5 Bankruptcy Tax Forms

Understanding Bankruptcy Tax Forms

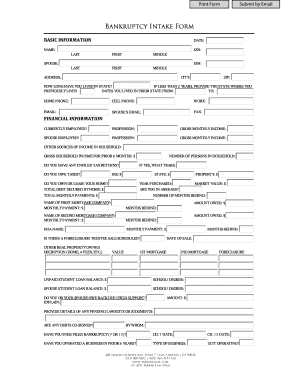

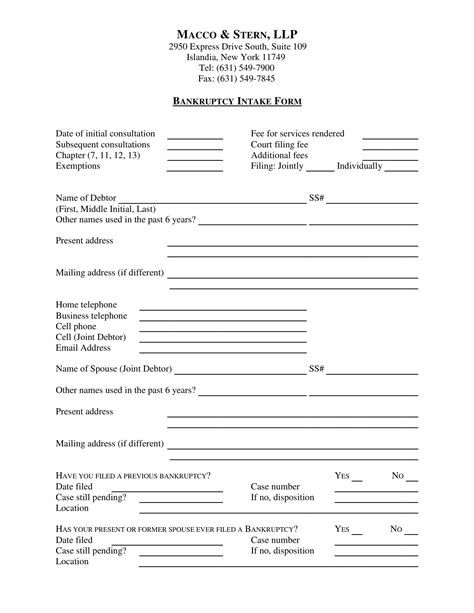

When individuals or businesses file for bankruptcy, they are required to submit various tax forms to the Internal Revenue Service (IRS) and other relevant authorities. These forms are crucial in determining the tax implications of bankruptcy and ensuring compliance with tax laws. In this article, we will delve into the world of bankruptcy tax forms, exploring the different types, their purposes, and the information required to complete them.

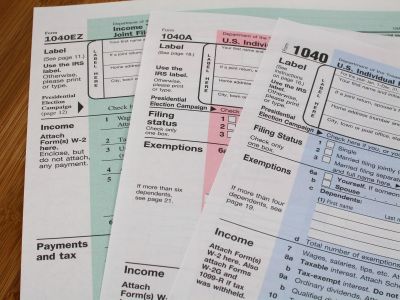

Type 1: Form 1040 - Individual Income Tax Return

The Form 1040 is a standard tax return form used by individuals to report their income, deductions, and credits. When filing for bankruptcy, individuals may need to submit this form to report any income earned during the tax year, including income from employment, investments, and other sources. The form requires detailed information about the individual’s income, including:

- Wages, salaries, and tips

- Interest and dividend income

- Capital gains and losses

- Business income and expenses

- Itemized deductions and credits

Type 2: Form 1041 - U.S. Income Tax Return for Estates and Trusts

The Form 1041 is used by estates and trusts to report their income, deductions, and credits. In the context of bankruptcy, this form may be required when an individual’s estate or trust is involved in the bankruptcy proceedings. The form requires information about the estate or trust’s income, including:

- Income from investments and assets

- Deductions and credits

- Distribution of income to beneficiaries

- Tax liabilities and payments

Type 3: Form 1120 - U.S. Corporation Income Tax Return

The Form 1120 is used by corporations to report their income, deductions, and credits. When a corporation files for bankruptcy, it may need to submit this form to report its income and expenses. The form requires detailed information about the corporation’s financial activities, including:

- Gross income and receipts

- Cost of goods sold and operating expenses

- Depreciation and amortization

- Taxes and payments

Type 4: Form 2210 - Underpayment of Estimated Tax by Individuals, Estates, and Trusts

The Form 2210 is used to calculate and report underpayment of estimated tax by individuals, estates, and trusts. In the context of bankruptcy, this form may be required when an individual or estate/trust has underpaid their estimated tax liability. The form requires information about the underpayment, including:

