Refinance Paperwork Needed

Introduction to Refinancing

Refinancing a mortgage can be a great way to save money on interest, lower monthly payments, or tap into home equity. However, the process can be complex and requires careful consideration. One of the key steps in refinancing is gathering the necessary paperwork. In this article, we will explore the refinance paperwork needed to complete the process.

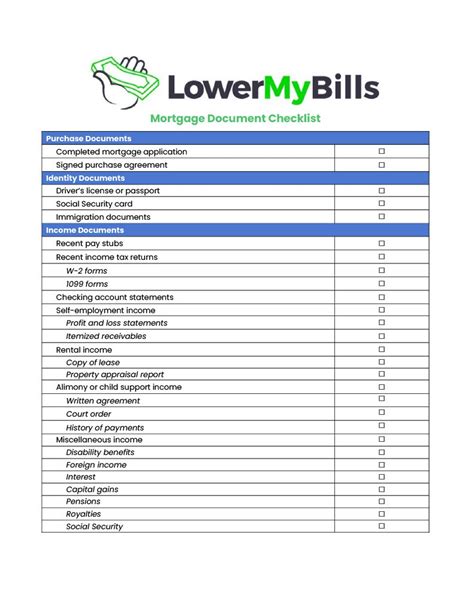

Pre-Refinance Checklist

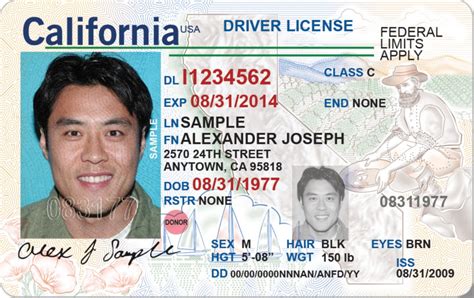

Before starting the refinance process, it’s essential to have a clear understanding of the required documents. The following list includes the typical paperwork needed for a refinance: * Identification documents: Driver’s license, passport, or state ID * Income verification: Pay stubs, W-2 forms, and tax returns * Employment verification: Letter from employer or proof of self-employment * Credit reports: Credit score and history * Property documents: Deed, title report, and appraisal * Loan documents: Current mortgage statement and loan payoff information

Income and Employment Verification

Lenders require income and employment verification to determine the borrower’s ability to repay the loan. The following documents are typically needed: * Pay stubs for the past 30 days * W-2 forms for the past two years * Tax returns for the past two years * Letter from employer or proof of self-employment * Business tax returns and financial statements (if self-employed)

Credit and Property Verification

A good credit score and a clear property title are essential for refinancing. The following documents are needed: * Credit report and credit score * Property deed and title report * Appraisal or valuation of the property * Homeowners insurance information

Loan Documents and Payoff Information

The lender will require documentation related to the current mortgage, including: * Current mortgage statement * Loan payoff information * Interest rate and loan term information

| Document | Description |

|---|---|

| Identification documents | Driver's license, passport, or state ID |

| Income verification | Pay stubs, W-2 forms, and tax returns |

| Employment verification | Letter from employer or proof of self-employment |

| Credit reports | Credit score and history |

| Property documents | Deed, title report, and appraisal |

| Loan documents | Current mortgage statement and loan payoff information |

📝 Note: The specific documents required may vary depending on the lender and the borrower's situation.

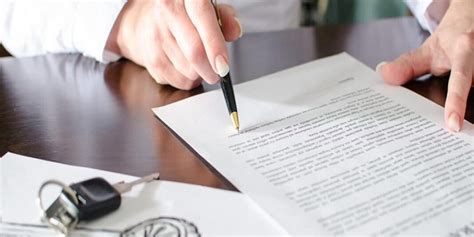

As the refinance process comes to a close, it’s essential to review the final documents carefully and ensure everything is in order. The lender will provide a closing disclosure that outlines the terms of the new loan, including the interest rate, loan term, and monthly payments. This is the final step before the refinance is complete, and the borrower can begin enjoying the benefits of their new loan.

In summary, refinancing a mortgage requires careful consideration and attention to detail. By gathering the necessary paperwork and understanding the process, borrowers can navigate the refinance journey with confidence. Whether it’s to save money on interest, lower monthly payments, or tap into home equity, refinancing can be a great way to achieve financial goals. By following the steps outlined above and staying informed, borrowers can make the most of their refinance experience.

What is the first step in the refinance process?

+

The first step in the refinance process is to check your credit score and history, as this will affect the interest rate you qualify for.

What documents are needed to verify income and employment?

+

Typically, lenders require pay stubs, W-2 forms, tax returns, and a letter from your employer or proof of self-employment to verify income and employment.

How long does the refinance process typically take?

+

The refinance process can take anywhere from 30 to 60 days, depending on the complexity of the loan and the efficiency of the lender.