Inheriting Property Paperwork Needed

Understanding the Process of Inheriting Property

When a loved one passes away, inheriting their property can be a complex and emotional process. It involves a significant amount of paperwork, legal procedures, and financial considerations. The goal of this article is to guide you through the necessary steps and documents required to inherit property, making the process as smooth as possible.

Initial Steps and Documents

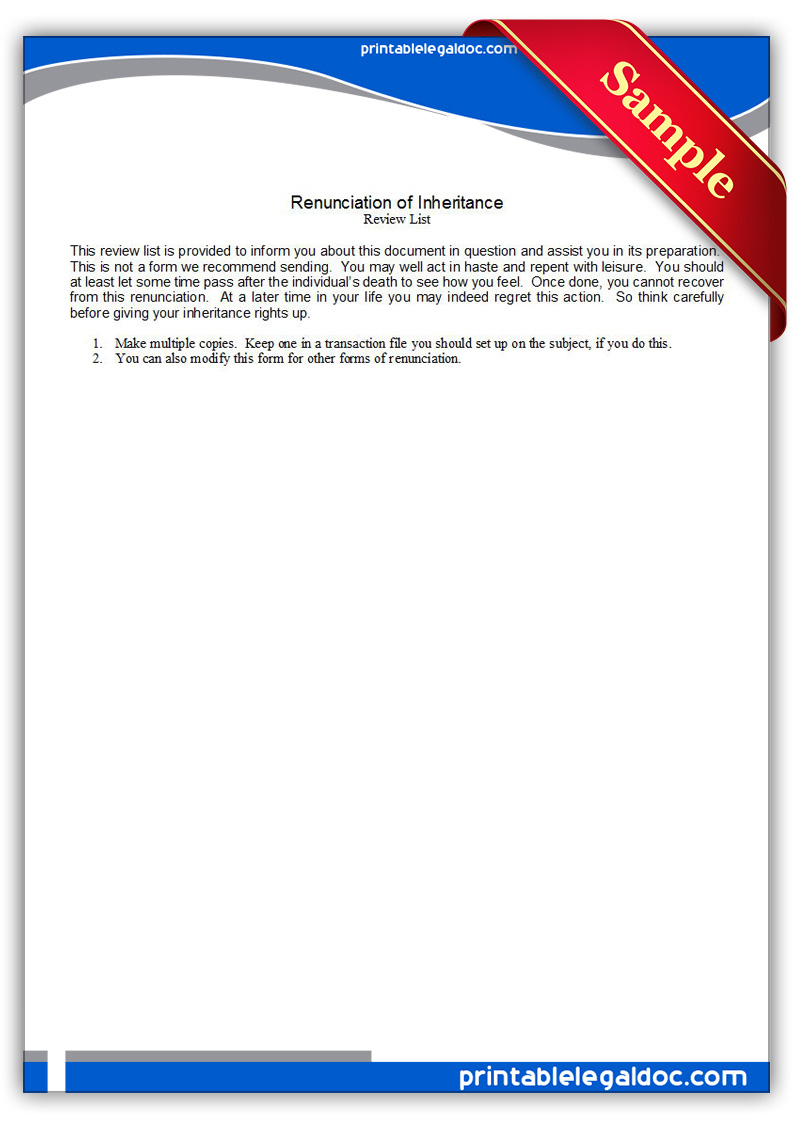

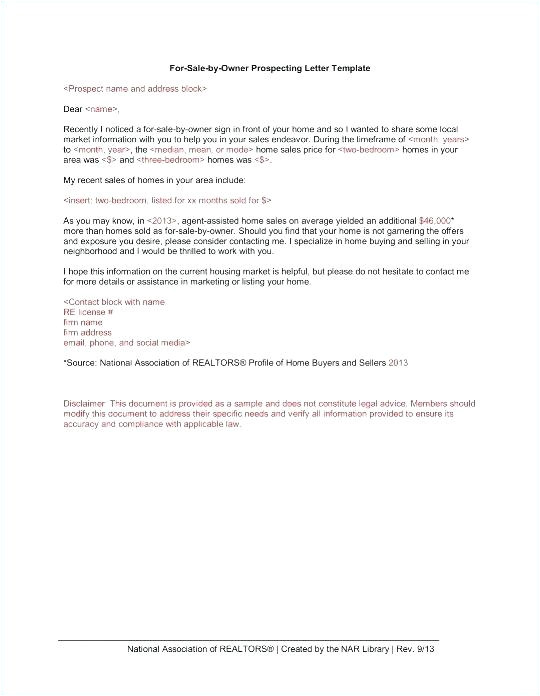

The first step in inheriting property is to determine if the deceased had a will or if they died intestate, meaning without a will. If there is a will, it should name an executor who is responsible for managing the estate and ensuring that the deceased’s wishes are carried out. Key documents at this stage include: - The will itself, which outlines how the deceased wanted their assets to be distributed. - Letters Testamentary, which are legal documents issued by the court that confirm the executor’s authority to act on behalf of the estate. - An inventory of the estate, which lists all the assets and liabilities of the deceased.

Probate Process

If the property is part of a larger estate that needs to go through probate, this process involves proving the validity of the will (if there is one) and ensuring that the estate is distributed according to the deceased’s wishes or the laws of intestacy. The probate process can be lengthy and may require additional paperwork, including: - Petition for Probate, which is filed with the court to start the probate process. - Notice to Creditors, which informs potential creditors of the estate that they have a limited time to make claims. - Inventory and Appraisal, which provides a detailed list and valuation of the estate’s assets.

