Paperwork

Rent Insurance Paperwork Requirements

Understanding Rent Insurance Paperwork Requirements

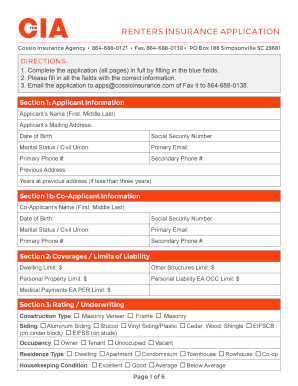

When it comes to rent insurance, also known as renters insurance, having the right paperwork is essential. Renters insurance protects tenants from financial losses due to theft, damage, or other unforeseen events that may occur in their rented property. To get the most out of your renters insurance policy, it’s crucial to understand the paperwork requirements involved. In this article, we will delve into the details of rent insurance paperwork, including the necessary documents, the application process, and what to expect from your insurance provider.

Necessary Documents for Rent Insurance

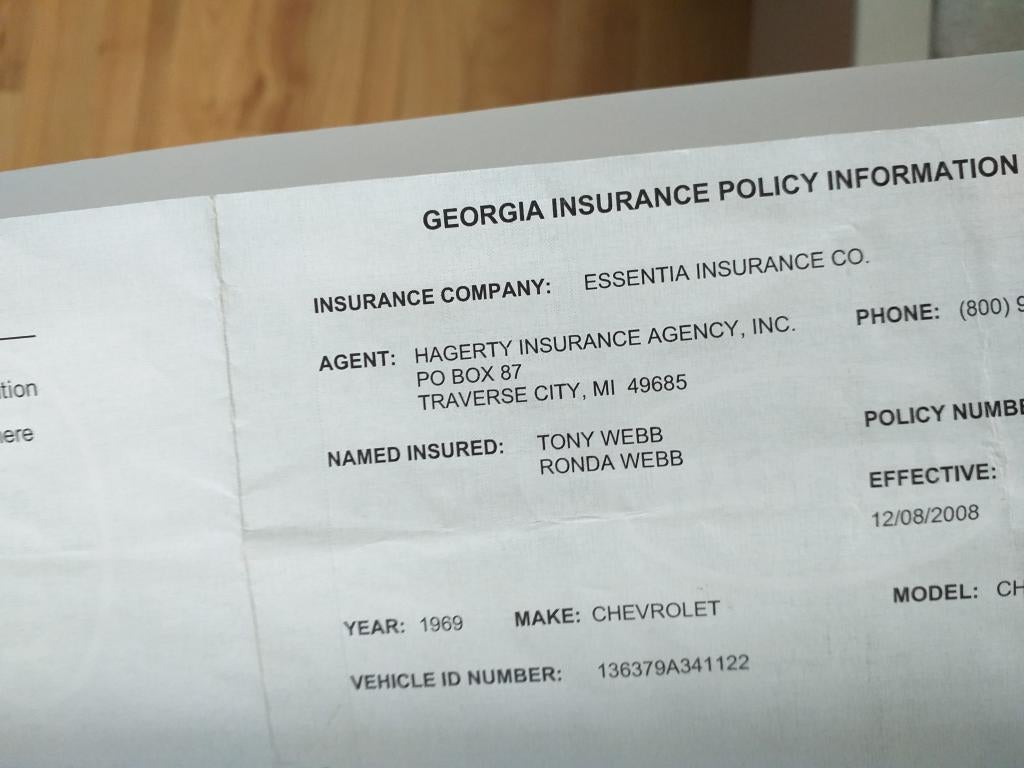

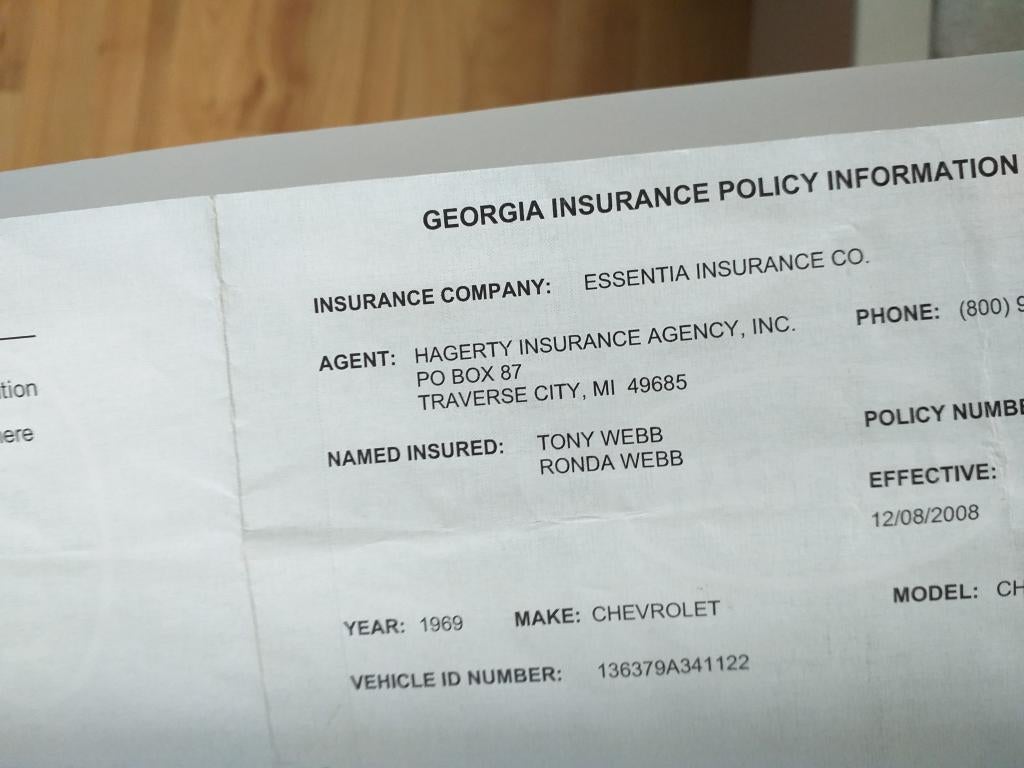

