5 Mortgage Paperwork Musts

Introduction to Mortgage Paperwork

When navigating the process of purchasing a home, one of the most critical and often overwhelming aspects is the mortgage paperwork. This complex and detailed process requires careful attention to ensure that all documents are accurately completed and submitted on time. Mortgage applications involve a plethora of paperwork, including personal identification, income verification, and property details. Understanding the key components of this process can significantly simplify the journey to homeownership.

Understanding the Mortgage Paperwork Process

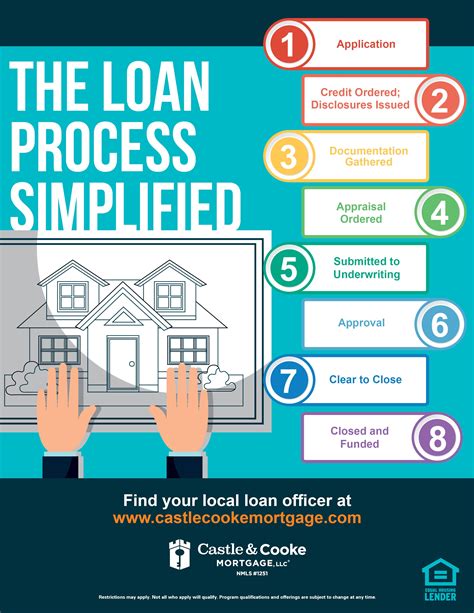

The mortgage paperwork process is designed to verify the borrower’s creditworthiness and ability to repay the loan. It involves several stages, starting from pre-approval to the final closing. Each stage requires specific documents that must be carefully reviewed and signed. Accuracy and completeness are paramount to avoid delays or even application rejection.

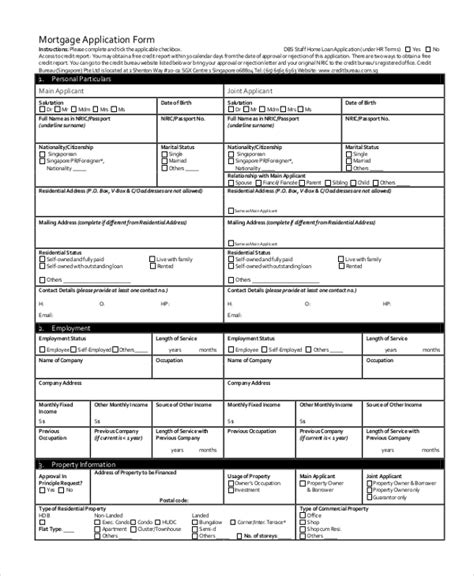

Some of the key documents involved in the mortgage paperwork process include: - Identification documents: These are essential for verifying the borrower’s identity and may include a driver’s license, passport, or state ID. - Income verification documents: Pay stubs, W-2 forms, and tax returns are used to confirm the borrower’s income and employment status. - Credit reports: These documents provide a detailed history of the borrower’s credit behavior and are crucial for determining credit scores and loan eligibility. - Property documents: These may include the property’s title, appraisal reports, and insurance documents, all of which are vital for securing the loan against the property.

Mortgage Paperwork Musts

Given the complexity and importance of mortgage paperwork, there are several musts that borrowers should be aware of to ensure a smooth and successful application process. These include:

- Accuracy and Completeness: All documents must be filled out accurately and completely. Incomplete applications can lead to delays, while inaccurate information can result in application rejection.

- Timeliness: Meeting deadlines for submitting paperwork is crucial. Delays can push back the closing date and potentially jeopardize the sale.

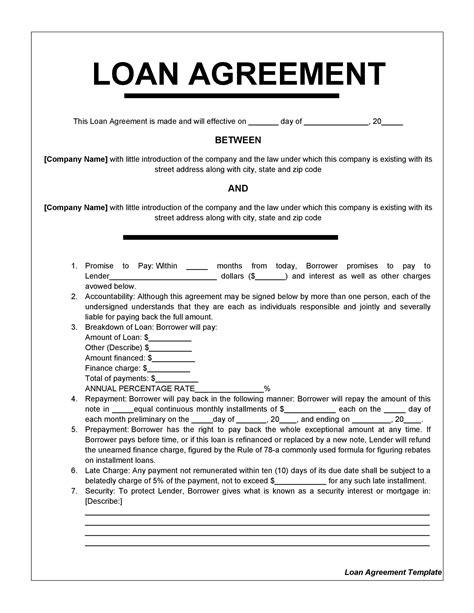

- Understanding Legal and Financial Implications: Borrowers should have a clear understanding of the legal and financial implications of the documents they are signing. This includes understanding the terms of the loan, the repayment schedule, and any penalties for late payments.

- Documentation of Income and Assets: Borrowers must be prepared to provide comprehensive documentation of their income and assets. This may include bank statements, investment accounts, and any other sources of income or wealth.

- Review and Approval: Finally, borrowers must carefully review all documents before signing and ensure they understand and agree with the terms and conditions outlined in the paperwork.

Importance of Professional Guidance

Given the complexity of mortgage paperwork, seeking professional guidance can be incredibly beneficial. Mortgage brokers and financial advisors can provide valuable insights and help navigate the process, ensuring that all paperwork is completed correctly and submitted on time. They can also offer advice on the best mortgage products available based on the borrower’s financial situation and goals.

📝 Note: It's essential to maintain open communication with your lender and other parties involved in the mortgage process to address any questions or concerns promptly.

Preparation is Key

Preparation is key to navigating the mortgage paperwork process successfully. Borrowers should start gathering required documents early and be prepared to provide additional information as needed. Organizing documents in a logical and accessible manner can also help reduce stress and make the process more manageable.

| Document Type | Description |

|---|---|

| Identification | Driver's license, passport, or state ID |

| Income Verification | Pay stubs, W-2 forms, tax returns |

| Credit Reports | History of credit behavior |

| Property Documents | Property title, appraisal reports, insurance documents |

In summary, the mortgage paperwork process is a critical component of buying a home. By understanding the necessary documents, the importance of accuracy and timeliness, and the value of professional guidance, borrowers can navigate this complex process with confidence. Remember, thorough preparation and a keen eye for detail are essential for a successful mortgage application.

The mortgage application process culminates in the borrower securing a loan that meets their needs and sets them on the path to successful homeownership. By carefully managing the paperwork and seeking help when needed, individuals can ensure that their dream of owning a home becomes a reality.

What is the most critical document in the mortgage paperwork process?

+

The credit report is often considered the most critical document as it directly affects the borrower’s credit score and loan eligibility.

How long does the mortgage paperwork process typically take?

+

The duration of the mortgage paperwork process can vary significantly depending on the complexity of the application and the efficiency of the lender. On average, it can take anywhere from a few weeks to a couple of months.

Can I apply for a mortgage without a broker?

+

Yes, it is possible to apply for a mortgage directly through a lender without using a broker. However, brokers can provide valuable advice and help navigate the process, potentially securing better loan terms.