File 501c6 Texas Paperwork

Understanding the 501©(6) Texas Paperwork Process

The process of obtaining 501©(6) status in Texas involves several steps, including forming an organization, applying for federal tax-exempt status, and registering with the state of Texas. Non-profit organizations, business leagues, and chambers of commerce are among the types of entities that can qualify for 501©(6) status. This status is crucial for these organizations as it provides them with federal tax exemption, which can significantly reduce their financial burden and allow them to focus more on their objectives.

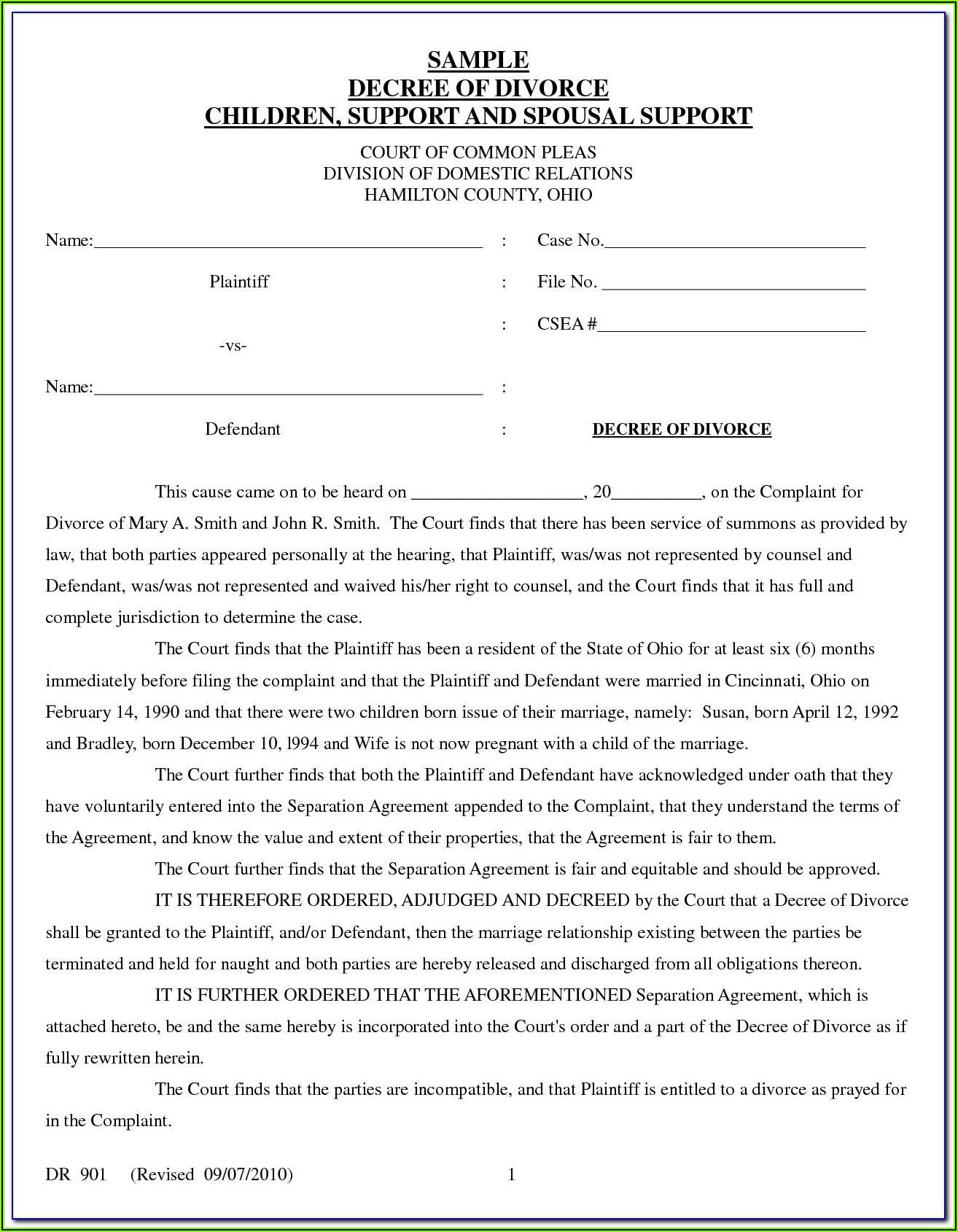

Step 1: Forming the Organization

To begin the process, the organization must be formed according to Texas state law. This typically involves choosing a business name, applying for necessary licenses and permits, and drafting and filing articles of incorporation with the Texas Secretary of State. It is essential to ensure that the organization’s purpose and structure comply with the requirements for 501©(6) status. Legal counsel can be beneficial in this step to ensure all legal requirements are met.

