Gifting a Car Paperwork Requirements

Introduction to Gifting a Car

Gifting a car to a family member or friend can be a generous and thoughtful act, but it involves more than just handing over the keys. There are several paperwork requirements and legal considerations that must be taken care of to ensure a smooth transfer of ownership. In this article, we will guide you through the process of gifting a car, including the necessary documents and steps to follow.

Why Gifting a Car Can Be Complex

Gifting a car can be complex because it involves tax implications, title transfer, and registration requirements. The donor (the person giving the car) and the recipient (the person receiving the car) must both be aware of their responsibilities and obligations in the gifting process. Additionally, the rules and regulations surrounding car gifting vary from state to state, so it’s essential to familiarize yourself with the specific laws and regulations in your area.

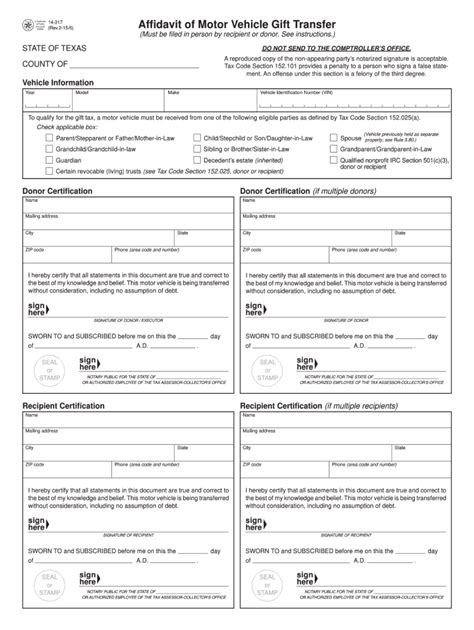

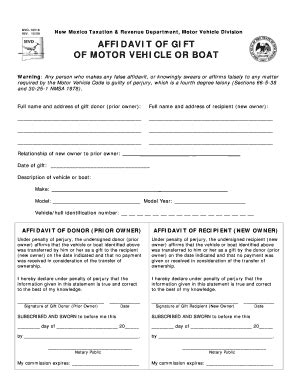

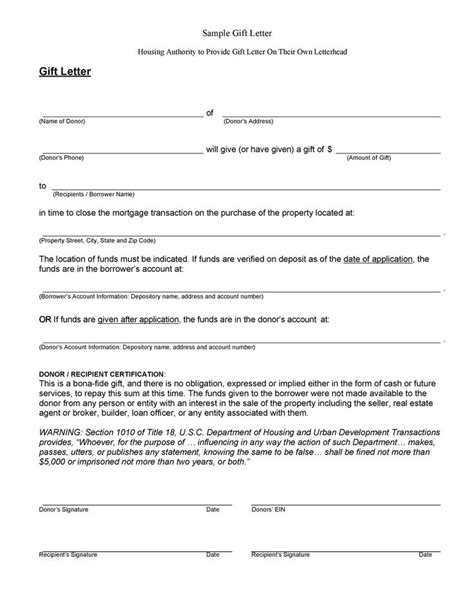

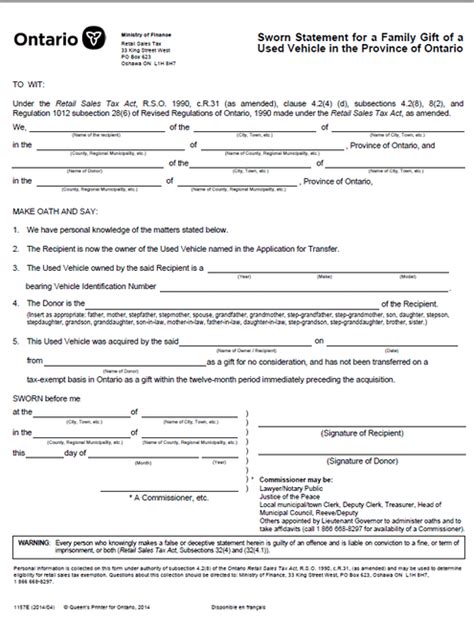

