Construction Loan Paperwork Requirements

Introduction to Construction Loan Paperwork Requirements

When it comes to financing a construction project, whether it’s for a new home, a commercial building, or any other type of property, one of the most critical steps is obtaining a construction loan. Unlike traditional mortgages, construction loans are specifically designed to cover the costs associated with building or renovating a property. However, the process of securing such a loan involves a plethora of paperwork and requirements that borrowers must navigate. Understanding these requirements is essential for a smooth and successful loan application process.

Pre-Approval and Initial Requirements

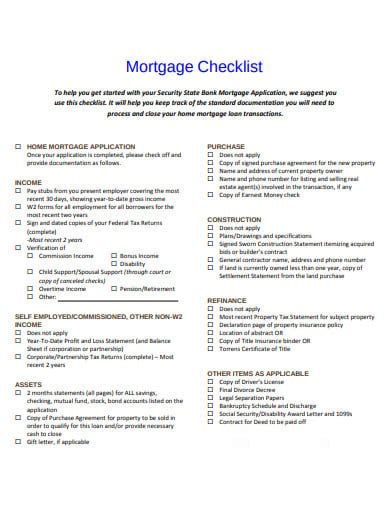

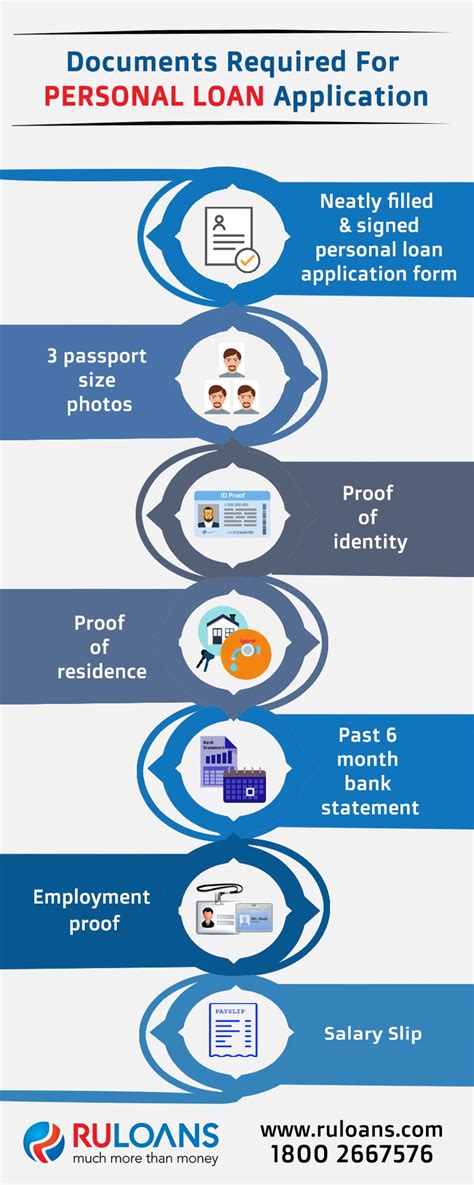

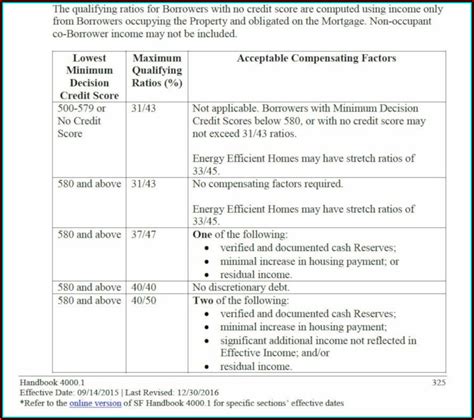

The journey to obtaining a construction loan begins with pre-approval. During this phase, lenders assess the borrower’s creditworthiness and ability to repay the loan. Credit score, income, and debt-to-income ratio are key factors considered. Borrowers are typically required to provide: - Identification documents - Proof of income (pay stubs, W-2 forms, etc.) - Bank statements - Tax returns - Credit reports

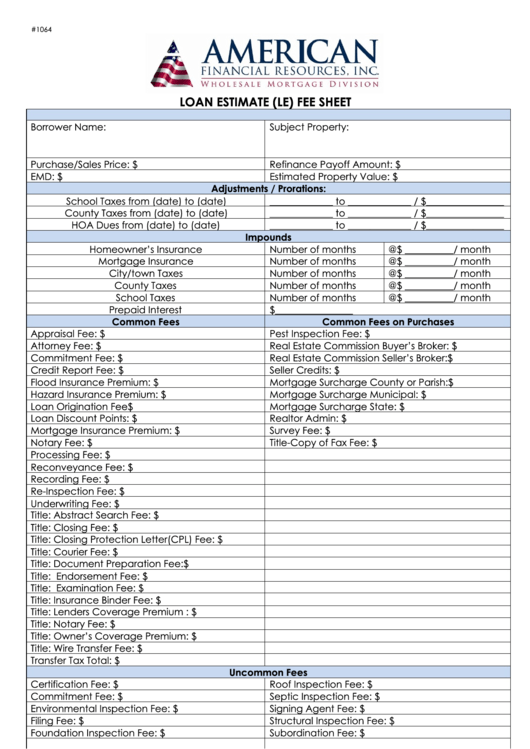

Construction Loan Application Process

Once pre-approved, the borrower moves on to the formal application process. This involves providing detailed information about the construction project, including: - Project plans and specifications - Building permits - Appraisals to determine the property’s value - Insurance information, including liability and property insurance - Contractor or builder information, if applicable

Loan Options and Considerations

Construction loans come in various forms, each with its own set of requirements and considerations: - Construction-to-Permanent Loans: These loans convert to a traditional mortgage once the construction is complete. - Stand-alone Construction Loans: These require a separate loan for the construction phase, which is then paid off with a traditional mortgage. - Owner-Builder Construction Loans: For borrowers who act as their own general contractors. Each type of loan has its advantages and disadvantages, and the choice depends on the borrower’s financial situation, project scope, and long-term plans.

