Mobile Home Buying Paperwork Requirements

Introduction to Mobile Home Buying Paperwork

When purchasing a mobile home, it’s essential to understand the various paperwork requirements involved in the process. Mobile home buying can be a complex and time-consuming process, but being prepared with the necessary documents can help simplify the transaction. In this article, we will delve into the world of mobile home buying paperwork, exploring the different types of documents required and providing tips for a smooth buying experience.

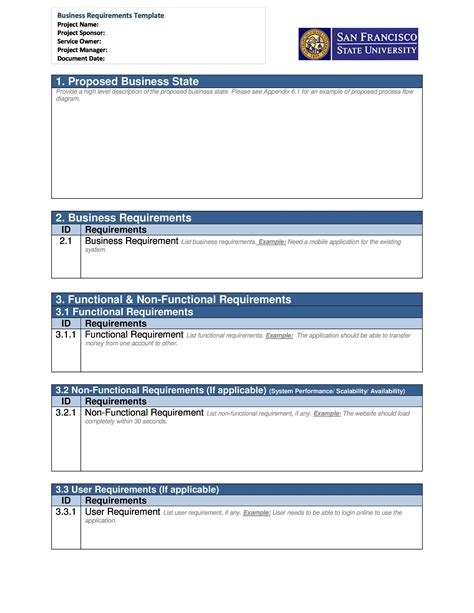

Pre-Purchase Paperwork

Before starting the mobile home buying process, it’s crucial to gather the necessary pre-purchase paperwork. This includes: * Identification documents: A valid government-issued ID, such as a driver’s license or passport, is required to verify the buyer’s identity. * Proof of income: Pay stubs, W-2 forms, or tax returns are needed to demonstrate the buyer’s income and ability to afford the mobile home. * Credit reports: A credit report is required to assess the buyer’s creditworthiness and determine the interest rate for the loan. * Bank statements: Recent bank statements are needed to verify the buyer’s savings and assets.

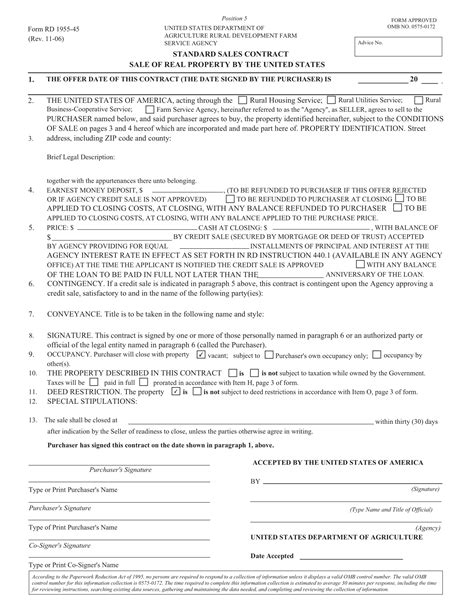

Purchase Agreement

The purchase agreement is a critical document in the mobile home buying process. It outlines the terms and conditions of the sale, including: * Purchase price: The agreed-upon price for the mobile home. * Financing terms: The details of the loan, including the interest rate, repayment terms, and any conditions. * Inspections and tests: The agreement may include provisions for inspections and tests to be conducted on the mobile home. * Warranties and guarantees: The manufacturer’s or seller’s warranties and guarantees for the mobile home.

Financing Paperwork

If the buyer is financing the mobile home purchase, additional paperwork is required. This includes: * Loan application: The buyer must submit a loan application, providing personal and financial information. * Loan approval: The lender will issue a loan approval, outlining the terms and conditions of the loan. * Loan documents: The buyer must sign and return the loan documents, which may include a promissory note and a security agreement.

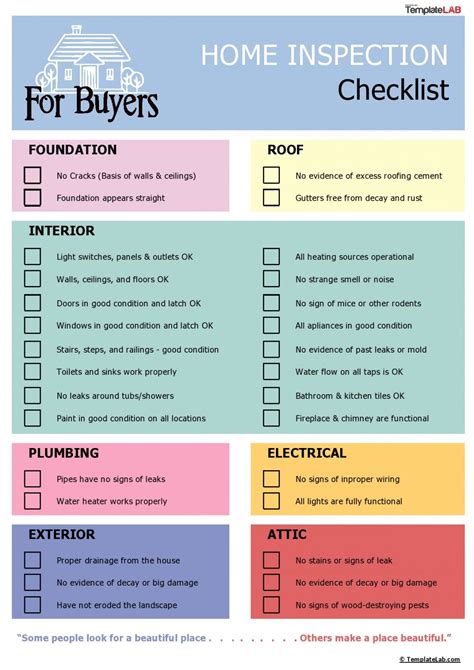

Inspections and Tests

As part of the purchase agreement, the buyer may request inspections and tests to be conducted on the mobile home. This can include: * Home inspection: A visual examination of the mobile home’s condition, including the roof, walls, floors, and systems. * Termite inspection: A inspection for termite damage and infestation. * Environmental tests: Tests for environmental hazards, such as lead-based paint or asbestos.

