5 Steps Schwab Account

Opening a Schwab Account: A Comprehensive Guide

Charles Schwab is one of the leading brokerage firms in the United States, offering a wide range of financial services and products to its customers. With a Schwab account, you can trade stocks, bonds, mutual funds, and other securities, as well as manage your retirement accounts and other investments. In this article, we will walk you through the 5 steps to open a Schwab account and start investing in your financial future.

Step 1: Choose Your Account Type

Before you can open a Schwab account, you need to decide which type of account is right for you. Schwab offers several different account options, including:

- Brokerage account: This is a standard account that allows you to buy and sell securities, as well as manage your investments.

- Retirement account: This includes accounts such as IRAs and 401(k)s, which are designed to help you save for retirement.

- Trading account: This account is designed for active traders, with features such as real-time quotes and advanced trading tools.

- Custodial account: This account is designed for minors, with a parent or guardian serving as the account custodian.

Each account type has its own unique features and benefits, so it’s essential to choose the one that best fits your investment goals and needs.

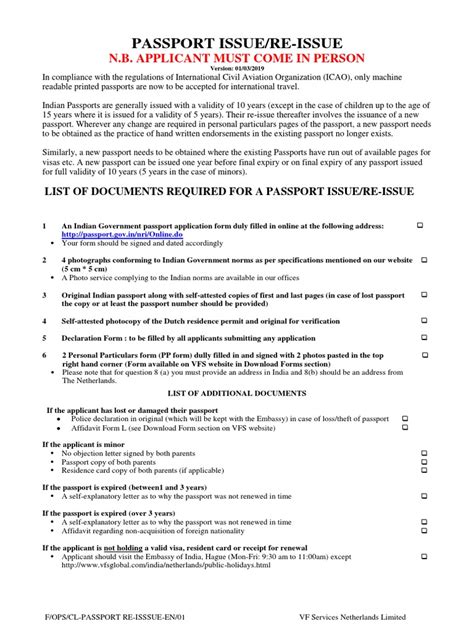

Step 2: Gather Required Documents

To open a Schwab account, you will need to provide certain documents and information. This may include:

- Identification: You will need to provide a valid government-issued ID, such as a driver’s license or passport.

- Address verification: You will need to provide proof of your address, such as a utility bill or bank statement.

- Employment information: You may need to provide information about your employment status and income.

- Tax identification number: You will need to provide your Social Security number or other tax identification number.

It’s a good idea to have these documents ready before you start the application process, as this will make it easier and faster to complete.

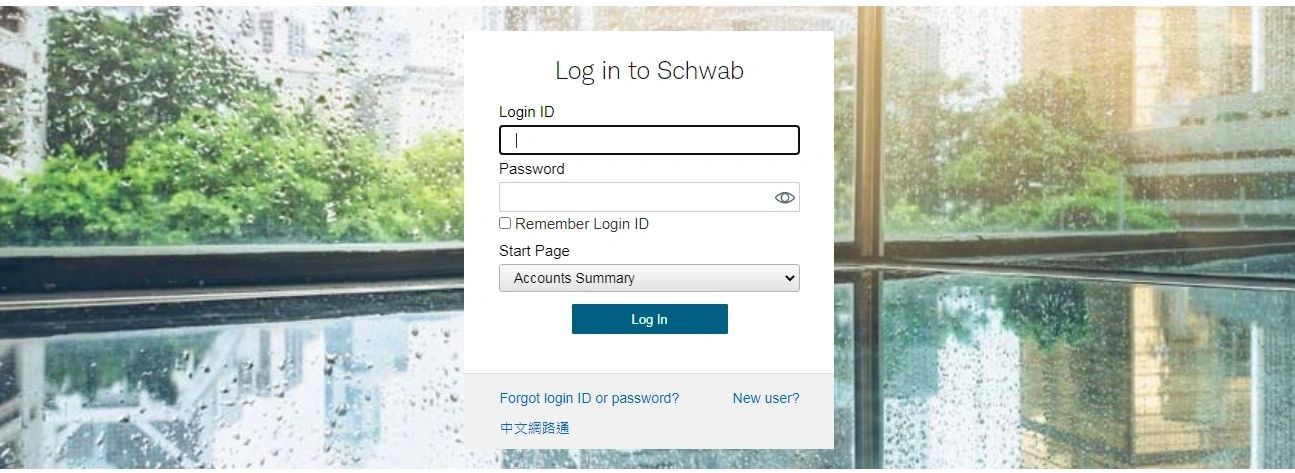

Step 3: Apply for Your Account

Once you have chosen your account type and gathered the required documents, you can apply for your Schwab account. You can do this online, by phone, or in person at a local Schwab branch.

The application process typically involves providing the required documents and information, as well as answering a series of questions about your investment experience and goals. This will help Schwab to determine which account options are best for you.

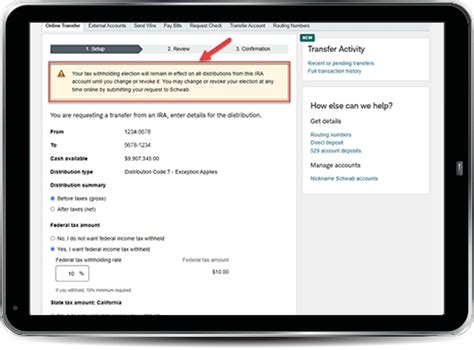

Step 4: Fund Your Account

After your account has been approved, you will need to fund it with an initial deposit. This can be done by transferring money from your bank account, depositing a check, or transferring securities from another brokerage firm.

The minimum initial deposit required to open a Schwab account varies depending on the account type and other factors. Be sure to check with Schwab for the most up-to-date information on minimum deposit requirements.

