Paperwork

5 BBL Paperwork Tips

Introduction to BBL Paperwork

When dealing with the Business Builder Loan (BBL), one of the most critical aspects is the paperwork involved. The BBL is designed to support small businesses and entrepreneurs, providing them with the necessary funds to grow and thrive. However, the application process can be daunting, especially when it comes to the paperwork. In this article, we will explore five essential tips to help you navigate the BBL paperwork efficiently.

Understanding the Requirements

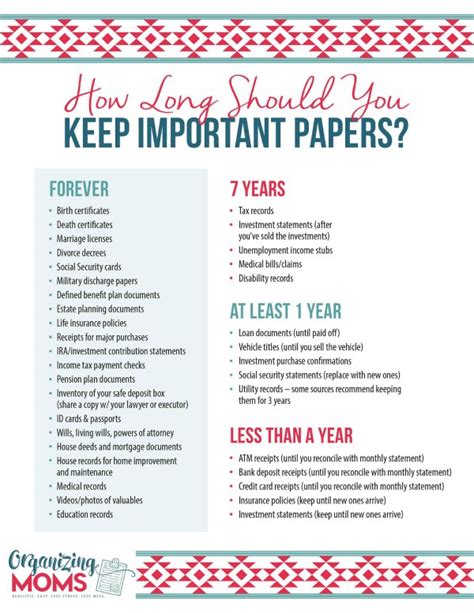

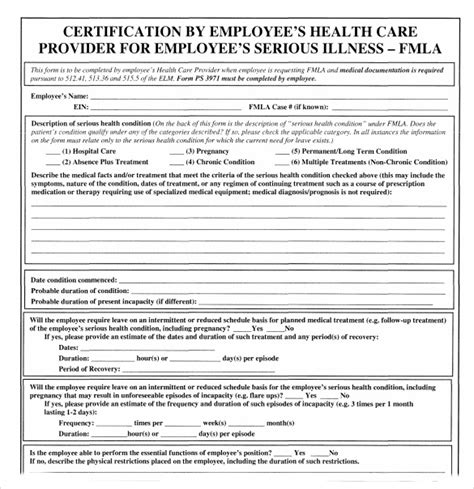

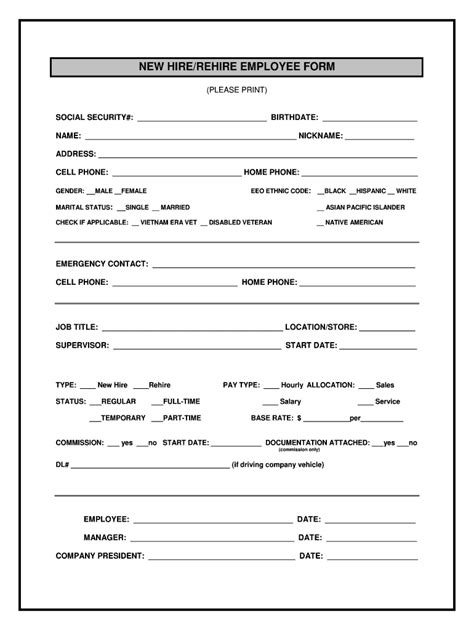

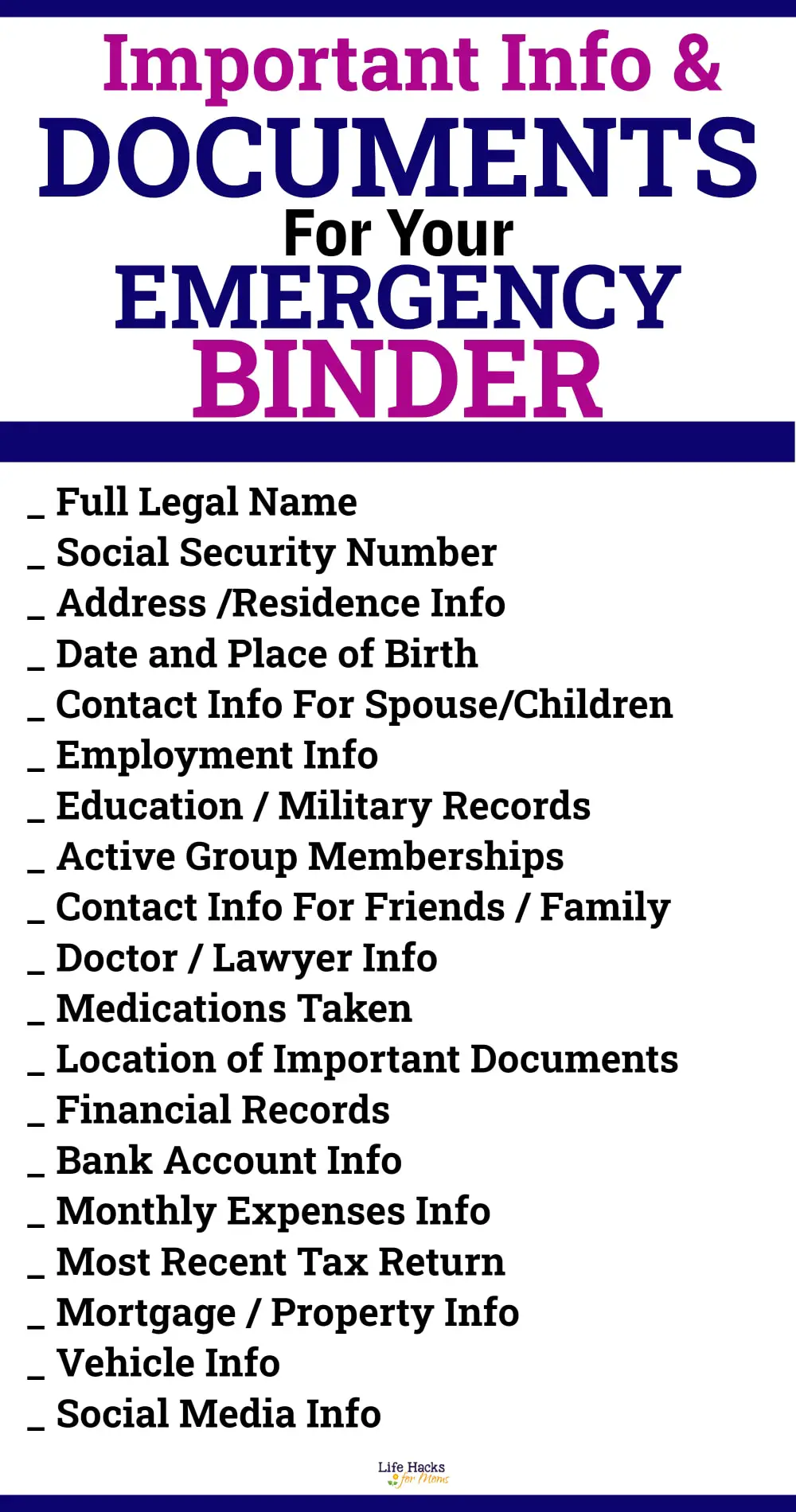

Before diving into the paperwork, it’s crucial to understand the requirements of the BBL program. The Small Business Administration (SBA) has specific guidelines and eligibility criteria that must be met. This includes providing detailed financial information, business plans, and personal guarantees. It’s essential to review these requirements carefully to ensure you have all the necessary documents and information.

Tips for Efficient Paperwork

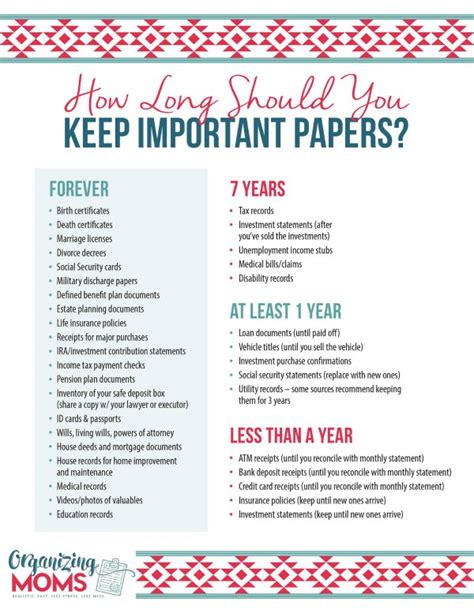

Here are five tips to help you with your BBL paperwork: * Gather all necessary documents: This includes financial statements, tax returns, business licenses, and personal identification documents. * Review and understand the application form: Take the time to carefully review the application form and ensure you understand what information is required. * Provide detailed financial information: This includes income statements, balance sheets, and cash flow statements. * Ensure accuracy and completeness: Double-check your application for any errors or omissions, as this can delay the processing of your application. * Seek professional help if needed: If you’re unsure about any aspect of the application process, consider seeking the help of a professional, such as an accountant or business advisor.

