Florida Home Buying Paperwork Needed

Introduction to Florida Home Buying

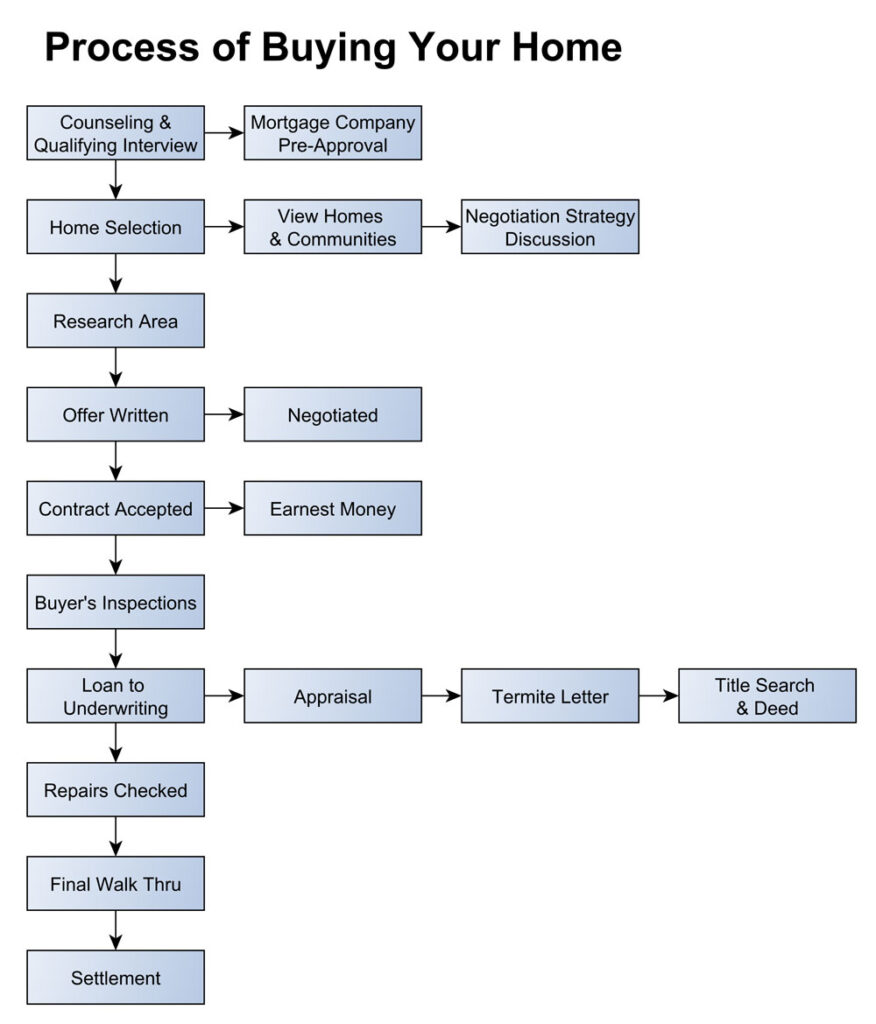

When purchasing a home in Florida, it’s essential to understand the various types of paperwork involved in the process. From pre-approval to closing, the journey can be overwhelming, especially for first-time homebuyers. In this article, we will delve into the necessary paperwork required for a smooth and successful home buying experience in the Sunshine State.

