Paperwork

Relinquish LLC Ownership Paperwork

Understanding the Process of Relinquishing LLC Ownership

When an individual decides to relinquish their ownership in a Limited Liability Company (LLC), it is essential to follow the proper procedures to ensure a smooth transition and to protect all parties involved. This process can be complex, involving various legal and financial considerations. It is crucial to understand the steps and potential implications before proceeding.

Reasons for Relinquishing LLC Ownership

There are several reasons why an owner might choose to relinquish their ownership in an LLC. These can include: - Disagreements with other owners regarding the direction or management of the company. - Financial difficulties, where the owner can no longer afford their share of the financial responsibilities. - Personal reasons, such as a change in career goals or health issues that prevent the owner from actively participating in the business. - Strategic business decisions, where the sale or transfer of ownership can benefit the company’s future growth or stability.

Steps to Relinquish LLC Ownership

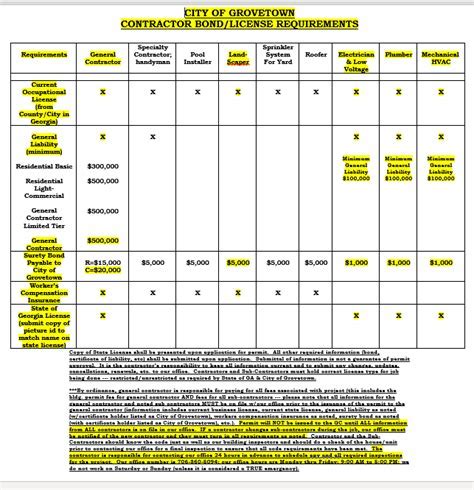

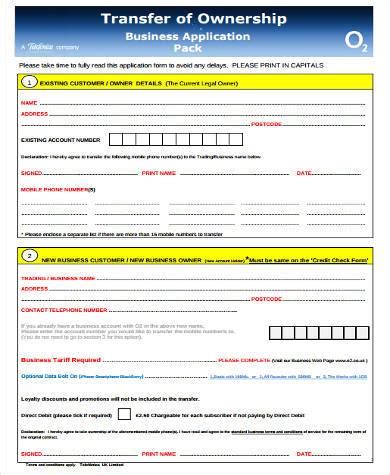

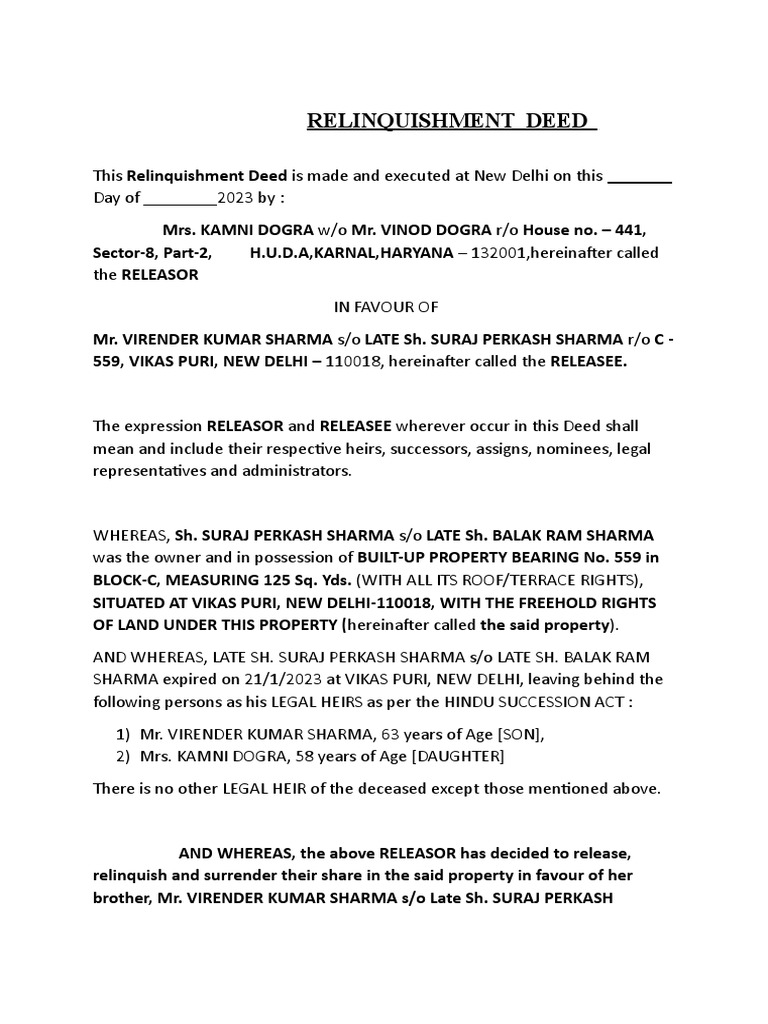

