Paperwork

Roth IRA Withdrawal Paperwork Requirements

Introduction to Roth IRA Withdrawal Paperwork

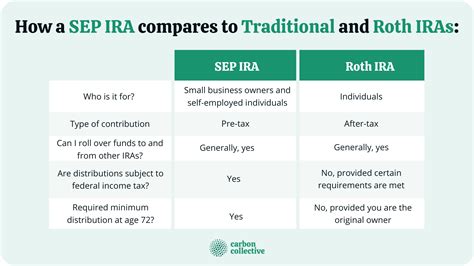

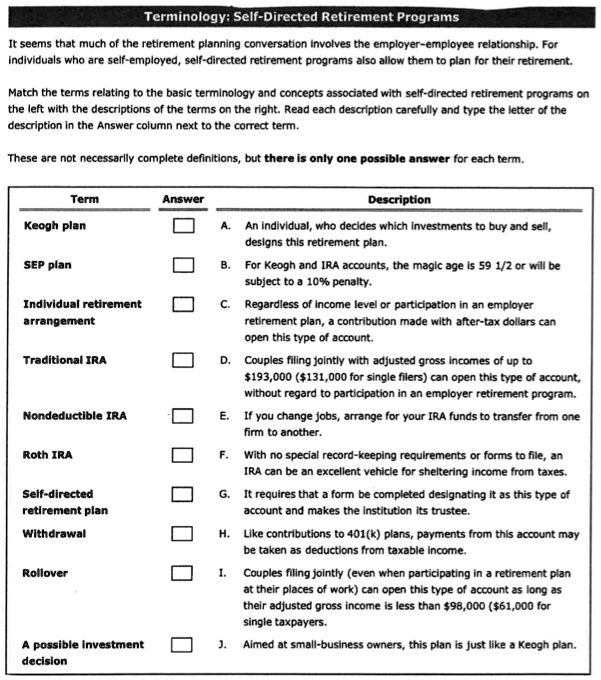

When it comes to managing your retirement savings, understanding the rules and requirements for withdrawals is crucial. A Roth Individual Retirement Account (Roth IRA) offers a unique set of benefits, including tax-free growth and withdrawals if certain conditions are met. However, navigating the Roth IRA withdrawal paperwork can be complex and requires careful consideration to avoid unnecessary penalties or taxes. In this article, we will delve into the specifics of Roth IRA withdrawal rules, the necessary paperwork, and important considerations to keep in mind.

Understanding Roth IRA Withdrawal Rules

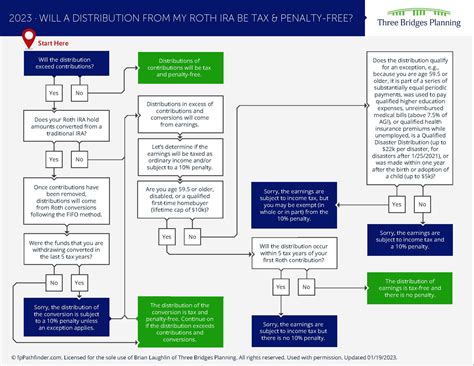

Before diving into the paperwork requirements, it’s essential to understand the basic rules governing Roth IRA withdrawals. The key factors that determine whether your withdrawals are tax-free and penalty-free include: - Contributions vs. Earnings: Contributions (the money you put into the Roth IRA) can be withdrawn at any time tax-free and penalty-free. However, the earnings (the investment gains) are subject to certain rules to be withdrawn tax-free and penalty-free. - Five-Year Rule: To withdraw earnings tax-free and penalty-free, you must have had a Roth IRA for at least five years, and you must be 59 1⁄2 or older, disabled, or using the funds for a first-time home purchase (up to a $10,000 lifetime limit). - Qualified Distributions: Withdrawals that meet the above conditions are considered qualified distributions and are tax-free and penalty-free.

