Mortgage Protection Insurance Policy Documents

Introduction to Mortgage Protection Insurance

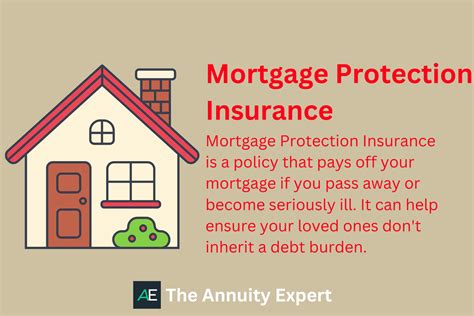

Mortgage protection insurance is a type of insurance policy designed to help individuals pay their mortgage payments in the event of unforeseen circumstances such as illness, injury, or death. This type of insurance can provide financial protection and peace of mind for homeowners, ensuring that their mortgage payments are covered in case they are unable to work or pass away. In this article, we will delve into the world of mortgage protection insurance policy documents, exploring what they entail, how they work, and what benefits they offer to policyholders.

Understanding Mortgage Protection Insurance Policy Documents

Mortgage protection insurance policy documents are legal contracts between the insurance provider and the policyholder. These documents outline the terms and conditions of the policy, including the coverage amount, premium payments, and eligibility criteria. It is essential for policyholders to carefully review and understand these documents to ensure they are aware of their rights and responsibilities. Some key components of mortgage protection insurance policy documents include: * Policy schedule: This section outlines the policy details, including the policyholder’s name, address, and mortgage information. * Policy terms and conditions: This section explains the rules and regulations of the policy, including the coverage amount, premium payments, and claims process. * Exclusions and limitations: This section lists the circumstances under which the policy will not pay out, such as pre-existing medical conditions or suicide.

Types of Mortgage Protection Insurance Policies

There are several types of mortgage protection insurance policies available, each with its own unique features and benefits. Some common types of policies include: * Level term insurance: This type of policy provides a fixed amount of coverage for a specified period, usually 10-30 years. * Decreasing term insurance: This type of policy provides a decreasing amount of coverage over a specified period, usually in line with the outstanding mortgage balance. * Income protection insurance: This type of policy provides a monthly income replacement benefit if the policyholder is unable to work due to illness or injury.

Benefits of Mortgage Protection Insurance Policies

Mortgage protection insurance policies offer several benefits to policyholders, including: * Financial protection: Mortgage protection insurance can help policyholders avoid falling behind on their mortgage payments in case of unforeseen circumstances. * Peace of mind: Knowing that their mortgage payments are covered can provide policyholders with peace of mind and reduce stress. * Flexibility: Some mortgage protection insurance policies offer flexible premium payments and coverage amounts, allowing policyholders to tailor their policy to their individual needs.

📝 Note: Policyholders should carefully review their policy documents to ensure they understand the terms and conditions of their policy.

How to Choose the Right Mortgage Protection Insurance Policy

Choosing the right mortgage protection insurance policy can be a daunting task, especially with so many options available. Here are some tips to help policyholders make an informed decision: * Assess your needs: Consider your individual circumstances, including your mortgage amount, income, and dependents. * Compare policies: Research and compare different policies from various insurance providers to find the best fit for your needs. * Read reviews: Check online reviews and ratings from other policyholders to get an idea of the insurance provider’s reputation and customer service.

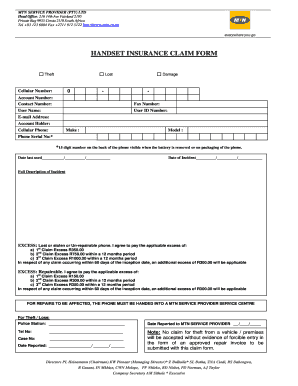

| Policy Type | Coverage Amount | Premium Payments |

|---|---|---|

| Level Term Insurance | Fixed amount | Fixed monthly premium |

| Decreasing Term Insurance | Decreasing amount | Fixed monthly premium |

| Income Protection Insurance | Monthly income replacement | Fixed monthly premium |

In summary, mortgage protection insurance policy documents are essential contracts that outline the terms and conditions of a policy. By understanding these documents and choosing the right policy, individuals can ensure they have financial protection and peace of mind in case of unforeseen circumstances. Whether you’re a first-time homeowner or an experienced property owner, mortgage protection insurance can provide a sense of security and stability. By carefully reviewing policy documents and assessing individual needs, policyholders can make informed decisions and select the best policy for their unique circumstances.

What is mortgage protection insurance?

+

Mortgage protection insurance is a type of insurance policy designed to help individuals pay their mortgage payments in the event of unforeseen circumstances such as illness, injury, or death.

What are the benefits of mortgage protection insurance policies?

+

Mortgage protection insurance policies offer several benefits, including financial protection, peace of mind, and flexibility.

How do I choose the right mortgage protection insurance policy?

+

To choose the right mortgage protection insurance policy, assess your needs, compare policies from various insurance providers, and read reviews from other policyholders.