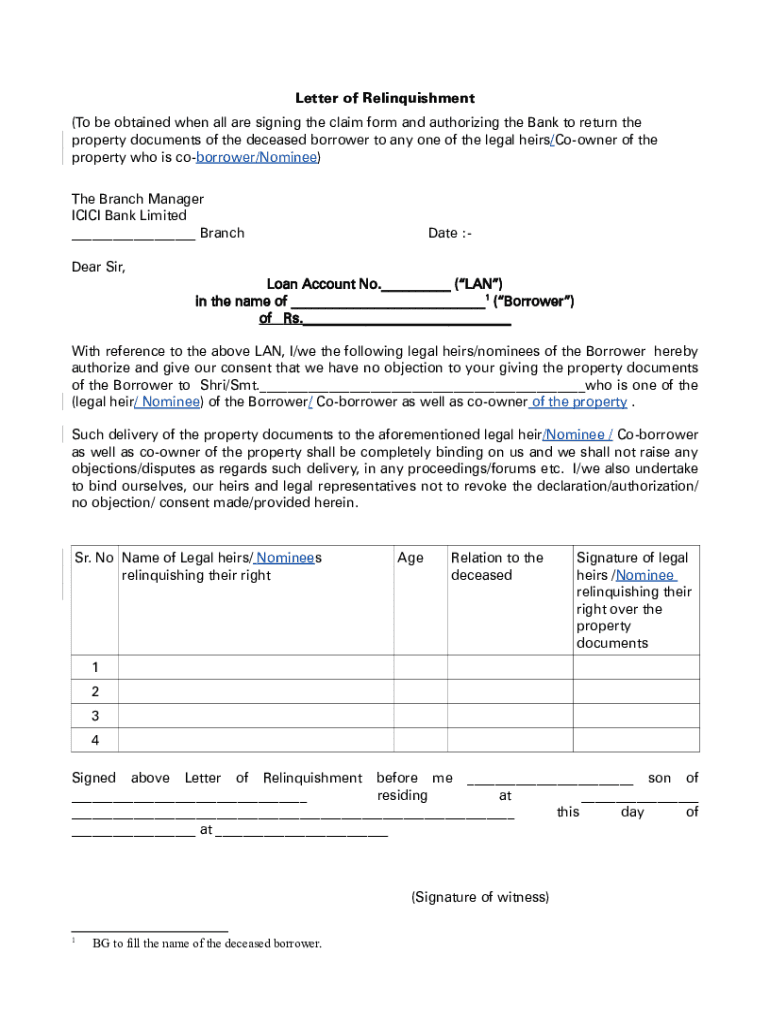

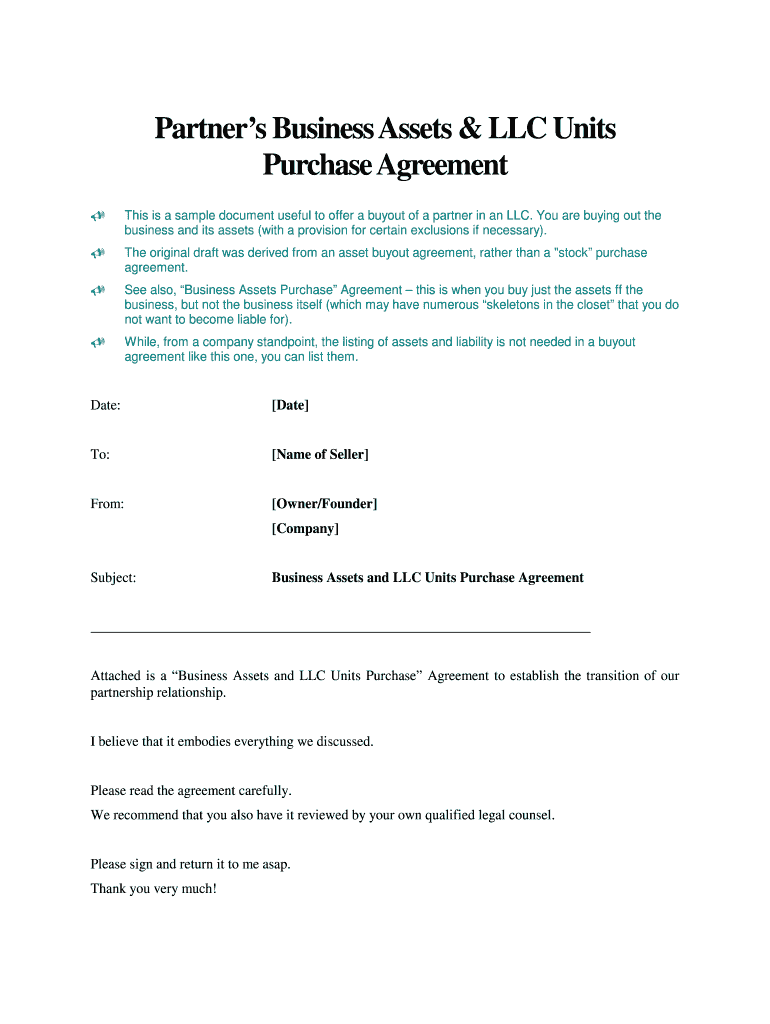

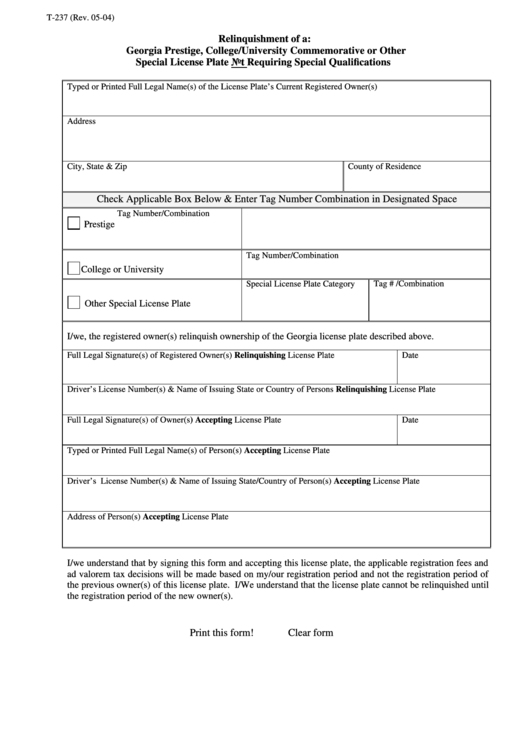

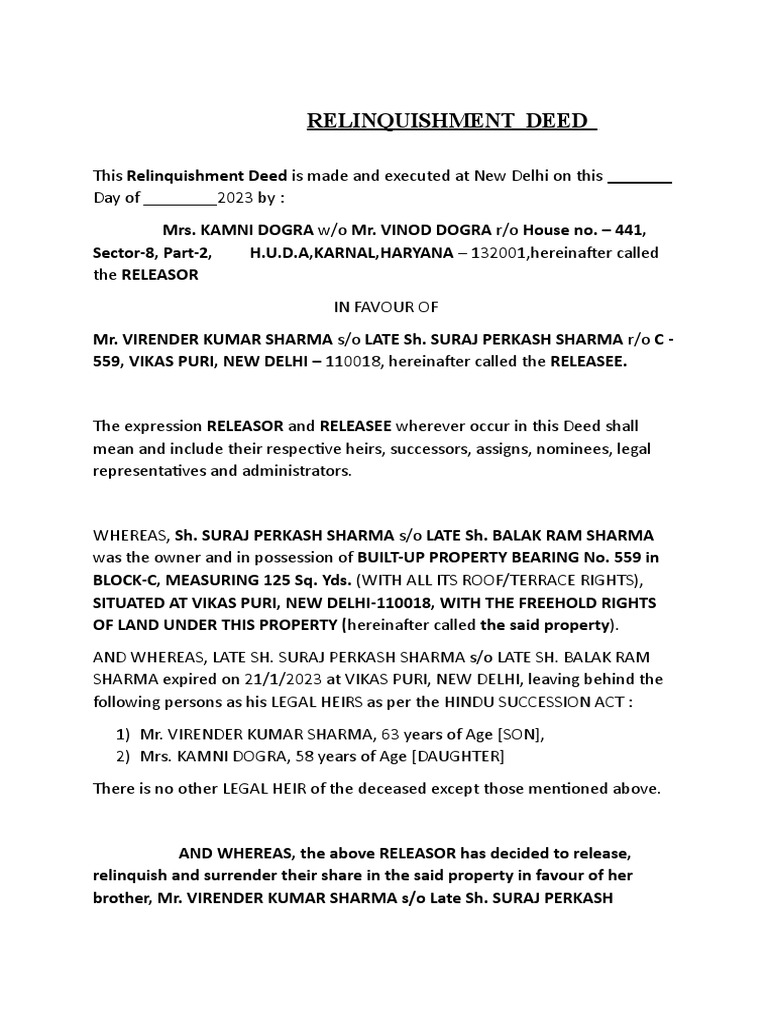

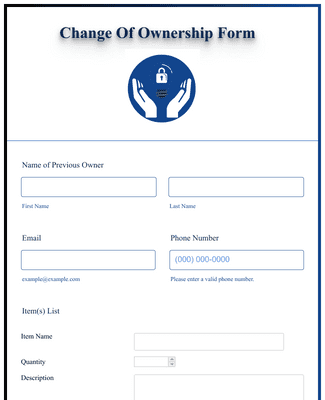

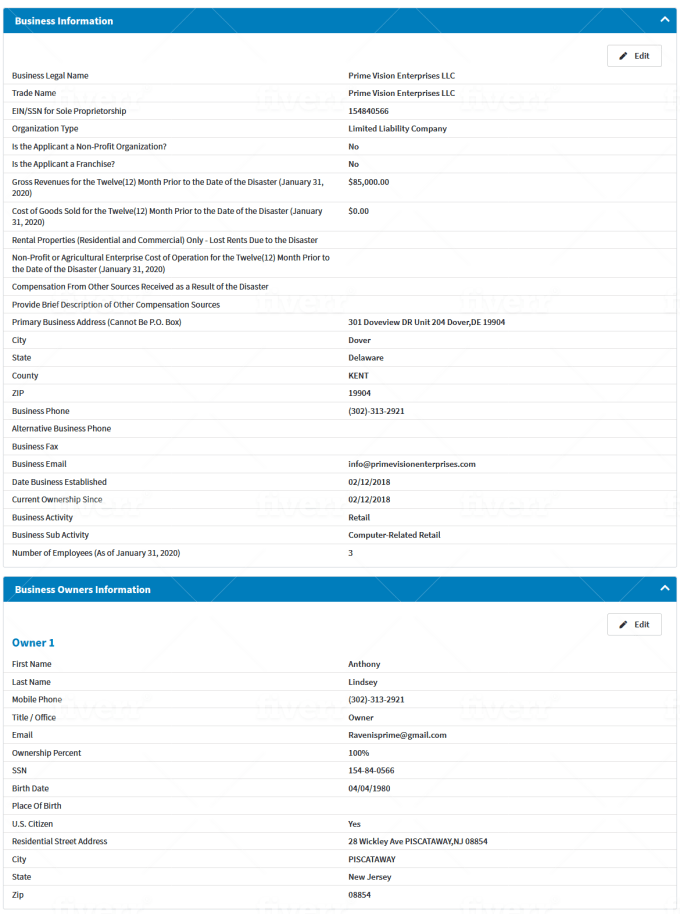

The process of relinquishing LLC ownership involves several key steps: - Review the Operating Agreement: The first step is to review the LLC’s operating agreement, which outlines the procedures for transferring ownership, buyout provisions, and other relevant details. - Notify Other Owners: The owner wishing to relinquish their share must notify the other owners in writing, stating their intention to leave the company. - Determine the Value of the Ownership Interest: This can be a complex process, often requiring an independent appraisal or valuation to determine the fair market value of the ownership interest. - Negotiate the Terms of the Buyout: The exiting owner and the remaining owners (or the company itself) must negotiate the terms of the buyout, including the price and payment terms. - Prepare and Sign the Necessary Documents: This includes a buy-sell agreement, an amendment to the operating agreement (if necessary), and any other documents required by the state or specified in the operating