Paperwork

Florida Partnership Paperwork Filing Requirements

Introduction to Florida Partnership Paperwork Filing Requirements

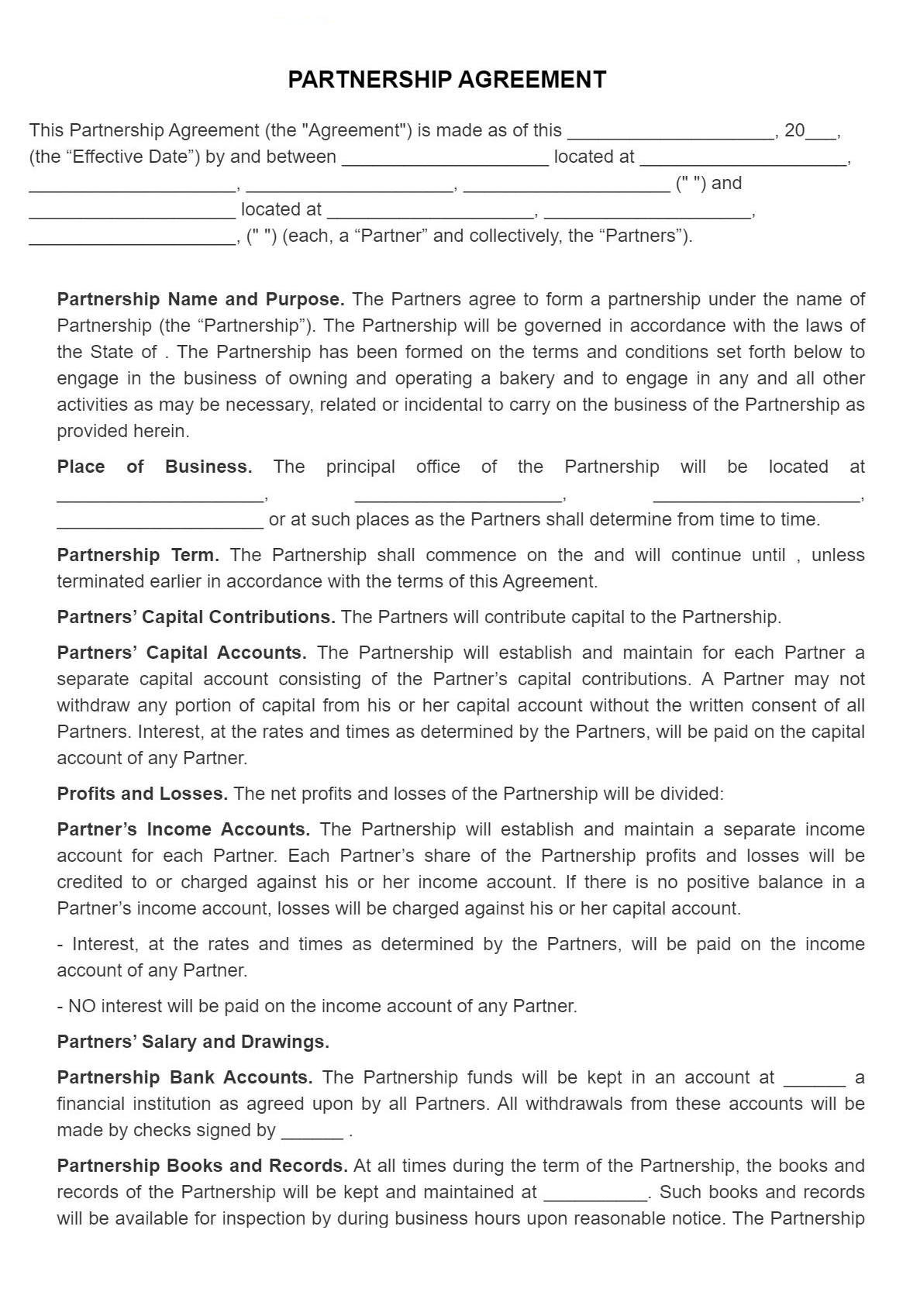

When establishing a partnership in Florida, it is essential to understand the necessary paperwork and filing requirements. A partnership is a type of business structure where two or more individuals share ownership and management responsibilities. In Florida, partnerships are governed by the Florida Revised Uniform Partnership Act (FRUPA). To ensure compliance with state regulations, partners must file the required paperwork and meet specific filing requirements.

