Refinance House Paperwork Needed

Introduction to Refinancing a House

Refinancing a house can be a great way to lower your monthly mortgage payments, switch from an adjustable-rate to a fixed-rate loan, or tap into your home’s equity. However, the process of refinancing can be complex and requires a significant amount of paperwork. In this article, we will guide you through the necessary documents and steps involved in refinancing a house.

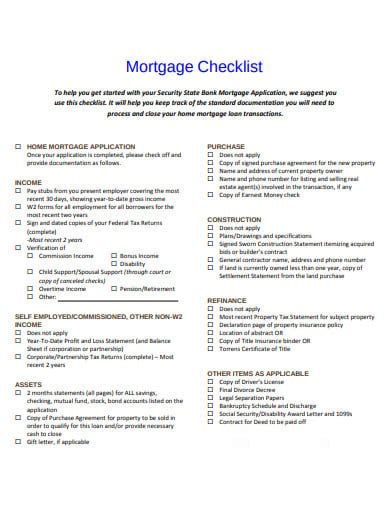

Documents Needed for Refinancing a House

To refinance a house, you will need to provide various documents to your lender. These documents may include: * Identification documents: A valid government-issued ID, such as a driver’s license or passport, to verify your identity. * Income documents: Pay stubs, W-2 forms, and tax returns to demonstrate your income and employment status. * Credit reports: Your credit score and history will be reviewed to determine your eligibility for refinancing. * Property documents: The deed to your property, title report, and appraisal to determine the value of your home. * Loan documents: Your current mortgage statement, loan estimate, and closing disclosure to provide information about your existing loan. * Asset documents: Bank statements, investment accounts, and retirement accounts to verify your assets and savings.

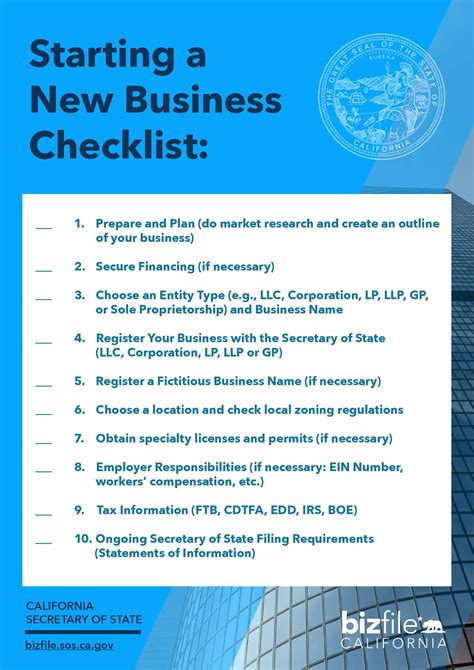

Steps Involved in Refinancing a House

The process of refinancing a house typically involves the following steps: * Research and comparison: Shop around for lenders and compare their rates, terms, and fees to find the best option for your needs. * Pre-approval: Get pre-approved for a refinance loan to determine how much you can borrow and what your monthly payments will be. * Application and processing: Submit your application and provide the necessary documents to your lender. * Appraisal and inspection: An appraiser will assess the value of your property, and an inspector may review the condition of your home. * Underwriting and approval: Your lender will review your application and make a decision about your eligibility for refinancing. * Closing: Sign the final documents and complete the refinance process.

Types of Refinancing Options

There are several types of refinancing options available, including: * Cash-out refinance: Tap into your home’s equity and receive a lump sum of cash. * Rate-and-term refinance: Lower your monthly payments by reducing your interest rate or extending your loan term. * Streamline refinance: Refinance your existing loan with a new loan that has a lower interest rate or better terms. * Government-backed refinance: Refinance your loan using a government-backed program, such as FHA or VA.

| Type of Refinance | Description |

|---|---|

| Cash-out Refinance | Tap into your home's equity and receive a lump sum of cash |

| Rate-and-Term Refinance | Lower your monthly payments by reducing your interest rate or extending your loan term |

| Streamline Refinance | Refinance your existing loan with a new loan that has a lower interest rate or better terms |

| Government-Backed Refinance | Refinance your loan using a government-backed program, such as FHA or VA |

📝 Note: The type of refinance you choose will depend on your individual circumstances and goals. It's essential to consult with a lender or financial advisor to determine the best option for your needs.

Benefits and Drawbacks of Refinancing a House

Refinancing a house can have several benefits, including: * Lower monthly payments: Reduce your monthly mortgage payments by lowering your interest rate or extending your loan term. * Tap into equity: Access the equity in your home and use it for other purposes, such as home improvements or debt consolidation. * Improved loan terms: Refinance your loan to get better terms, such as a fixed interest rate or a longer loan term. However, refinancing a house also has some drawbacks, including: * Closing costs: Pay closing costs, which can range from 2% to 5% of the loan amount. * Credit score impact: Refinancing can affect your credit score, especially if you have multiple inquiries or a high debt-to-income ratio. * Risk of overspending: Be cautious not to overspend the cash you receive from a cash-out refinance, as this can lead to financial difficulties.

In summary, refinancing a house can be a great way to lower your monthly mortgage payments, tap into your home’s equity, or improve your loan terms. However, it’s essential to carefully consider the benefits and drawbacks and choose the right type of refinance for your individual circumstances and goals.

What are the benefits of refinancing a house?

+

The benefits of refinancing a house include lower monthly payments, tapping into equity, and improving loan terms. Refinancing can also help you switch from an adjustable-rate to a fixed-rate loan or consolidate debt.

What are the drawbacks of refinancing a house?

+

The drawbacks of refinancing a house include closing costs, credit score impact, and the risk of overspending. Refinancing can also lead to a longer loan term, which may result in paying more interest over the life of the loan.

How do I choose the right type of refinance for my needs?

+

To choose the right type of refinance for your needs, consider your individual circumstances and goals. Research and compare different types of refinancing options, and consult with a lender or financial advisor to determine the best option for your situation.