Paperwork

NJ Income Tax Required Paperwork

Introduction to NJ Income Tax

When it comes to filing income taxes in New Jersey, residents and non-residents alike must navigate through various requirements and paperwork. The state’s income tax system is designed to ensure that all individuals and businesses contribute their fair share to the state’s revenue. In this blog post, we will delve into the world of NJ income tax required paperwork, exploring the necessary documents and forms that individuals and businesses must complete to comply with state tax laws.

Individual Income Tax Paperwork

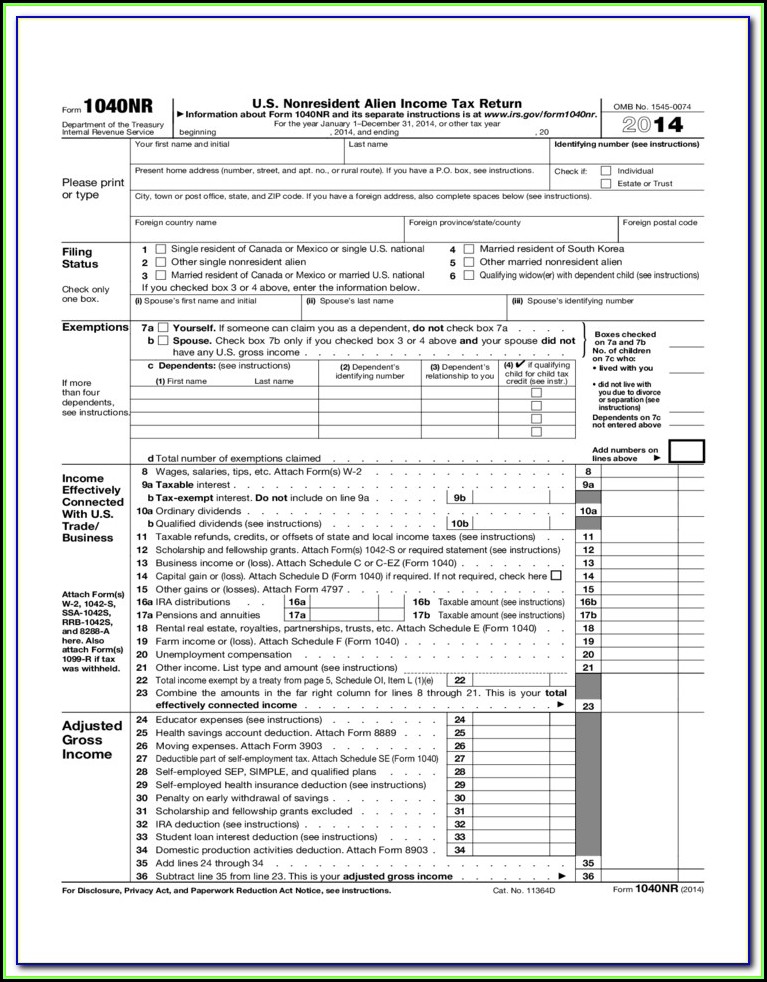

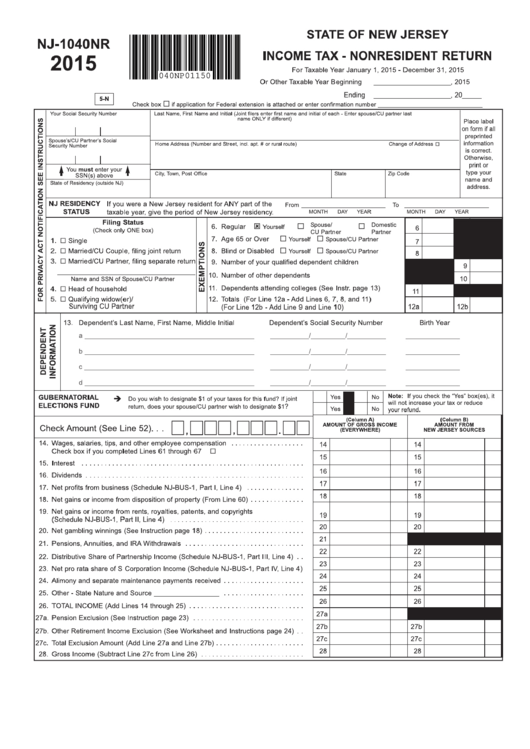

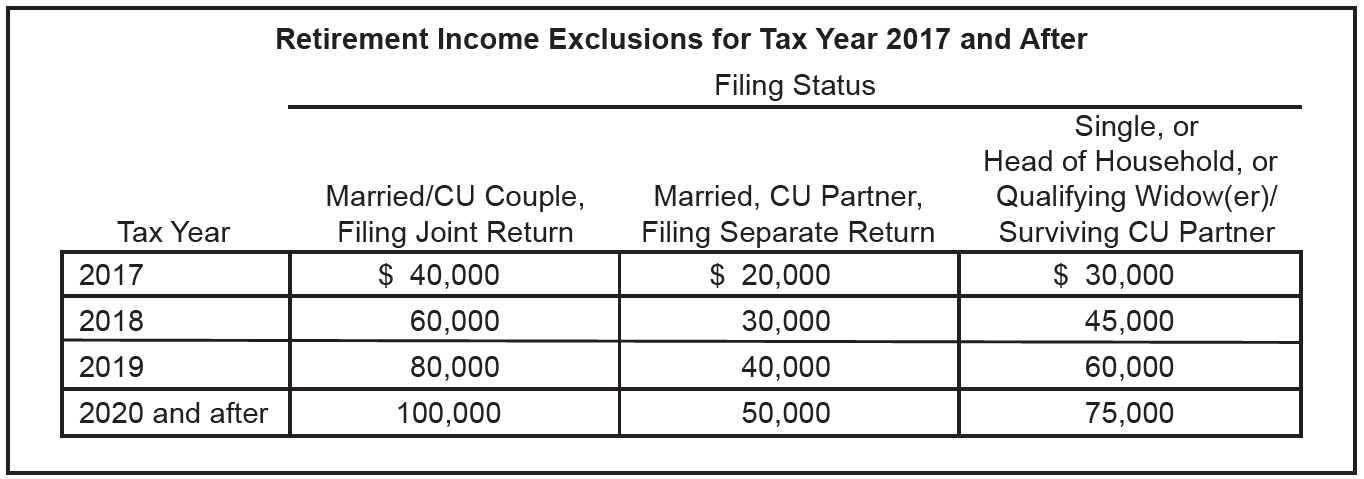

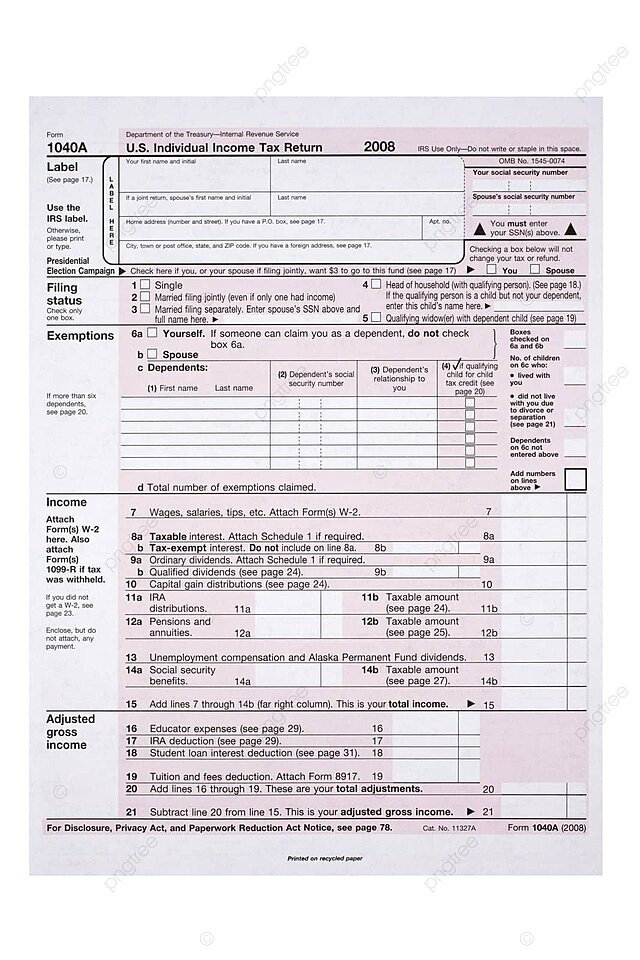