Types of Partnerships in Florida

There are several types of partnerships that can be formed in Florida, including: * General Partnership (GP): A general partnership is the most common type of partnership, where all partners have equal rights and responsibilities. * Limited Partnership (LP): A limited partnership consists of at least one general partner and one or more limited partners, who have limited liability and no management control. * Limited Liability Partnership (LLP): A limited liability partnership is a type of partnership that provides personal liability protection for all partners. * Limited Liability Limited Partnership (LLLP): A limited liability limited partnership is a type of partnership that combines the benefits of a limited partnership and a limited liability partnership.

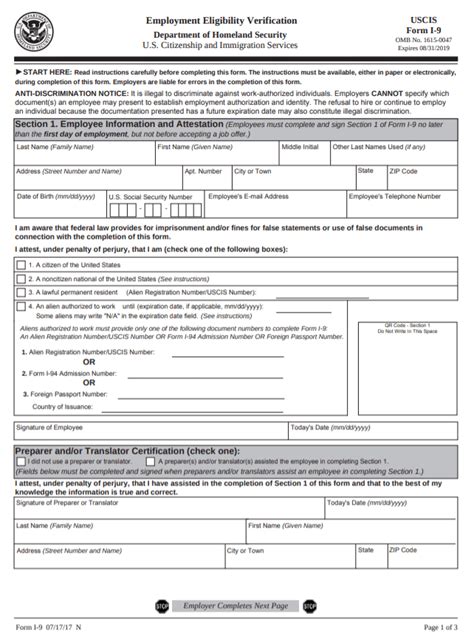

Florida Partnership Paperwork Filing Requirements

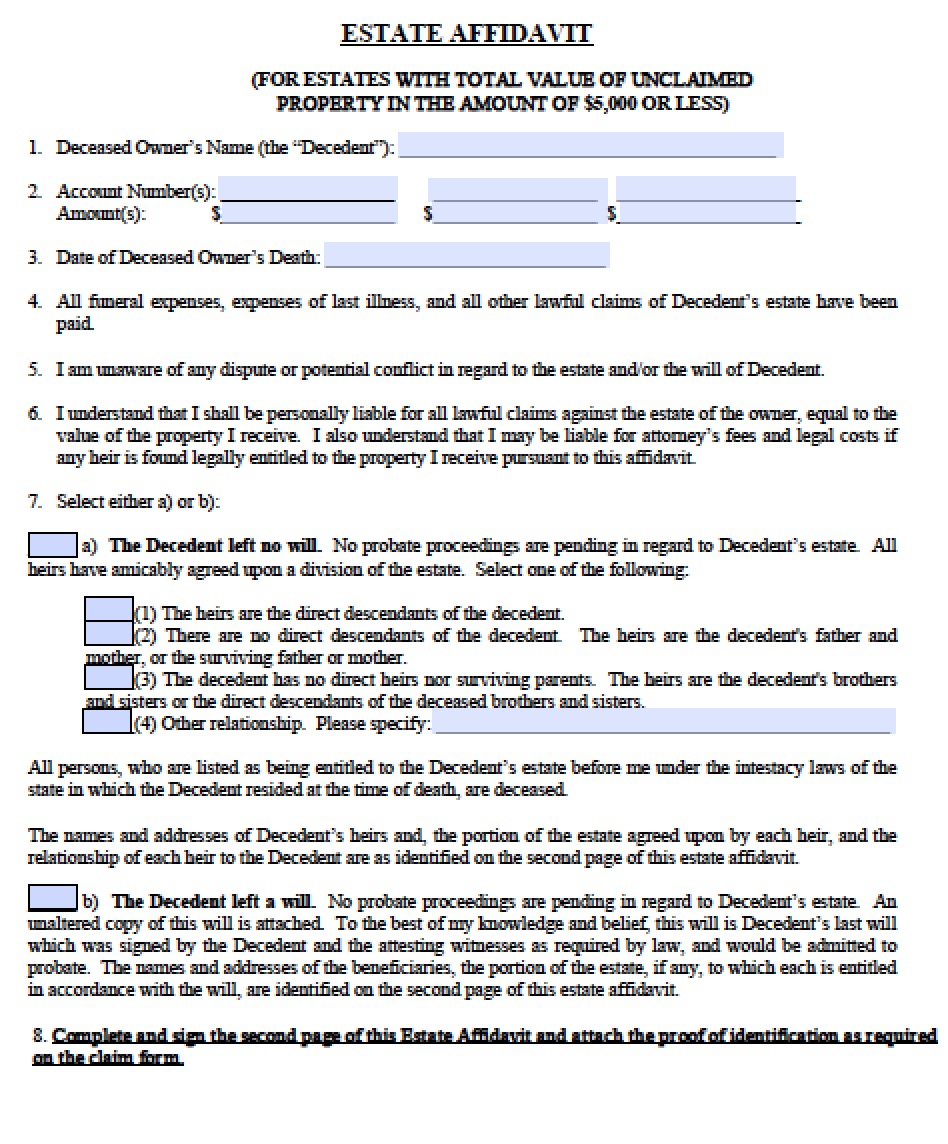

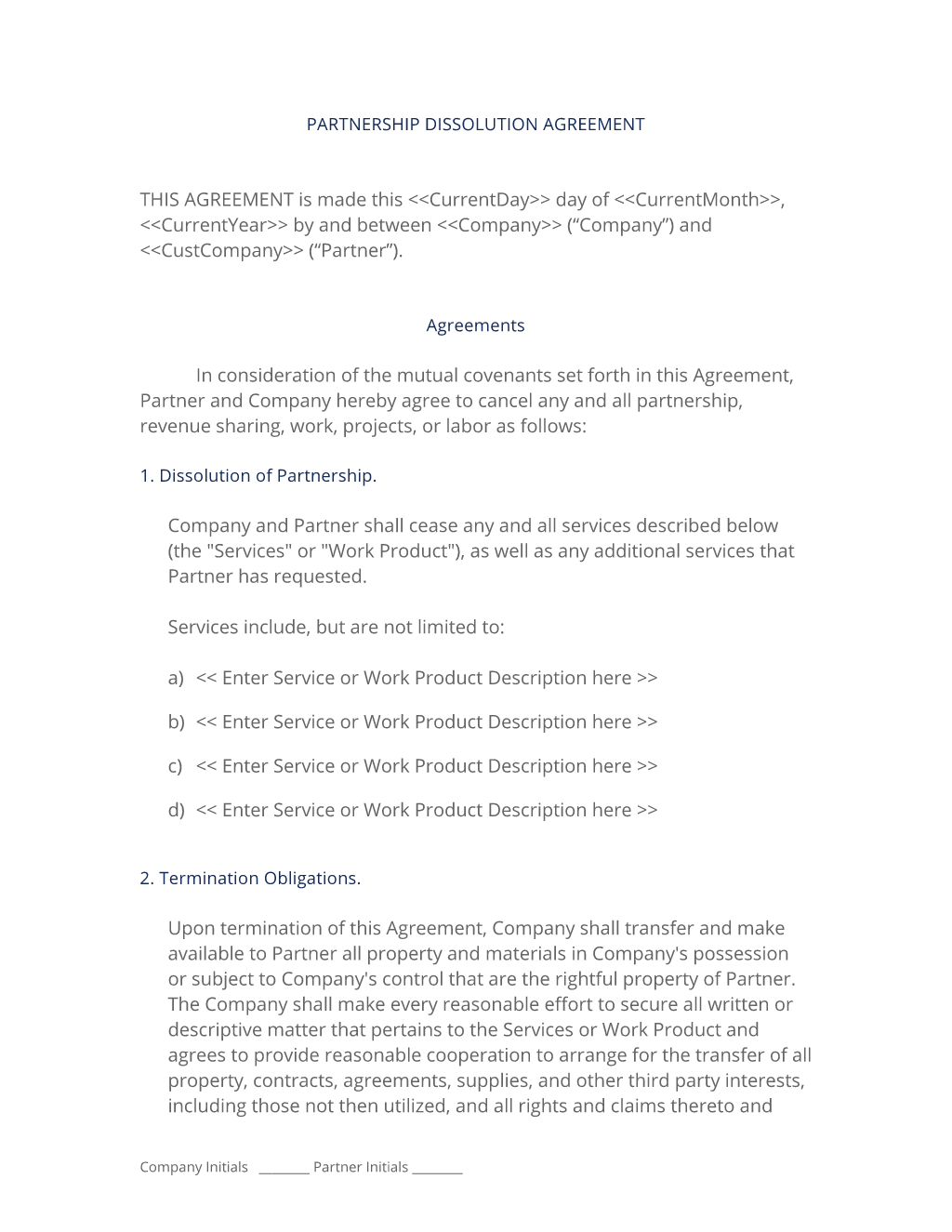

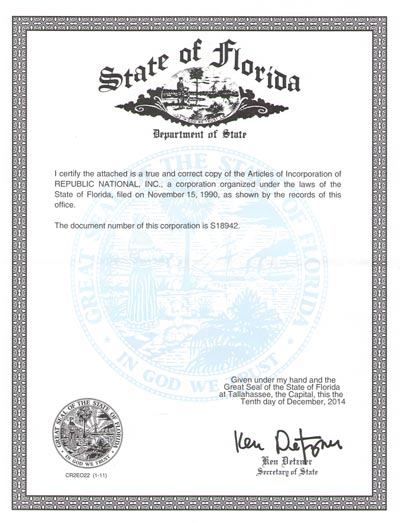

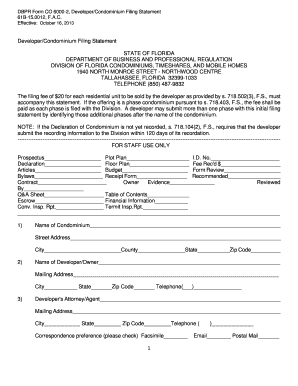

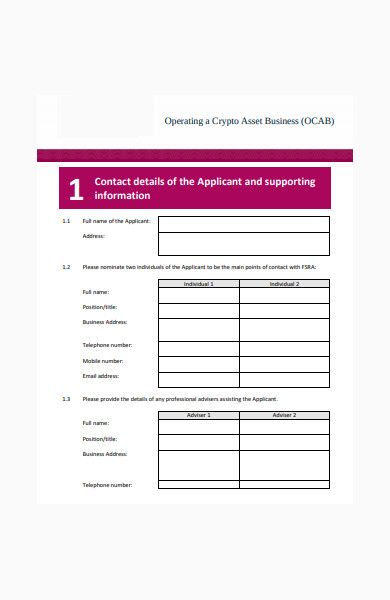

To establish a partnership in Florida, the following paperwork must be filed: * Articles of Partnership: The articles of partnership, also known as the partnership agreement, outline the terms and conditions of the partnership, including the partnership’s name, purpose, and management structure. * Partnership Registration: The partnership must register with the Florida Department of State, Division of Corporations, by filing a registration statement. * Employer Identification Number (EIN): The partnership must obtain an EIN from the Internal Revenue Service (IRS) for tax purposes. * Business Tax Receipt: The partnership must obtain a business tax receipt from the county tax collector’s office.

