5 Documents Needed

Introduction to Essential Documents

When it comes to legal, financial, and personal matters, having the right documents in order can make a significant difference. These documents not only help in times of need but also ensure that your wishes are respected and your loved ones are protected. In this article, we will explore five essential documents that everyone should have, understanding their importance, and how to prepare them.

1. Last Will and Testament

A Last Will and Testament is a document that outlines how you want your assets to be distributed after your death. It allows you to decide who will inherit your property, who will be the guardian of your minor children, and who will manage your estate. Without a will, the state will decide how your assets are distributed, which might not align with your wishes. Preparing a will is a straightforward process that can be done with the help of an attorney or through online services.

2. Power of Attorney

A Power of Attorney (POA) is a document that grants someone you trust the authority to make decisions on your behalf if you become incapacitated. This can include financial decisions, such as managing your bank accounts, and personal decisions, such as your health care. There are different types of POA, including durable, springing, and limited, each serving a specific purpose. Having a POA ensures that your affairs are managed according to your preferences even when you cannot make decisions for yourself.

3. Advance Directive

An Advance Directive, also known as a living will, is a document that specifies your wishes regarding end-of-life medical treatment. It informs your family and healthcare providers about the medical care you do or do not want to receive if you are unable to communicate. This can include decisions about life-sustaining treatments, such as ventilators or feeding tubes. Having an advance directive can reduce the burden on your loved ones and ensure that your wishes are respected.

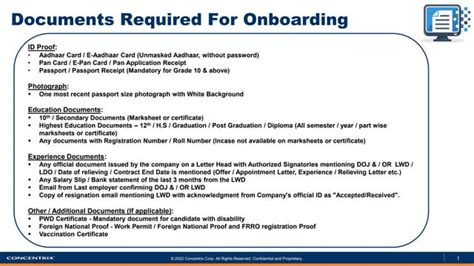

4. Health Insurance Documents

Health Insurance Documents are crucial for accessing medical care without incurring significant financial burdens. These documents prove your insurance coverage and outline what is covered under your policy. It is essential to understand your health insurance, including deductibles, copays, and any limitations or exclusions. Keeping these documents organized and easily accessible can simplify the process of seeking medical care and dealing with insurance claims.

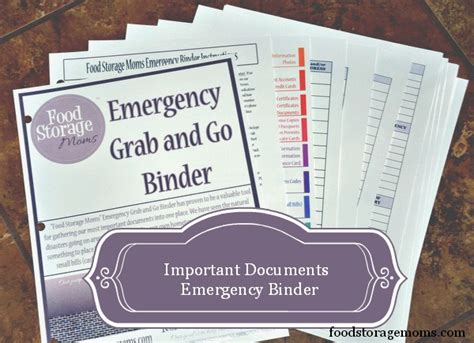

5. Emergency Contact and Medical Information

Having an Emergency Contact and Medical Information document readily available can be lifesaving. This document should include your emergency contacts, medical conditions, allergies, current medications, and any relevant medical history. In the event of an emergency, this information can be critical for first responders and healthcare providers to make informed decisions about your care. It is a good idea to keep a copy of this document in your wallet, with a trusted friend or family member, and in your vehicle.

📝 Note: It is crucial to review and update these documents regularly to ensure they reflect any changes in your life, preferences, or circumstances.

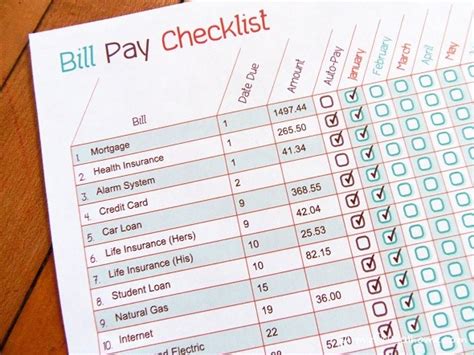

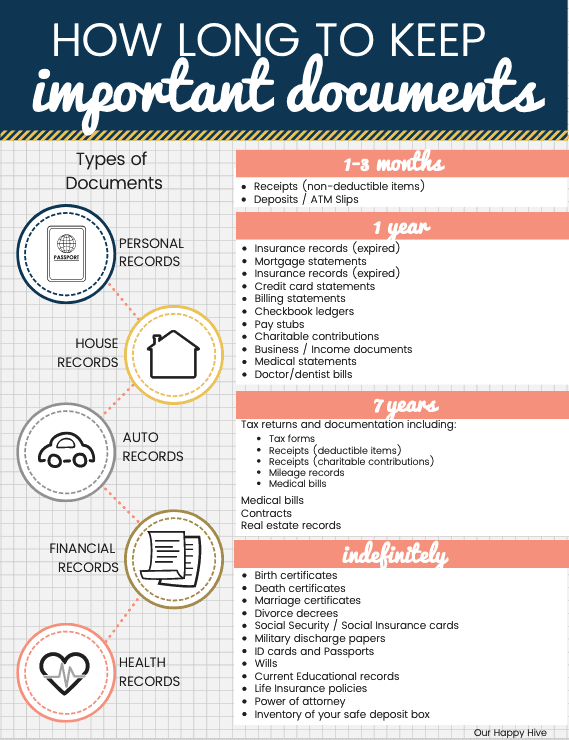

To organize these documents efficiently, consider the following steps: - Create digital copies and store them securely, such as in a password-protected folder or with a trusted online storage service. - Inform your loved ones about the existence and location of these documents. - Review and update the documents periodically, such as during tax season or at the start of a new year.

In summary, having the right documents in place can provide peace of mind and ensure that your wishes are carried out. From managing your estate to making healthcare decisions, these five documents are essential for everyone. By understanding their importance and taking the steps to prepare them, you can protect yourself and your loved ones from unnecessary stress and uncertainty.

What is the difference between a will and a trust?

+

A will and a trust are both estate planning tools, but they serve different purposes. A will outlines how you want your assets to be distributed after your death and is subject to probate. A trust, on the other hand, allows you to distribute assets without going through probate and can be used to manage assets during your lifetime as well.

Do I need a lawyer to prepare these documents?

+

While it is possible to prepare some of these documents on your own or with online services, consulting with a lawyer can ensure that your documents are legally binding and tailored to your specific situation. This is especially important for complex estates or unique family situations.

How often should I review and update my documents?

+