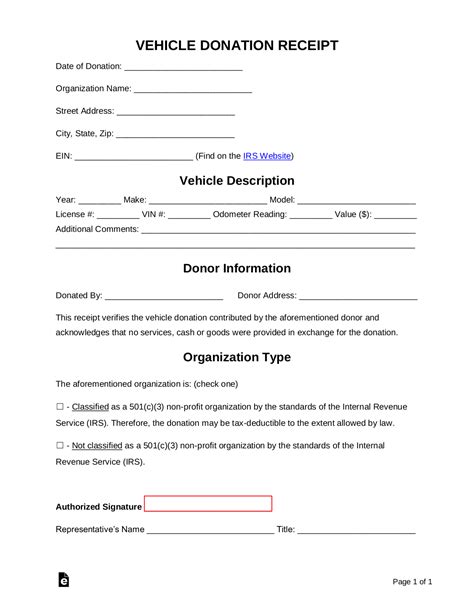

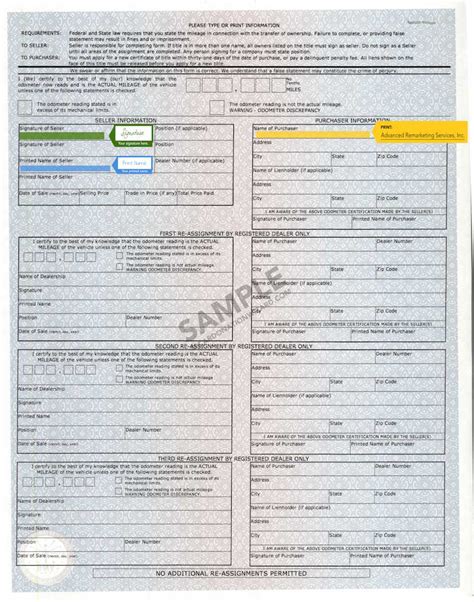

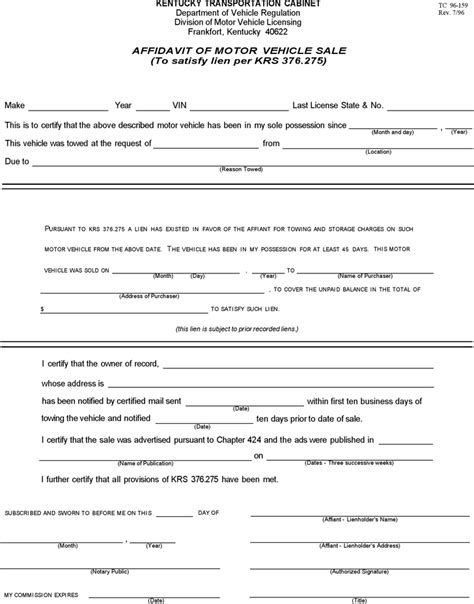

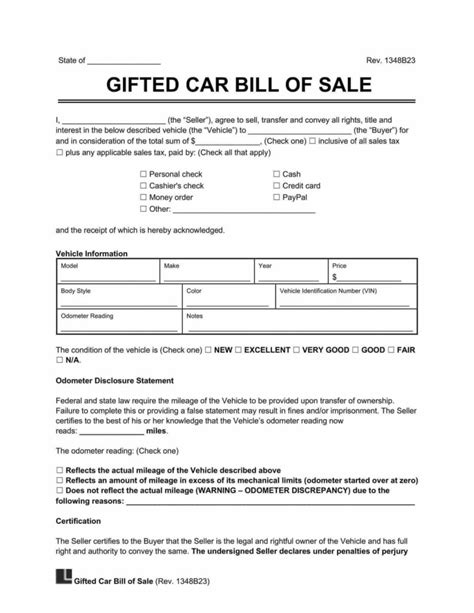

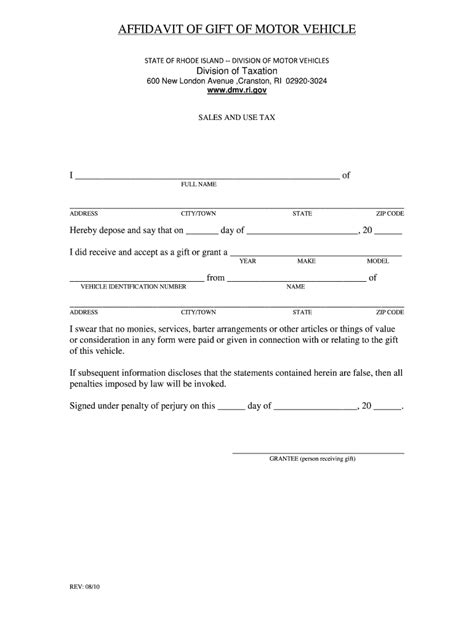

Necessary Documents for Gifting a Car

To gift a car, you will need to gather the following documents: * Title: The vehicle’s title is the most critical document in the gifting process. It proves ownership and is required to transfer the title to the recipient. * Bill of Sale: A bill of sale is a document that confirms the transfer of ownership from the donor to the recipient. It should include the vehicle’s make, model, year, VIN, and the sale price (which can be listed as $0 since it’s a gift). * Gift Letter: A gift letter is a document that states the vehicle is being given as a gift and that no money is being exchanged. This letter can help avoid any tax implications or misunderstandings. * Registration: The recipient will need to register the vehicle in their name and obtain a new license plate and registration sticker. * Insurance: The recipient should also obtain insurance for the vehicle to protect against accidents or damage.

