Paperwork

Revocable Trust Paperwork Filing Requirements

Understanding Revocable Trust Paperwork Filing Requirements

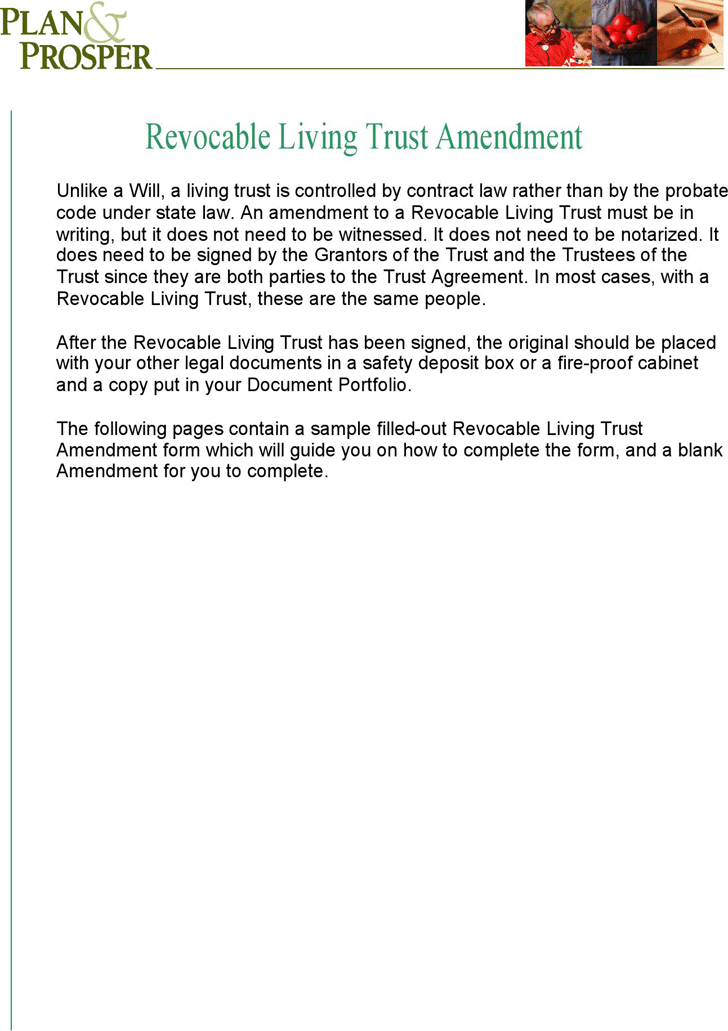

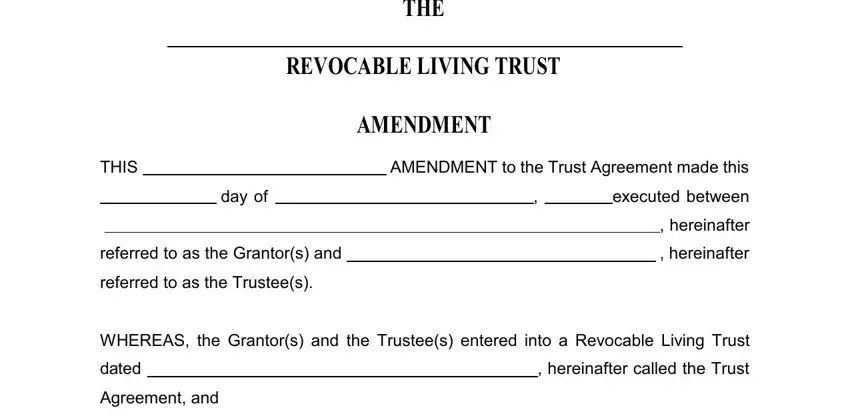

When establishing a revocable trust, also known as a living trust, it’s essential to understand the paperwork and filing requirements involved. A revocable trust allows the grantor (the person creating the trust) to transfer assets into the trust and still maintain control over them during their lifetime. The trust can be modified or revoked at any time, hence the name “revocable.” However, to ensure the trust is valid and functions as intended, certain paperwork and filing requirements must be met.

