5 PA Paperwork Needs

Understanding the Basics of Pennsylvania Paperwork Requirements

When it comes to managing a business or personal affairs in Pennsylvania, understanding the necessary paperwork is crucial. The state has its own set of rules and regulations that individuals and businesses must adhere to, which can sometimes be overwhelming. In this article, we will delve into the 5 PA paperwork needs that are essential for a smooth operation, whether you are a resident, a business owner, or just someone looking to conduct transactions within the state.

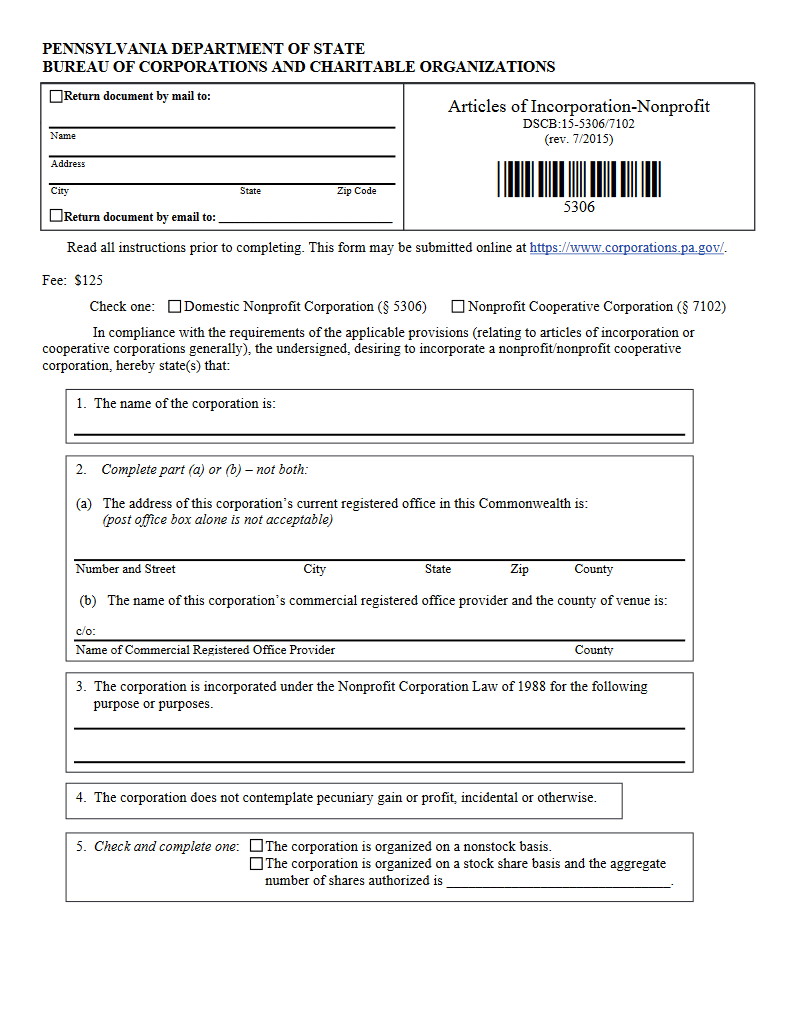

1. Business Registration

For any business operating in Pennsylvania, registration is a mandatory step. This involves obtaining necessary licenses and permits from both the state and local governments. The type of license or permit required can vary depending on the nature of the business. For instance, a food establishment would need a different set of permits compared to a retail store. Pennsylvania Department of State and the Pennsylvania Department of Revenue are key resources for businesses looking to register and understand their obligations.

2. Tax Filings

Tax filings are a critical aspect of PA paperwork needs. Both individuals and businesses must file their taxes with the state and federal government. Pennsylvania has a state income tax, and the rate can vary. Moreover, businesses may need to file for sales tax, employment tax, and other types of taxes depending on their operations. The Pennsylvania Department of Revenue provides detailed information and resources for tax filings, including forms and deadlines.

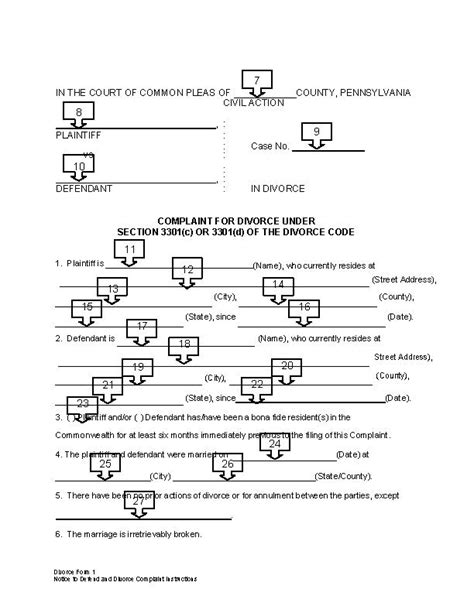

3. Real Estate Transactions

For anyone involved in real estate transactions in Pennsylvania, whether buying, selling, or transferring property, there are specific paperwork requirements. This includes deeds, titles, and other legal documents that must be properly executed and recorded. Understanding the process and ensuring all documents are in order is vital to avoid any legal or financial issues. Real estate agents and attorneys can provide guidance on the necessary paperwork for these transactions.