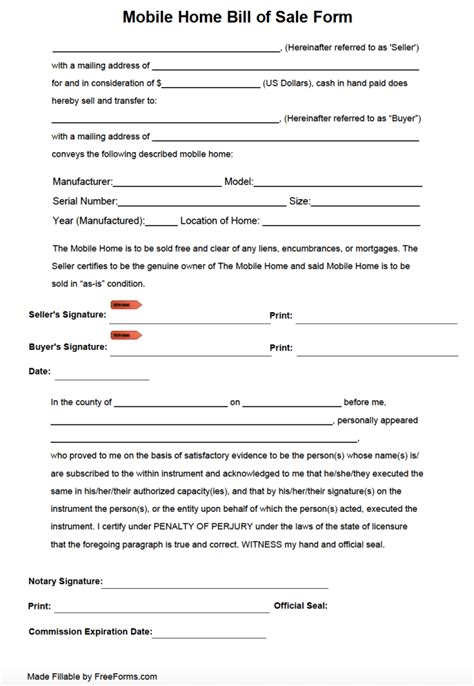

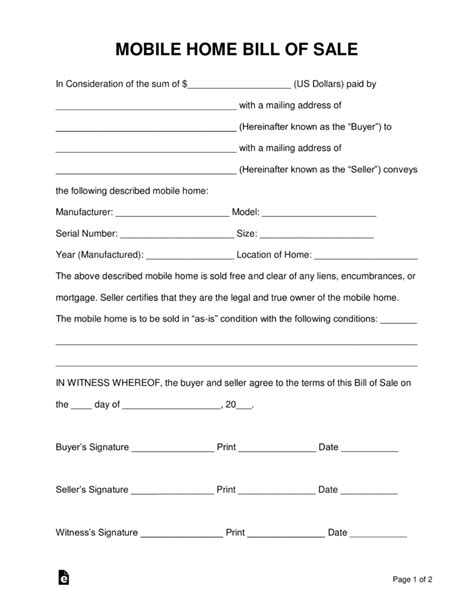

Closing Paperwork

At the closing, the buyer and seller will sign the final paperwork, transferring ownership of the mobile home. This includes: * Bill of sale: A document that transfers ownership of the mobile home from the seller to the buyer. * Title transfer: The transfer of the mobile home’s title from the seller to the buyer. * Loan documents: The buyer will sign and return the loan documents, which may include a promissory note and a security agreement.

💡 Note: It's essential to review and understand all the paperwork requirements before signing any documents.

Post-Purchase Paperwork

After the closing, the buyer will need to complete additional paperwork, including: * Registration: Registering the mobile home with the relevant state or local authorities. * Tax payments: Paying property taxes on the mobile home. * Insurance: Obtaining insurance coverage for the mobile home.

| Document | Description |

|---|---|

| Identification documents | Valid government-issued ID, such as a driver's license or passport |

| Proof of income | Pay stubs, W-2 forms, or tax returns |

| Credit reports | Credit report to assess creditworthiness |

| Bank statements | Recent bank statements to verify savings and assets |

In summary, the mobile home buying process involves a significant amount of paperwork, from pre-purchase documents to closing and post-purchase requirements. By understanding the different types of documents required, buyers can navigate the process with confidence and ensure a smooth transaction. It’s crucial to review and understand all the paperwork requirements before signing any documents, and to seek professional advice if needed.

What are the essential documents required for mobile home buying?

+

The essential documents required for mobile home buying include identification documents, proof of income, credit reports, and bank statements.

What is the purpose of the purchase agreement?

+

The purchase agreement outlines the terms and conditions of the sale, including the purchase price, financing terms, inspections, and warranties.

What is the difference between a bill of sale and a title transfer?

+

A bill of sale is a document that transfers ownership of the mobile home from the seller to the buyer, while a title transfer is the actual transfer of the mobile home’s title from the seller to the buyer.