- Total tax liability

- Estimated tax payments made

- Underpayment amount and penalty

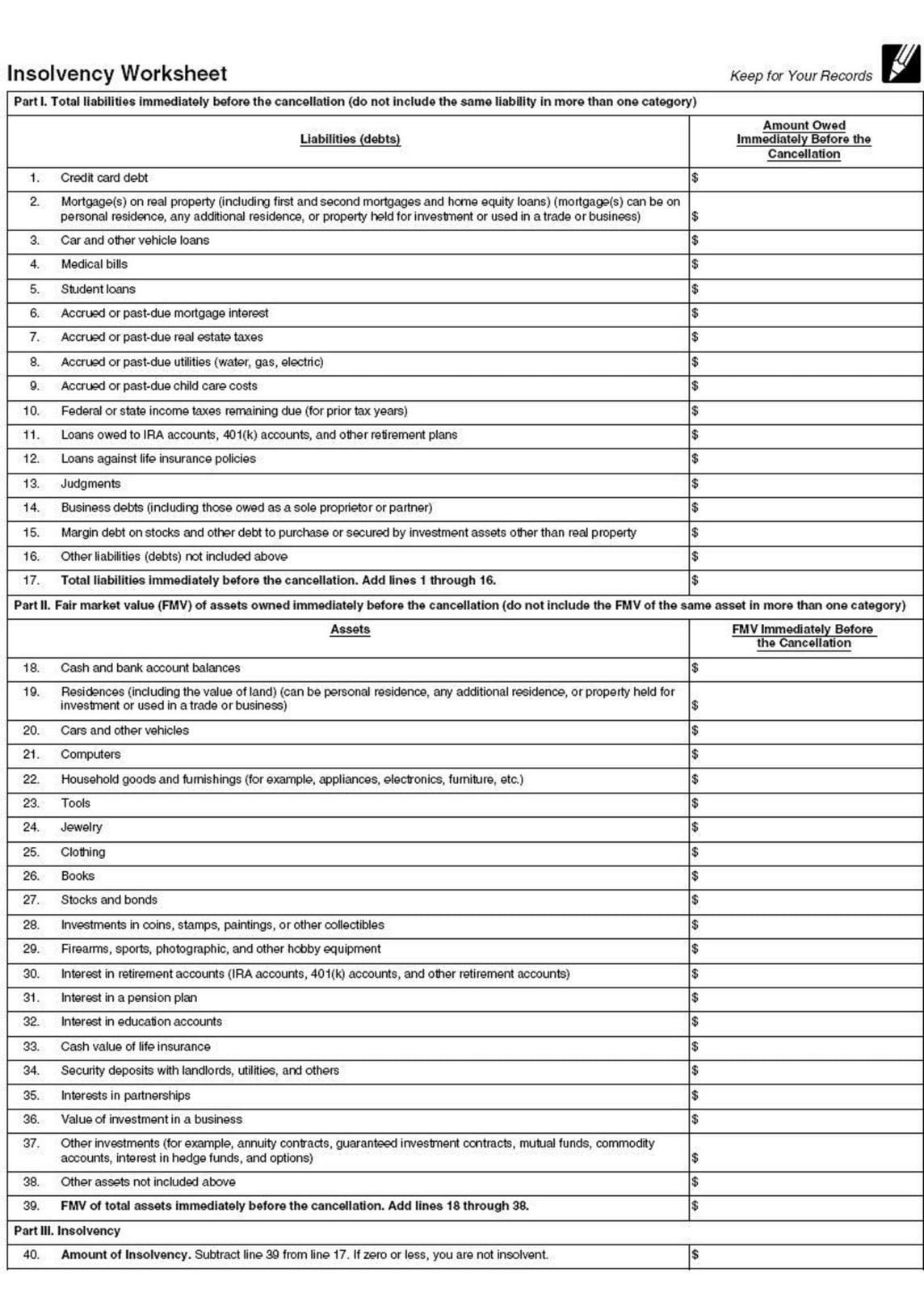

Type 5: Form 982 - Reduction of Tax Attributes Due to Discharge of Indebtedness

The Form 982 is used to report the reduction of tax attributes due to the discharge of indebtedness. When an individual or business has debt cancelled or forgiven, they may be required to report the reduction of tax attributes, such as net operating losses or capital losses. The form requires information about the discharged debt, including:

- Amount of debt discharged

- Type of debt discharged (e.g., credit card, mortgage, etc.)

- Reduction of tax attributes

📝 Note: It is essential to consult with a tax professional or attorney to ensure accurate completion of these forms and compliance with tax laws.

In addition to these forms, individuals and businesses may need to submit other documentation, such as financial statements, asset valuations, and tax returns, to support their bankruptcy filing.

| Form Number | Form Name | Purpose |

|---|---|---|

| 1040 | Individual Income Tax Return | Report individual income, deductions, and credits |

| 1041 | U.S. Income Tax Return for Estates and Trusts | Report estate or trust income, deductions, and credits |

| 1120 | U.S. Corporation Income Tax Return | Report corporate income, deductions, and credits |

| 2210 | Underpayment of Estimated Tax by Individuals, Estates, and Trusts | Calculate and report underpayment of estimated tax |

| 982 | Reduction of Tax Attributes Due to Discharge of Indebtedness | Report reduction of tax attributes due to debt discharge |

To ensure compliance with tax laws and regulations, it is crucial to seek the advice of a tax professional or attorney when filing for bankruptcy. They can help navigate the complex process of completing and submitting the required tax forms, reducing the risk of errors and penalties.

In the end, understanding the different types of bankruptcy tax forms and their purposes is essential for individuals and businesses navigating the bankruptcy process. By being aware of the required forms and documentation, individuals can ensure a smoother and more efficient bankruptcy filing, minimizing the risk of delays and complications.