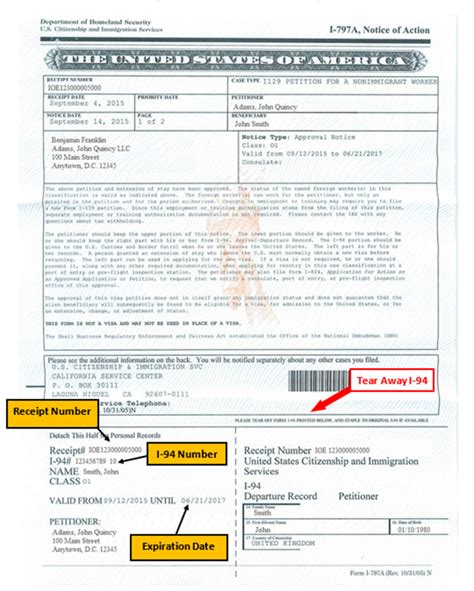

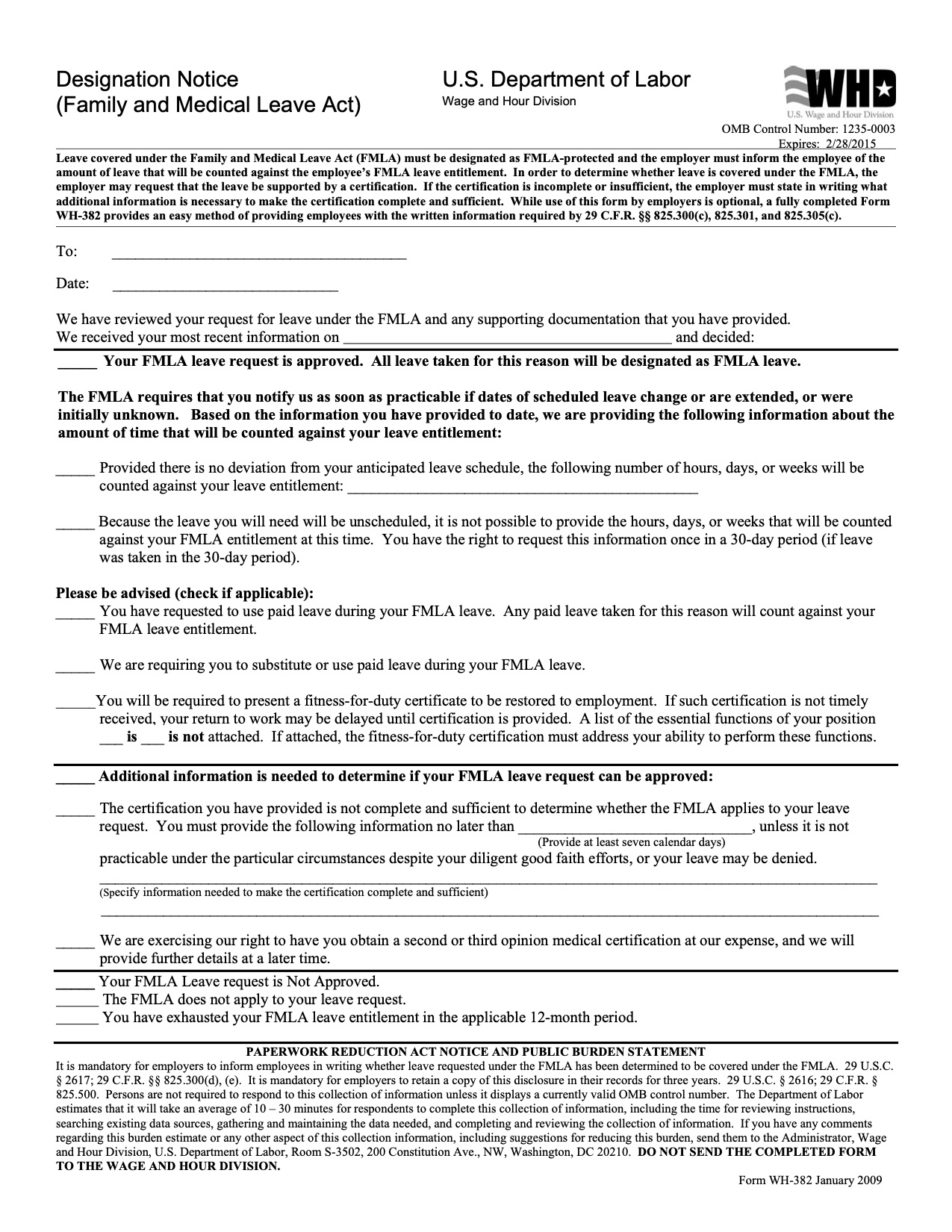

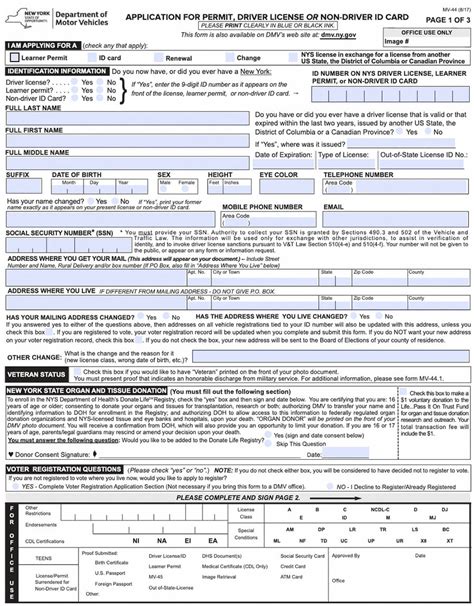

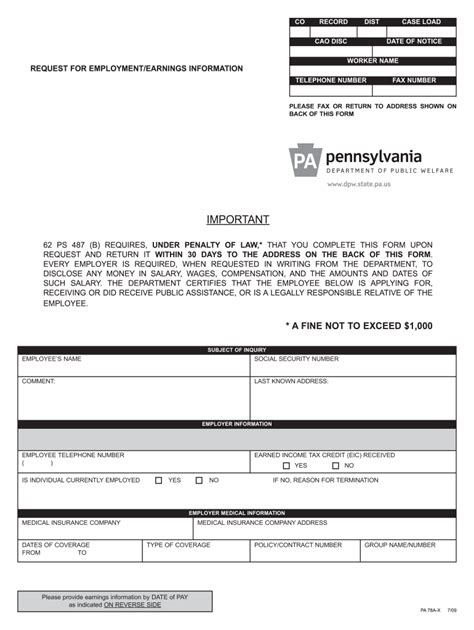

4. Employment Paperwork

Employers in Pennsylvania must comply with various employment laws and regulations, which include specific paperwork requirements. This encompasses everything from new hire forms, tax withholding forms, to workers’ compensation insurance documents. Employers must also display certain posters in the workplace that inform employees of their rights under Pennsylvania and federal law. The Pennsylvania Department of Labor & Industry is a valuable resource for understanding these requirements.

5. Estate Planning Documents

Lastly, for individuals, having the right estate planning documents in place is essential. This includes wills, powers of attorney, and living wills. These documents ensure that an individual’s wishes are respected regarding their assets, healthcare, and personal affairs in the event they become incapacitated or pass away. Estate planning attorneys can help individuals prepare these documents, ensuring they comply with Pennsylvania laws.

📝 Note: It's always recommended to consult with a professional, such as an attorney or accountant, to ensure that all paperwork is correctly filled out and filed, as requirements can change and individual circumstances may affect the types of paperwork needed.

When navigating the world of Pennsylvania paperwork, whether for business, personal, or legal matters, understanding the specific requirements and regulations is key. By being informed and prepared, individuals and businesses can avoid potential issues and ensure compliance with state laws. This not only protects their interests but also contributes to a smoother operation of their affairs within the state.

In summary, managing paperwork effectively is crucial for anyone dealing with Pennsylvania’s legal and administrative systems. Whether it’s about starting a business, conducting real estate transactions, or planning one’s estate, the right paperwork can make all the difference. By focusing on these 5 PA paperwork needs and seeking professional advice when necessary, individuals and businesses can better navigate the complexities of Pennsylvania’s regulatory landscape.

What are the primary licenses and permits needed to start a business in Pennsylvania?

+

The primary licenses and permits needed can vary based on the type of business. However, common requirements include a sales tax license, employer withholding tax account (if hiring employees), and any local permits or zoning approvals necessary for the business location.

How do I file my state income taxes in Pennsylvania?

+

To file your state income taxes in Pennsylvania, you can use the Pennsylvania Department of Revenue’s e-file options or submit your return by mail. The department’s website provides detailed instructions, forms, and deadlines to help with the filing process.

What documents are required for real estate transactions in Pennsylvania?

+

Key documents for real estate transactions include the deed, which transfers ownership, and the title, which proves ownership. Other necessary documents may include mortgages, notes, and any agreements related to the sale or transfer of the property.