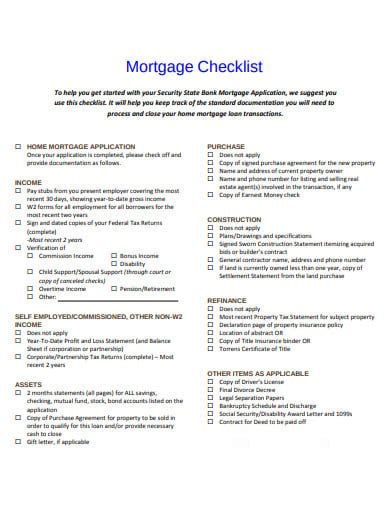

5 Mortgage Proof Documents

Introduction to Mortgage Proof Documents

When applying for a mortgage, lenders require various documents to verify the borrower’s identity, income, creditworthiness, and other essential information. These documents, known as mortgage proof documents, play a crucial role in the mortgage application process. In this article, we will discuss the five primary mortgage proof documents required by lenders to approve a mortgage application.

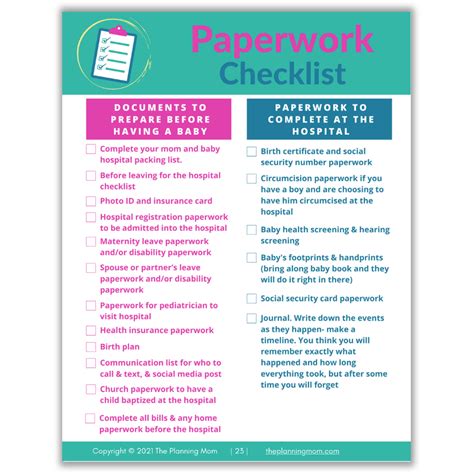

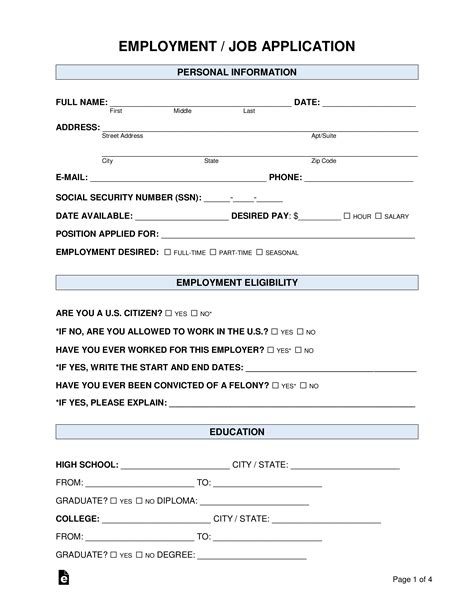

1. Identification Documents

The first set of documents required by lenders is identification documents. These documents help lenders verify the borrower’s identity and ensure they are who they claim to be. Some common identification documents include: * Passport * Driver’s license * State ID * Social Security card * Birth certificate

📝 Note: Lenders may require additional identification documents, such as a utility bill or bank statement, to confirm the borrower's address.