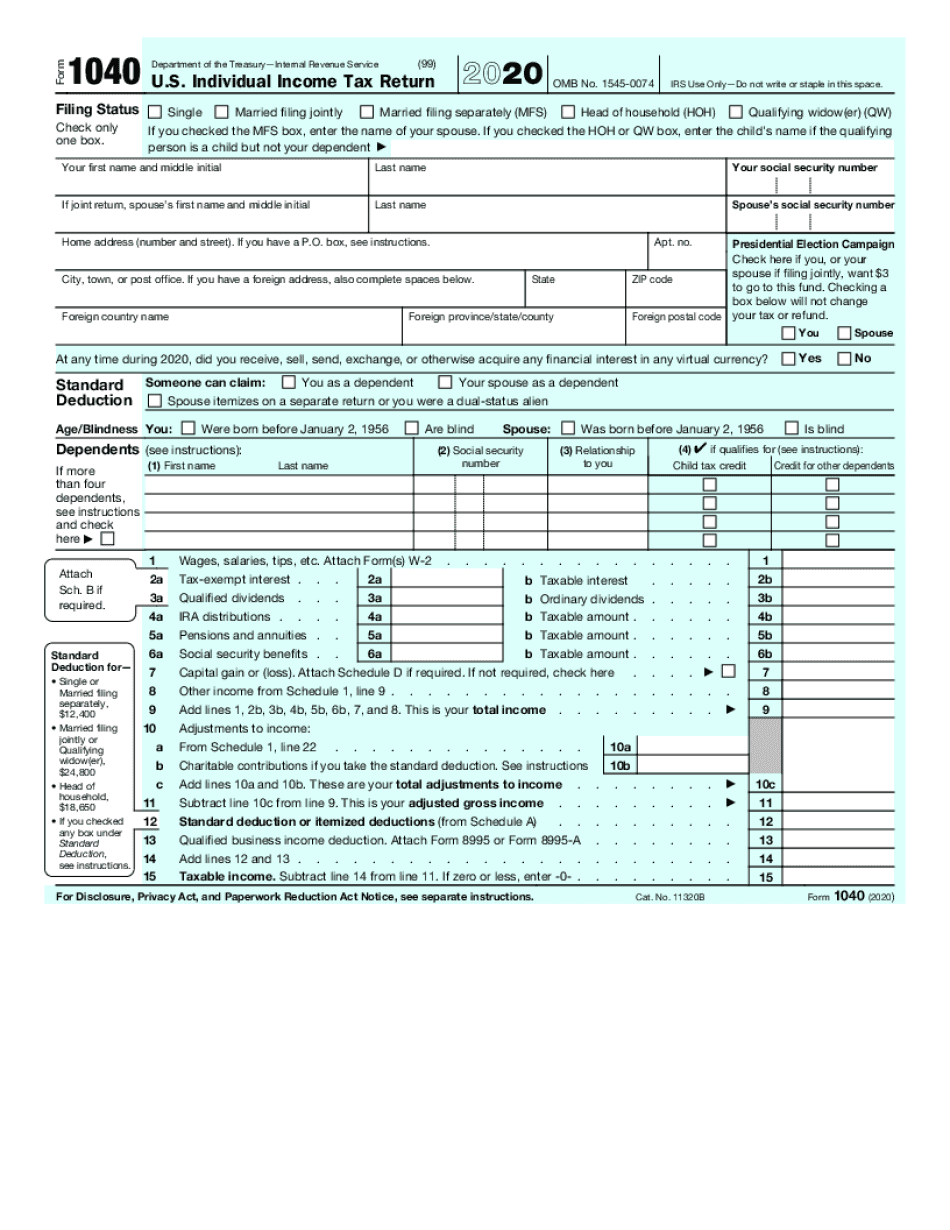

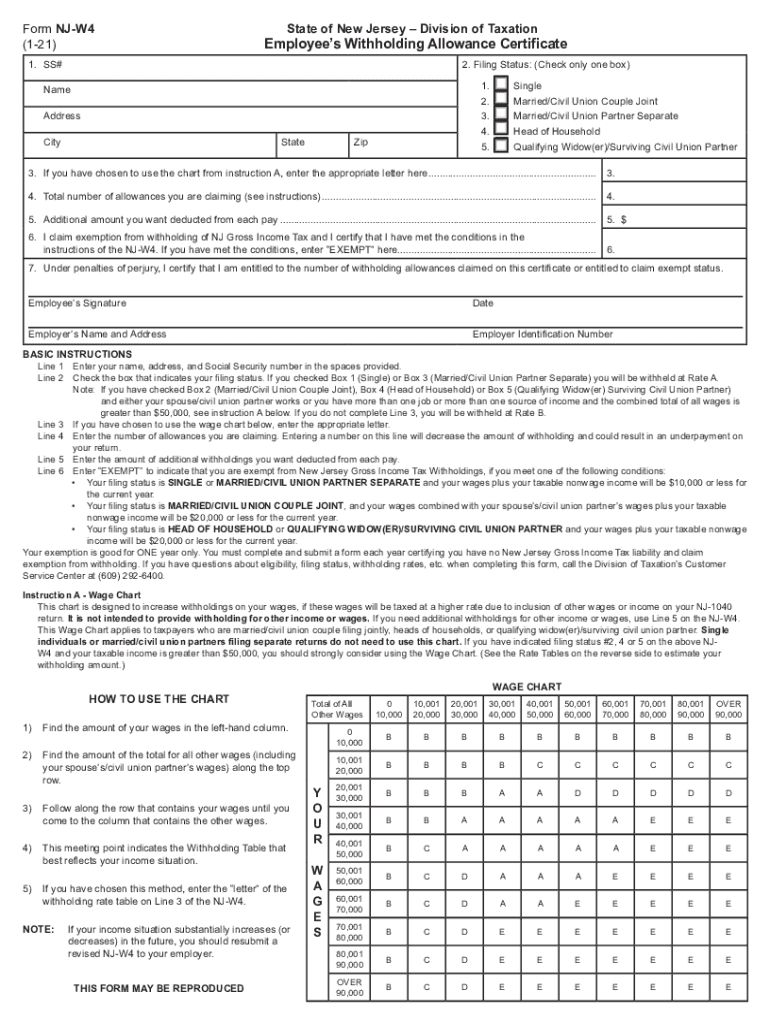

Individuals residing in New Jersey are required to file a state income tax return if their gross income exceeds certain thresholds. The New Jersey Gross Income Tax Return (Form NJ-1040) is the primary form used for filing individual income taxes. This form requires individuals to report their income, deductions, and credits, as well as calculate their tax liability. Some of the key documents and forms that individuals may need to complete include: * W-2 forms: Used to report employment income and taxes withheld * 1099 forms: Used to report self-employment income, interest, dividends, and capital gains * Schedule A (Itemized Deductions): Used to claim itemized deductions, such as medical expenses, mortgage interest, and charitable donations * Schedule B (Interest and Dividend Income): Used to report interest and dividend income

