File Taxes Paperwork Needed

Introduction to Tax Filing

When it comes to filing taxes, one of the most critical steps is gathering all the necessary paperwork. This process can be overwhelming, especially for those who are new to tax filing. However, with a clear understanding of what documents are required, the process can become much more manageable. In this article, we will delve into the details of the paperwork needed to file taxes, ensuring that readers are well-prepared for the task ahead.

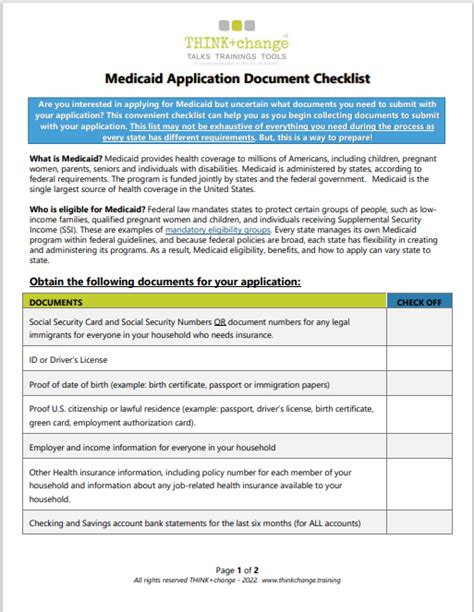

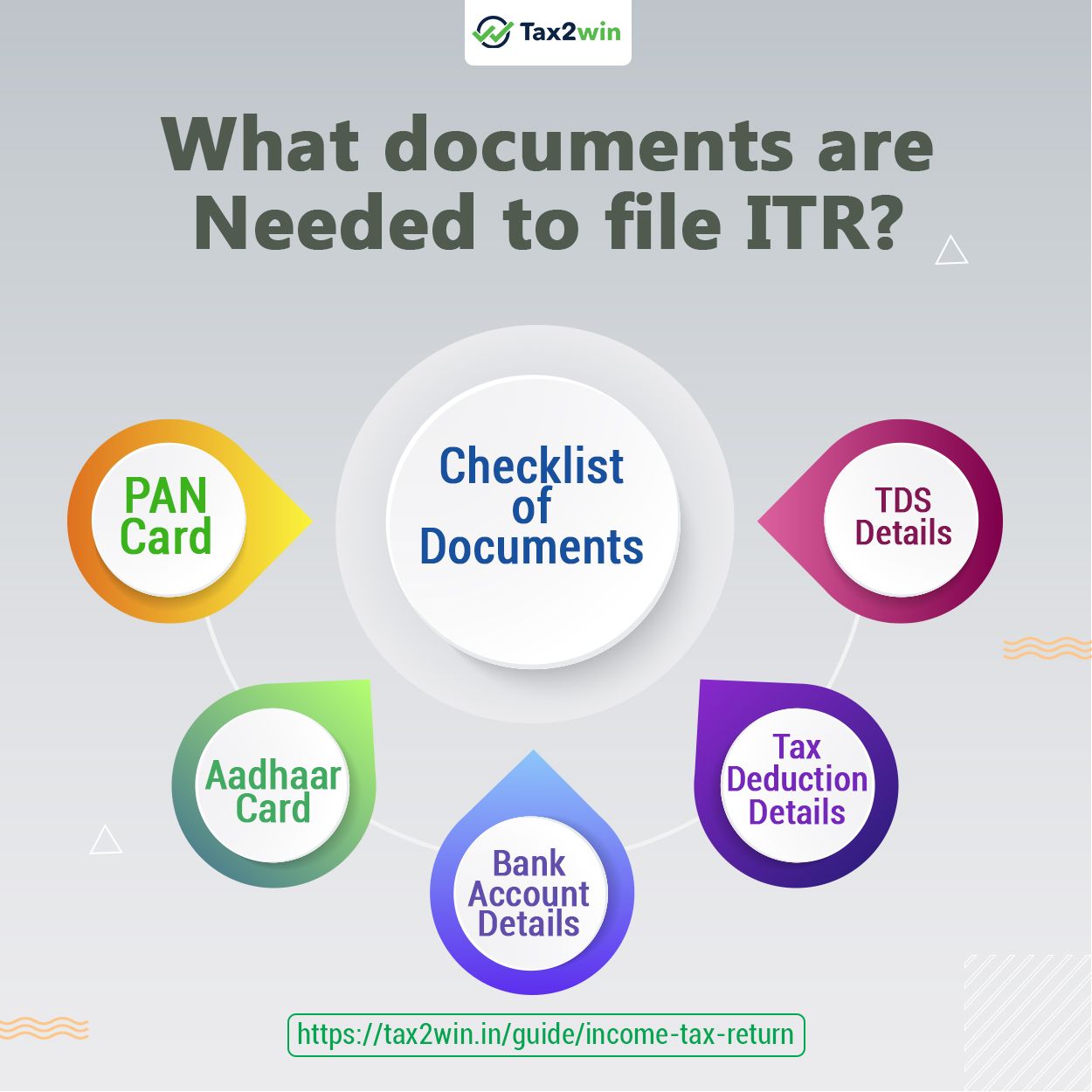

Understanding Tax-Related Documents

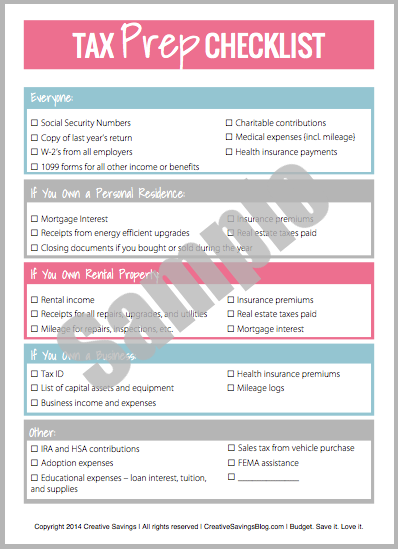

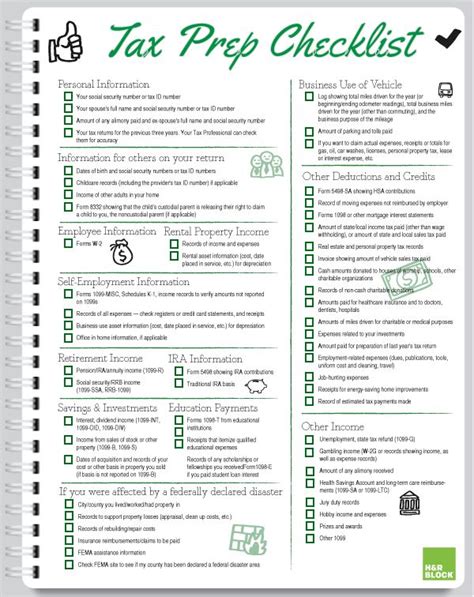

To start, it’s essential to understand the different types of documents that are typically required for tax filing. These include: - W-2 Forms: Provided by employers, these forms detail an individual’s income and the taxes withheld. - 1099 Forms: For individuals who are self-employed or have income from freelance work, these forms are crucial as they report income that is not subject to tax withholding. - Interest Statements: Banks and other financial institutions provide these statements, which show the interest earned on accounts. - Dividend Statements: For those who have investments, these statements are necessary as they report dividends received. - Charitable Donation Receipts: Donations to charity can be deducted from taxable income, making these receipts important for tax purposes.