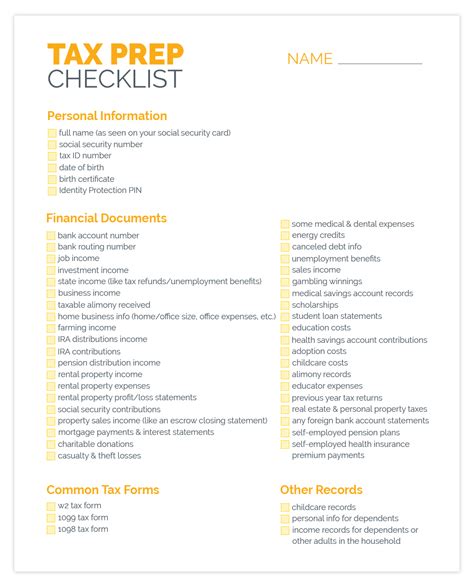

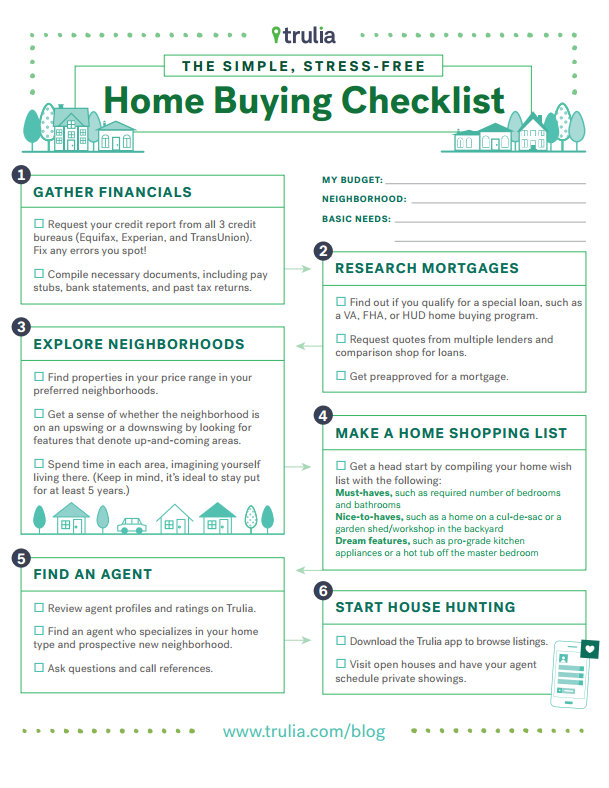

Pre-Approval Paperwork

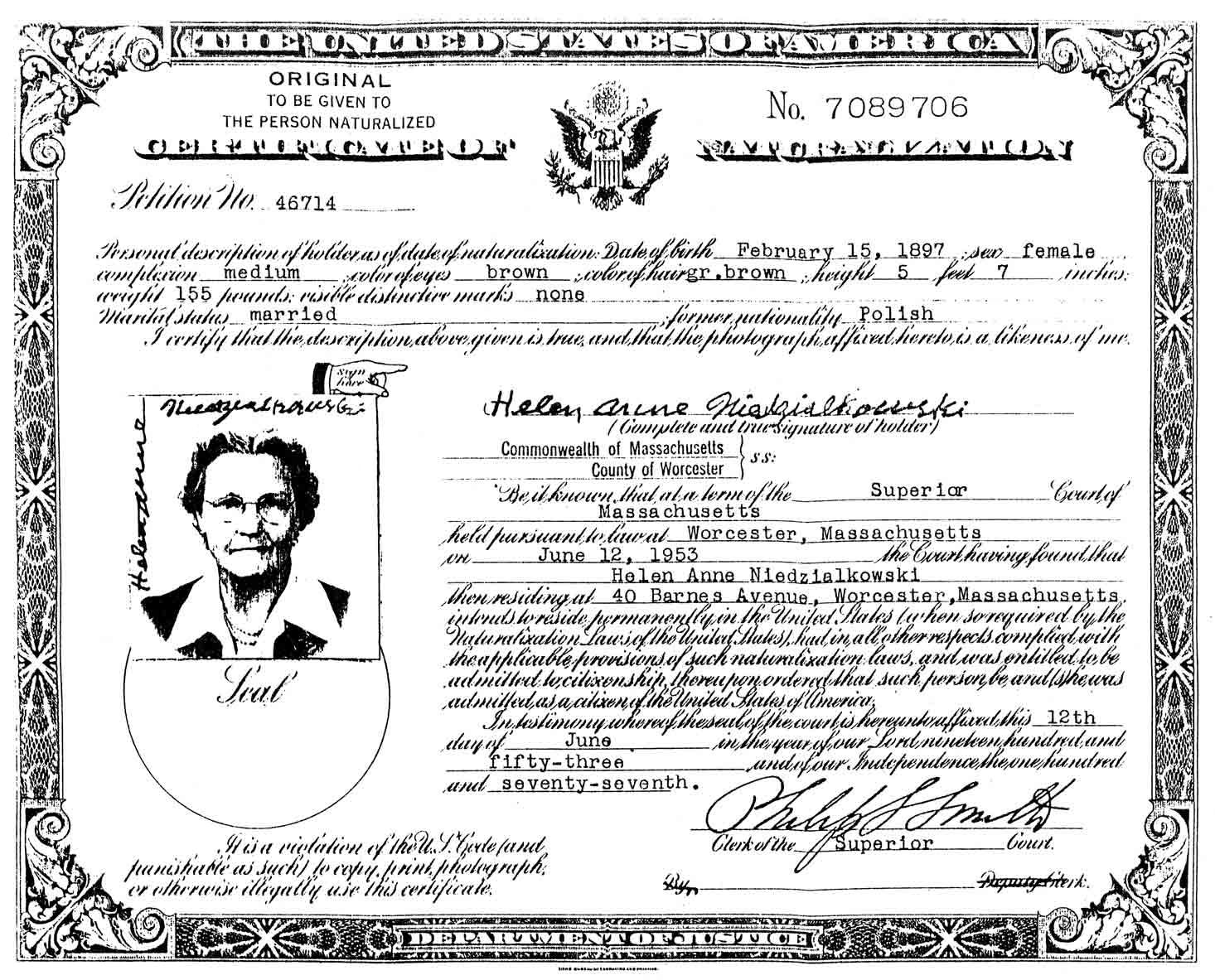

Before starting the home search, buyers need to get pre-approved for a mortgage. This step involves providing financial documents to a lender, who will then determine the buyer’s creditworthiness and ability to secure a loan. The necessary paperwork for pre-approval includes: * Identification documents: Driver’s license, passport, or state ID * Income verification: Pay stubs, W-2 forms, and tax returns * Bank statements: Recent statements showing account balances and transaction history * Credit reports: Reports from the three major credit bureaus (Equifax, Experian, and TransUnion)