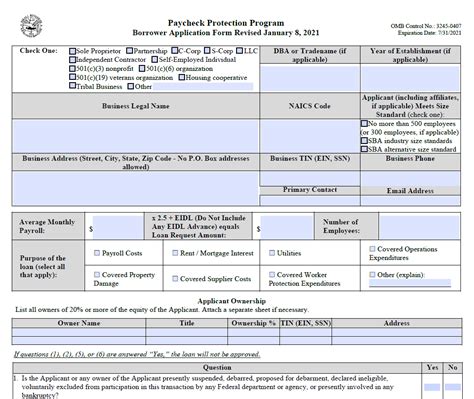

Business Income Tax Paperwork

Businesses operating in New Jersey must also comply with state income tax laws. The type of paperwork required depends on the business structure, such as sole proprietorships, partnerships, corporations, or limited liability companies (LLCs). Some of the key documents and forms that businesses may need to complete include: * New Jersey Corporation Business Tax Return (Form CBT-100): Used to report corporate income and calculate tax liability * New Jersey Partnership Return (Form NJ-1065): Used to report partnership income and calculate tax liability * New Jersey Limited Liability Company (LLC) Return (Form NJ-1065): Used to report LLC income and calculate tax liability * Schedule K-1: Used to report partner or shareholder income and deductions

Other Required Paperwork

In addition to the forms mentioned above, individuals and businesses may need to complete other paperwork to comply with NJ income tax laws. Some examples include: * Estimated tax payments: Used to make quarterly payments towards estimated tax liability * Amended returns: Used to correct errors or make changes to previously filed returns * Extension requests: Used to request an extension of time to file a return

📝 Note: It is essential to keep accurate and detailed records of all income, deductions, and credits to ensure compliance with NJ income tax laws and to avoid potential penalties or audits.

