Paperwork

IRS Paperwork to Keep

Introduction to IRS Paperwork

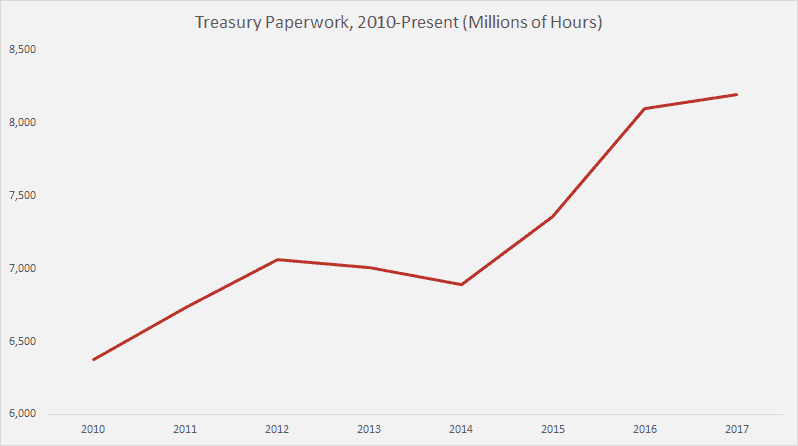

When it comes to managing your finances, one of the most critical aspects is dealing with the IRS (Internal Revenue Service) and the paperwork that comes with it. The IRS requires individuals and businesses to maintain accurate and detailed records of their financial transactions, which can be overwhelming. In this blog post, we will discuss the importance of keeping IRS paperwork, the types of documents you need to keep, and how to organize them efficiently.

Why Keep IRS Paperwork?

Keeping IRS paperwork is essential for several reasons: * It helps you prepare your tax returns accurately and on time. * It provides proof of income and expenses, which can be useful in case of an audit. * It helps you claim deductions and credits you are eligible for. * It ensures you are compliant with IRS regulations and avoid any potential penalties.