Required Paperwork for Roth IRA Withdrawals

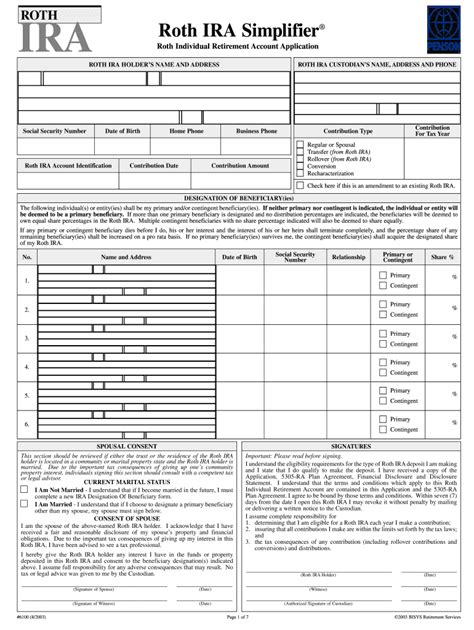

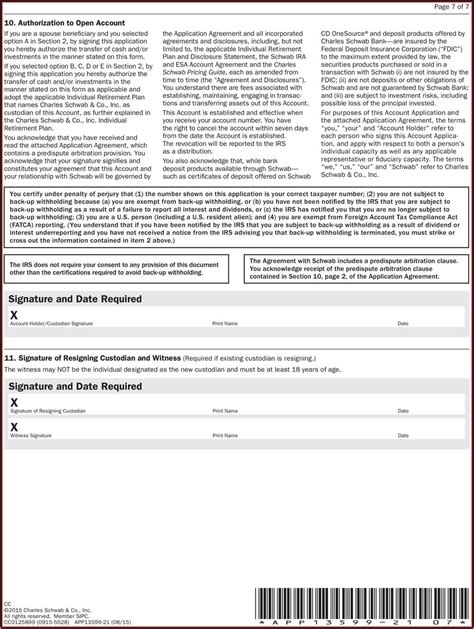

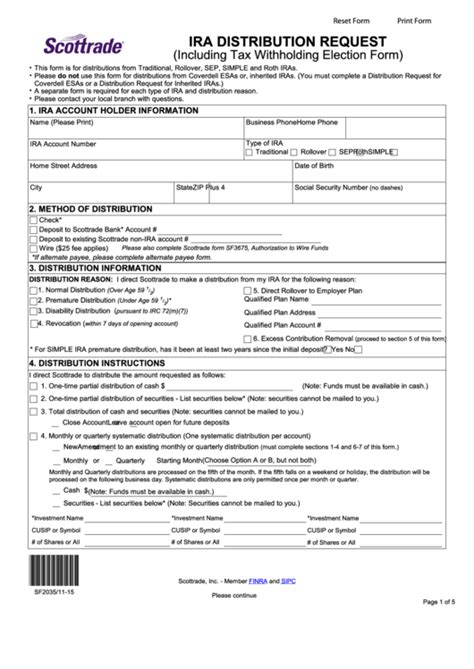

The specific paperwork required for a Roth IRA withdrawal can vary depending on the custodian of your account (e.g., bank, brokerage firm) and the type of withdrawal you are making. Generally, you will need to:

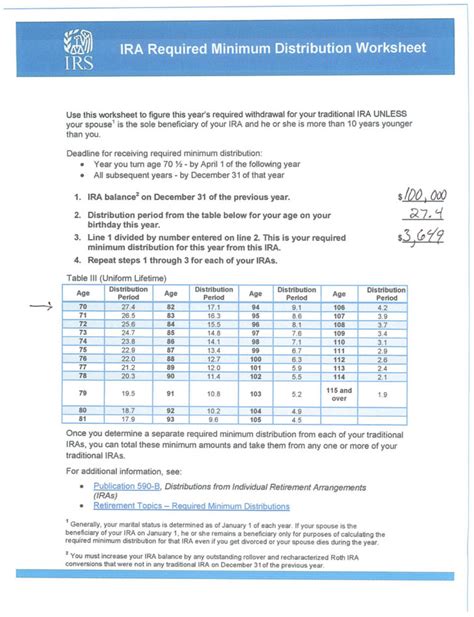

- Submit a Withdrawal Request Form: Most custodians have a form that you must fill out to request a withdrawal. This form will ask for your account information, the amount you wish to withdraw, and possibly the reason for the withdrawal.

- Provide Identification: You may need to provide identification to verify your identity, especially if you are withdrawing a large sum or if you are requesting the withdrawal to be sent to a different address than what is on file.

- Certify the Nature of the Withdrawal: If you are making a withdrawal for a specific qualified purpose (e.g., first-time home purchase), you may need to certify this on the withdrawal request form or provide additional documentation.

Special Considerations and Potential Penalties

It’s crucial to be aware of the potential penalties and taxes associated with Roth IRA withdrawals that do not meet the qualified distribution criteria. If you withdraw earnings before age 59 1⁄2 or within the five-year window, you may be subject to: - 10% Penalty: On the earnings withdrawn, unless an exception applies. - Income Tax: On the earnings withdrawn, as they will be considered taxable income.

Managing Your Roth IRA for Future Withdrawals

To make the most of your Roth IRA and minimize potential issues with withdrawals, consider the following strategies: - Keep Accurate Records: Maintain detailed records of your contributions and any withdrawals. This can help if you need to prove the five-year rule or the source of funds for tax purposes. - Plan Ahead: Consider your future financial needs and how they might align with Roth IRA withdrawal rules. Planning can help you avoid unnecessary penalties and taxes. - Consult a Financial Advisor: For personalized advice tailored to your financial situation and goals.

📝 Note: It's always a good idea to consult with a financial advisor or tax professional to ensure you are making the most tax-efficient decisions regarding your Roth IRA withdrawals.

Conclusion and Future Planning

In conclusion, navigating the paperwork and rules associated with Roth IRA withdrawals requires careful planning and attention to detail. By understanding the basic rules, maintaining accurate records, and planning ahead, you can make the most of your Roth IRA and avoid unnecessary complications. Whether you’re approaching retirement or just starting to plan for the future, a well-managed Roth IRA can be a valuable component of your overall financial strategy.

What is the primary condition for tax-free and penalty-free withdrawals from a Roth IRA?

+

The primary conditions include having had a Roth IRA for at least five years and being 59 1⁄2 or older, disabled, or using the funds for a first-time home purchase.

Can I withdraw contributions from my Roth IRA at any time without penalty or tax?

+

Yes, contributions (not earnings) can be withdrawn at any time tax-free and penalty-free.

How do I avoid the 10% penalty on early withdrawals from a Roth IRA?

+

Avoid withdrawing earnings before age 59 1⁄2 or within the five-year window, or meet one of the exceptions such as using the funds for a first-time home purchase, qualified education expenses, or due to a qualified disability or death.