Step-by-Step Guide to Gifting a Car

Here’s a step-by-step guide to gifting a car: * Step 1: Gather all the necessary documents, including the title, bill of sale, and gift letter. * Step 2: Fill out the title transfer section on the back of the title and sign it as the seller. * Step 3: Give the title, bill of sale, and gift letter to the recipient. * Step 4: The recipient should then take these documents to their local DMV office to register the vehicle in their name. * Step 5: The recipient should also obtain insurance for the vehicle.

🚨 Note: The recipient may need to pay sales tax or registration fees when registering the vehicle, even though it was a gift.

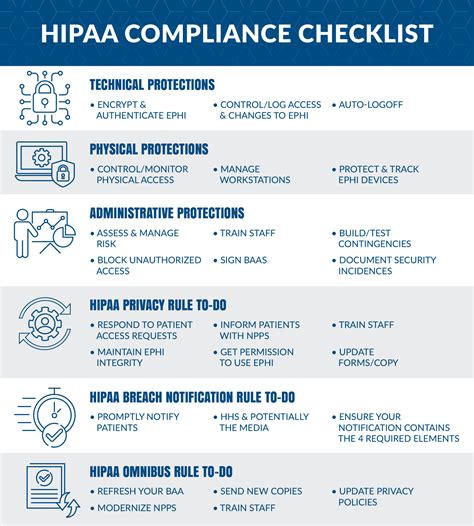

Tax Implications of Gifting a Car

Gifting a car can have tax implications for both the donor and the recipient. The donor may be subject to gift tax if the value of the vehicle exceeds a certain threshold (currently $15,000 per year). The recipient may also be subject to sales tax or use tax when registering the vehicle. It’s essential to consult with a tax professional to understand the tax implications of gifting a car.

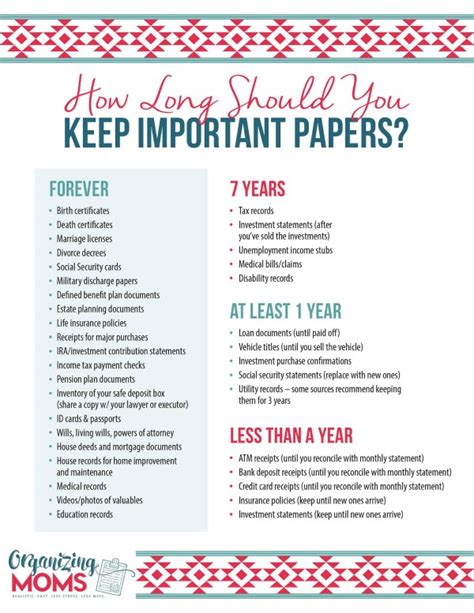

Registering a Gifted Car

Registering a gifted car requires the recipient to follow these steps: * Step 1: Gather all the necessary documents, including the title, bill of sale, and gift letter. * Step 2: Take these documents to the local DMV office. * Step 3: Fill out the registration application and provide the required identification and proof of insurance. * Step 4: Pay the required registration fees and sales tax (if applicable).

| State | Registration Fee | Sales Tax |

|---|---|---|

| California | $64 | 7.25% |

| Texas | $50.75 | 6.25% |

| Florida | $27.60 | 6% |

Benefits of Gifting a Car

Gifting a car can have several benefits, including: * Reducing clutter: If you have an extra vehicle that you no longer need or use, gifting it can help reduce clutter and free up space. * Helping a loved one: Gifting a car to a family member or friend can be a thoughtful and generous act that can help them in their time of need. * Tax benefits: In some cases, gifting a car can provide tax benefits for the donor, such as reducing their taxable income.

In summary, gifting a car requires careful consideration of the paperwork requirements, tax implications, and legal considerations. By following the steps outlined in this article and consulting with a tax professional or attorney, you can ensure a smooth transfer of ownership and avoid any potential issues or complications.

What documents do I need to gift a car?

+

To gift a car, you will need to gather the title, bill of sale, and gift letter. You may also need to provide additional documents, such as proof of insurance and registration.

Do I need to pay sales tax when gifting a car?

+

It depends on the state and local laws. In some cases, the recipient may need to pay sales tax or use tax when registering the vehicle, even though it was a gift.

Can I gift a car to anyone?

+

No, there may be restrictions on who you can gift a car to, such as family members or charitable organizations. It’s essential to check with your state’s DMV and tax authority to determine any restrictions.