Refinance Mortgage Paperwork Requirements

Understanding Refinance Mortgage Paperwork Requirements

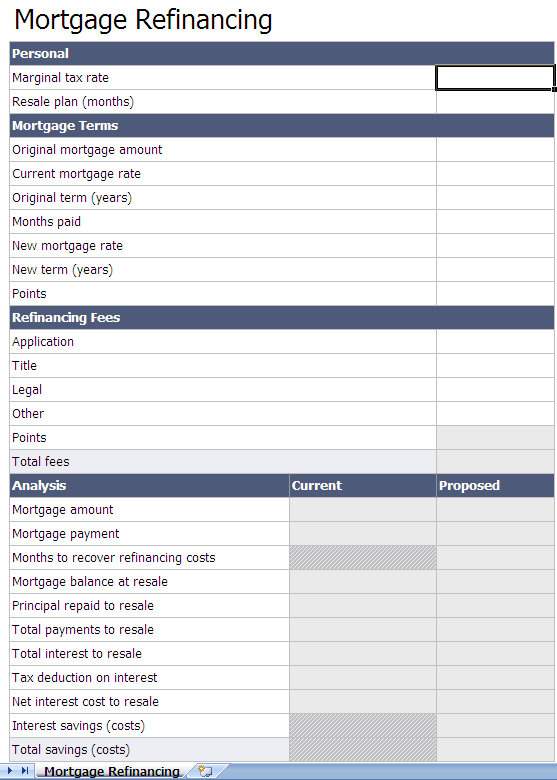

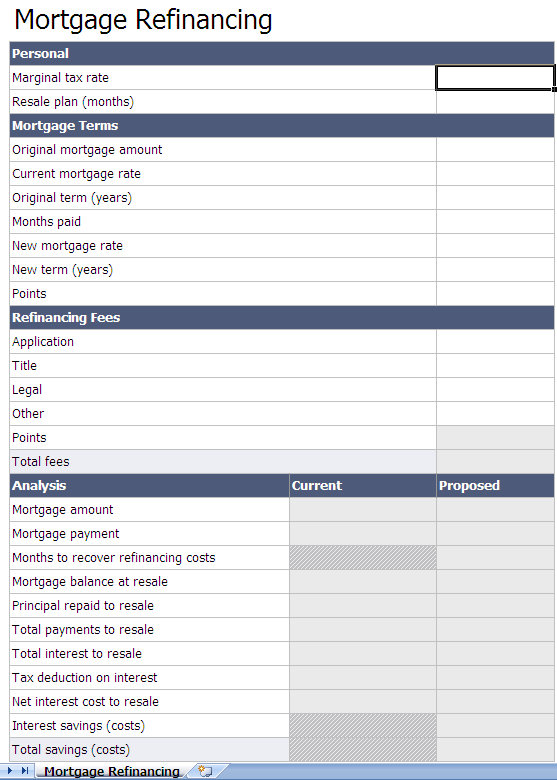

Refinancing a mortgage can be a complex process, involving a significant amount of paperwork. The requirements for refinance mortgage paperwork can vary depending on the lender, the type of loan, and the borrower’s financial situation. However, there are some common documents and information that are typically required. In this article, we will explore the refinance mortgage paperwork requirements and provide guidance on how to navigate the process.

Pre-Approval and Pre-Qualification

Before starting the refinance process, it’s essential to get pre-approved or pre-qualified for a mortgage. This involves providing some basic financial information to the lender, such as income, credit score, and debt obligations. The lender will then provide a pre-approval or pre-qualification letter, which indicates the amount of money they are willing to lend. This letter is usually valid for a specific period, typically 30 to 60 days.