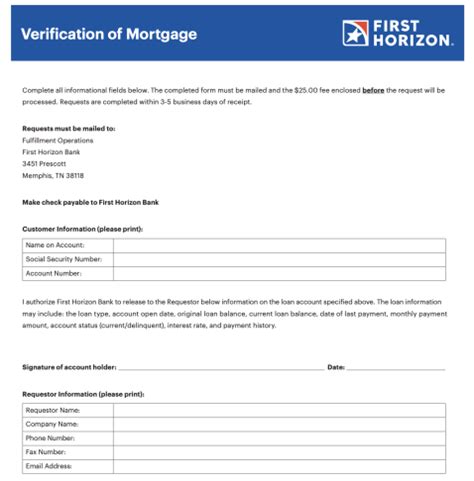

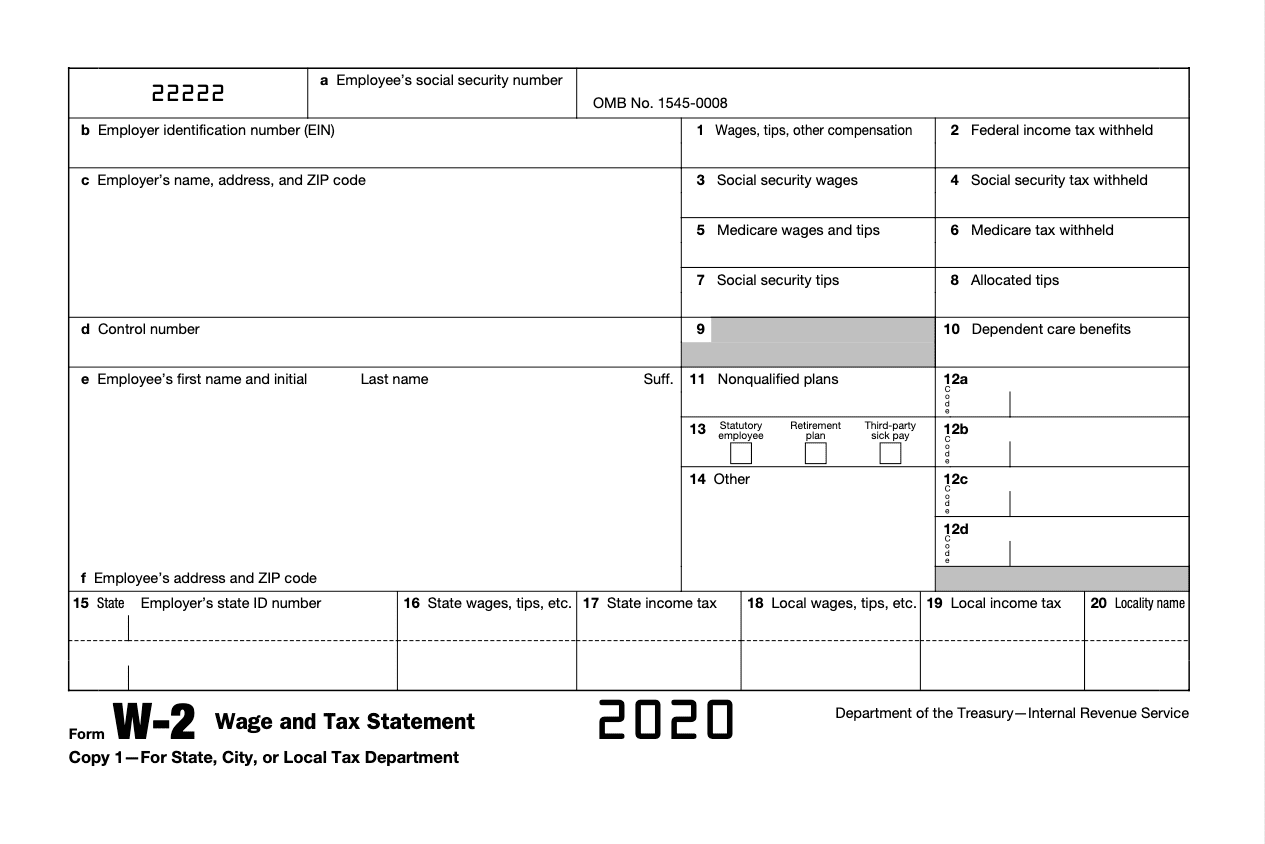

2. Income Verification Documents

Income verification documents are essential to demonstrate the borrower’s ability to repay the mortgage. Lenders typically require: * Pay stubs * W-2 forms * Tax returns (personal and business, if applicable) * Letters from employers * Bank statements

These documents help lenders assess the borrower’s income stability and calculate their debt-to-income ratio.