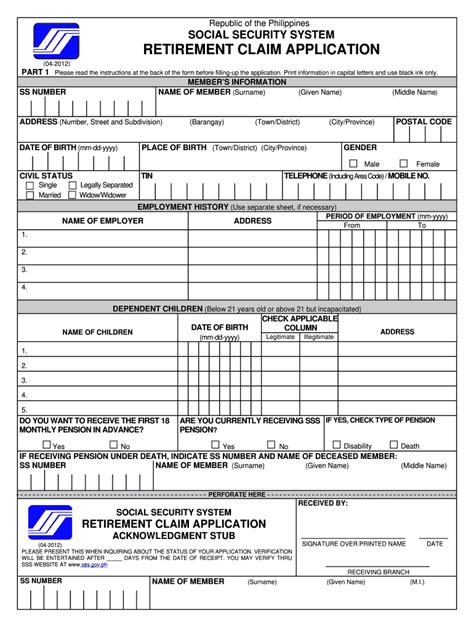

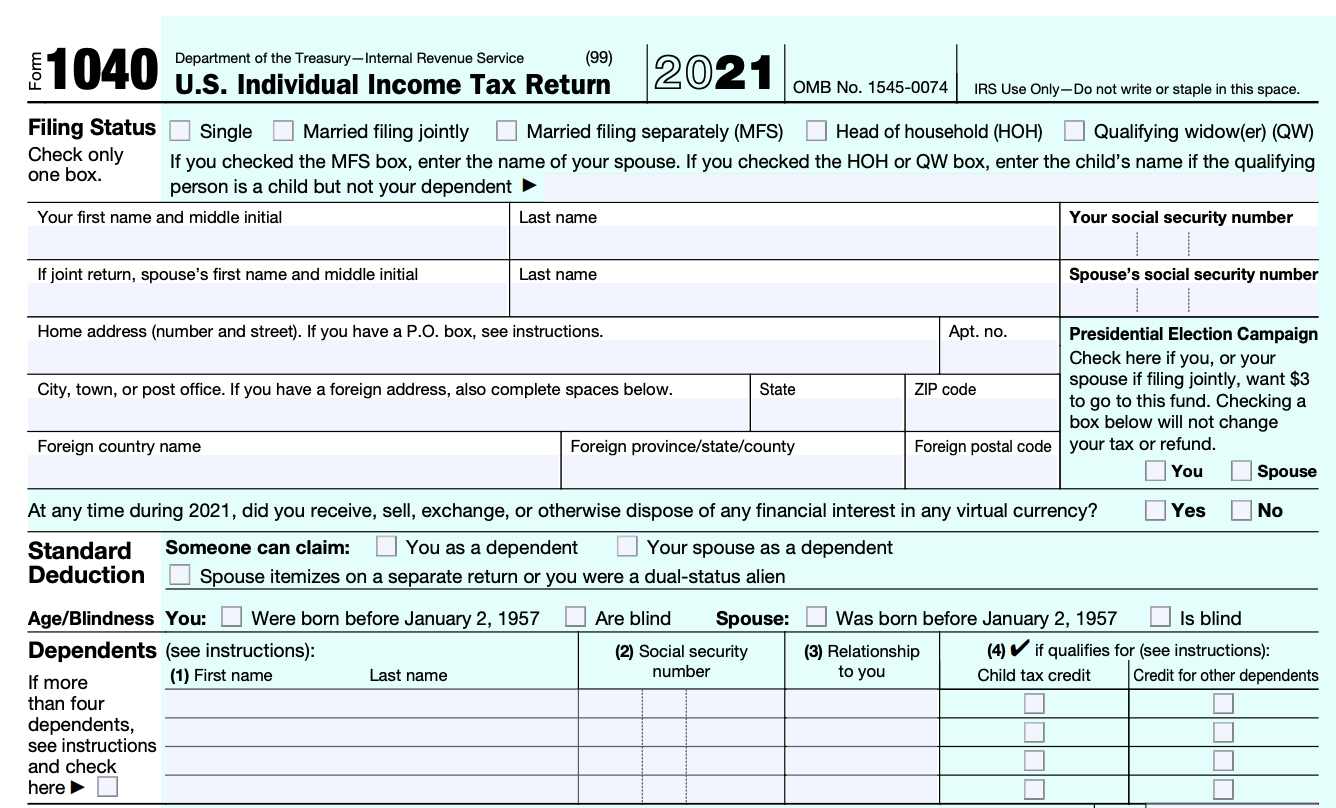

Gathering Personal Information

Before diving into the financial aspects, it’s crucial to gather personal information. This includes: - Full Name - Address - Social Security Number or Individual Taxpayer Identification Number (ITIN) - Date of Birth - Spouse’s Information (if applicable) - Dependent Information (if applicable)

This personal information is vital for accurately filling out tax forms and ensuring that the tax return is processed correctly.

