5 Mortgage Papers

Understanding the 5 Essential Mortgage Papers

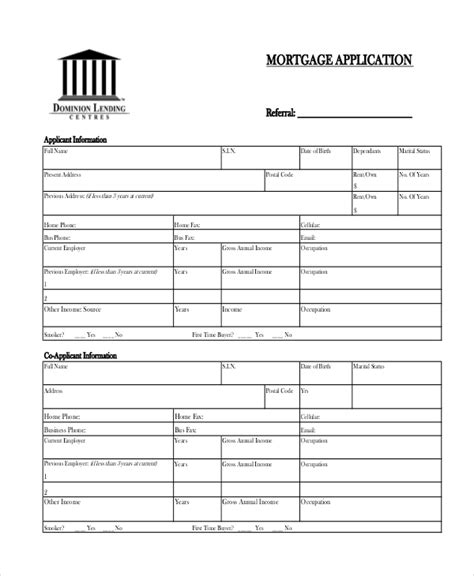

When navigating the process of purchasing a home, understanding the various mortgage papers involved is crucial. These documents are the foundation of the mortgage agreement between the borrower and the lender, outlining the terms, conditions, and obligations of both parties. The five essential mortgage papers include the Good Faith Estimate, Truth-in-Lending Disclosure, Loan Estimate, Closing Disclosure, and the Mortgage Note. Each of these documents plays a vital role in the mortgage process, providing transparency and clarity for borrowers.

The Good Faith Estimate

The Good Faith Estimate (GFE) is a document that lenders are required to provide to borrowers within three business days of receiving a mortgage application. It outlines the estimated costs associated with the mortgage, including the loan amount, interest rate, monthly payments, and closing costs. The GFE is designed to give borrowers a clear understanding of the mortgage terms and costs, allowing them to make informed decisions when comparing different loan offers. Although the GFE has been largely replaced by the Loan Estimate (LE) under the TRID rule, understanding its historical context and purpose is essential for appreciating the evolution of mortgage disclosure documents.

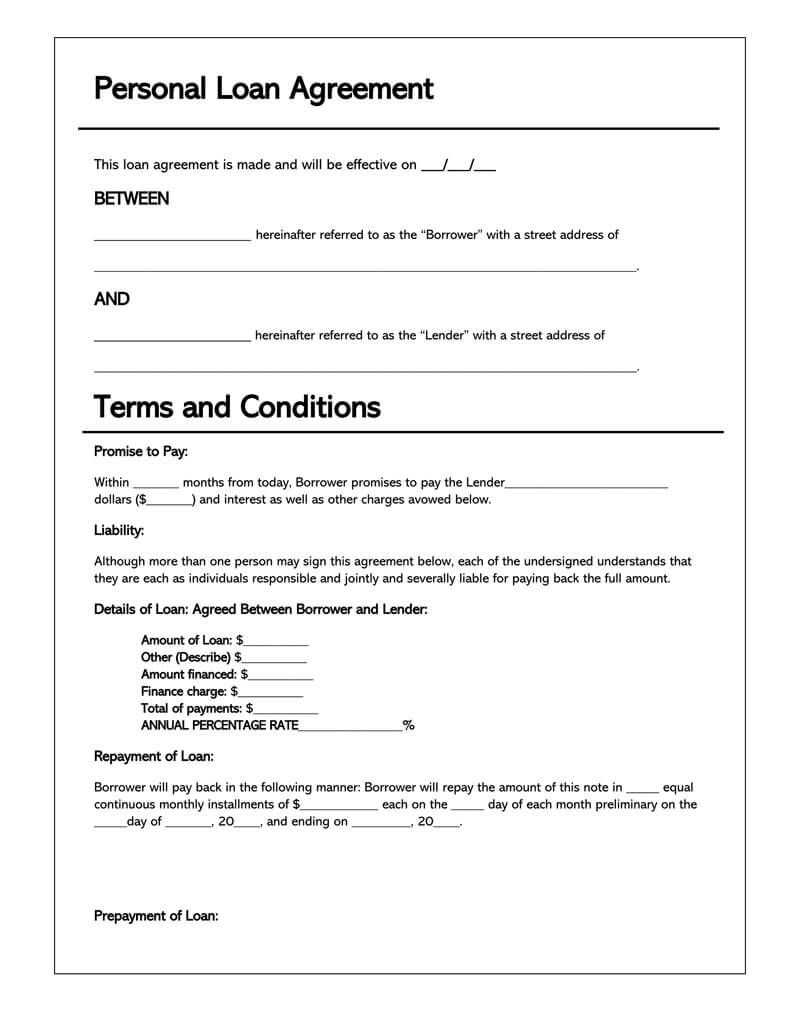

The Truth-in-Lending Disclosure

The Truth-in-Lending Disclosure (TIL) is another critical document that lenders must provide to borrowers. It details the Annual Percentage Rate (APR), the finance charge, the amount financed, and the total payments over the life of the loan. The TIL is designed to ensure that borrowers have a complete understanding of the loan’s terms and the total cost of the credit. This disclosure is mandatory under the Truth in Lending Act (TILA) and is typically provided alongside the Loan Estimate. The TIL helps borrowers understand the true cost of the loan, enabling them to make comparisons between different loan products.

