7 Tax Papers Needed

Understanding the Importance of Tax Papers

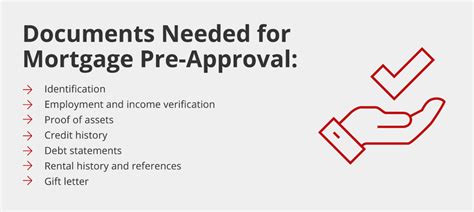

When it comes to managing your finances, especially during tax season, having the right documents is crucial. These documents, often referred to as tax papers, are essential for filing your taxes accurately and efficiently. In this article, we will delve into the 7 key tax papers you need to ensure a smooth tax filing process.

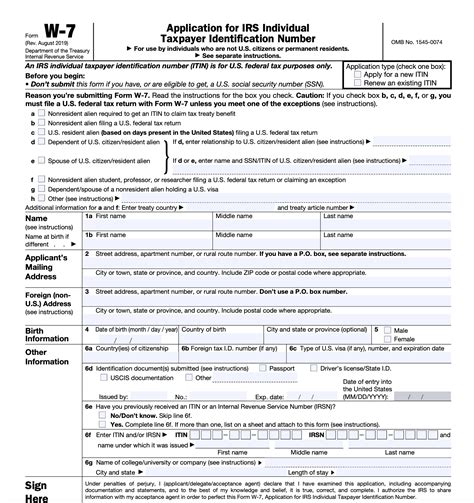

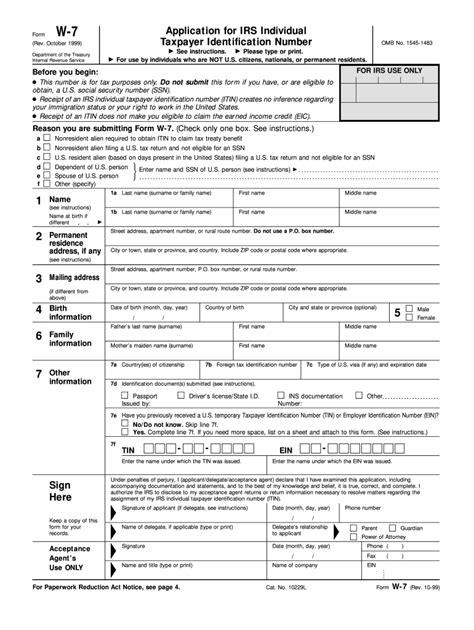

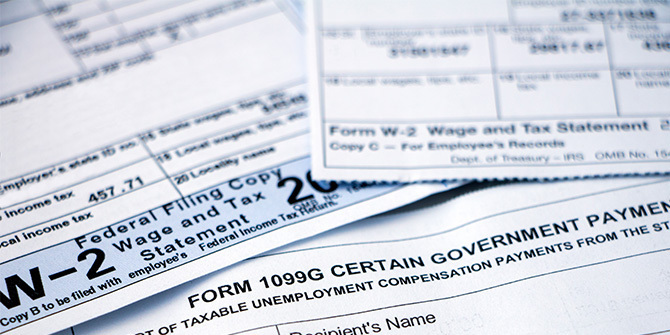

1. W-2 Form: Wage and Tax Statement

The W-2 form is one of the most critical tax papers you will need. It is provided by your employer and details your income and the taxes withheld from your paycheck throughout the year. This form is essential for reporting your income to the IRS and calculating your tax liability.

2. 1099 Forms: Miscellaneous Income

If you have worked as a freelancer, independent contractor, or have received income from other sources such as dividends, capital gains, or rent, you will receive a 1099 form for each of these sources. These forms are used to report income that is not subject to withholding, and you will need them to accurately report your income on your tax return.

3. Interest Statements (1099-INT)

For those with savings accounts, certificates of deposit (CDs), or other investment vehicles that earn interest, you will receive a 1099-INT form from your financial institution. This form reports the interest income you have earned, which is subject to taxation.

4. Dividend Statements (1099-DIV)

Investors who receive dividends from their investments will be issued a 1099-DIV form. This document details the dividend income you have received, which must be reported on your tax return.

5. Capital Gains and Losses Statements

If you have sold stocks, bonds, mutual funds, or other investments, you will receive a statement from your brokerage firm detailing your capital gains and losses. This information is crucial for calculating your tax liability, as capital gains are subject to taxation, while losses can be used to offset gains.

6. Charitable Donation Receipts

Donations to qualified charitable organizations can be deducted from your taxable income, reducing your tax liability. To claim these deductions, you will need receipts from the charities detailing the amount of your donations.

7. Medical Expense Receipts

For those who have significant medical expenses, these can be deducted from your taxable income if they exceed a certain threshold of your adjusted gross income. To claim these deductions, you will need receipts for your medical expenses, including prescriptions, doctor visits, hospital stays, and other healthcare-related costs.

📝 Note: It's essential to keep all your tax papers and receipts organized throughout the year to make the tax filing process easier and less prone to errors.

To further understand the importance of these documents, let’s consider a scenario where an individual has multiple sources of income, including a full-time job, freelance work, and investments. Without the correct tax papers, such as the W-2, 1099 forms, and interest statements, this individual would struggle to accurately report their income and claim the appropriate deductions, potentially leading to delays or even audits.

Here is a summary of the key tax papers in a table format:

| Tax Paper | Description |

|---|---|

| W-2 Form | Reports wage and tax withholding information |

| 1099 Forms | Reports miscellaneous income, such as freelance earnings |

| 1099-INT | Reports interest income earned |

| 1099-DIV | Reports dividend income received |

| Capital Gains and Losses Statements | Details gains and losses from investment sales |

| Charitable Donation Receipts | Supports deductions for charitable donations |

| Medical Expense Receipts | Supports deductions for medical expenses |

In summary, having the right tax papers is vital for a smooth and accurate tax filing process. These documents provide the necessary information to report your income, claim deductions, and calculate your tax liability. By understanding the importance of each tax paper and keeping them organized, you can ensure compliance with tax regulations and potentially reduce your tax burden.

What is the purpose of the W-2 form?

+

The W-2 form is used to report your income and the taxes withheld from your paycheck to the IRS.

Do I need to report all sources of income on my tax return?

+

Yes, you are required to report all sources of income, including freelance work, interest, dividends, and capital gains, on your tax return.

Can I deduct charitable donations and medical expenses from my taxable income?

+

Yes, donations to qualified charitable organizations and certain medical expenses can be deducted from your taxable income, but you must have the appropriate receipts and documentation to support these deductions.