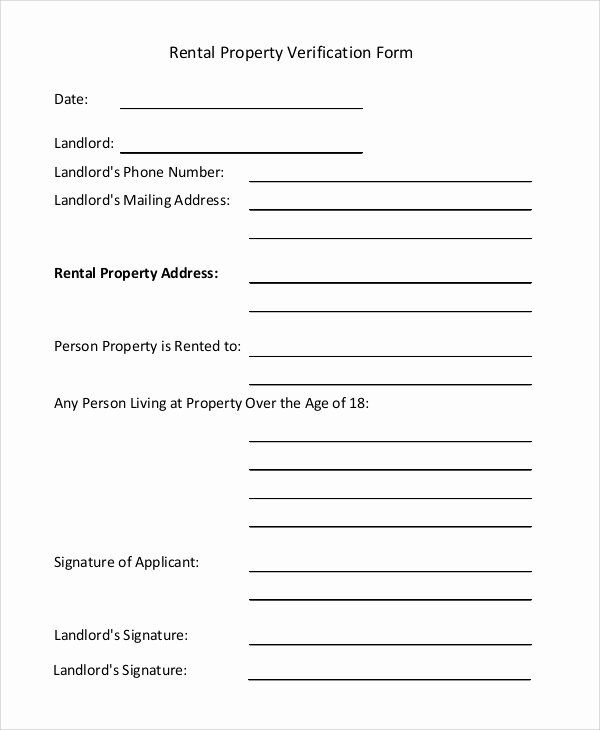

To apply for renters insurance, you will typically need to provide certain documents to your insurance provider. These may include: * Proof of identity: This can be a driver’s license, passport, or state ID. * Proof of residency: This can include a lease agreement, utility bills, or a letter from your landlord confirming your tenancy. * Proof of income: You may need to provide pay stubs, tax returns, or other documentation to verify your income. * Inventory of belongings: Making a list of your valuable items, including their estimated value, can help you determine how much coverage you need. * Information about the rental property: This may include the address, type of property, and any safety features, such as security cameras or a fire alarm system.