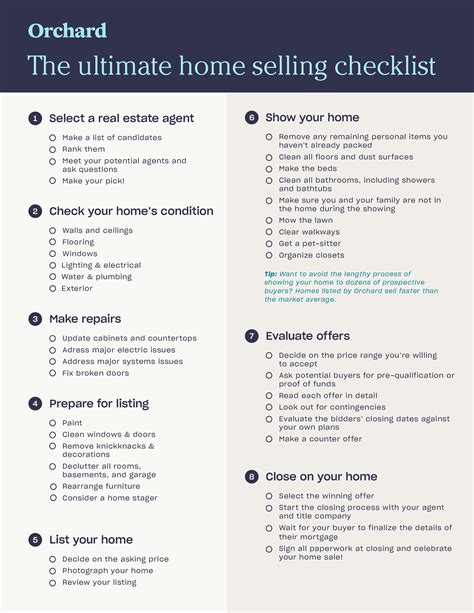

Offer and Acceptance Paperwork

Once a buyer finds their dream home, they’ll need to submit an offer to the seller. This involves drafting a purchase agreement, which outlines the terms of the sale, including the price, financing, and closing date. The necessary paperwork for this stage includes: * Purchase agreement: A document outlining the terms of the sale * Deposit receipt: A receipt for the earnest money deposit * Inspections and due diligence: Reports from home inspections, termite inspections, and other due diligence activities

Inspection and Due Diligence Paperwork

After the offer is accepted, the buyer will typically conduct various inspections to ensure the property is in good condition. The necessary paperwork for this stage includes: * Home inspection report: A report detailing the condition of the property * Termite inspection report: A report detailing any termite damage or activity * Environmental inspection reports: Reports detailing the presence of environmental hazards such as mold or lead-based paint

Financing Paperwork

To secure financing, buyers will need to provide additional documentation to their lender. The necessary paperwork for this stage includes: * Loan application: A detailed application outlining the buyer’s financial information * Appraisal report: A report detailing the value of the property * Title report: A report detailing the property’s ownership history and any liens or encumbrances

Closing Paperwork

The final stage of the home buying process involves closing, where the buyer and seller sign the necessary documents to transfer ownership. The necessary paperwork for this stage includes: * Deed: A document transferring ownership of the property * Mortgage note: A document outlining the terms of the loan * Property survey: A report detailing the property’s boundaries and any easements or encumbrances

📝 Note: It's essential to carefully review all paperwork and ask questions if you're unsure about any aspect of the process.

Additional Paperwork and Fees

In addition to the paperwork mentioned above, buyers should also be aware of the various fees associated with the home buying process. These fees can include: * Origination fees: Fees charged by the lender for processing the loan * Discount points: Fees paid to the lender to reduce the interest rate * Closing costs: Fees associated with the closing process, including title insurance and escrow fees * Property taxes: Annual taxes on the property, which can be paid through an escrow account

| Fee Type | Typical Cost |

|---|---|

| Origination fees | 0.5% - 1% of the loan amount |

| Discount points | 0.25% - 1% of the loan amount |

| Closing costs | 2% - 5% of the purchase price |

| Property taxes | Varying depending on the location and property value |

To ensure a smooth home buying experience, it’s crucial to work with a qualified real estate agent and lender who can guide you through the process and help you navigate the necessary paperwork.

In the end, purchasing a home in Florida requires a significant amount of paperwork and documentation. By understanding the various types of paperwork involved and being prepared, buyers can navigate the process with confidence and ensure a successful transaction. With the right guidance and support, you can find your dream home in the Sunshine State and enjoy all the benefits of homeownership.

What is the first step in the home buying process?

+

The first step in the home buying process is to get pre-approved for a mortgage. This involves providing financial documents to a lender, who will then determine the buyer’s creditworthiness and ability to secure a loan.

What is the purpose of a home inspection?

+

The purpose of a home inspection is to ensure the property is in good condition and to identify any potential issues or defects. This can include inspections for termite damage, mold, and other environmental hazards.

What are closing costs, and how much can I expect to pay?

+

Closing costs are fees associated with the closing process, including title insurance, escrow fees, and other expenses. The typical cost of closing costs can range from 2% to 5% of the purchase price.