Income-Related Paperwork

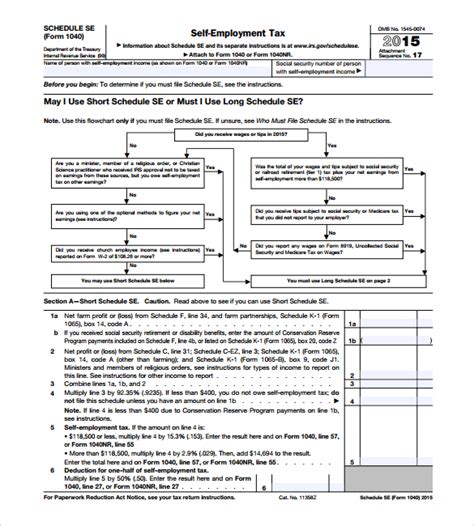

Income is a significant aspect of tax filing. The following are examples of income-related paperwork that may be needed: - Pay stubs to verify income and taxes withheld - Self-employment records, including invoices and records of business expenses - Rental income statements, if applicable - Unemployment benefits statements, as these are considered taxable income

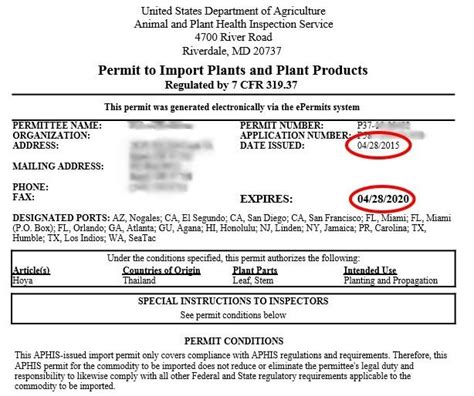

Deductions and Credits

Deductions and credits can significantly reduce the amount of tax owed. Common examples include: - Medical expenses - Mortgage interest - Charitable donations - Child care costs - Educational expenses

It’s essential to keep receipts and records for these expenses, as they will be needed to claim deductions and credits on the tax return.

Table of Common Tax Documents

| Document Type | Description |

|---|---|

| W-2 | Employment income and taxes withheld |

| 1099 | Self-employment, freelance, or investment income |

| Interest Statements | Interest earned on bank accounts |

| Dividend Statements | Dividends received from investments |

| Charitable Donation Receipts | Donations made to charity |

📝 Note: The specific documents required can vary depending on individual circumstances, such as self-employment or investment income. It's always a good idea to consult with a tax professional if unsure.

Final Preparations

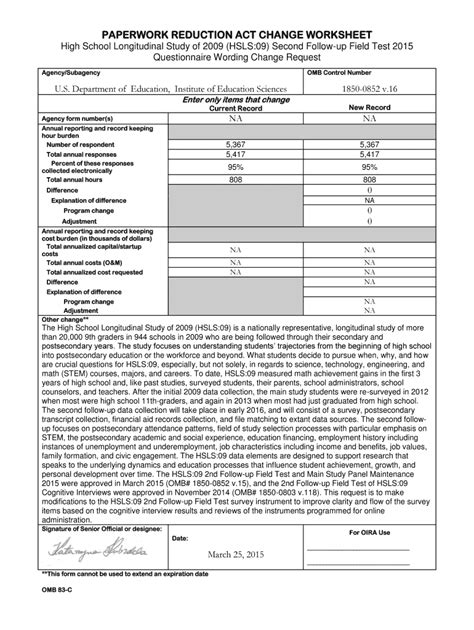

Once all the necessary paperwork has been gathered, the next step is to decide how to file the tax return. Options include filing manually, using tax software, or hiring a tax professional. Each method has its advantages and disadvantages, and the choice should be based on individual comfort with tax laws and the complexity of the return.

In preparation for filing, it’s also important to be aware of the deadline for tax submissions and to plan accordingly. Missing the deadline can result in penalties and interest on any tax owed.