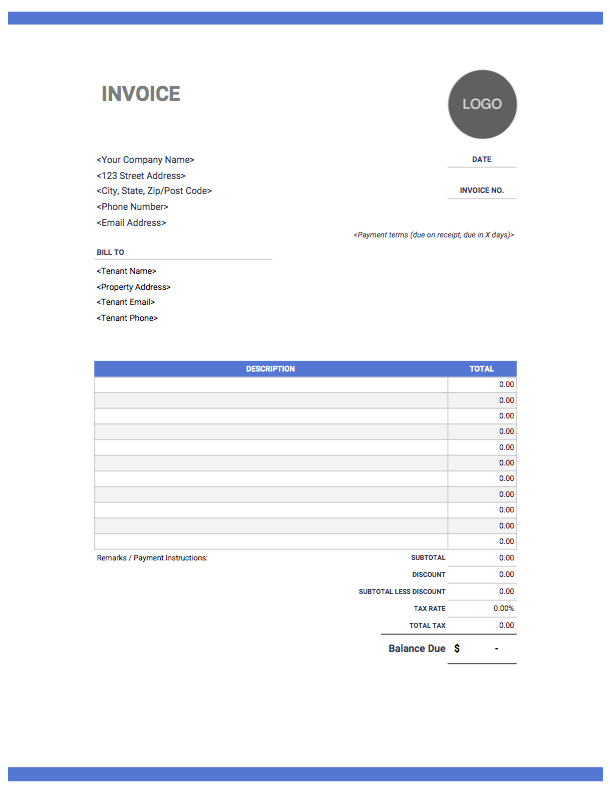

The Application Process

The application process for renters insurance typically involves the following steps: * Getting a quote: You can get a quote from an insurance provider by phone, online, or in person. Be prepared to provide the necessary documents and information about your rental property and belongings. * Choosing a policy: Once you have a quote, you can choose a policy that meets your needs and budget. Consider factors such as the coverage limit, deductible, and any additional features, such as flood or earthquake coverage. * Signing the policy: Once you have chosen a policy, you will need to sign the paperwork to finalize the agreement. Make sure to read the policy carefully and ask any questions you may have before signing.

What to Expect from Your Insurance Provider

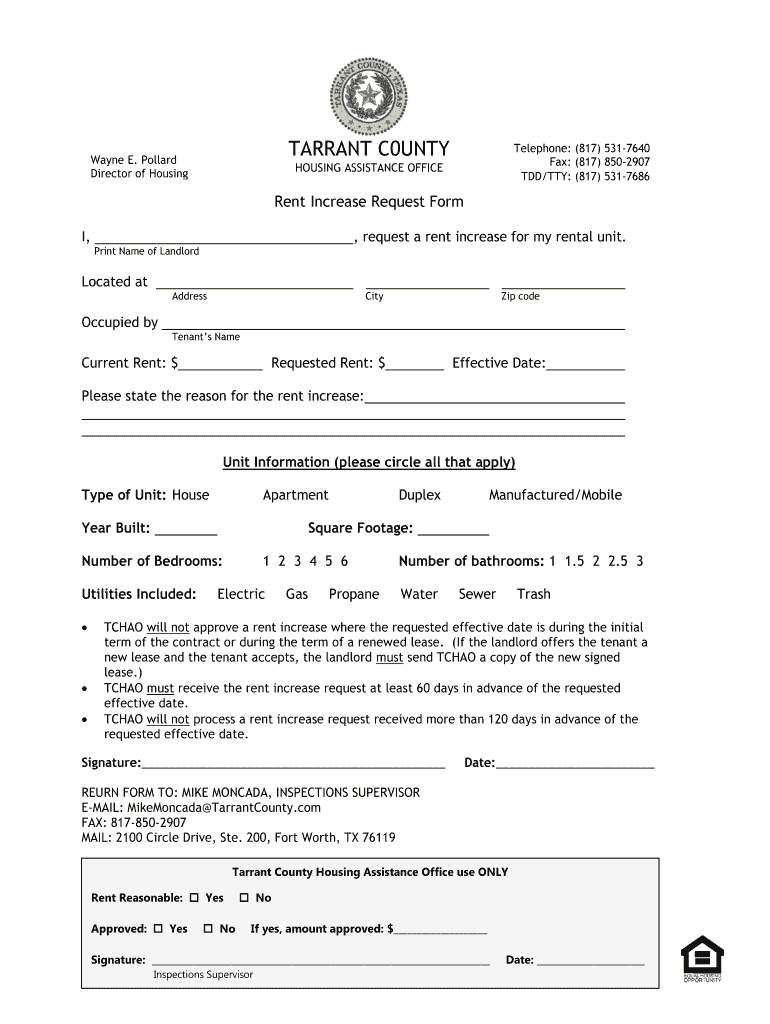

After you have signed the policy, your insurance provider will typically send you a policy document that outlines the terms and conditions of your coverage. This document will include information such as: * Coverage limits: The maximum amount your insurance provider will pay out in the event of a claim. * Deductible: The amount you must pay out of pocket before your insurance provider will cover the rest of the cost. * Premium: The amount you pay for your insurance coverage, usually on a monthly or annual basis. * Claims process: The steps you need to take to file a claim, including contact information for your insurance provider.

📝 Note: It's essential to read and understand your policy document to ensure you have the right coverage for your needs.