agreement. - File the Required Documents with the State: Depending on the state’s requirements, it may be necessary to file articles of amendment or other documents with the state business registration office.

Legal and Financial Considerations

Relinquishing LLC ownership has significant legal and financial implications. Tax considerations are particularly important, as the sale or transfer of ownership can trigger tax liabilities. It is also crucial to ensure that all legal requirements are met to avoid any potential disputes or liabilities. Consulting with a lawyer and an accountant can provide valuable guidance throughout this process.

Best Practices for a Smooth Transition

To ensure a smooth transition, consider the following best practices: - Maintain open communication with all parties involved. - Seek professional advice from lawyers, accountants, and business advisors. - Document everything, including all agreements, notifications, and transfers of ownership. - Plan for the future, considering how the change in ownership will affect the company’s operations and goals.

📝 Note: It's essential to keep detailed records of all transactions and agreements related to the relinquishment of LLC ownership, as these documents can protect the rights and interests of all parties involved.

Conclusion and Final Thoughts

In conclusion, relinquishing LLC ownership is a significant decision that requires careful consideration and planning. By understanding the reasons for relinquishing ownership, following the necessary steps, and being aware of the legal and financial implications, individuals can navigate this process effectively. It’s also important to prioritize open communication, seek professional advice, and maintain detailed records to ensure a smooth transition for all parties involved.

What is the first step in relinquishing LLC ownership?

+

The first step is to review the LLC’s operating agreement to understand the procedures for transferring ownership and any buyout provisions.

Why is it important to determine the value of the ownership interest?

+

Determining the fair market value of the ownership interest is crucial for negotiating a fair buyout price and ensuring that the transaction is equitable for all parties involved.

What documents are typically required for relinquishing LLC ownership?

+

The documents required can include a buy-sell agreement, an amendment to the operating agreement, and any other documents specified by the state or outlined in the operating agreement.