Initial Paperwork Requirements

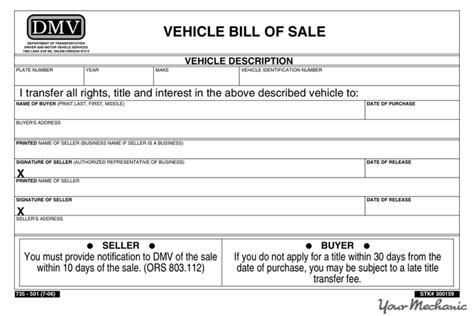

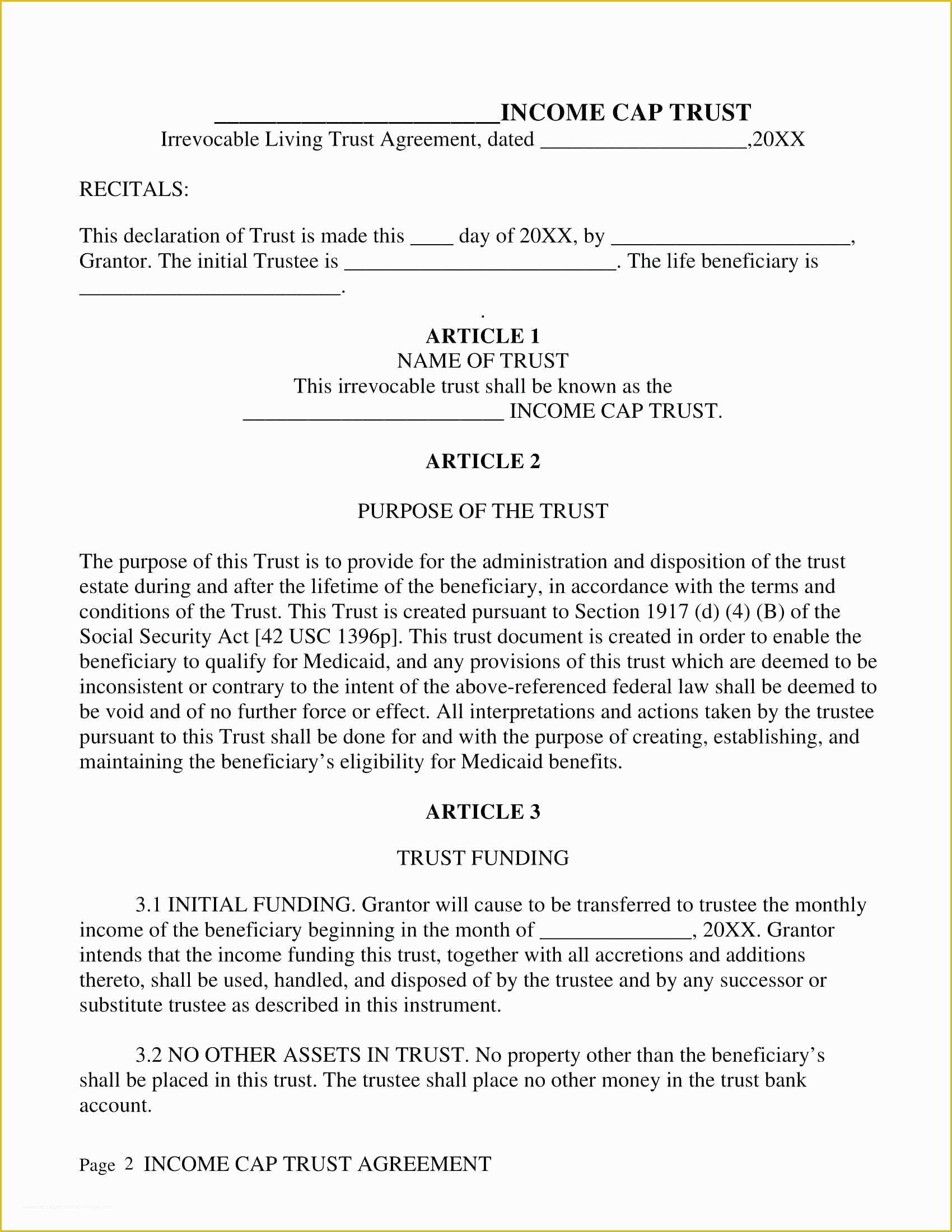

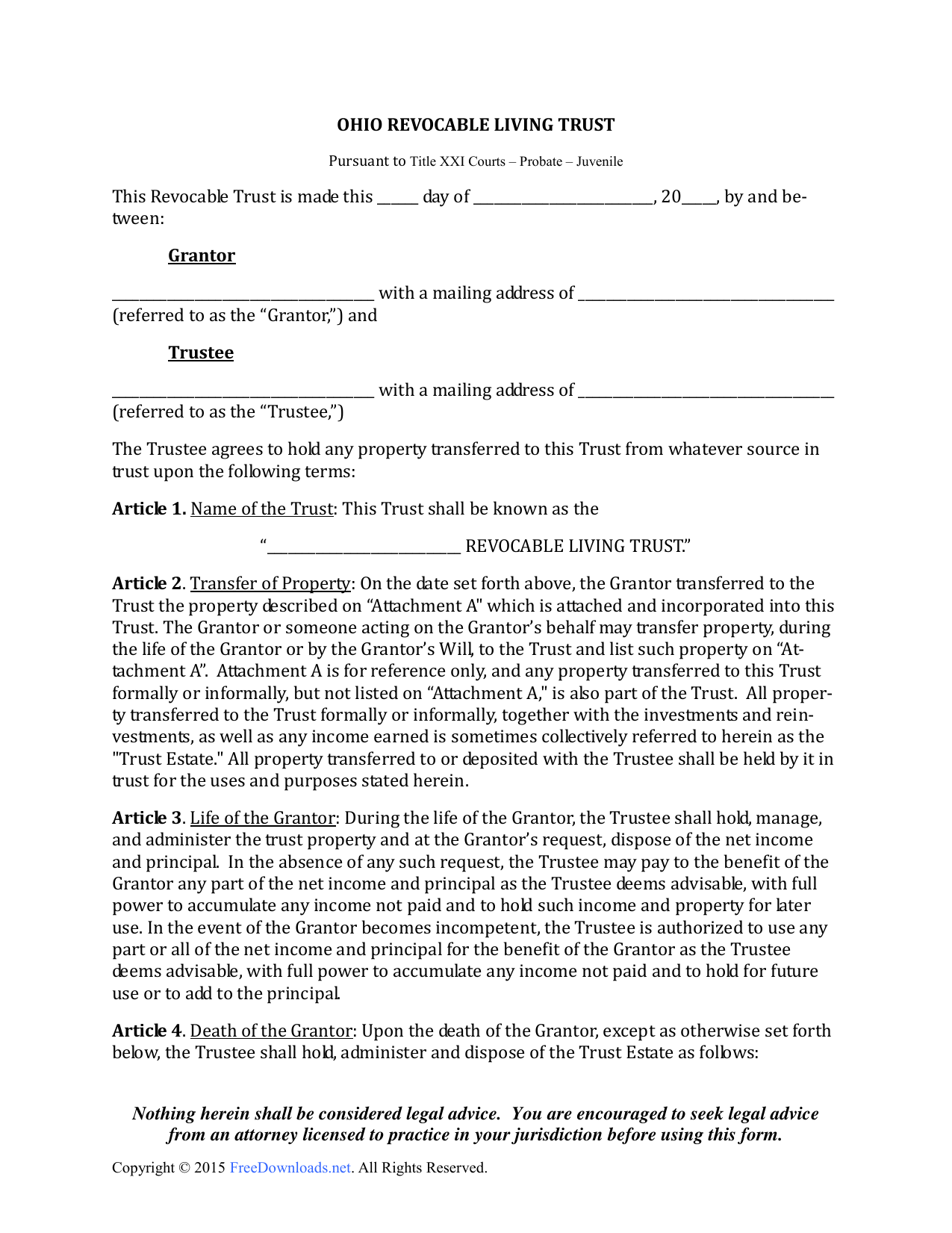

The initial paperwork required to establish a revocable trust typically includes: * Trust agreement: This is the legal document that outlines the terms of the trust, including the grantor’s powers, the trustee’s duties, and the beneficiaries’ rights. * Schedule of assets: This document lists all the assets that will be transferred into the trust, such as real estate, bank accounts, investments, and personal property. * Assignment of assets: This document formally transfers ownership of the assets from the grantor to the trust. * Certificate of trust: This document provides a summary of the trust’s existence and the trustee’s authority, which can be used to verify the trust’s validity.

