Paperwork

Donate Car Paperwork Requirements

Introduction to Donating a Car

Donating a car to a charity can be a wonderful way to support a good cause and also receive a tax deduction. However, the process of donating a car involves several steps and requires various paperwork. In this article, we will guide you through the necessary paperwork requirements for donating a car.

Types of Paperwork Required

The types of paperwork required for donating a car may vary depending on the charity and the state in which you live. However, here are some of the common types of paperwork that you may need to complete:

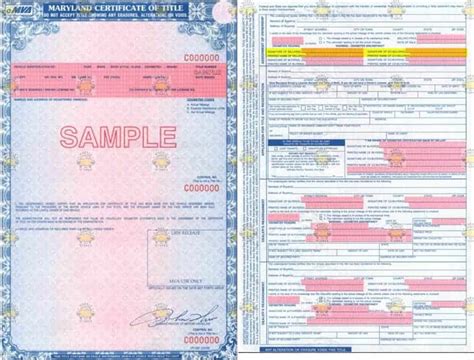

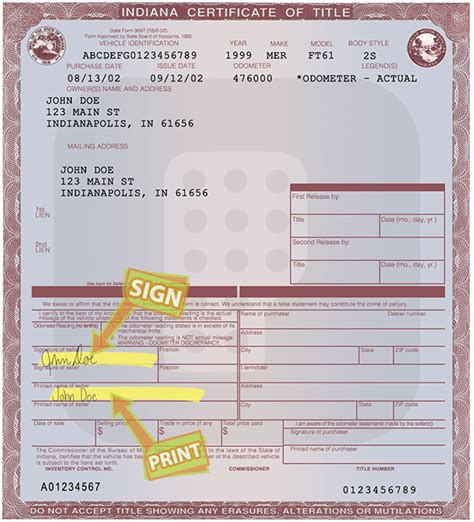

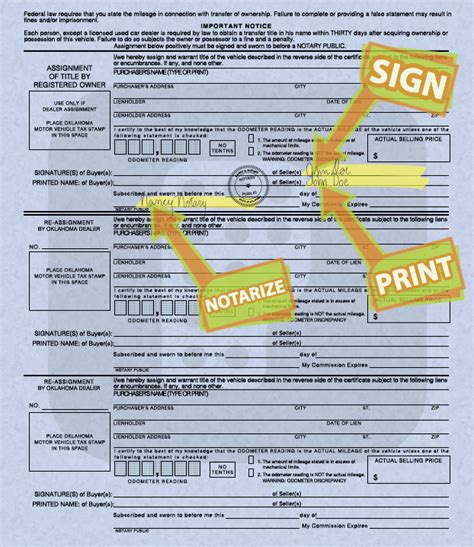

- Vehicle Title: You will need to provide the charity with the title to your vehicle, which proves ownership.

- Registration: You may need to provide the charity with a copy of your vehicle’s registration.

- Identification: You will need to provide a valid government-issued ID, such as a driver’s license or passport.

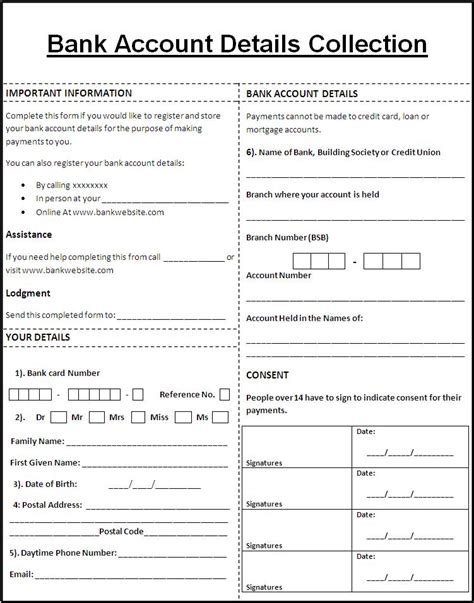

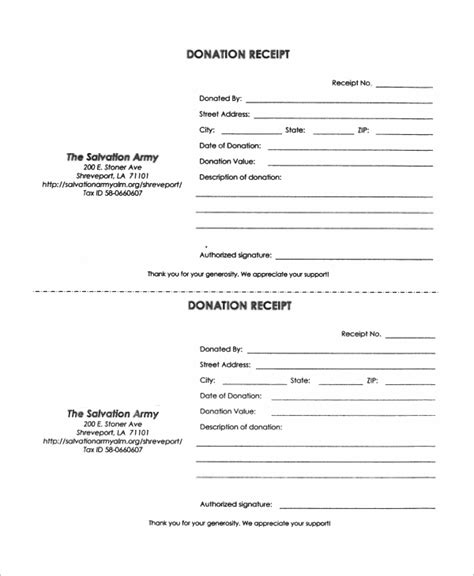

- Donation Agreement: The charity will provide you with a donation agreement, which outlines the terms of the donation.

Steps to Donate a Car

Here are the steps to follow when donating a car:

- Choose a Charity: Research and choose a reputable charity that accepts car donations.

- Gather Required Documents: Collect all the necessary documents, including the vehicle title, registration, and identification.

- Contact the Charity: Reach out to the charity and inform them of your intention to donate a car.

- Complete the Donation Agreement: The charity will provide you with a donation agreement, which you will need to sign and return.

- Transfer the Vehicle Title: You will need to sign over the vehicle title to the charity.

Benefits of Donating a Car

Donating a car can have several benefits, including:

- Tax Deduction: You may be eligible for a tax deduction for the fair market value of your vehicle.

- Supporting a Good Cause: Your donation will support a charitable organization and help make a difference in your community.

- Free Towing: Many charities offer free towing, which can save you money and hassle.

Paperwork Requirements by State

The paperwork requirements for donating a car may vary depending on the state in which you live. Here is a table outlining some of the specific requirements by state:

| State | Required Documents |

|---|---|

| California | Vehicle title, registration, identification, and donation agreement |

| New York | Vehicle title, registration, identification, and donation agreement |

| Florida | Vehicle title, registration, identification, and donation agreement |

🚗 Note: The paperwork requirements may vary depending on the charity and the state in which you live, so it's essential to check with the charity and your state's DMV for specific requirements.

Conclusion and Final Thoughts

Donating a car can be a rewarding experience, but it’s essential to ensure that you follow the necessary steps and complete the required paperwork. By understanding the types of paperwork required and the steps to donate a car, you can make the process smoother and more efficient. Remember to research the charity and understand the benefits of donating a car, including the potential tax deduction and the positive impact on your community.

What are the benefits of donating a car?

+

The benefits of donating a car include a potential tax deduction, supporting a good cause, and free towing.

What paperwork is required to donate a car?

+

The required paperwork may include the vehicle title, registration, identification, and donation agreement.

How do I choose a reputable charity to donate my car to?

+

Research the charity, check their ratings and reviews, and ensure they are registered with the IRS as a 501©(3) organization.