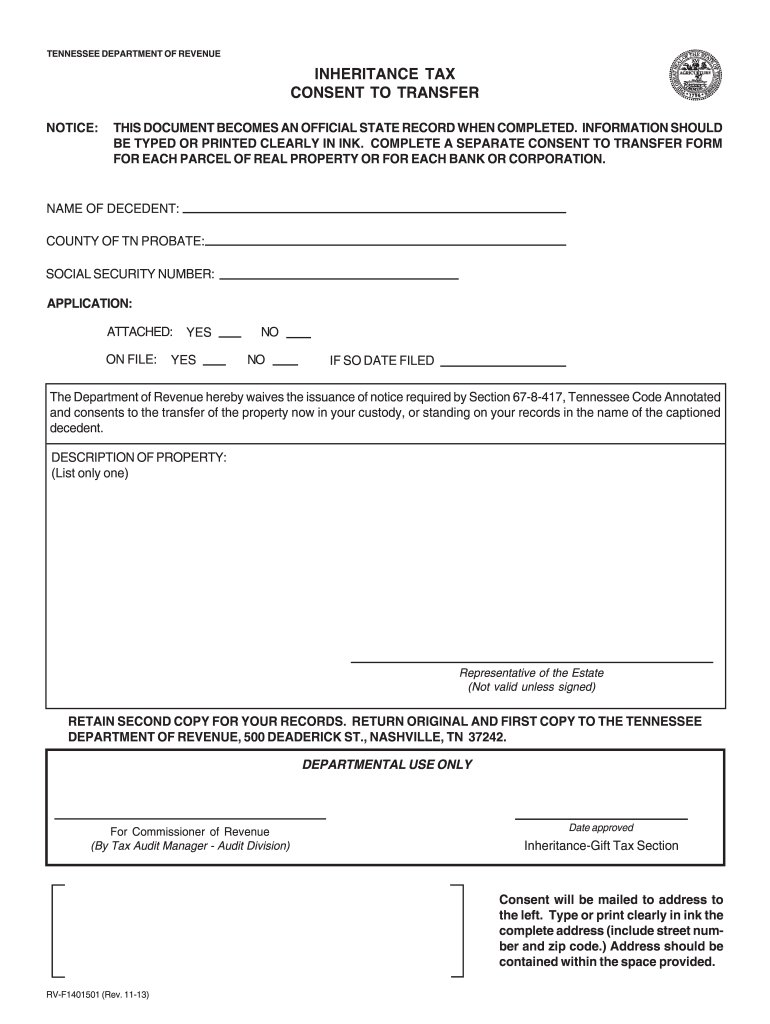

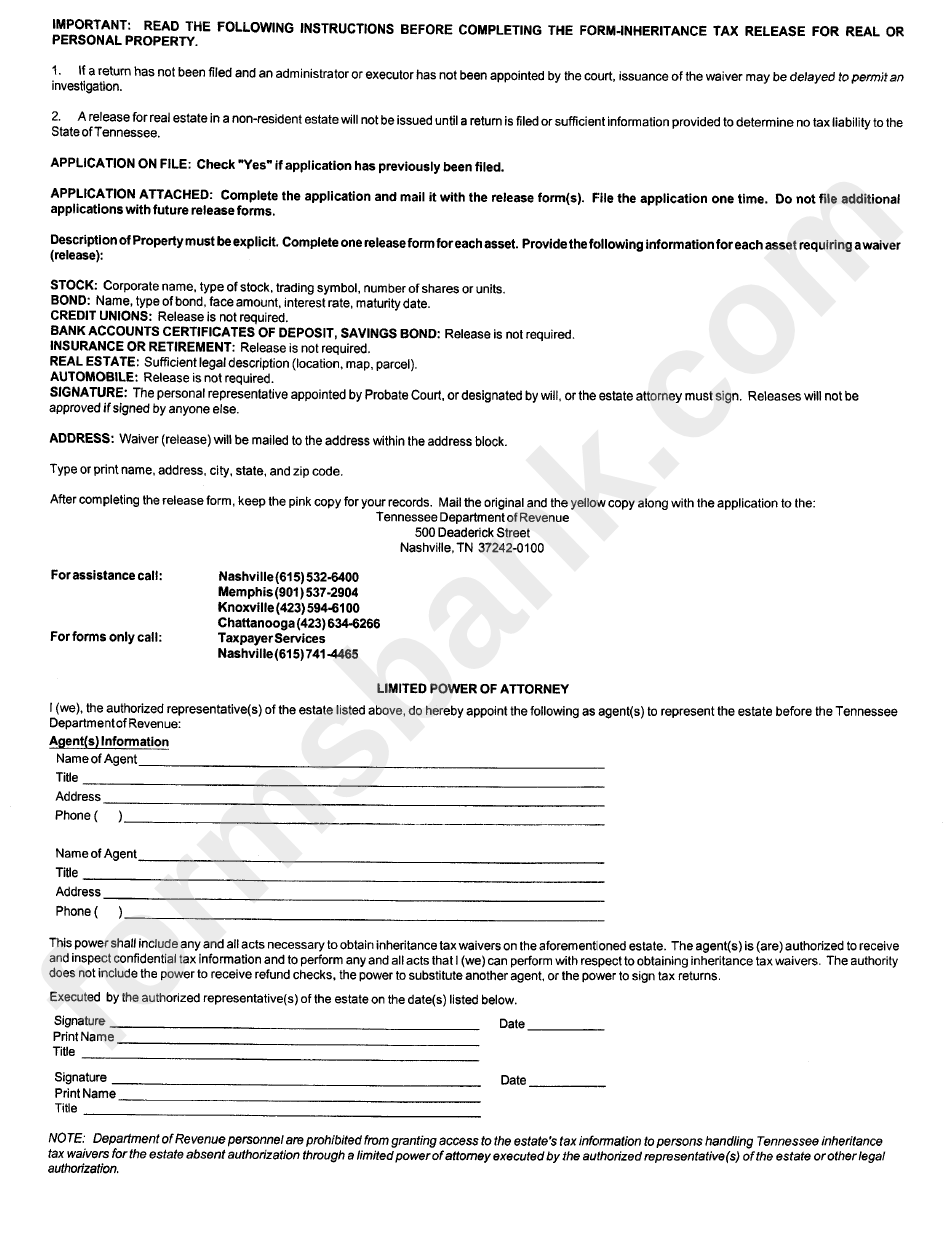

Tax Considerations

Inheriting property also involves tax considerations. The estate may need to file tax returns, and there could be inheritance taxes or estate taxes due, depending on the jurisdiction and the size of the estate. Important documents in this context include: - Estate Tax Return (if required), which reports the value of the estate and calculates any estate taxes owed. - Form 1041, the income tax return for estates and trusts, which may need to be filed annually until the estate is fully distributed.