Filing Requirements

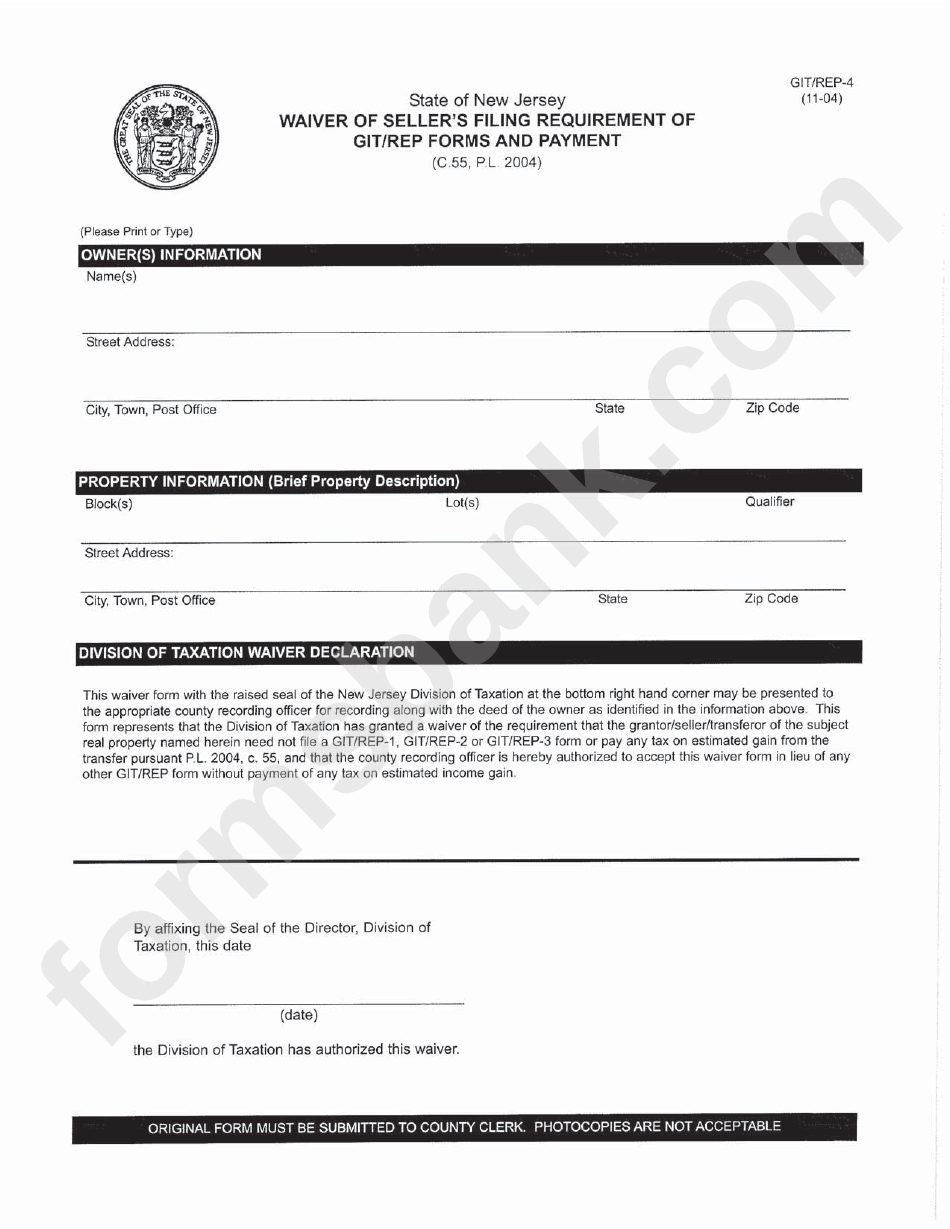

While revocable trusts do not require filing with the court, there are certain filing requirements to consider: * Recording deeds: If the trust owns real estate, the deed must be recorded in the county where the property is located to reflect the trust’s ownership. * Obtaining an EIN: The trust must obtain an Employer Identification Number (EIN) from the IRS for tax purposes. * Filing tax returns: The trust must file annual tax returns (Form 1041) with the IRS, reporting any income earned by the trust. * Notifying beneficiaries: The trustee must notify the beneficiaries of their interests in the trust and provide them with annual statements and tax information.

State-Specific Requirements

Some states have specific requirements for revocable trusts, such as: * Trust registration: Some states require trusts to be registered with the state or county, which may involve filing a registration statement or paying a registration fee. * Annual reports: Some states require trusts to file annual reports with the state or county, which may include information about the trust’s assets, income, and beneficiaries.

📝 Note: It's essential to consult with an attorney or tax professional to ensure compliance with state-specific requirements and to determine the best course of action for the trust.