Documentation for Construction Projects

For construction projects, detailed documentation is crucial. This includes: - Blueprints and architectural drawings - Engineering and soil reports - Material and labor contracts - Timeline and project schedule - Budget and cost breakdown

| Document Type | Purpose |

|---|---|

| Blueprints | Outline the project's design and layout |

| Engineering Reports | Assess the project's structural integrity and compliance with building codes |

| Contracts | Define the agreements between the borrower, contractors, and suppliers |

Financial Requirements and Cash Flow

Lenders closely examine the borrower’s financial situation to ensure they can manage the loan repayments. This involves reviewing: - Cash flow statements - Cash reserves to cover unexpected expenses - Income statements to assess the borrower’s ability to repay the loan

📝 Note: Borrowers should maintain detailed financial records and be prepared to provide them upon request.

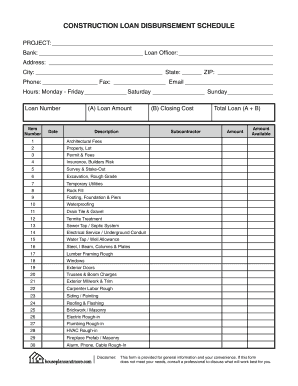

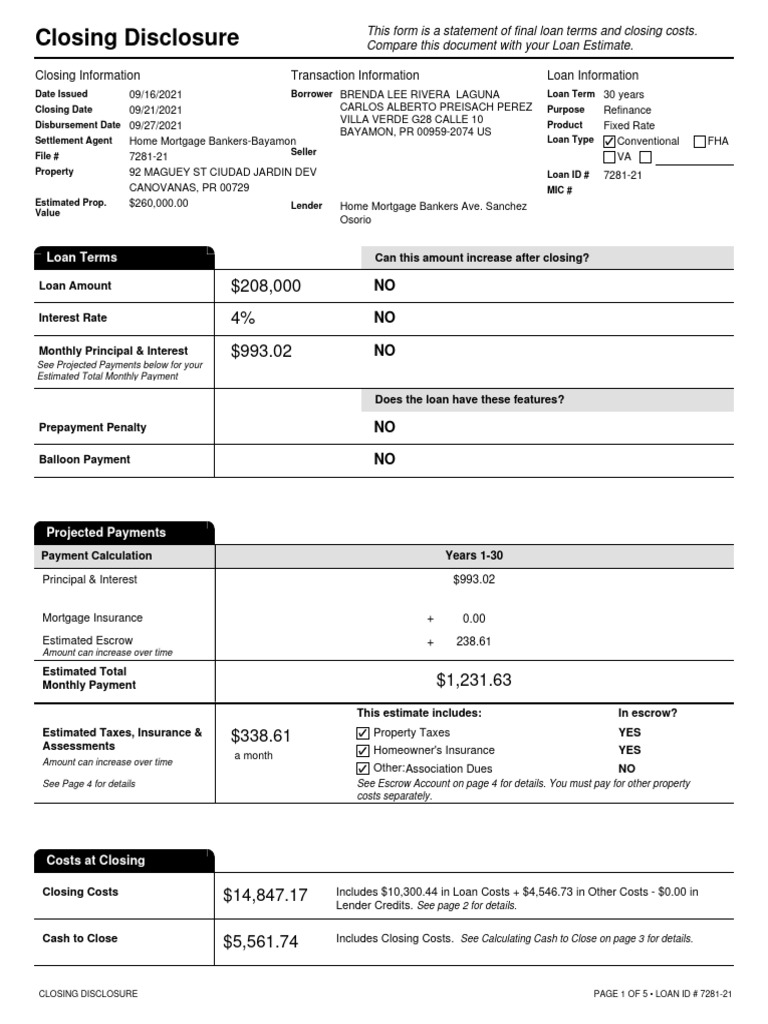

Inspections and Draw Schedules

Construction loans are typically disbursed in stages, based on the project’s progress. This process involves: - Regular inspections by the lender to assess the project’s progress - Draw schedules that outline when funds will be released - Interest payments on the disbursed amount, which can be complex and require careful management

Final Inspection and Loan Conversion

Upon completion of the project, a final inspection is conducted to ensure the work meets the approved plans and building codes. Once satisfactory, the loan can be converted to a permanent mortgage, if applicable, or paid off.

In summary, the process of obtaining a construction loan involves a comprehensive array of paperwork and financial assessments. Understanding these requirements and being prepared can significantly ease the loan application process and pave the way for a successful construction project.

What are the primary factors considered for construction loan approval?

+

Credit score, income, debt-to-income ratio, and the project’s details, including plans, specifications, and budget.

Can I act as my own general contractor for a construction project?

+

Yes, but this typically requires special financing, known as an owner-builder construction loan, and may involve additional risks and requirements.

How are construction loans disbursed?

+

Construction loans are usually disbursed in stages, based on the project’s progress, as outlined in a draw schedule. The lender conducts regular inspections to assess the project’s progress before releasing funds.