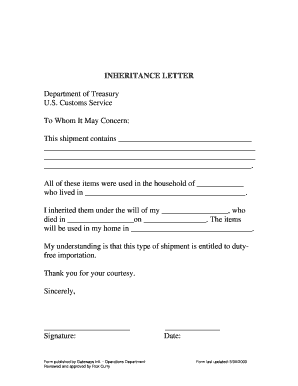

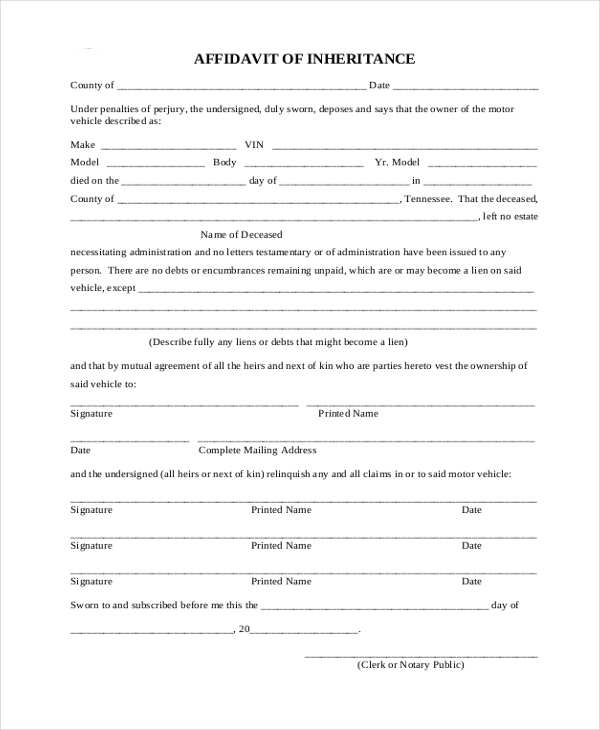

Transfer of Property

Once the estate has been settled, the next step is to transfer the property into the names of the beneficiaries. This involves: - Deeds, which are legal documents that transfer ownership of real property. - Affidavits of Heirship, which may be used in some jurisdictions to establish the right to inherit property without going through probate. - Tax Affidavits, which are sometimes required to transfer property, especially if there are tax implications.

Final Steps

After all the legal and financial aspects have been addressed, the final step is to ensure that all parties are in agreement with the distribution of the property. This may involve: - Release and Waiver documents, which beneficiaries sign to acknowledge receipt of their inheritance and release the estate from any further obligations. - Updating property records and obtaining a new title for the property in the name(s) of the beneficiary(ies).

📝 Note: The specific documents and steps required can vary significantly depending on the jurisdiction, the size and complexity of the estate, and whether the deceased had a will. It is often advisable to consult with an attorney who specializes in estate law to ensure that all legal requirements are met.

Considerations for Beneficiaries

For those inheriting property, it’s essential to consider not just the legal and financial aspects but also the emotional impact. Inheriting a property can come with a mix of feelings, from grief to responsibility. Beneficiaries should take the time to understand their rights, the condition of the property, and any obligations that come with the inheritance, such as maintaining the property or managing any associated debts.

| Document | Purpose |

|---|---|

| Will | Outlines the deceased's wishes for the distribution of their estate. |

| Letters Testamentary | Confirms the executor's authority to manage the estate. |

| Inventory of the Estate | Lists all the assets and liabilities of the deceased. |

| Petition for Probate | Starts the probate process if there is a will or if the deceased died intestate. |

| Estate Tax Return | Reports the value of the estate and calculates any estate taxes owed. |

In summary, inheriting property involves a detailed process that includes understanding the legal documents, navigating the probate process, considering tax implications, transferring property, and finalizing the estate. Each step requires careful attention to ensure that the process is handled correctly and efficiently. Whether you are an executor managing an estate or a beneficiary receiving an inheritance, it’s crucial to approach the situation with a clear understanding of the legal, financial, and emotional aspects involved.