5 Lease Insurance Papers

Understanding Lease Insurance Papers

When entering into a lease agreement, whether as a landlord or a tenant, it’s crucial to understand the importance of lease insurance papers. These documents not only protect the property from potential damages but also provide a layer of financial security for both parties involved. In this article, we will delve into the world of lease insurance papers, exploring their significance, types, and the benefits they offer to landlords and tenants alike.

Types of Lease Insurance Papers

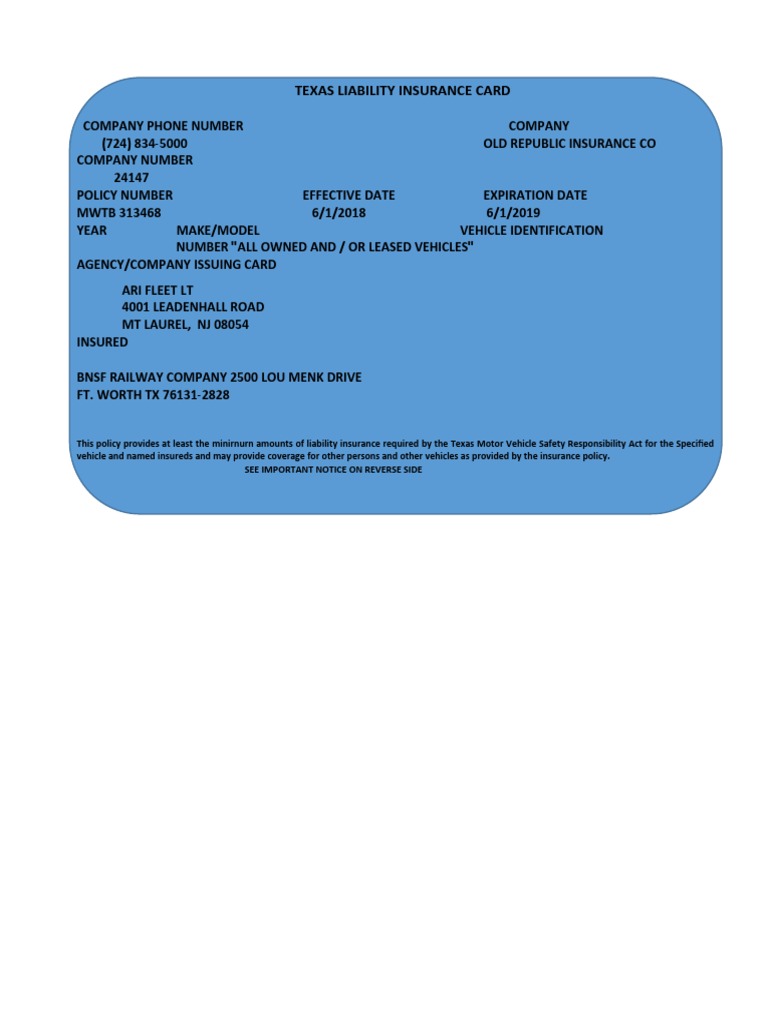

There are several types of lease insurance papers, each designed to cater to specific needs and circumstances. Some of the most common include: - Renter’s Insurance: This type of insurance is designed for tenants and covers their personal belongings against theft, damage, or loss. - Landlord Insurance: Tailored for property owners, landlord insurance protects the property itself from damages and provides liability coverage in case a tenant or guest is injured on the premises. - Liability Insurance: This insurance is crucial for protecting against financial losses if someone is injured on the rented property. - Flood Insurance: For properties located in flood-prone areas, flood insurance is essential as it covers damages caused by flooding, which is often not included in standard insurance policies. - Earthquake Insurance: Similar to flood insurance, earthquake insurance is vital for properties in seismic zones, providing coverage for damages resulting from earthquakes.

Benefits of Lease Insurance Papers

The benefits of lease insurance papers are multifaceted, offering protection and peace of mind for both landlords and tenants. Some of the key advantages include: - Financial Protection: In the event of unexpected damages or losses, insurance helps mitigate financial burdens, ensuring that neither party faces significant out-of-pocket expenses. - Legal Compliance: Depending on the jurisdiction, certain types of insurance may be legally required. Having the appropriate lease insurance papers ensures compliance with local laws and regulations. - Peace of Mind: Knowing that your property or belongings are insured against unforeseen events can significantly reduce stress and anxiety for both landlords and tenants. - Improved Tenant-Landlord Relationships: When both parties are protected, it can foster a more positive and respectful relationship, as each understands the other’s rights and responsibilities.

How to Choose the Right Lease Insurance

Choosing the right lease insurance involves several steps and considerations: - Assess Your Needs: Determine what type of coverage is necessary based on the property’s location, value, and the tenant’s personal belongings. - Research Insurance Providers: Look for reputable insurance companies that offer competitive rates and comprehensive coverage. - Read Policy Details Carefully: Understand what is covered, the deductibles, and any exclusions before signing an insurance policy. - Seek Professional Advice: If unsure, consulting with an insurance broker or legal advisor can provide valuable insights and help in making an informed decision.

