Paperwork After Death Requirements

Introduction to Paperwork After Death Requirements

When a loved one passes away, the last thing on your mind is the mountain of paperwork that needs to be completed. However, dealing with the administrative tasks associated with a person’s death is crucial for settling their estate, managing their assets, and ensuring that their wishes are respected. In this blog post, we will guide you through the necessary paperwork and steps to take after a death, helping you navigate this difficult and often overwhelming process.

Notifying Relevant Parties

After a person’s death, it’s essential to notify the relevant parties, including: * Social Security Administration: To report the death and stop any benefits from being sent to the deceased. * Insurance companies: To claim life insurance benefits and cancel any existing policies. * Banks and financial institutions: To notify them of the death and manage the deceased’s accounts. * Credit reporting agencies: To prevent identity theft and ensure that the deceased’s credit information is updated. * Employer or pension provider: To report the death and manage any benefits or pension payments.

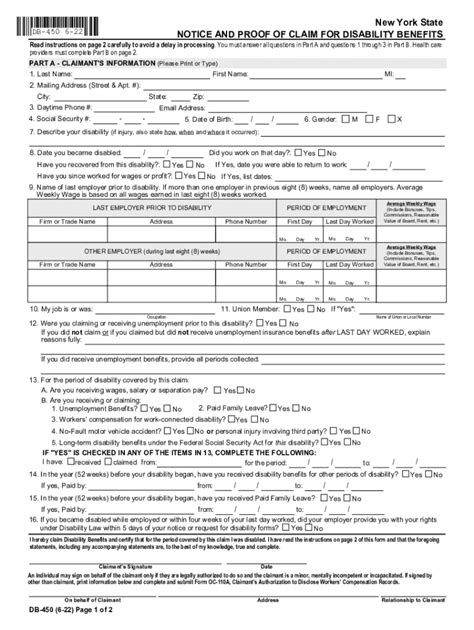

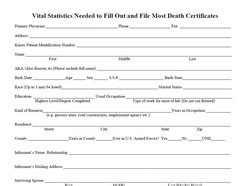

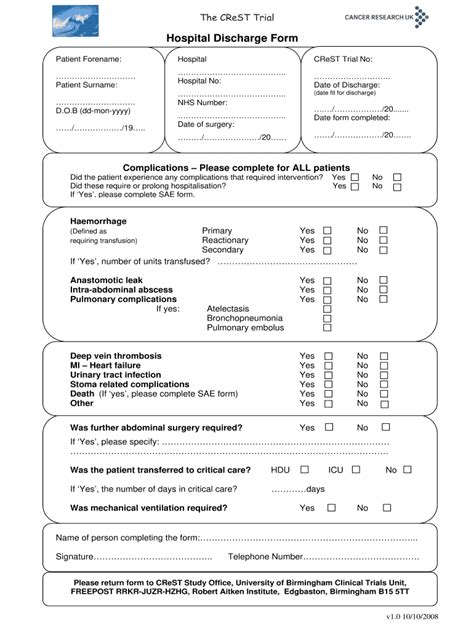

Obtaining a Death Certificate

A death certificate is a vital document that serves as proof of a person’s death. You will need to obtain multiple copies of the death certificate, as it will be required for various purposes, such as: * Settling the estate: To distribute the deceased’s assets according to their will or the laws of intestacy. * Claiming life insurance benefits: To provide proof of death to the insurance company. * Notifying government agencies: To update records and stop benefits from being sent to the deceased. * Managing tax affairs: To file tax returns and claim any deductions or exemptions.