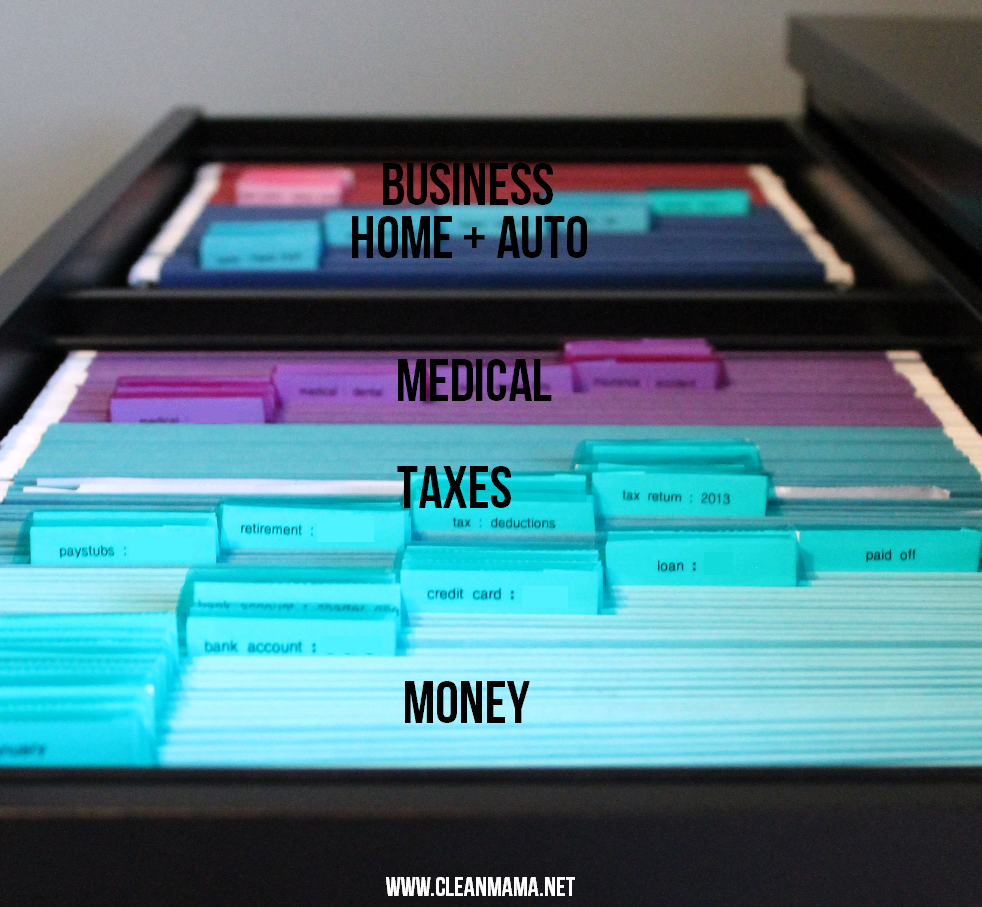

To ensure a smooth and stress-free tax filing experience, it’s crucial to stay organized, keep detailed records, and seek professional advice when needed. By doing so, individuals can navigate the complex world of tax filing with confidence.

Finally, after understanding the paperwork needed and the process of filing taxes, individuals can approach tax season with a sense of readiness and accomplishment. The key to a successful tax filing experience is preparation and attention to detail. By following the guidelines outlined in this article, readers can ensure that they are well-prepared for the task ahead, making the process as efficient and stress-free as possible.

What is the deadline for filing taxes?

+

The deadline for filing taxes typically falls on April 15th of each year, but it can vary if this date falls on a weekend or a federal holiday.

Do I need to file taxes if I don’t owe any money?

+

Even if you don’t owe taxes, you may still need to file a tax return to receive a refund if too much tax was withheld from your income. Additionally, filing is required to report certain types of income or to claim specific credits or deductions.

Can I file taxes electronically?

+

Yes, electronic filing, or e-filing, is a convenient and secure way to submit your tax return. It offers faster processing and refunds compared to manual filing.