Filing Requirements for Different Types of Partnerships

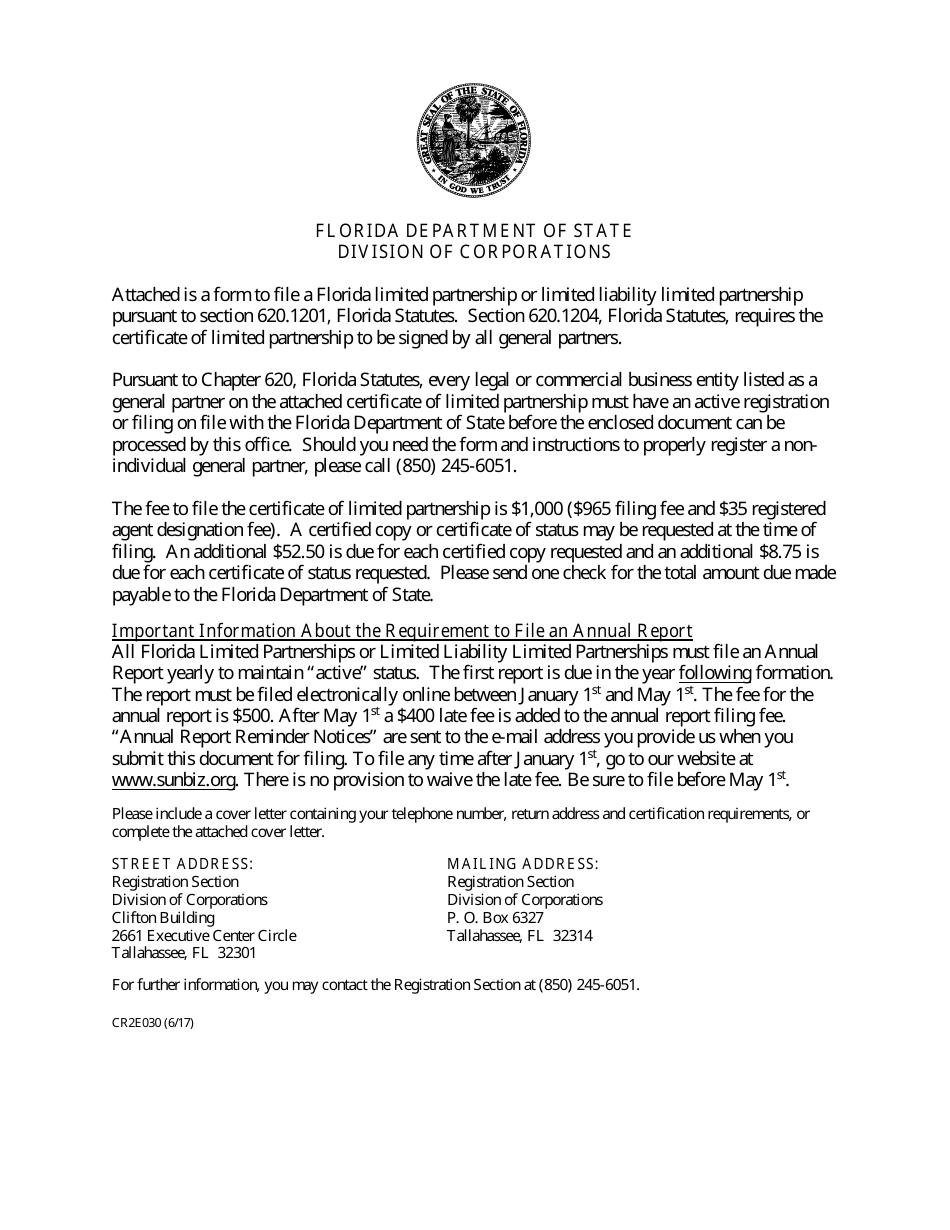

The filing requirements for different types of partnerships in Florida vary: * General Partnership: A general partnership is not required to file any paperwork with the state, but it is recommended that partners draft a partnership agreement. * Limited Partnership: A limited partnership must file a certificate of limited partnership with the Florida Department of State, Division of Corporations. * Limited Liability Partnership: A limited liability partnership must file a registration statement with the Florida Department of State, Division of Corporations. * Limited Liability Limited Partnership: A limited liability limited partnership must file a certificate of limited partnership and a registration statement with the Florida Department of State, Division of Corporations.

Timeline for Filing Partnership Paperwork

The timeline for filing partnership paperwork in Florida varies: * Pre-Filing: Before filing any paperwork, partners should draft a partnership agreement and obtain an EIN from the IRS. * Filing: The partnership must file the required paperwork with the Florida Department of State, Division of Corporations, within a certain timeframe, usually within 30 days of formation. * Post-Filing: After filing the paperwork, the partnership must obtain a business tax receipt and comply with ongoing filing requirements, such as filing annual reports.

📝 Note: It is essential to consult with an attorney or accountant to ensure compliance with all filing requirements and to draft a comprehensive partnership agreement.

Consequences of Non-Compliance

Failure to comply with Florida partnership paperwork filing requirements can result in: * Penalties: The partnership may be subject to penalties and fines for non-compliance. * Dissolution: The partnership may be dissolved if it fails to file the required paperwork. * Liability: Partners may be personally liable for the partnership’s debts and obligations if the partnership is not properly formed and registered.

Conclusion and Final Thoughts

In conclusion, establishing a partnership in Florida requires careful consideration of the necessary paperwork and filing requirements. Partners must file the required documents, obtain an EIN, and comply with ongoing filing requirements to ensure compliance with state regulations. It is essential to consult with an attorney or accountant to ensure that all filing requirements are met, and to draft a comprehensive partnership agreement.

What is the difference between a general partnership and a limited partnership in Florida?

+

A general partnership is a type of partnership where all partners have equal rights and responsibilities, while a limited partnership consists of at least one general partner and one or more limited partners, who have limited liability and no management control.

Do I need to file any paperwork to establish a general partnership in Florida?

+

No, a general partnership is not required to file any paperwork with the state, but it is recommended that partners draft a partnership agreement.

What is the purpose of obtaining an Employer Identification Number (EIN) for a partnership in Florida?

+

The EIN is required for tax purposes and is used to identify the partnership on tax returns and other documents filed with the IRS.