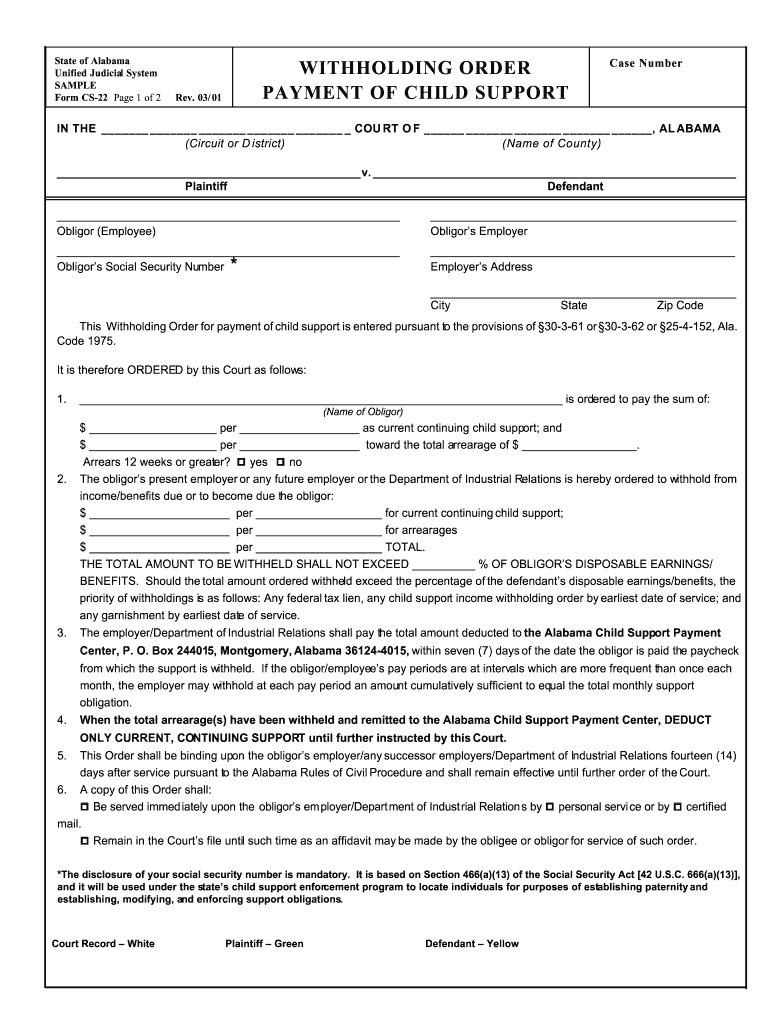

Step 2: Applying for Federal Tax-Exempt Status

The next step is to apply for federal tax-exempt status by filing Form 1024 with the Internal Revenue Service (IRS). This form requires detailed information about the organization, including its purpose, structure, and financial plans. The organization must also submit Form 1024-A if it intends to solicit contributions or apply for a determination letter recognizing its exemption. Along with these forms, the organization needs to provide its articles of incorporation, bylaws, and other supporting documents.

Step 3: Registering with the State of Texas

After applying for federal tax-exempt status, the organization must register with the state of Texas. This involves filing a certificate of formation (for a non-profit corporation) or a statement of registration (for a foreign non-profit corporation) with the Texas Secretary of State. The organization must also obtain any necessary state licenses and permits. Annual reports may need to be filed with the state to maintain good standing.

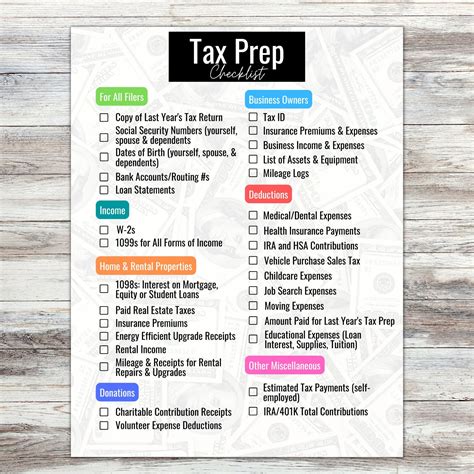

Key Documents and Forms

Several key documents and forms are required throughout the 501©(6) application process in Texas. These include: - Articles of Incorporation: Filed with the Texas Secretary of State to form the non-profit corporation. - Bylaws: Outline the rules and procedures for the organization’s internal management. - Form 1024: Application for Recognition of Exemption under Section 501(a) of the Internal Revenue Code. - Form 1024-A: Schedule for Form 1024, used for organizations that intend to solicit contributions. - Certificate of Formation or Statement of Registration: Filed with the Texas Secretary of State for state registration.

