5 Mortgage Paperworks

Understanding the 5 Essential Mortgage Paperworks

When applying for a mortgage, it’s essential to understand the various paperwork involved in the process. The mortgage application process can be overwhelming, especially for first-time homebuyers. However, being familiar with the necessary documents can help streamline the process and ensure a smooth transaction. In this article, we’ll explore the 5 essential mortgage paperwork that you need to know.

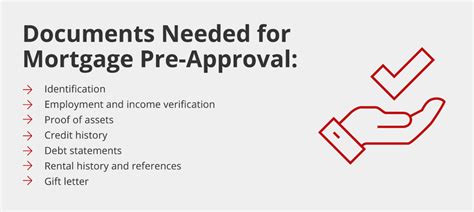

1. Pre-Approval Letter

A pre-approval letter is a document issued by a lender that states the amount of money they are willing to lend you to purchase a home. This letter is usually valid for 30 to 60 days and is based on your credit score, income, and other financial factors. The pre-approval letter is essential because it:

- Indicates your purchasing power to real estate agents and sellers

- Helps you determine your budget for a home

- Provides an estimate of your monthly mortgage payments

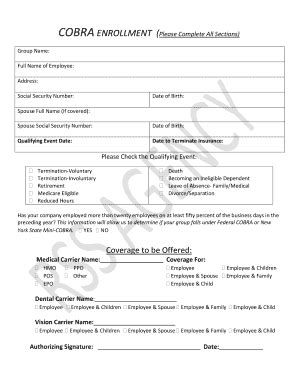

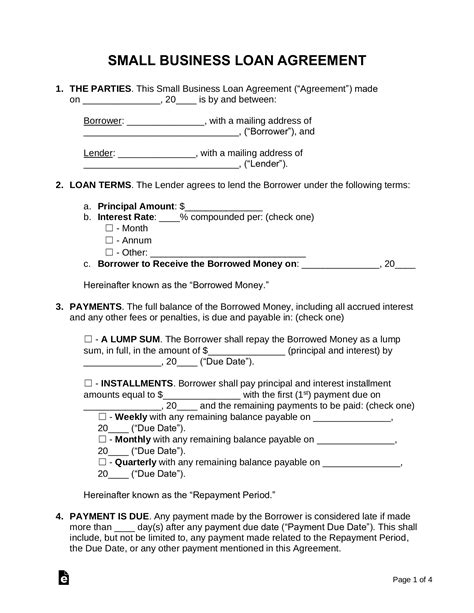

2. Loan Application

The loan application is a detailed document that requires you to provide personal and financial information. This information includes:

- Identification and contact information

- Employment history and income

- Credit history and credit score

- Assets, debts, and financial obligations

3. Good Faith Estimate (GFE)

The Good Faith Estimate (GFE) is a document that outlines the estimated costs associated with your mortgage. The GFE includes:

- Loan terms, including interest rate and loan amount

- Estimated monthly mortgage payments

- Closing costs, including origination fees and title insurance

- Other expenses, such as appraisal fees and credit report fees

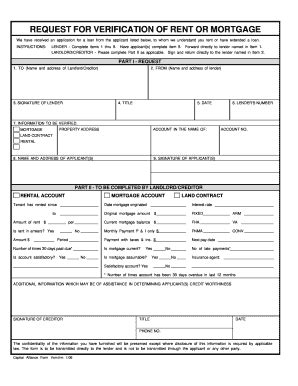

4. Appraisal Report

An appraisal report is a document that provides an independent assessment of the value of the property you’re purchasing. The appraisal report includes:

- A detailed description of the property

- An estimate of the property’s value

- A comparison of the property’s value to similar properties in the area

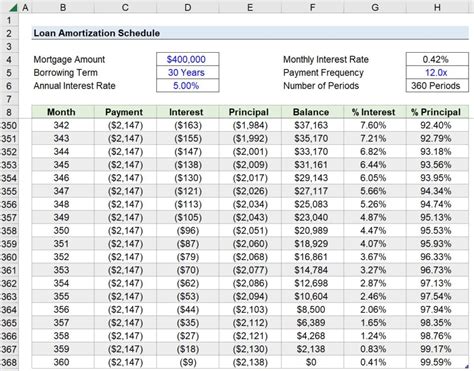

5. Closing Disclosure

The Closing Disclosure (CD) is a document that outlines the final terms of your mortgage. The CD includes:

- Loan terms, including interest rate and loan amount

- Monthly mortgage payments

- Closing costs, including origination fees and title insurance

- Other expenses, such as appraisal fees and credit report fees

📝 Note: It's crucial to carefully review all mortgage paperwork to ensure that you understand the terms and conditions of your mortgage. If you have any questions or concerns, don't hesitate to ask your lender or a mortgage professional for clarification.

In summary, understanding the 5 essential mortgage paperwork is crucial to ensuring a smooth and successful mortgage application process. By being familiar with the pre-approval letter, loan application, Good Faith Estimate, appraisal report, and Closing Disclosure, you can navigate the process with confidence and make informed decisions about your mortgage.

What is the purpose of a pre-approval letter?

+

The purpose of a pre-approval letter is to indicate your purchasing power to real estate agents and sellers, help you determine your budget for a home, and provide an estimate of your monthly mortgage payments.

What information is required for a loan application?

+

The loan application requires personal and financial information, including identification and contact information, employment history and income, credit history and credit score, and assets, debts, and financial obligations.

What is the difference between a Good Faith Estimate and a Closing Disclosure?

+

The Good Faith Estimate is an estimate of the costs associated with your mortgage, while the Closing Disclosure outlines the final terms of your mortgage. The Closing Disclosure is provided at least three business days before closing, while the Good Faith Estimate is provided within three business days of submitting your loan application.