Paperwork

Ohio New Employee Paperwork Requirements

Introduction to Ohio New Employee Paperwork Requirements

When hiring new employees in Ohio, it is essential to understand the necessary paperwork required by state and federal laws. This paperwork not only ensures compliance with legal requirements but also helps in maintaining a smooth and organized onboarding process for new hires. In this article, we will delve into the details of the new employee paperwork requirements in Ohio, covering both state-specific and federal mandates.

Federal Requirements

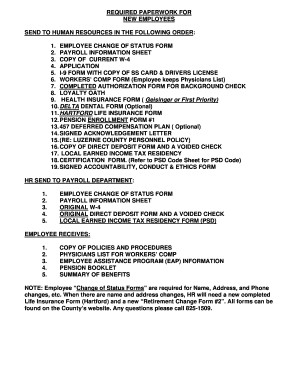

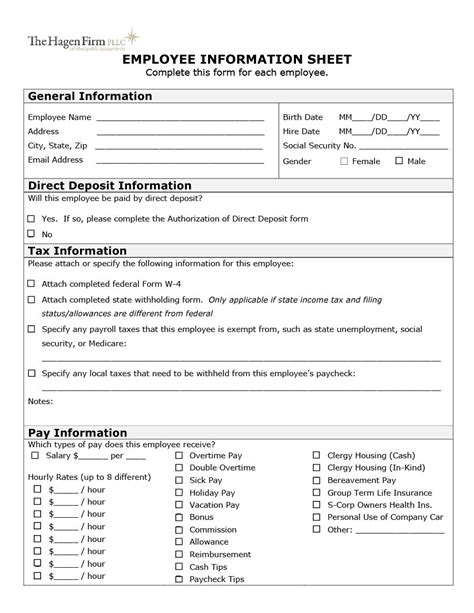

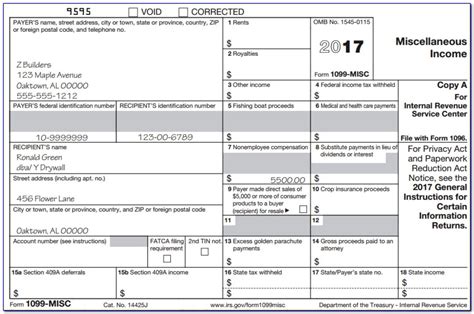

Before diving into Ohio-specific requirements, it’s crucial to understand the federal paperwork requirements that apply to all new employees across the United States. These include: - Form I-9: This form is used to verify the identity and employment authorization of each new employee. It must be completed by both the employer and the employee. - Form W-4: The Employee’s Withholding Certificate is completed by the employee to determine the amount of federal income tax to withhold from their wages. - New Hire Reporting: Employers must report new hires to the state, which is used for child support enforcement purposes. This can often be done online through the Ohio New Hire Reporting Center.

Ohio State Requirements

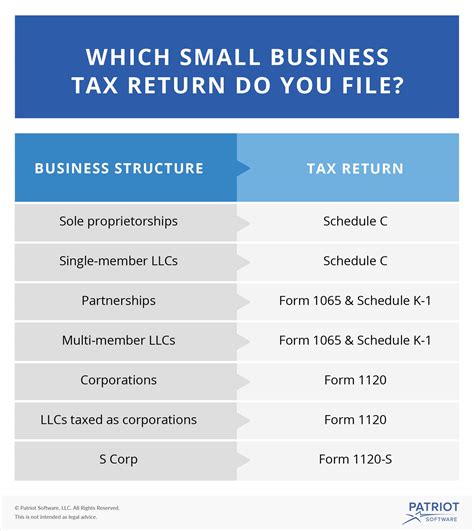

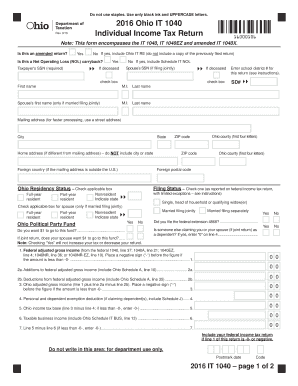

In addition to federal requirements, Ohio has its own set of paperwork that must be completed when hiring new employees. These include: - Ohio Income Tax Withholding: Employees may need to complete a form for Ohio state income tax withholding, similar to the federal Form W-4. - Workers’ Compensation: Employers must provide information about workers’ compensation insurance to new employees. - Unemployment Compensation: Employees should be informed about their rights and obligations under Ohio’s unemployment compensation laws.