Additional Features and Considerations

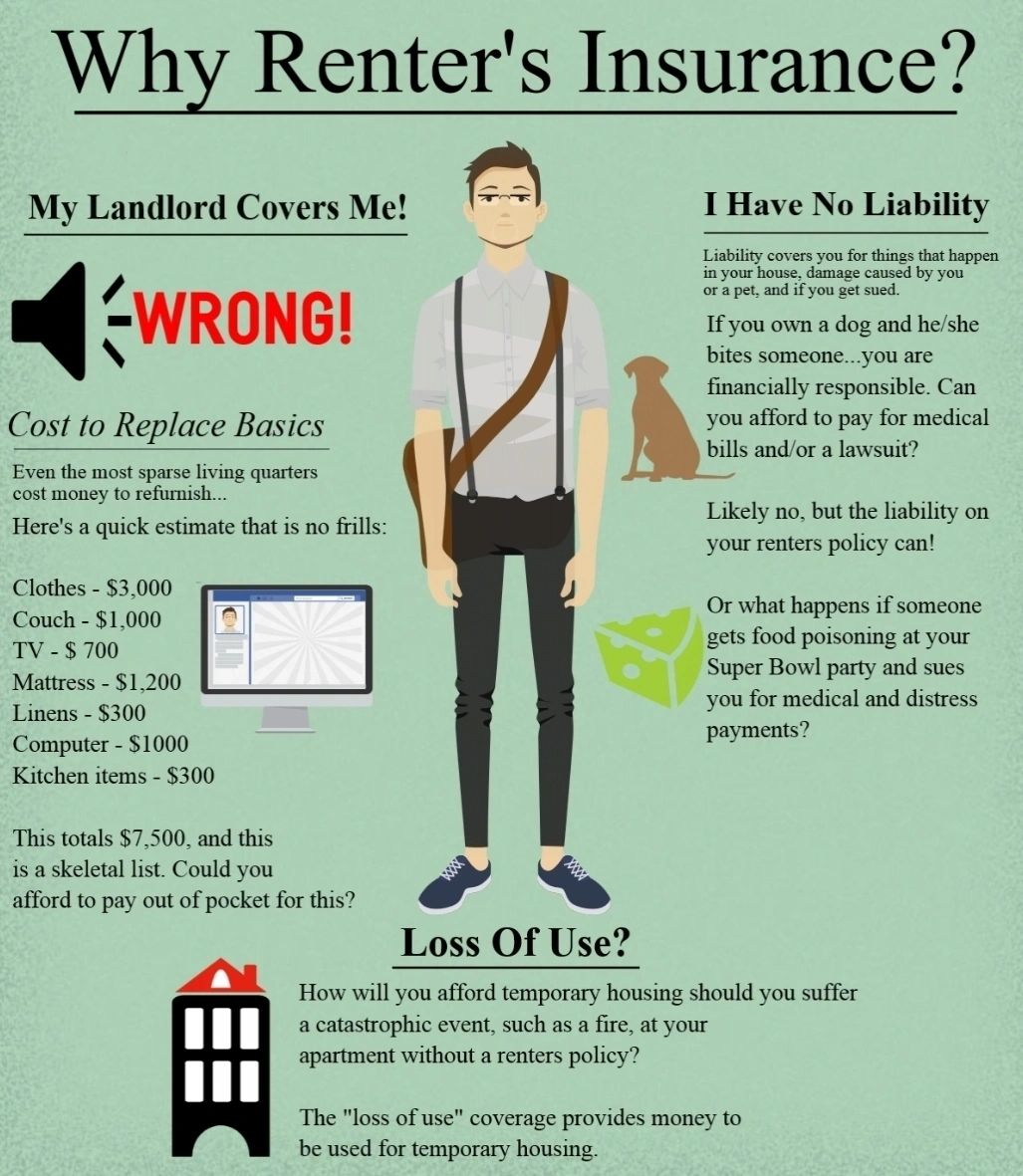

In addition to the standard coverage, you may want to consider adding extra features to your renters insurance policy, such as: * Flood or earthquake coverage: If you live in an area prone to natural disasters, you may want to consider adding this coverage to your policy. * Valuable items coverage: If you have expensive items, such as jewelry or artwork, you may want to consider adding extra coverage for these items. * Liability coverage: This coverage can help protect you in the event of an accident or injury in your rental property.

| Feature | Description |

|---|---|

| Flood or earthquake coverage | Covers damage or loss due to natural disasters |

| Valuable items coverage | Covers expensive items, such as jewelry or artwork |

| Liability coverage | Covers accidents or injuries in the rental property |

Final Thoughts

In conclusion, understanding the paperwork requirements for rent insurance is crucial to getting the right coverage for your needs. By knowing what documents to provide, what to expect from your insurance provider, and what additional features to consider, you can ensure you have the protection you need in the event of an unforeseen event. Remember to always read and understand your policy document, and don’t hesitate to ask questions if you’re unsure about any aspect of your coverage.

What is the purpose of renters insurance?

+

Renters insurance protects tenants from financial losses due to theft, damage, or other unforeseen events that may occur in their rented property.

What documents do I need to apply for renters insurance?

+

You will typically need to provide proof of identity, proof of residency, proof of income, an inventory of belongings, and information about the rental property.

How do I file a claim with my renters insurance provider?

+

The claims process will vary depending on your insurance provider, but you will typically need to contact them and provide documentation of the damage or loss.