| Document/Form | Purpose | Filing Location |

|---|---|---|

| Articles of Incorporation | Form non-profit corporation | Texas Secretary of State |

| Bylaws | Internal management rules | Organizational records |

| Form 1024 | Apply for federal tax-exempt status | Internal Revenue Service (IRS) |

| Form 1024-A | Solicit contributions, apply for determination letter | Internal Revenue Service (IRS) |

| Certificate of Formation/Statement of Registration | State registration | Texas Secretary of State |

Maintaining 501©(6) Status

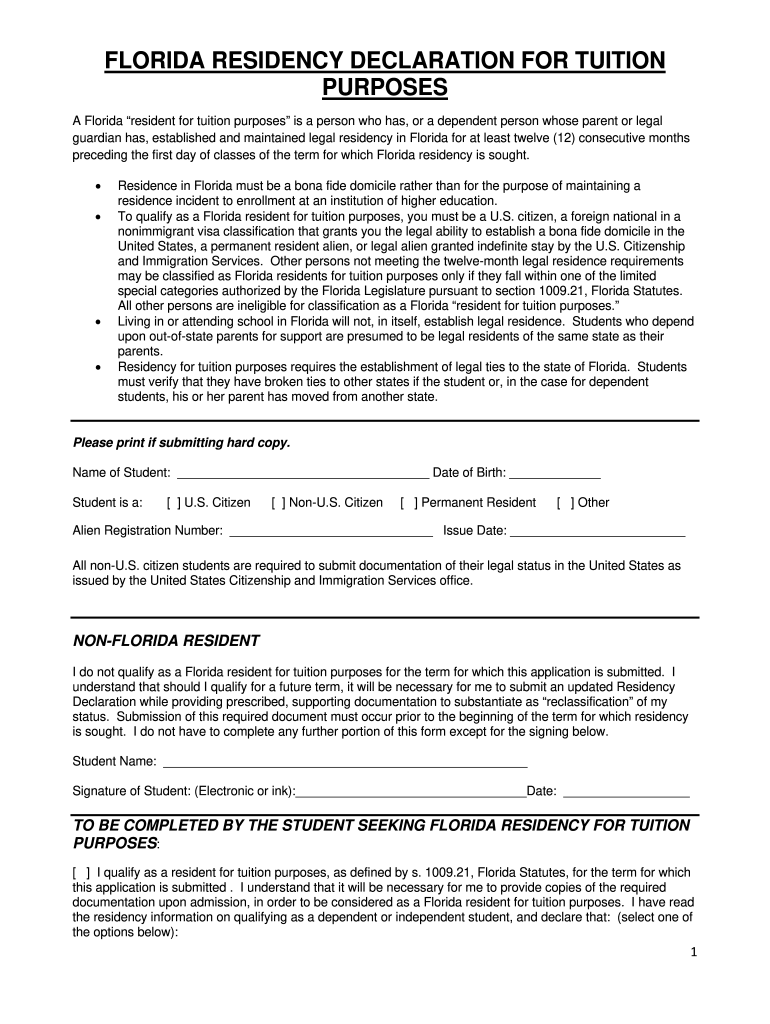

After obtaining 501©(6) status, the organization must comply with ongoing requirements to maintain its tax-exempt status. These requirements include: - Filing annual information returns (Form 990) with the IRS. - Complying with Texas state reporting requirements, such as filing annual reports with the Secretary of State. - Ensuring ongoing compliance with the purposes and activities that qualify the organization for 501©(6) status. - Maintaining accurate and detailed records of the organization’s activities, finances, and governance.

📝 Note: It is crucial for organizations to consult with legal and tax professionals to ensure they meet all the requirements for 501(c)(6) status and maintain compliance with federal and state laws.

In summary, obtaining and maintaining 501©(6) status in Texas involves several critical steps, including forming the organization, applying for federal tax-exempt status, and registering with the state. Compliance with ongoing requirements is essential to maintaining tax-exempt status. By understanding and following these steps, organizations can successfully navigate the process and focus on their mission and objectives.

What types of organizations are eligible for 501©(6) status?

+

Business leagues, chambers of commerce, real estate boards, boards of trade, and professional football leagues are among the types of organizations eligible for 501©(6) status.

How long does it take to obtain 501©(6) status?

+

The time it takes to obtain 501©(6) status can vary. It typically takes several months for the IRS to process Form 1024, but this timeframe can be longer or shorter depending on the complexity of the application and the workload of the IRS.

What are the main benefits of having 501©(6) status?

+

The main benefits include federal tax exemption, the ability to attract and retain members by offering tax-deductible contributions or dues, and enhanced credibility and reputation. However, contributions to 501©(6) organizations are generally not deductible as charitable contributions but may be deductible as business expenses.