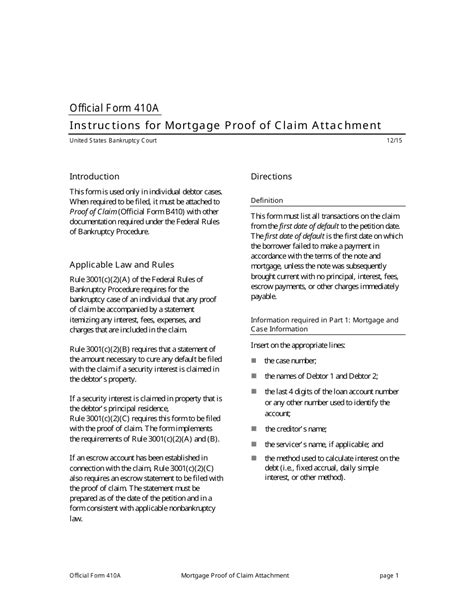

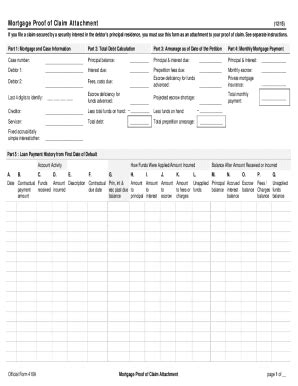

3. Credit Reports

Credit reports are critical in determining the borrower’s creditworthiness. Lenders use credit reports to evaluate the borrower’s credit history, credit score, and debt obligations. A good credit score can help borrowers qualify for better interest rates and terms.

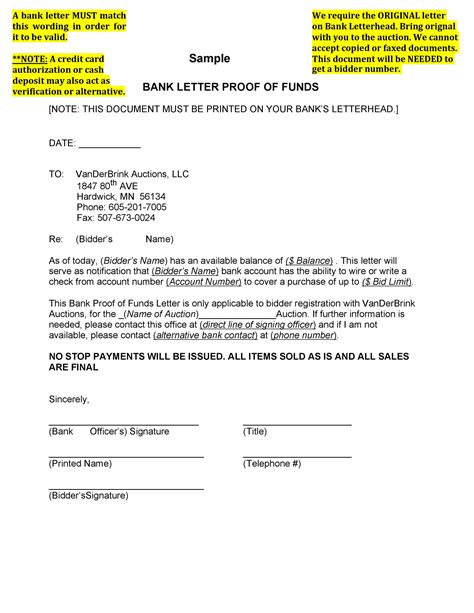

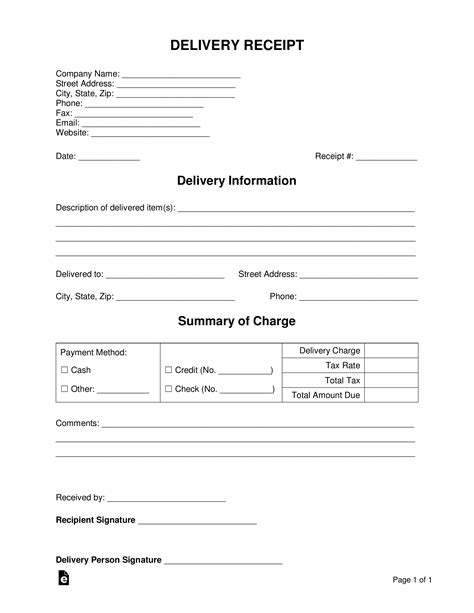

4. Asset Verification Documents

Asset verification documents are necessary to confirm the borrower’s assets, such as savings, investments, and other properties. Lenders may require: * Bank statements * Investment accounts * Retirement accounts * Other property deeds or titles

These documents help lenders understand the borrower’s financial situation and assess their ability to make down payments or cover closing costs.