Step 5: Start Investing

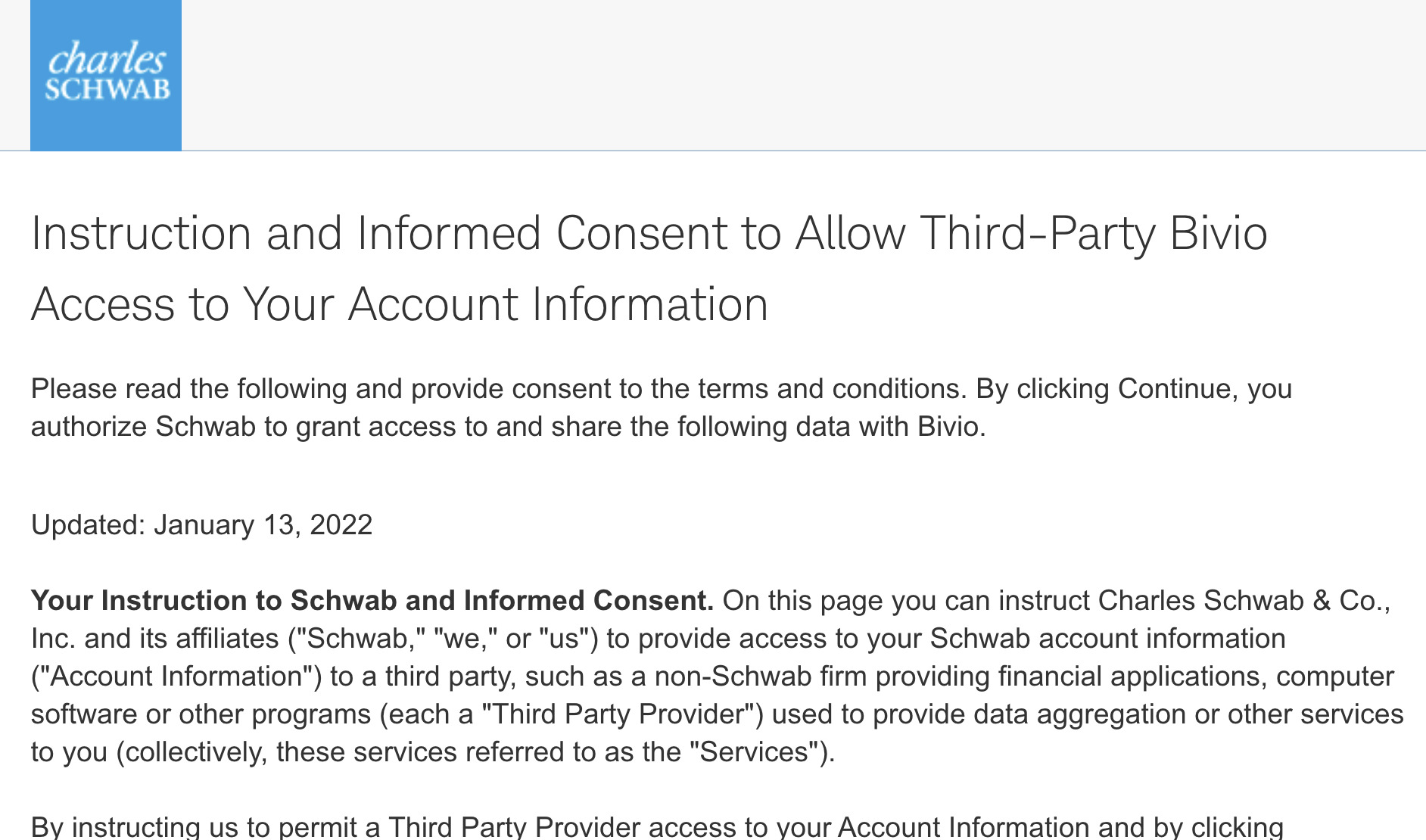

Once your account is funded, you can start investing in a wide range of securities, including stocks, bonds, mutual funds, and exchange-traded funds (ETFs). You can use Schwab’s online trading platform or mobile app to buy and sell securities, as well as monitor your account activity and track your investment performance.

Schwab also offers a range of investment tools and resources, including research reports, market analysis, and portfolio management services. These can help you to make informed investment decisions and achieve your financial goals.

💡 Note: It's essential to carefully review the terms and conditions of your Schwab account, as well as the fees and charges associated with different investment products and services.

| Account Type | Minimum Initial Deposit | Fees and Charges |

|---|---|---|

| Brokerage account | $1,000 | Commissions on trades, account maintenance fees |

| Retirement account | $1,000 | Commissions on trades, account maintenance fees, potential penalties for early withdrawal |

| Trading account | $2,000 | Commissions on trades, account maintenance fees, potential fees for advanced trading tools and services |

In summary, opening a Schwab account is a straightforward process that involves choosing your account type, gathering required documents, applying for your account, funding your account, and starting to invest. By following these steps and taking advantage of the investment tools and resources available through Schwab, you can achieve your financial goals and secure your financial future.

What is the minimum initial deposit required to open a Schwab account?

+

The minimum initial deposit required to open a Schwab account varies depending on the account type and other factors. Be sure to check with Schwab for the most up-to-date information on minimum deposit requirements.

How do I fund my Schwab account?

+

You can fund your Schwab account by transferring money from your bank account, depositing a check, or transferring securities from another brokerage firm.

What investment tools and resources are available through Schwab?

+

Schwab offers a range of investment tools and resources, including research reports, market analysis, and portfolio management services. These can help you to make informed investment decisions and achieve your financial goals.