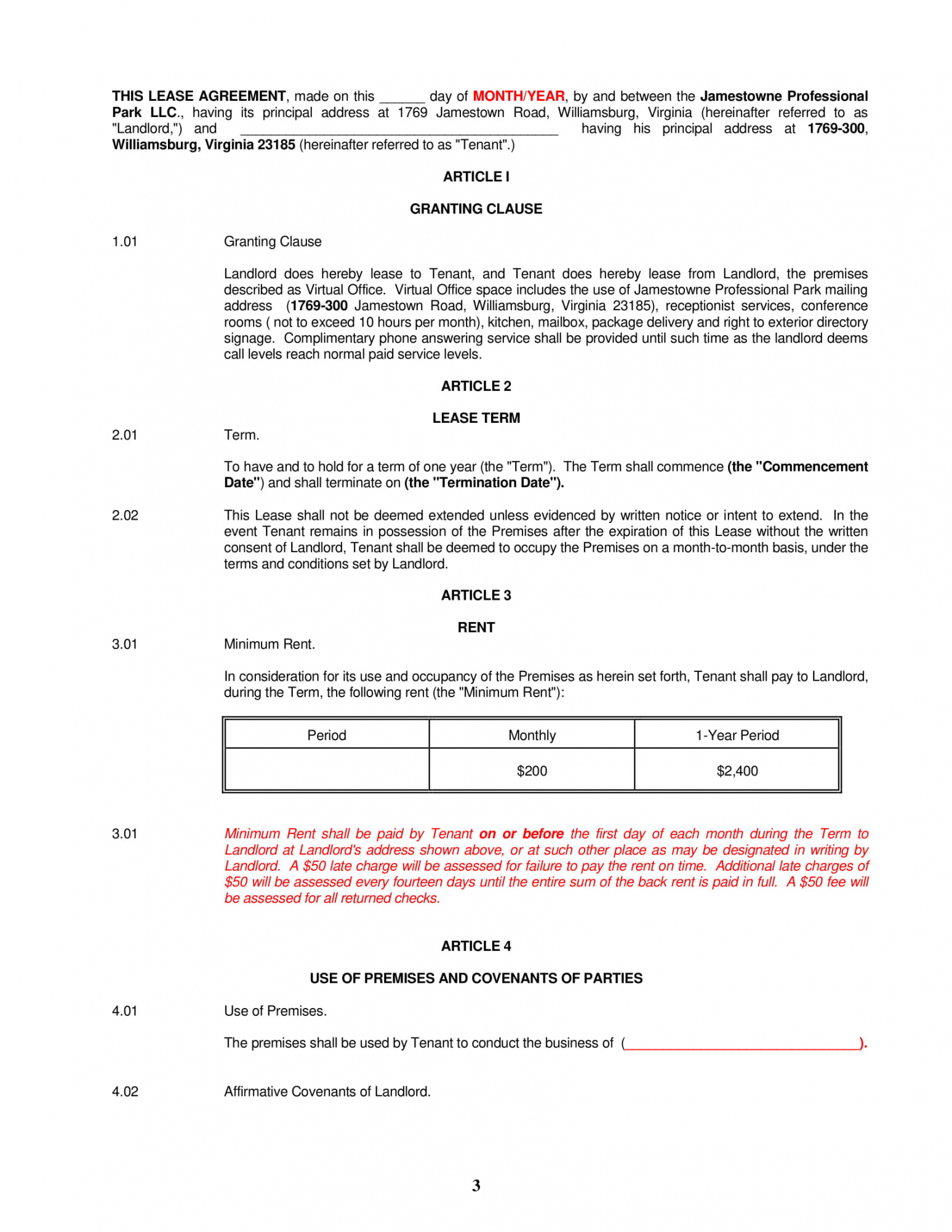

Table of Lease Insurance Types and Benefits

| Type of Insurance | Benefits | Target Audience |

|---|---|---|

| Renter’s Insurance | Covers personal belongings, provides liability coverage | Tenants |

| Landlord Insurance | Protects property, provides liability coverage | Landlords |

| Liability Insurance | Protects against financial losses from injuries on the property | Both Landlords and Tenants |

| Flood Insurance | Covers damages from flooding | Properties in flood-prone areas |

| Earthquake Insurance | Covers damages from earthquakes | Properties in seismic zones |

📝 Note: It's essential to review and understand the terms and conditions of any insurance policy before purchase to ensure it meets your specific needs and circumstances.

In the end, lease insurance papers are a critical component of any lease agreement, offering a safeguard against unforeseen events and financial losses. By understanding the different types of insurance available and their benefits, both landlords and tenants can make informed decisions to protect their interests. Whether you’re renting out a property or renting one, ensuring you have the right insurance coverage can make all the difference in securing your financial future and maintaining a positive landlord-tenant relationship.

What is the primary purpose of lease insurance papers?

+

The primary purpose of lease insurance papers is to provide financial protection against damages, losses, or liabilities that may arise during the lease period, ensuring that both landlords and tenants are safeguarded against unforeseen events.

Do all tenants need renter’s insurance?

+

While it’s not always legally required, renter’s insurance is highly recommended for all tenants to protect their personal belongings and provide liability coverage. The necessity can depend on the lease agreement and local laws.

How do I choose the right insurance provider for my lease insurance needs?

+

Choosing the right insurance provider involves researching reputable companies, comparing their policies and rates, reading reviews, and possibly consulting with an insurance broker to find the best fit for your specific needs and budget.