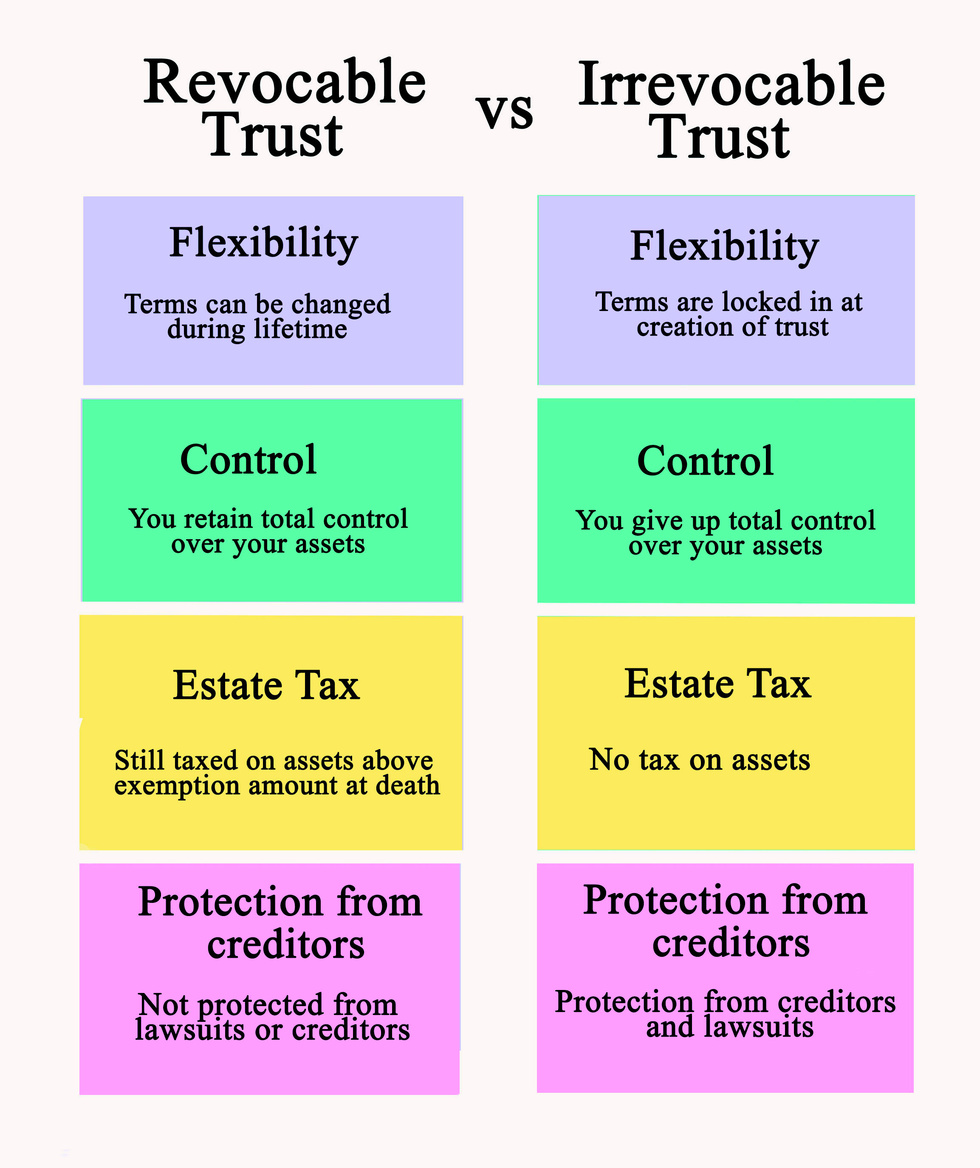

Benefits of Proper Paperwork and Filing

Proper paperwork and filing are crucial to ensure the revocable trust functions as intended and avoids potential issues, such as: * Avoiding probate: A properly established and funded revocable trust can avoid probate, which can save time, money, and hassle for the beneficiaries. * Reducing taxes: A revocable trust can help reduce taxes by allowing the grantor to transfer assets into the trust and avoiding estate taxes. * Protecting assets: A revocable trust can help protect assets from creditors and lawsuits, providing an added layer of security for the grantor and beneficiaries.

Common Mistakes to Avoid

When establishing a revocable trust, it’s essential to avoid common mistakes, such as: * Incomplete or inaccurate paperwork: Failing to properly complete or update the trust agreement, schedule of assets, or assignment of assets can lead to disputes or invalidation of the trust. * Insufficient funding: Failing to transfer assets into the trust or funding the trust inadequately can render the trust ineffective. * Lack of communication: Failing to communicate with beneficiaries or keep them informed about the trust’s activities can lead to misunderstandings or disputes.

Conclusion and Next Steps

In summary, establishing a revocable trust requires careful attention to paperwork and filing requirements to ensure the trust is valid and functions as intended. It’s essential to consult with an attorney or tax professional to ensure compliance with state-specific requirements and to determine the best course of action for the trust. By avoiding common mistakes and properly establishing and funding the trust, individuals can enjoy the benefits of a revocable trust, including avoiding probate, reducing taxes, and protecting assets.

What is the purpose of a revocable trust?

+

A revocable trust is used to manage and distribute assets during the grantor’s lifetime and after their death, while avoiding probate and reducing taxes.

Do I need to file my revocable trust with the court?

+

No, revocable trusts do not require filing with the court. However, you may need to record deeds or obtain an EIN for tax purposes.

How do I fund my revocable trust?

+

To fund your revocable trust, you need to transfer ownership of your assets into the trust by executing an assignment of assets and updating the schedule of assets.