule C is a tax form used by self-employed individuals and small business owners to report their business income and expenses. This form is necessary for calculating the net profit or loss from a business, which is then reported on the individual’s tax return. Schedule C includes details about business income, cost of goods sold, operating expenses, and deductions. Accurate completion of Schedule C is crucial for ensuring compliance with tax laws and regulations.

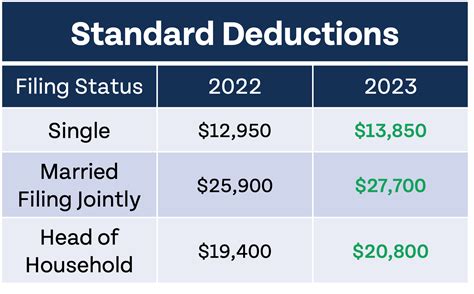

4. Form 1098: Mortgage Interest Statement

The Form 1098, also known as the Mortgage Interest Statement, is a tax paper issued by lenders to borrowers. This form provides details about the amount of mortgage interest paid during the tax year, which can be claimed as a tax deduction. Homeowners who itemize their deductions can use Form 1098 to claim the mortgage interest deduction, which can help reduce their taxable income.

5. Form 8606: Nondeductible IRAs and Coverdell ESAs

Form 8606 is used to report nondeductible contributions to Individual Retirement Accounts (IRAs) and Coverdell Education Savings Accounts (ESAs). This form is necessary for tracking the basis in these accounts, which can help avoid taxes on withdrawals. Individuals who make nondeductible contributions to IRAs or ESAs must file Form 8606 to report the contributions and calculate the taxable portion of withdrawals.

📝 Note: It is essential to maintain accurate and complete records of tax papers, as they can be requested by the tax authorities during audits or examinations.

To ensure compliance with tax laws and regulations, it is crucial to understand the different types of tax papers and their purposes. The five tax papers discussed in this article are essential for individuals and businesses, and their accurate completion can help avoid penalties and fines. By staying organized and maintaining complete records, taxpayers can ensure a smooth and efficient tax filing process.

In terms of organization, it is recommended to keep tax papers in a safe and secure location, such as a fireproof safe or a secure online storage service. This can help protect sensitive information and prevent loss or damage to important documents. Additionally, taxpayers can use tax software or consult with a tax professional to ensure accurate completion of tax forms and compliance with tax laws.

The following table summarizes the five tax papers discussed in this article:

| Tax Paper | Purpose |

|---|---|

| W-2 Form | Reports income and taxes withheld |

| 1099 Form | Reports miscellaneous income |

| Schedule C | Reports business income and expenses |

| Form 1098 | Reports mortgage interest paid |

| Form 8606 | Reports nondeductible IRA and ESA contributions |

By understanding the importance of tax papers and maintaining accurate records, taxpayers can ensure compliance with tax laws and regulations. It is essential to stay organized and seek professional help when needed to avoid penalties and fines.

In the end, managing tax papers effectively is crucial for individuals and businesses. By being aware of the different types of tax papers and their purposes, taxpayers can ensure a smooth and efficient tax filing process. Remember to keep tax papers in a safe and secure location, and consider using tax software or consulting with a tax professional to ensure accurate completion of tax forms.

What is the purpose of the W-2 form?

+

The W-2 form is used to report an employee’s income and the amount of taxes withheld from their paycheck.

What is the difference between a 1099 and a W-2?

+

A 1099 is used to report miscellaneous income, such as freelance work or rent income, while a W-2 is used to report income and taxes withheld from an employee’s paycheck.

What is the purpose of Schedule C?

+

Schedule C is used to report business income and expenses, and to calculate the net profit or loss from a business.