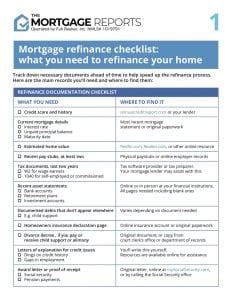

Required Documents

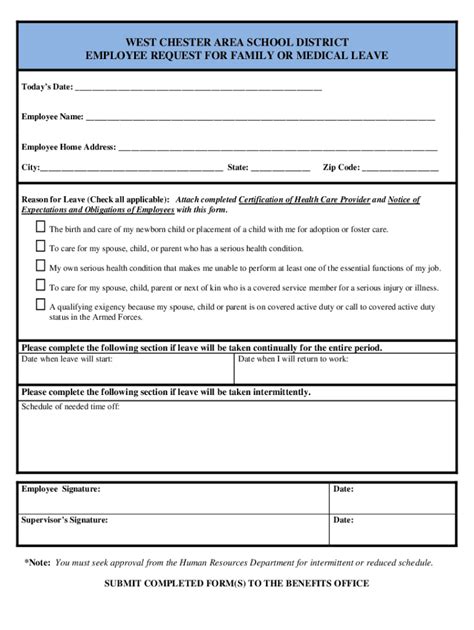

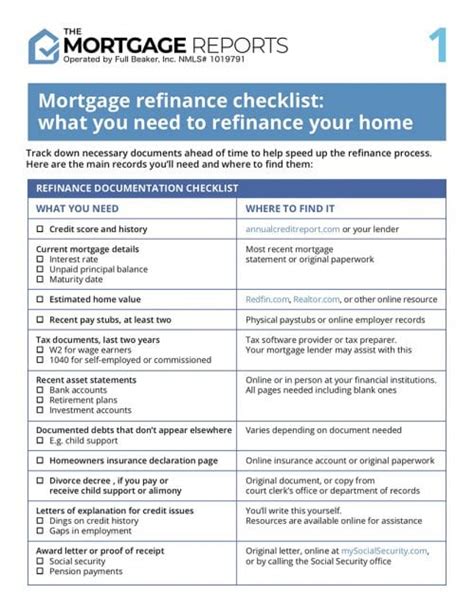

To refinance a mortgage, borrowers will typically need to provide the following documents:

- Identification: A valid government-issued ID, such as a driver’s license or passport

- Income verification: Pay stubs, W-2 forms, and tax returns to demonstrate income and employment history

- Credit reports: The lender will pull credit reports from the three major credit bureaus to evaluate creditworthiness

- Property valuation: An appraisal or valuation of the property to determine its current value

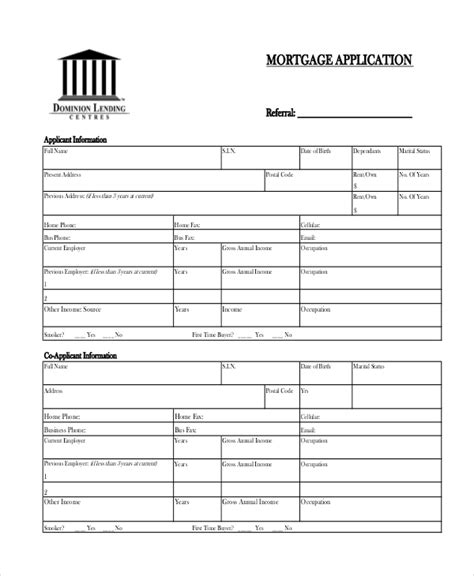

- Loan application: A completed loan application, which will include information about the borrower, the property, and the loan being refinanced

- Title report: A title report, which shows the ownership history of the property and any outstanding liens

Additional Requirements

Depending on the type of loan and the borrower’s financial situation, additional documentation may be required. For example:

- Bank statements: To verify assets and income

- Investment accounts: To verify assets and income

- Retirement accounts: To verify assets and income

- Divorce or separation documents: If the borrower is divorced or separated, they may need to provide documentation related to the divorce or separation

Streamline Refinance

A streamline refinance is a type of refinance that requires less documentation than a traditional refinance. This type of refinance is typically available to borrowers who have a good payment history and are refinancing an existing loan with the same lender. The requirements for a streamline refinance may include:

- Loan application: A simplified loan application, which will include basic information about the borrower and the loan

- Income verification: Limited income verification, such as a pay stub or W-2 form

- Credit report: A credit report, which will be used to evaluate creditworthiness

📝 Note: The requirements for a streamline refinance may vary depending on the lender and the type of loan.

FHA and VA Refinance

The Federal Housing Administration (FHA) and the Department of Veterans Affairs (VA) offer refinance options with more lenient requirements. For example:

- FHA refinance: The FHA allows borrowers to refinance with a lower credit score and a higher debt-to-income ratio than traditional lenders

- VA refinance: The VA offers an Interest Rate Reduction Refinance Loan (IRRRL), which allows borrowers to refinance with a lower interest rate and lower fees

Table of Refinance Mortgage Paperwork Requirements

| Type of Refinance | Required Documents |

|---|---|

| Traditional Refinance | Identification, income verification, credit reports, property valuation, loan application, title report |

| Streamline Refinance | Loan application, income verification, credit report |

| FHA Refinance | Identification, income verification, credit reports, property valuation, loan application |

| VA Refinance | Identification, income verification, credit reports, property valuation, loan application |

In summary, refinancing a mortgage requires a significant amount of paperwork, including identification, income verification, credit reports, property valuation, and loan applications. The requirements may vary depending on the type of loan and the borrower’s financial situation. It’s essential to understand the requirements and to provide all necessary documentation to ensure a smooth refinance process. By doing so, borrowers can navigate the process with confidence and achieve their financial goals.

What is the difference between a traditional refinance and a streamline refinance?

+

A traditional refinance requires more documentation and verification than a streamline refinance. A streamline refinance is a type of refinance that requires less documentation and is typically available to borrowers who have a good payment history and are refinancing an existing loan with the same lender.

What are the benefits of refinancing a mortgage?

+

The benefits of refinancing a mortgage include lowering the interest rate, reducing monthly payments, and tapping into home equity. Refinancing can also help borrowers to consolidate debt, improve their credit score, and achieve their long-term financial goals.

How long does the refinance process typically take?

+

The refinance process typically takes 30 to 60 days, depending on the complexity of the loan and the efficiency of the lender. However, this timeframe may vary depending on the type of loan and the borrower’s financial situation.