Tax Paperwork Needed

Introduction to Tax Paperwork

When it comes to managing your finances, one of the most critical aspects is handling your tax paperwork efficiently. Tax season can be overwhelming, especially with the numerous forms and deadlines to keep track of. In this article, we will delve into the world of tax paperwork, exploring the essential documents you need to file your taxes accurately and on time.

Understanding Tax Forms

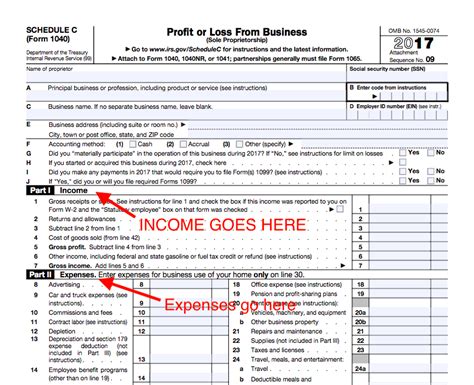

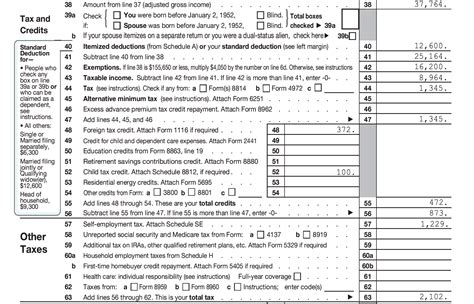

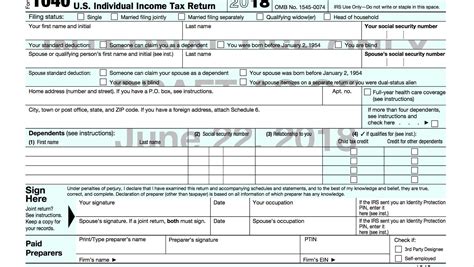

The first step in tackling your tax paperwork is to understand the different types of tax forms you may need to file. The most common form for individuals is the Form 1040, which is used to report income, deductions, and credits. There are also various schedules and attachments that may be required, depending on your specific situation. For instance, if you have business income, you will need to file Schedule C, while investment income requires Schedule D.