Additional Requirements and Recommendations

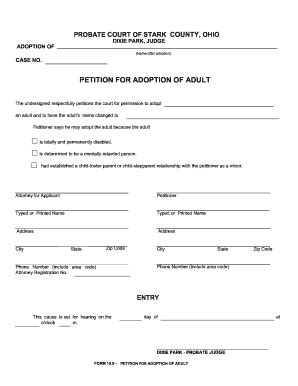

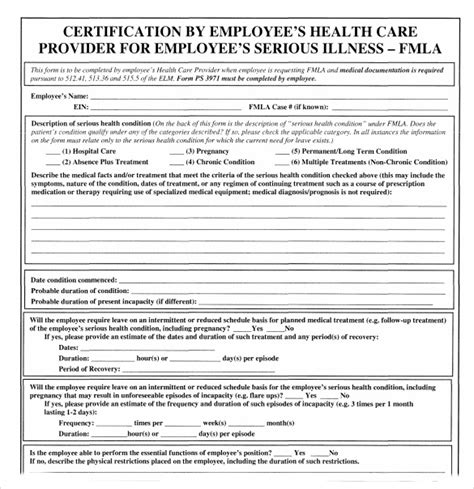

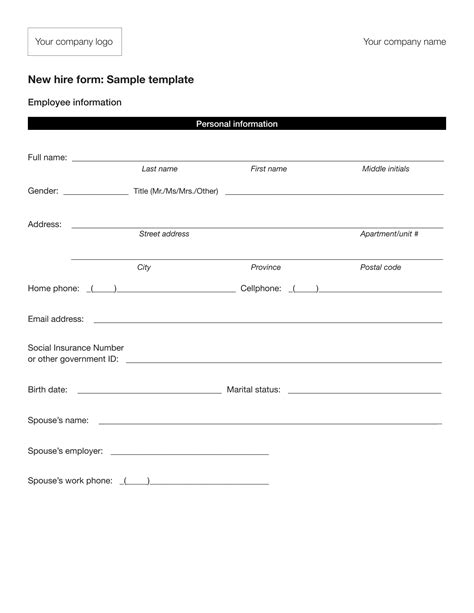

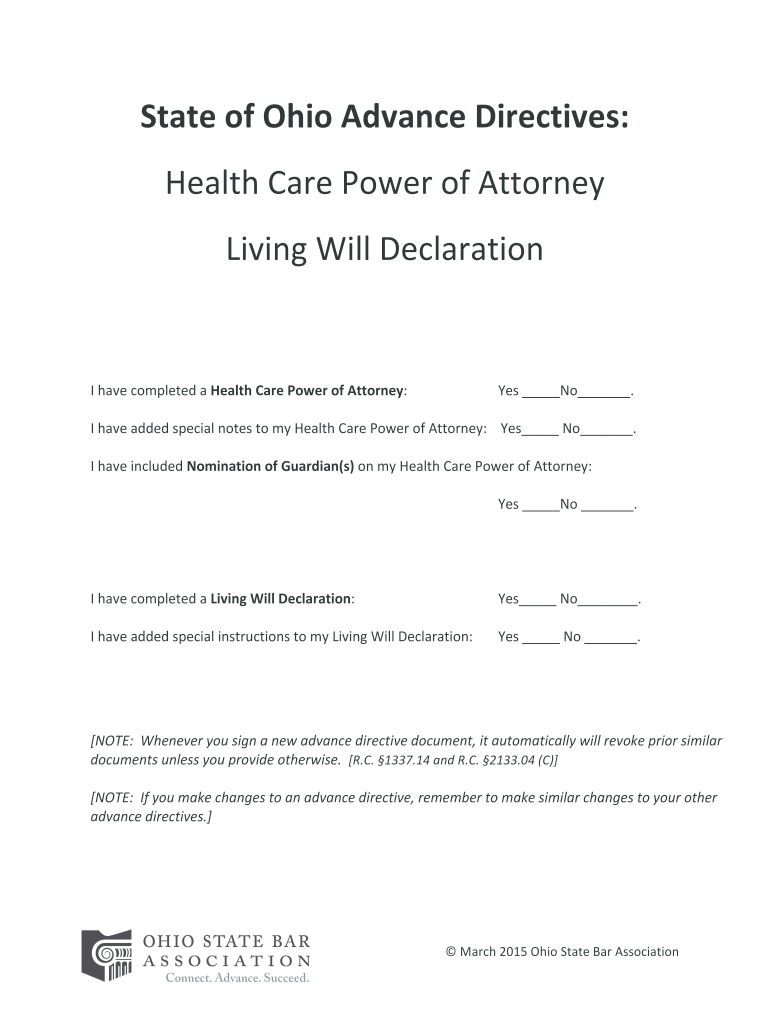

Besides the mandatory paperwork, there are additional documents and steps that employers might consider to ensure a comprehensive onboarding process: - Employee Handbook Acknowledgement: This document confirms that the employee has received and understood the company’s policies and procedures outlined in the employee handbook. - Non-Disclosure Agreements (NDAs): Depending on the nature of the business, employers may require employees to sign NDAs to protect confidential and proprietary information. - Benefits Enrollment Forms: If the company offers health insurance, retirement plans, or other benefits, employees will need to complete enrollment forms. - Emergency Contact Information: It’s a good practice to have employees provide emergency contact information in case of an accident or illness at work.