The Loan Estimate

The Loan Estimate (LE) is a three-page document that replaced the Good Faith Estimate and the initial Truth-in-Lending Disclosure under the TRID rule. It provides a detailed overview of the loan terms, including the loan amount, interest rate, monthly payment, and closing costs. The LE must be delivered to the borrower within three business days of applying for the mortgage and is designed to give borrowers a clear and concise summary of the loan. One of the key features of the LE is its Loan Terms section, which outlines the loan type, loan term, and whether the interest rate can rise, among other details.

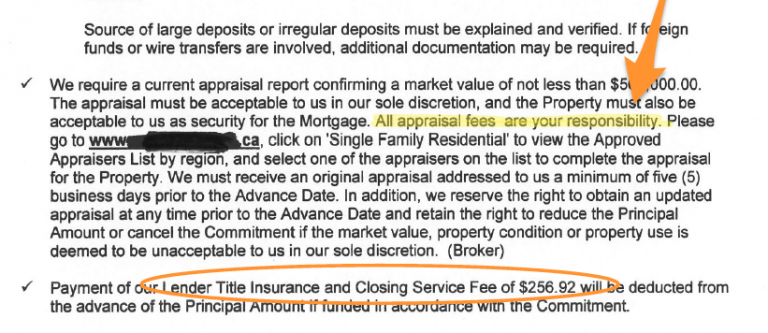

The Closing Disclosure

The Closing Disclosure (CD) is the final version of the loan documents, provided to the borrower at least three business days before the loan closing. It is a five-page document that summarizes the terms of the loan, the costs of the loan, and the borrower’s obligations. The CD includes information such as the loan amount, interest rate, monthly payments, and the total cost of the loan over its lifetime. It also details the closing costs, including all fees associated with the loan. The purpose of the CD is to ensure that the borrower has a complete understanding of the loan terms and costs before signing the loan documents.

The Mortgage Note

The Mortgage Note, also known as the promissory note, is a legal document that outlines the borrower’s promise to repay the loan. It includes the loan amount, interest rate, repayment terms, and the borrower’s obligations. The Mortgage Note is a critical component of the mortgage process, as it serves as the borrower’s contractual agreement to repay the loan according to the specified terms. The note is typically accompanied by a mortgage deed or deed of trust, which secures the loan by granting the lender a lien on the property.

| Document | Purpose | Timing |

|---|---|---|

| Good Faith Estimate | Estimates mortgage costs | Within 3 business days of application |

| Truth-in-Lending Disclosure | Details loan terms and costs | With Loan Estimate |

| Loan Estimate | Summarizes loan terms and costs | Within 3 business days of application |

| Closing Disclosure | Finalizes loan terms and costs | At least 3 business days before closing |

| Mortgage Note | Outlines borrower's repayment obligations | At closing |

📝 Note: Understanding these documents is crucial for borrowers to navigate the mortgage process effectively. It is essential to review each document carefully and ask questions if anything is unclear.

In wrapping up the discussion on the five essential mortgage papers, it’s clear that each document plays a vital role in the mortgage process. From the initial application to the final closing, these documents provide borrowers with the information they need to make informed decisions about their mortgage. By understanding the purpose and content of the Good Faith Estimate, Truth-in-Lending Disclosure, Loan Estimate, Closing Disclosure, and Mortgage Note, borrowers can better navigate the complexities of the mortgage process. This comprehensive understanding not only protects borrowers’ interests but also ensures that they are well-prepared for the responsibilities and obligations associated with homeownership.

What is the primary purpose of the Loan Estimate?

+

The primary purpose of the Loan Estimate is to provide borrowers with a detailed summary of the loan terms and costs, enabling them to make informed decisions when comparing different loan offers.

How does the Closing Disclosure differ from the Loan Estimate?

+

The Closing Disclosure is the final version of the loan documents, provided at least three business days before the loan closing, whereas the Loan Estimate is an initial disclosure provided within three business days of applying for the mortgage. The Closing Disclosure finalizes the loan terms and costs, reflecting any changes that may have occurred since the Loan Estimate was issued.

What information is included in the Mortgage Note?

+

The Mortgage Note includes the loan amount, interest rate, repayment terms, and the borrower’s obligations, serving as the borrower’s contractual agreement to repay the loan according to the specified terms.