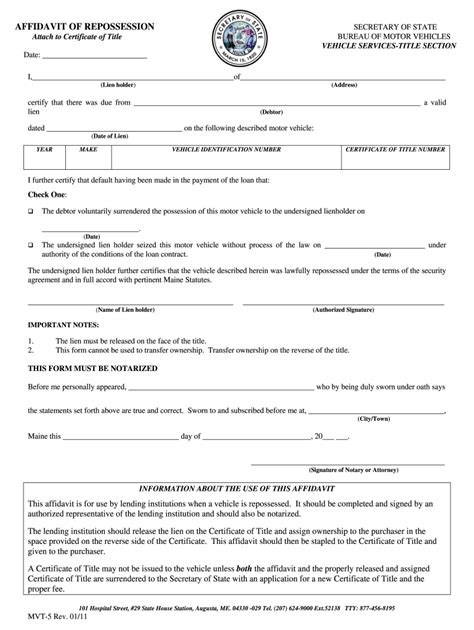

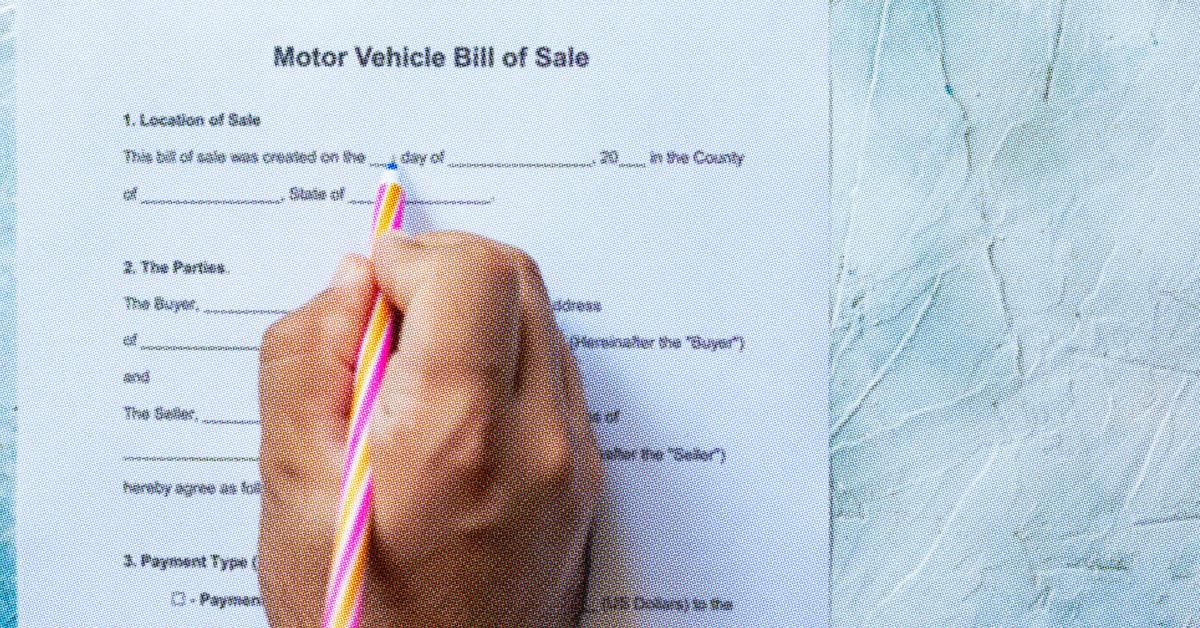

Managing the Estate

The estate of the deceased person includes all their assets, such as property, investments, and personal belongings. To manage the estate, you will need to: * Locate the will: If the deceased person had a will, it’s essential to find it and review its contents. * Identify the executor: The executor is responsible for managing the estate and carrying out the deceased person’s wishes. * Inventory the assets: Make a list of all the deceased person’s assets, including property, investments, and personal belongings. * Pay off debts: Use the estate’s assets to pay off any debts or liabilities.

Tax Implications

Death can have significant tax implications, and it’s essential to understand the tax laws and regulations that apply. You may need to: * File a tax return: For the deceased person’s income tax return, as well as any estate tax returns. * Claim deductions: For funeral expenses, medical expenses, and other eligible deductions. * Pay taxes: On any income earned by the estate, such as interest or dividends.

📝 Note: It's recommended to consult with a tax professional or accountant to ensure that all tax obligations are met and that any eligible deductions are claimed.

Other Administrative Tasks

In addition to the above tasks, you may also need to: * Cancel utilities: Such as electricity, gas, and water. * Notify the post office: To redirect mail or cancel any mail services. * Manage digital assets: Such as email accounts, social media accounts, and online storage. * Dispose of personal belongings: According to the deceased person’s wishes or the laws of intestacy.

| Task | Description |

|---|---|

| Notify relevant parties | Inform social security administration, insurance companies, banks, and other relevant parties of the death. |

| Obtain a death certificate | Get multiple copies of the death certificate to use for various purposes. |

| Manage the estate | Locate the will, identify the executor, inventory the assets, and pay off debts. |

| Tax implications | File tax returns, claim deductions, and pay taxes on the estate's income. |

| Other administrative tasks | Cancel utilities, notify the post office, manage digital assets, and dispose of personal belongings. |

In the end, dealing with the paperwork after a death can be a complex and time-consuming process. However, by understanding the necessary steps and tasks, you can ensure that the deceased person’s wishes are respected, and their estate is managed efficiently. It’s essential to take your time, seek professional advice when needed, and prioritize your own well-being during this difficult period.

What is the first step to take after a death?

+

The first step to take after a death is to notify the relevant parties, such as the social security administration, insurance companies, and banks.

How many copies of the death certificate do I need to obtain?

+

You will need to obtain multiple copies of the death certificate, as it will be required for various purposes, such as settling the estate, claiming life insurance benefits, and managing tax affairs.

What are the tax implications of death?

+

Death can have significant tax implications, including the need to file tax returns, claim deductions, and pay taxes on the estate’s income.