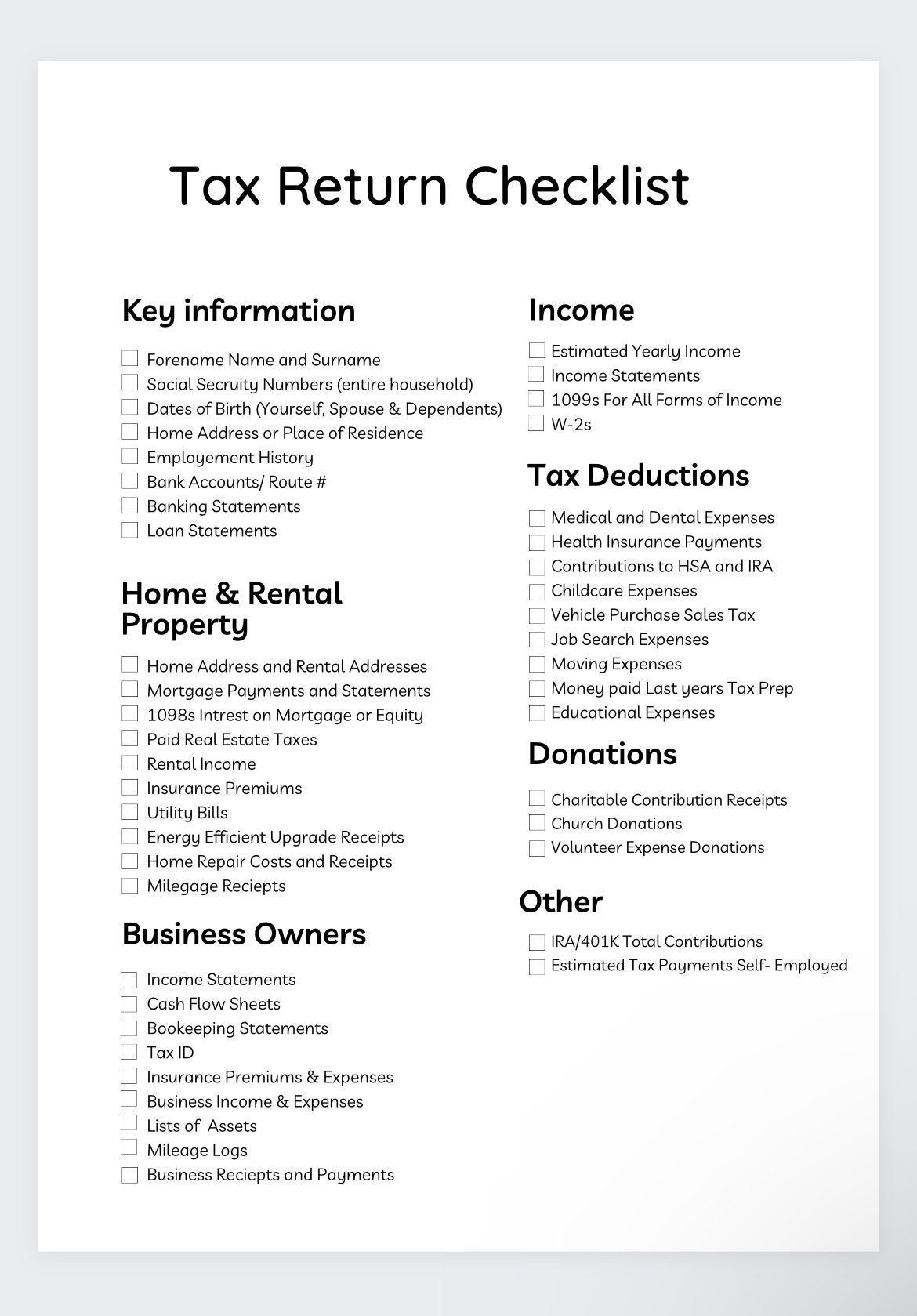

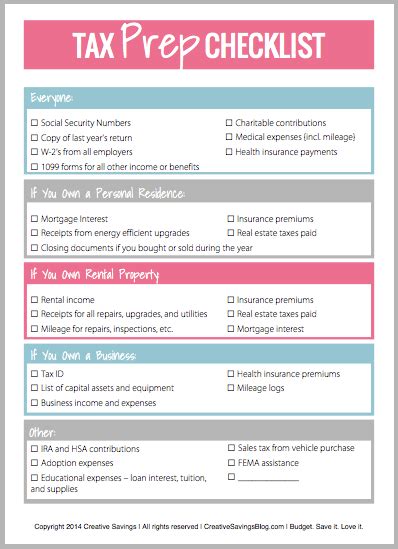

Gathering Necessary Documents

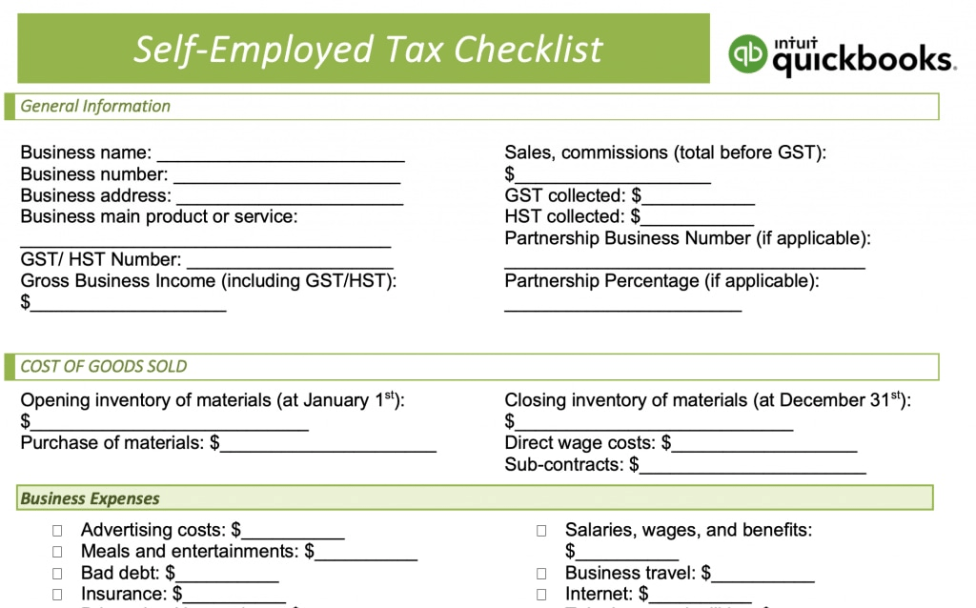

To ensure a smooth tax-filing process, it’s crucial to gather all the necessary documents beforehand. These may include: * W-2 forms from your employer, showing your income and taxes withheld * 1099 forms for freelance work, investments, or other sources of income * Receipts for deductions, such as charitable donations or medical expenses * Interest statements from banks and other financial institutions * Dividend statements from investments

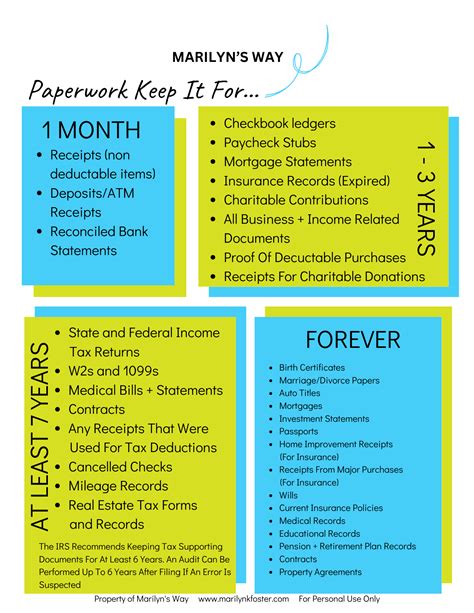

Organizing Your Tax Paperwork

With all the documents in hand, the next step is to organize them in a logical and accessible manner. Consider using a tax folder or digital storage system to keep everything in one place. This will help you quickly locate the information you need when filing your taxes. You can also use tax software to guide you through the process and ensure you’re taking advantage of all the deductions and credits available to you.

Deadlines and Penalties

It’s essential to be aware of the tax filing deadlines to avoid penalties and fines. In the United States, the typical deadline for filing individual tax returns is April 15th. However, this can vary depending on your location and specific circumstances. If you need more time, you can file for an extension, but be sure to do so before the original deadline to avoid any penalties.

Seeking Professional Help

If you’re feeling overwhelmed by the tax paperwork process, consider seeking the help of a tax professional. They can guide you through the process, ensure you’re taking advantage of all the deductions and credits available, and help you avoid any potential errors or penalties. You can also use tax preparation services to help with the filing process.

| Form | Description |

|---|---|

| Form 1040 | Individual income tax return |

| Schedule C | Business income and expenses |

| Schedule D | Investment income and expenses |

📝 Note: It's crucial to keep accurate records of your tax paperwork, including receipts, invoices, and bank statements, in case of an audit or other issues.

To summarize, handling your tax paperwork efficiently requires understanding the different types of tax forms, gathering necessary documents, organizing your paperwork, being aware of deadlines and penalties, and seeking professional help when needed. By following these steps and staying organized, you can ensure a smooth tax-filing process and avoid any potential issues.

What is the deadline for filing individual tax returns in the United States?

+

The typical deadline for filing individual tax returns in the United States is April 15th.

What is the purpose of Form 1040?

+

Form 1040 is used to report income, deductions, and credits for individual income tax returns.

Can I file for an extension if I need more time to file my taxes?

+

Yes, you can file for an extension, but be sure to do so before the original deadline to avoid any penalties.