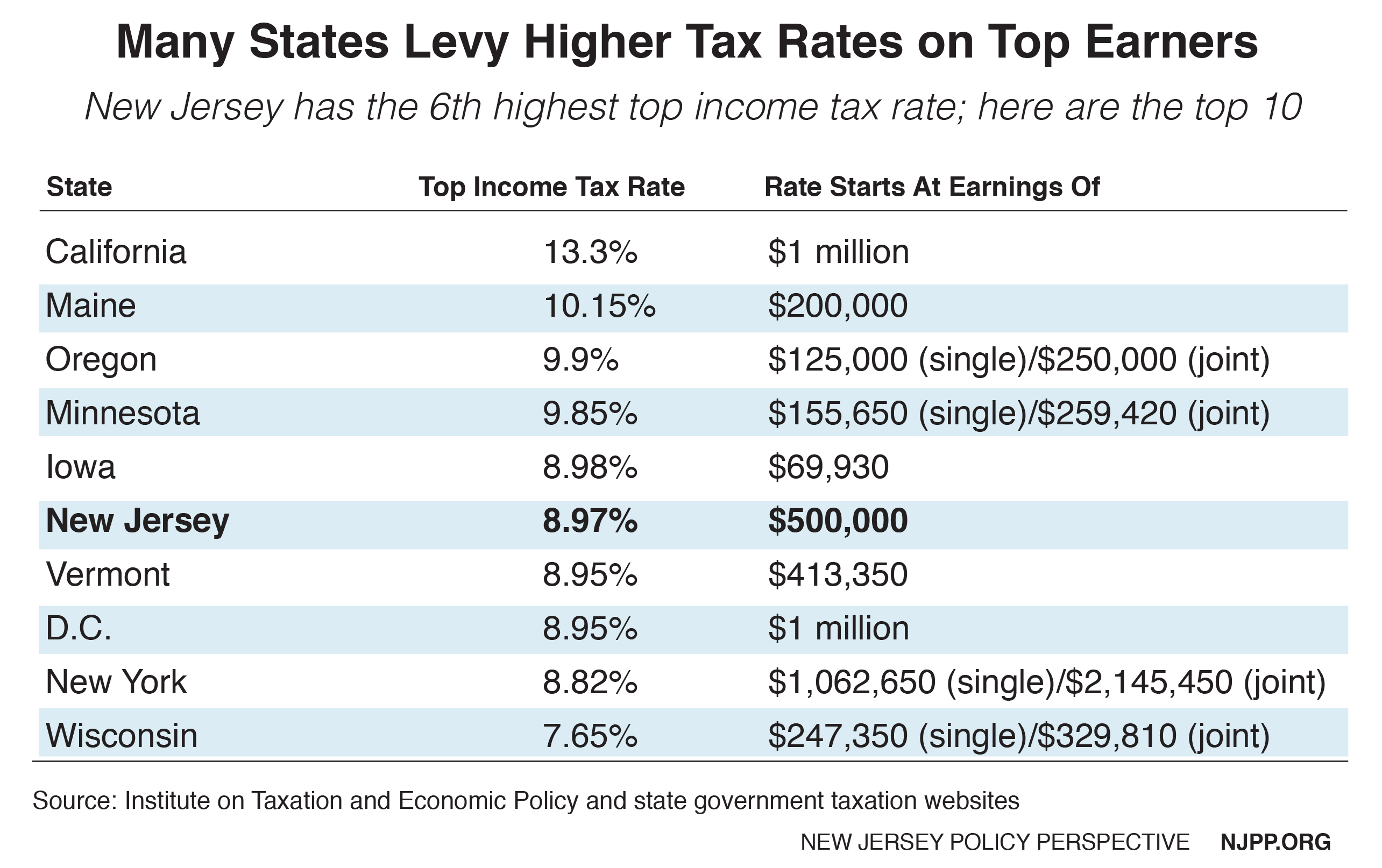

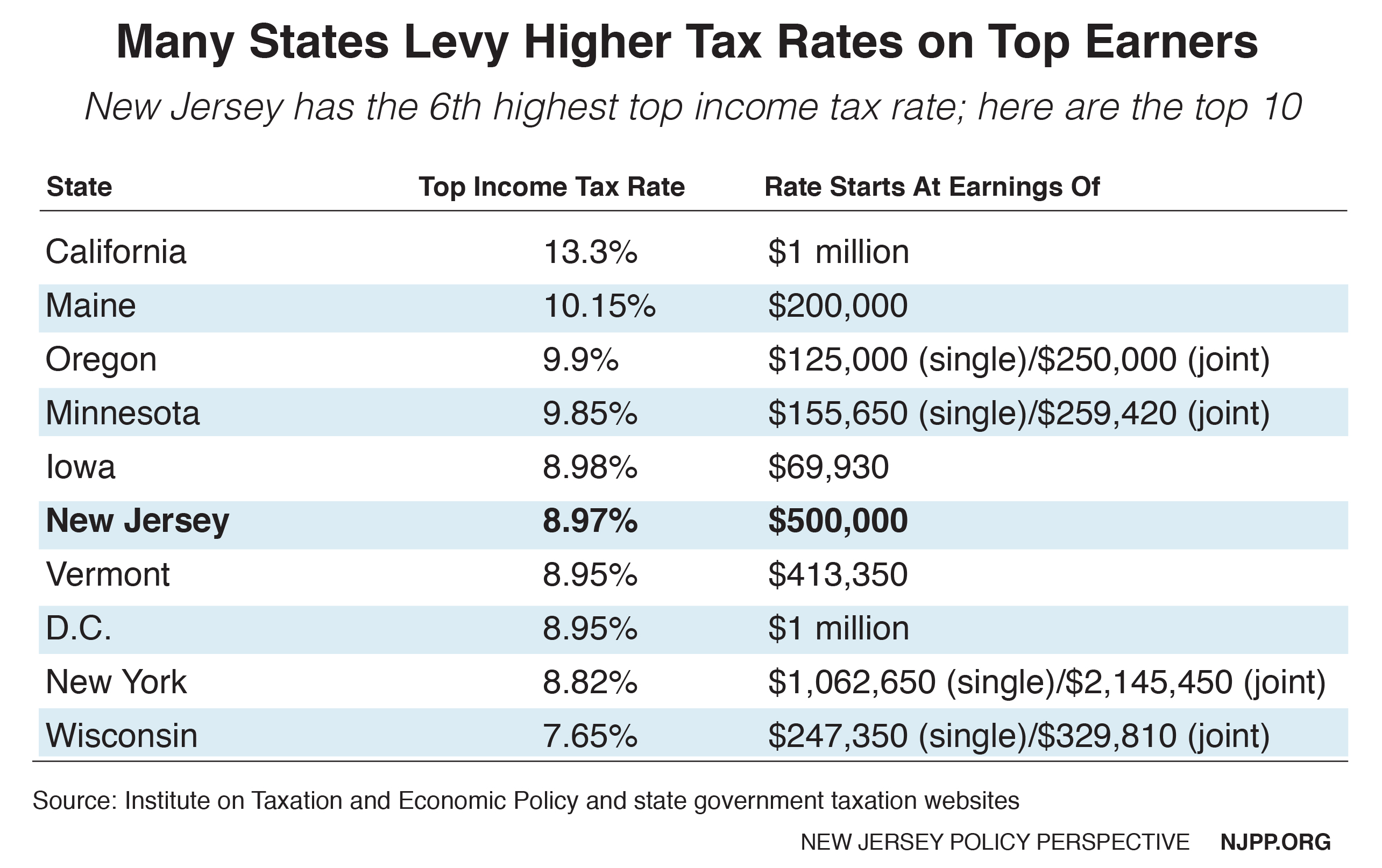

Table of NJ Income Tax Rates

The following table shows the NJ income tax rates for the 2022 tax year:

| Taxable Income | Tax Rate |

|---|---|

| 0 - 20,000 | 5.525% |

| 20,001 - 50,000 | 6.37% |

| 50,001 - 75,000 | 7.95% |

| 75,001 - 500,000 | 8.97% |

| $500,001 and above | 10.75% |

Conclusion and Final Thoughts

In conclusion, navigating the world of NJ income tax required paperwork can be complex and overwhelming. However, by understanding the necessary documents and forms, individuals and businesses can ensure compliance with state tax laws and avoid potential penalties or audits. It is essential to keep accurate and detailed records, stay up-to-date with changing tax laws and regulations, and seek professional advice when needed. By doing so, individuals and businesses can minimize their tax liability and maximize their refunds.

What is the deadline for filing NJ income tax returns?

+

The deadline for filing NJ income tax returns is typically April 15th of each year, unless an extension is requested.

Can I file my NJ income tax return electronically?

+

Yes, you can file your NJ income tax return electronically through the New Jersey Division of Taxation’s website or through tax preparation software.

What are the penalties for late payment or non-payment of NJ income tax?

+

The penalties for late payment or non-payment of NJ income tax can include interest charges, late payment fees, and potential audits or collection actions.