5 Tax Papers Needed

Understanding the Importance of Tax Papers

When it comes to managing your finances, especially during tax season, having the right documents is crucial. These papers are essential for filing your taxes accurately and efficiently. In this article, we will discuss the 5 key tax papers you need to ensure a smooth tax filing process.

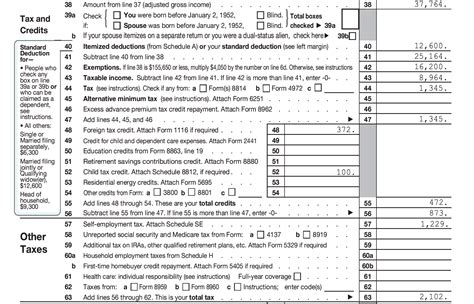

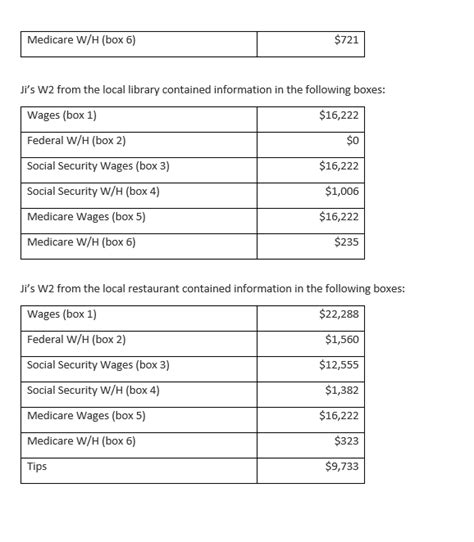

1. W-2 Form: Wage and Tax Statement

The W-2 form is one of the most critical tax papers you will need. It is provided by your employer and outlines your income and the amount of taxes withheld from your paycheck throughout the year. This form is essential for reporting your income to the IRS and calculating your tax refund or liability. You should receive a W-2 form from each employer you worked for during the tax year.

2. 1099 Forms: Miscellaneous Income

If you are self-employed or have income from freelance work, investments, or other sources, you will need 1099 forms. There are several types of 1099 forms, including: - 1099-MISC: For miscellaneous income, such as freelance work or consulting fees. - 1099-INT: For interest income from banks and other financial institutions. - 1099-DIV: For dividend income from investments. These forms report your income from sources other than employment, which you will need to include in your tax return.

3. 1098 Form: Mortgage Interest Statement

The 1098 form is provided by your lender and shows the amount of mortgage interest you paid during the year. This can be an important deduction on your tax return, helping to reduce your taxable income. If you have a mortgage, you should receive a 1098 form from your lender.

4. 1095 Forms: Health Insurance Coverage

The 1095 forms are related to your health insurance coverage. There are different versions of this form, depending on whether you receive health insurance through your employer, the marketplace, or another source. These forms are used to verify that you had health insurance coverage for the year, which is essential for avoiding penalties under the Affordable Care Act.

5. Charitable Donation Receipts

If you made charitable donations during the year, you may be eligible for a tax deduction. To claim this deduction, you will need receipts from the charitable organizations you donated to. These receipts should include the date, amount, and nature of your donation. Keep in mind that only donations to qualified charitable organizations are eligible for a tax deduction.

📝 Note: It is essential to keep all your tax papers organized and in a safe place. This will make it easier to prepare your tax return and ensure you do not miss any important deductions or credits.

In addition to these key tax papers, you may need other documents depending on your specific situation. For example, if you have dependent care expenses, you may need a Form 2441 to claim the child and dependent care credit. If you are a student, you may need a 1098-T form to claim education credits.

To further illustrate the importance of these tax papers, consider the following benefits: - Accurate Tax Filing: Having all the necessary tax papers ensures that you file your taxes accurately, reducing the risk of errors or audits. - Maximizing Refunds: By including all eligible deductions and credits, you can maximize your tax refund. - Reducing Liability: Accurate reporting of income and deductions helps in reducing your tax liability.

In the process of gathering and organizing your tax papers, you may encounter various challenges, such as missing forms or unclear documentation. To overcome these challenges, consider the following tips: - Contact Your Employer or Lender: If you are missing a W-2 or 1098 form, contact your employer or lender to request a copy. - Consult a Tax Professional: If you are unsure about how to report certain income or claim deductions, consider consulting a tax professional.

As you prepare to file your taxes, remember that having the right tax papers is just the first step. You must also ensure that you understand how to use these documents to your advantage. By doing so, you can navigate the tax filing process with confidence and make the most of the deductions and credits available to you.

To summarize, the key to a successful tax filing experience is being prepared with the necessary documents. By understanding the importance of the 5 tax papers needed and taking the time to gather and organize them, you can ensure a smooth and efficient tax filing process. This, in turn, can help you maximize your refund, reduce your liability, and avoid any potential issues with the IRS.

What is the deadline for receiving tax papers from my employer or lender?

+

Employers and lenders are typically required to provide tax papers, such as W-2 and 1098 forms, to recipients by January 31st of each year.

How do I report income from freelance work on my tax return?

+

You will need to report income from freelance work on a Schedule C (Form 1040), using the information provided on your 1099-MISC forms.

Can I claim a deduction for charitable donations without a receipt?

+

No, to claim a deduction for charitable donations, you must have a receipt from the charitable organization that includes the date, amount, and nature of your donation.