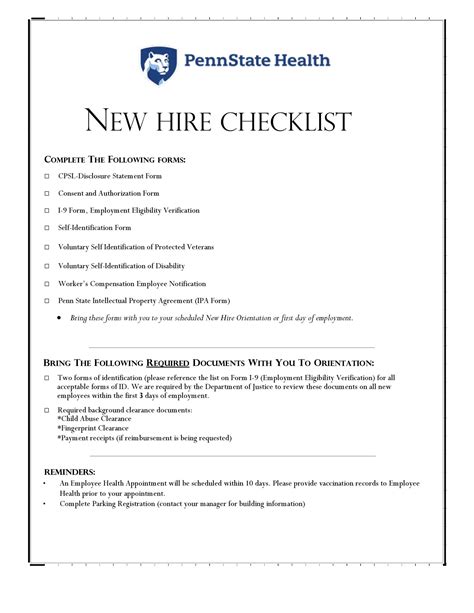

Types of IRS Paperwork to Keep

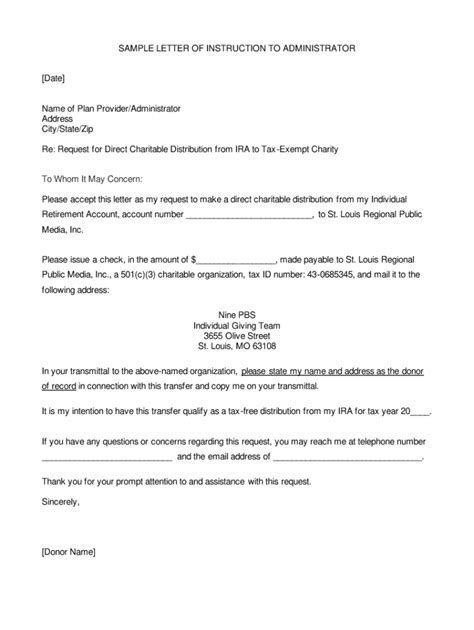

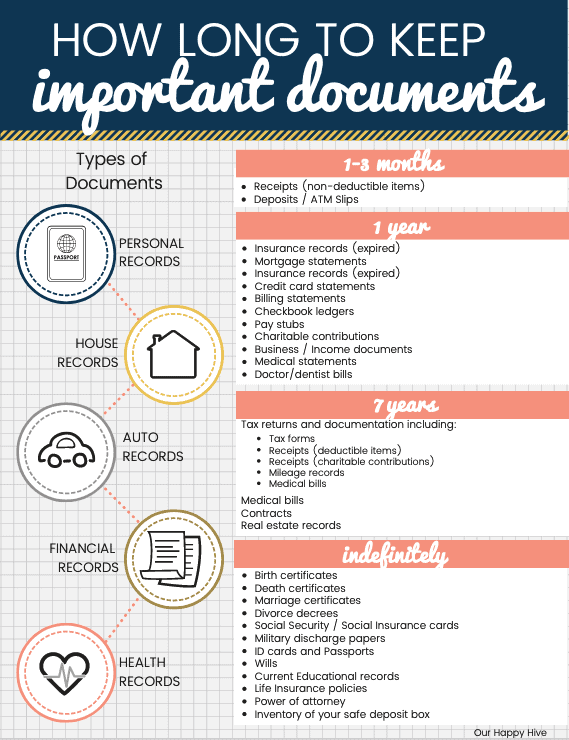

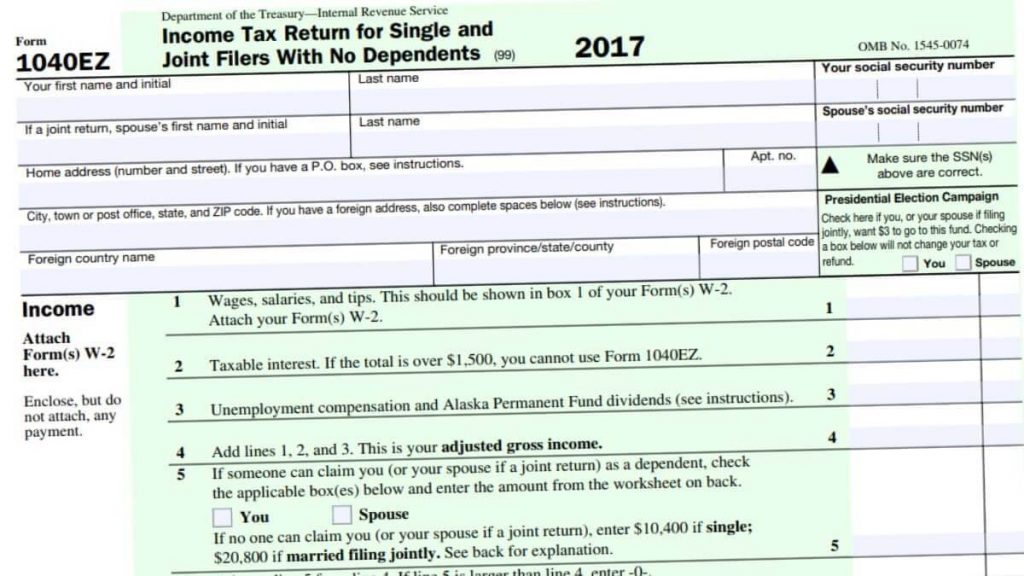

Here are some of the most common types of IRS paperwork you need to keep: * W-2 forms: These forms show your income and taxes withheld from your employer. * 1099 forms: These forms show income from freelance work, interest, dividends, and capital gains. * Receipts and invoices: These documents prove your business expenses and charitable donations. * Bank statements: These statements show your income, expenses, and financial transactions. * Tax returns: Keep copies of your tax returns for at least three years.

How to Organize Your IRS Paperwork

Organizing your IRS paperwork can be challenging, but here are some tips to help you: * Create a filing system: Set up a filing system with folders and labels to categorize your documents. * Use a scanner: Scan your documents and save them digitally to free up physical storage space. * Keep digital copies: Save digital copies of your documents in a secure cloud storage service. * Shred unnecessary documents: Shred documents that are no longer needed to protect your identity and prevent clutter.

Best Practices for Maintaining IRS Paperwork

Here are some best practices to help you maintain your IRS paperwork: * Keep accurate records: Ensure your records are accurate and up-to-date. * Review and update regularly: Review your records regularly and update them as needed. * Seek professional help: If you are unsure about any aspect of your IRS paperwork, seek help from a tax professional.

💡 Note: Keep your IRS paperwork for at least three years in case of an audit.

Conclusion

In conclusion, keeping IRS paperwork is crucial for managing your finances and ensuring compliance with IRS regulations. By understanding the types of documents you need to keep, organizing them efficiently, and following best practices, you can simplify your tax preparation process and avoid any potential penalties. Remember to keep your records accurate, up-to-date, and secure, and seek professional help if you need it.

What types of IRS paperwork do I need to keep?

+

You need to keep W-2 forms, 1099 forms, receipts and invoices, bank statements, and tax returns.

How long do I need to keep my IRS paperwork?

+

You need to keep your IRS paperwork for at least three years in case of an audit.

Can I keep my IRS paperwork digitally?

+

Yes, you can keep your IRS paperwork digitally, but make sure to save them in a secure cloud storage service.