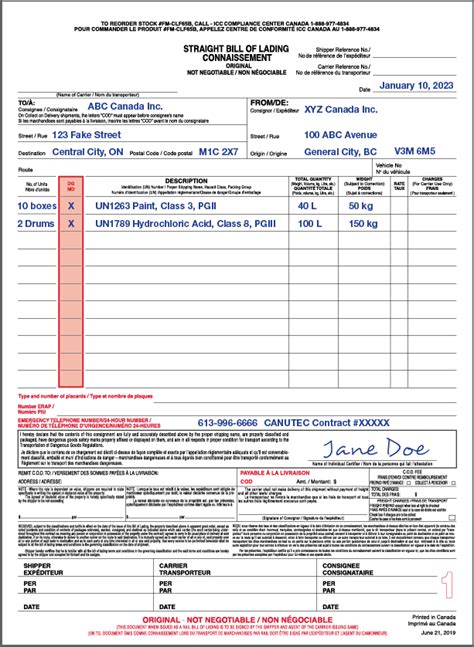

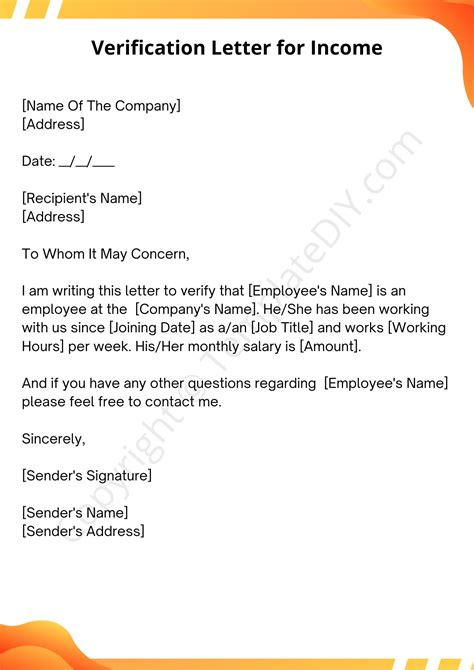

5. Employment Verification Documents

Employment verification documents are used to confirm the borrower’s employment status and income stability. Lenders may require: * Letters from employers * Pay stubs * W-2 forms * Business licenses (for self-employed individuals)

These documents help lenders evaluate the borrower’s job security and income prospects.

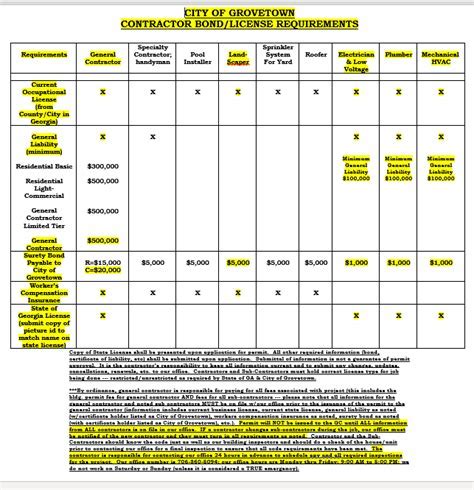

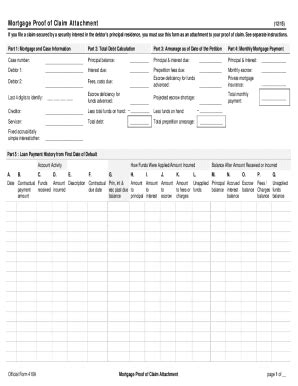

| Document Type | Description |

|---|---|

| Identification Documents | Verify borrower's identity |

| Income Verification Documents | Demonstrate borrower's income stability |

| Credit Reports | Evaluate borrower's creditworthiness |

| Asset Verification Documents | Confirm borrower's assets |

| Employment Verification Documents | Verify borrower's employment status |

In summary, the five primary mortgage proof documents required by lenders are identification documents, income verification documents, credit reports, asset verification documents, and employment verification documents. These documents help lenders assess the borrower’s creditworthiness, income stability, and ability to repay the mortgage. By providing these documents, borrowers can increase their chances of getting approved for a mortgage and achieving their dream of homeownership.

What is the purpose of mortgage proof documents?

+

Mortgage proof documents are used to verify the borrower’s identity, income, creditworthiness, and other essential information to assess their ability to repay the mortgage.

What are the common identification documents required by lenders?

+

Common identification documents include passport, driver’s license, state ID, social security card, and birth certificate.

Why are credit reports important in the mortgage application process?

+

Credit reports are used to evaluate the borrower’s creditworthiness, credit score, and debt obligations, which helps lenders determine their ability to repay the mortgage.