Common Mistakes to Avoid

When completing your BBL paperwork, there are several common mistakes to avoid. These include: * Inaccurate or incomplete information: This can lead to delays or even rejection of your application. * Insufficient documentation: Failing to provide all necessary documents can slow down the processing of your application. * Not meeting eligibility criteria: Ensure you meet all the eligibility criteria before submitting your application.

💡 Note: It's essential to carefully review the BBL program's requirements and guidelines to ensure you have the best chance of a successful application.

Conclusion and Next Steps

In conclusion, the BBL paperwork can be a challenging aspect of the application process. However, by following these five tips and avoiding common mistakes, you can ensure a smooth and efficient process. Remember to stay organized, provide detailed financial information, and seek professional help if needed. With careful planning and attention to detail, you can increase your chances of a successful BBL application and take your business to the next level.

What is the Business Builder Loan (BBL) program?

+

The Business Builder Loan (BBL) program is a loan program designed to support small businesses and entrepreneurs, providing them with the necessary funds to grow and thrive.

What are the eligibility criteria for the BBL program?

+

The eligibility criteria for the BBL program include providing detailed financial information, business plans, and personal guarantees, as well as meeting specific guidelines set by the Small Business Administration (SBA).

How long does the BBL application process take?

+

The length of the BBL application process can vary, but it’s essential to ensure accuracy and completeness to avoid delays. Seeking professional help if needed can also help expedite the process.