Best Practices for Managing New Employee Paperwork

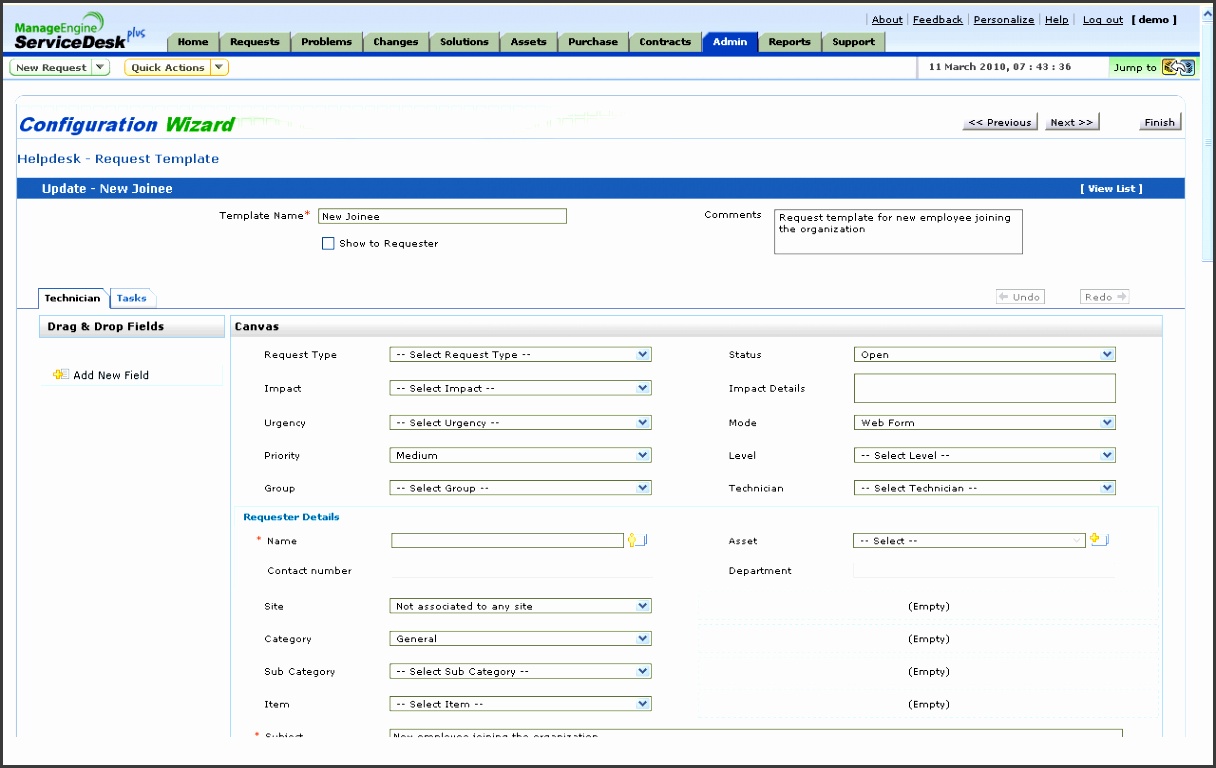

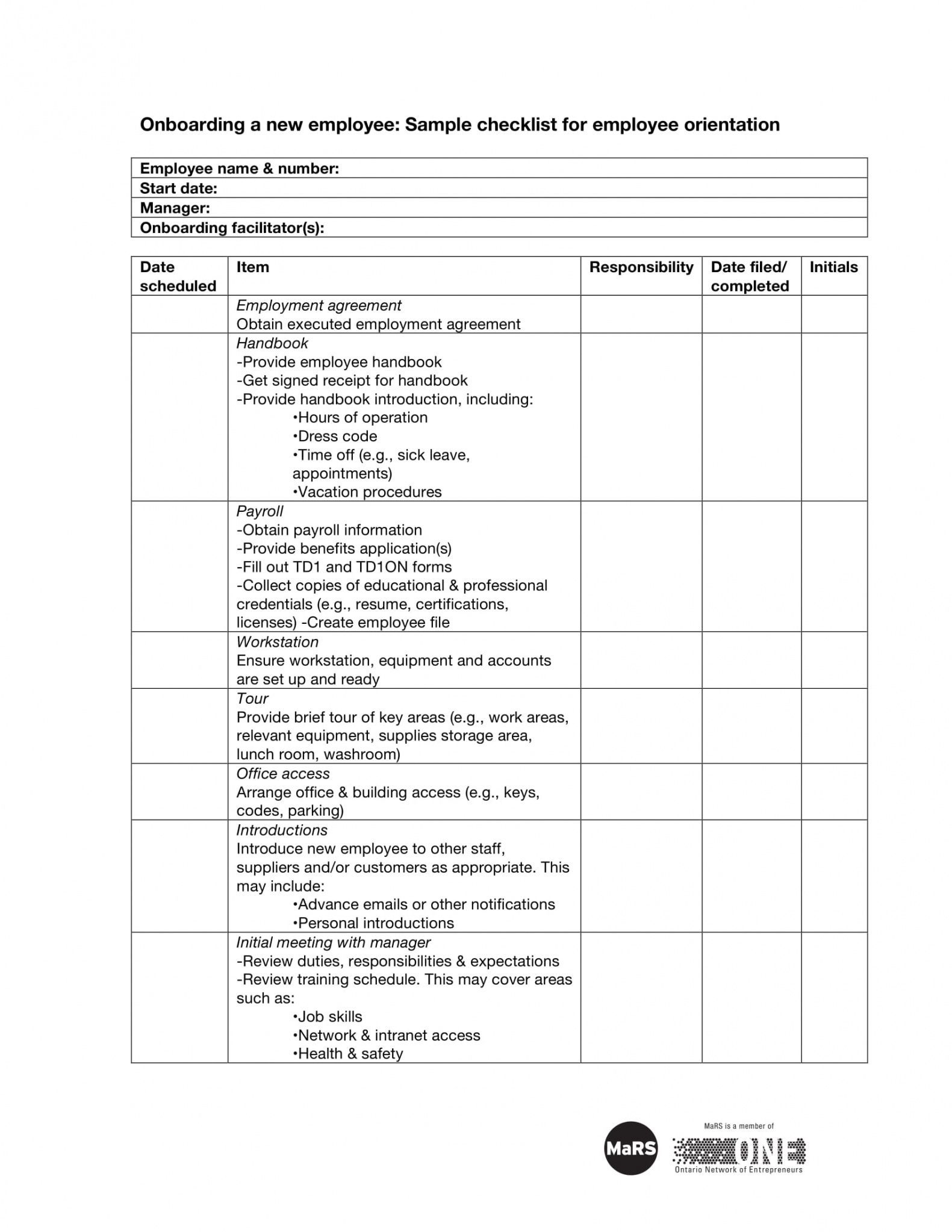

To efficiently manage the paperwork process for new employees, consider the following best practices: - Use Digital Solutions: Utilize digital platforms for paperwork whenever possible to reduce paperwork clutter and increase efficiency. - Create a Checklist: Develop a comprehensive checklist of all required documents to ensure nothing is missed during the onboarding process. - Designate a Point of Contact: Assign a specific person or department to oversee the paperwork process to ensure consistency and compliance. - Review and Update Regularly: Periodically review and update your paperwork process to reflect any changes in state or federal laws.

📝 Note: Employers should consult with legal counsel or HR experts to ensure their paperwork process is compliant with all applicable laws and regulations.

Conclusion and Next Steps

In summary, the process of hiring new employees in Ohio involves completing various federal and state-specific paperwork requirements. By understanding these requirements and implementing best practices for managing paperwork, employers can ensure a smooth onboarding process for new hires while maintaining compliance with legal mandates. It’s essential for employers to stay updated on any changes in laws and regulations that may affect their paperwork processes.

What is the purpose of the Form I-9?

+

The purpose of Form I-9 is to verify the identity and employment authorization of each new employee hired in the United States.

Do all employers in Ohio need to report new hires?

+

Yes, all employers in Ohio are required to report new hires to the state for child support enforcement purposes.

How often should an employer review and update their new employee paperwork process?

+

Employers should review and update their new employee paperwork process periodically, ideally every 6-12 months, or whenever there are changes in state or federal laws affecting employment practices.