Keep Paperwork 20 Years

Understanding the Importance of Keeping Paperwork for 20 Years

When it comes to managing personal or business finances, one of the most critical aspects is maintaining accurate and comprehensive records. This includes keeping paperwork for an extended period, often up to 20 years, depending on the type of document and the jurisdiction’s requirements. The necessity of retaining such documents for two decades might seem excessive, but it is crucial for several reasons, including tax purposes, audits, and legal disputes.

Types of Documents to Keep

There are various types of documents that individuals and businesses should consider keeping for 20 years. These include: - Tax Returns: Keeping tax returns and supporting documentation for at least 20 years can be beneficial in case of audits or if there’s a need to prove income or expenses from past years. - Financial Records: Bank statements, investment records, and loan documents should be retained for extended periods to track financial history and for potential legal or tax needs. - Business Records: For businesses, this includes invoices, receipts, contracts, and employment records. These documents are essential for audits, legal disputes, and understanding the financial trajectory of the company. - Property Records: Documents related to property purchases, sales, and improvements should be kept for 20 years. These can be crucial for tax deductions, proving ownership, and understanding the property’s value over time.

Why 20 Years?

The 20-year timeframe is significant because it often aligns with the statute of limitations for various legal and financial matters. For instance, in some jurisdictions, the statute of limitations for tax audits or legal claims related to property can be up to 20 years. By keeping documents for this duration, individuals and businesses can ensure they have the necessary paperwork to defend themselves in case of disputes or audits.

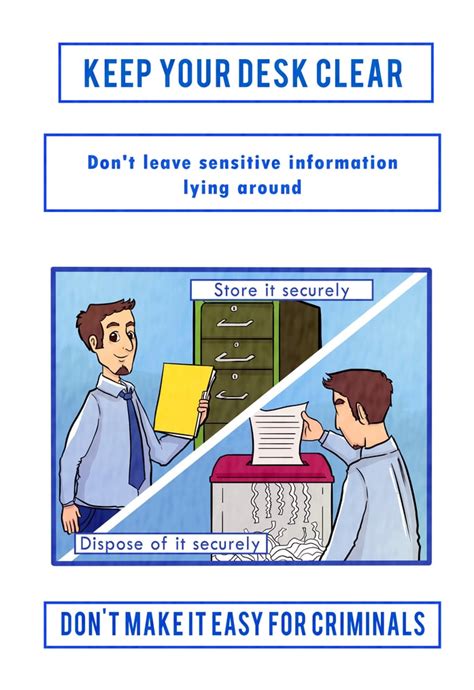

Best Practices for Document Storage

Given the importance of these documents, it’s crucial to store them securely and efficiently. Some best practices include: - Digital Storage: Consider scanning physical documents and storing them digitally. This can help reduce physical storage space and make documents easier to access and share. - Secure Storage: Use secure methods for storing both physical and digital documents. This can include safes, locked cabinets, or encrypted digital storage solutions. - Organization: Keep documents well-organized, either physically or digitally, to ensure they can be easily found when needed.

Benefits of Long-Term Record Keeping

The benefits of keeping paperwork for 20 years are multifaceted: - Audit Protection: Having comprehensive records can protect individuals and businesses during audits by providing clear evidence of financial transactions and tax compliance. - Legal Protection: In legal disputes, having detailed records can be invaluable in proving claims or defending against allegations. - Financial Insight: Long-term financial records can provide valuable insights into spending habits, investment performance, and business operations, helping inform future financial decisions.

Challenges and Solutions

One of the primary challenges of keeping paperwork for 20 years is the space and resource requirements. Physical documents can occupy significant storage space, and digital documents require secure and reliable storage solutions. Solutions to these challenges include: - Cloud Storage: Utilizing cloud storage services can provide a secure, accessible, and space-efficient way to store digital documents. - Document Scanning Services: For individuals or businesses with large volumes of physical documents, professional scanning services can convert these into digital formats, reducing storage needs and improving accessibility.

| Document Type | Retention Period | Purpose |

|---|---|---|

| Tax Returns | 20 Years | Audits, Tax Purposes |

| Financial Records | 20 Years | Financial Tracking, Legal Needs |

| Business Records | 20 Years | Audits, Legal Disputes, Financial History |

| Property Records | 20 Years | Tax Deductions, Ownership, Value Assessment |

💡 Note: The retention period for documents can vary based on jurisdiction and specific legal requirements. It's essential to consult with legal or financial advisors to determine the appropriate retention period for your specific situation.

In summary, keeping paperwork for 20 years is a prudent practice that offers protection, insight, and compliance benefits. By understanding which documents to keep, why they are important, and how to store them effectively, individuals and businesses can better navigate financial and legal landscapes. This approach to document management underscores the importance of preparation and diligence in maintaining comprehensive and accessible records over the long term. The ultimate goal is to ensure that critical documents are available when needed, providing a foundation for informed decision-making and strategic planning.