Get Cobra Paperwork Easily

Introduction to COBRA Paperwork

When it comes to managing health insurance, especially in situations involving job loss or significant life changes, the Consolidated Omnibus Budget Reconciliation Act (COBRA) plays a crucial role. COBRA paperwork is essential for individuals and families who wish to continue their health insurance coverage after a qualifying event. In this article, we will delve into the world of COBRA, understanding what it is, its benefits, and how to navigate the paperwork involved.

Understanding COBRA

COBRA is a federal law that allows certain individuals to continue their health insurance coverage after a qualifying event, such as a job loss, divorce, or death of a covered employee. This law applies to group health plans sponsored by employers with 20 or more employees. The key aspect of COBRA is that it provides a safety net, ensuring that individuals and their families do not experience a gap in health coverage during critical times.

Benefits of COBRA

The benefits of COBRA are multifaceted: - Continuity of Coverage: Perhaps the most significant benefit is the ability to maintain health insurance coverage, ensuring that any ongoing medical treatments or needs are continuously met without interruption. - Family Protection: COBRA extends to covered spouses and dependents, providing them with the same opportunity to continue their health coverage. - Time to Explore Options: It gives individuals time to explore new health insurance options, whether through a new employer, the health insurance marketplace, or other private plans.

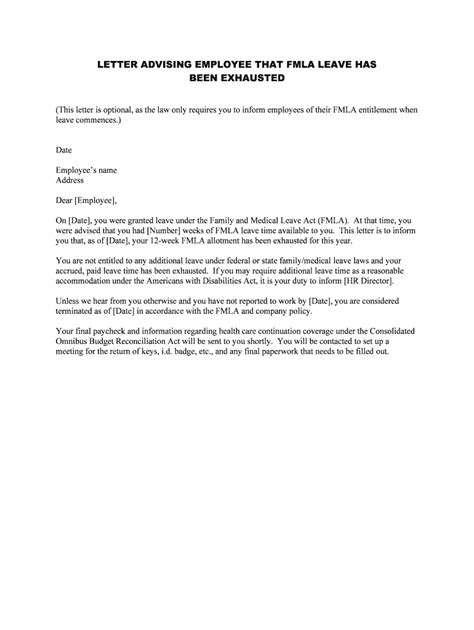

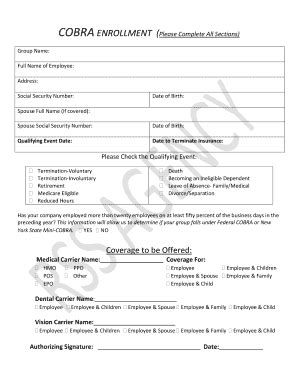

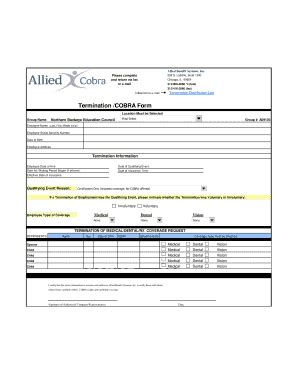

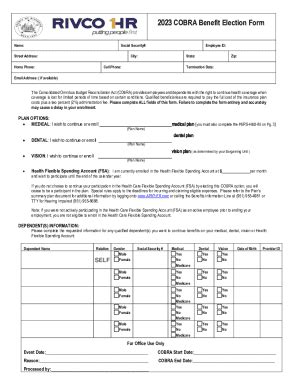

COBRA Paperwork: What to Expect

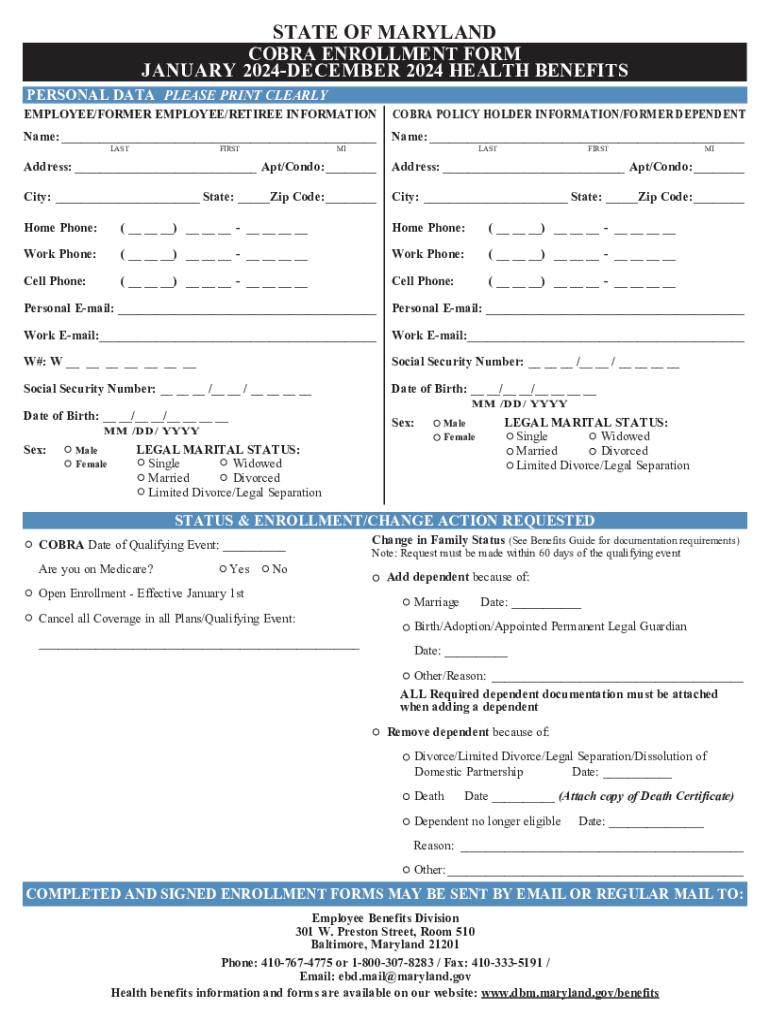

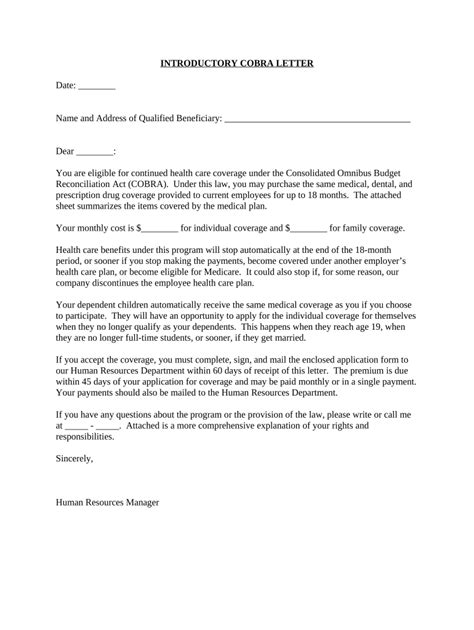

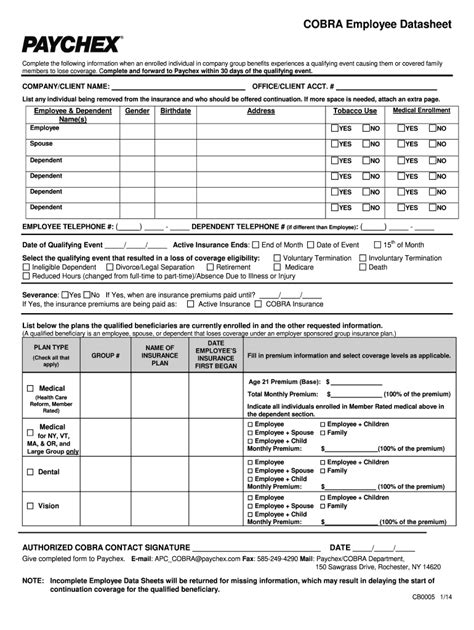

The COBRA paperwork process begins with the employer or the plan administrator notifying the affected individuals of their rights under COBRA. This notification is crucial and must be provided within specific timeframes following a qualifying event. The key documents involved in COBRA paperwork include: - The COBRA Election Notice: This is the initial document provided to qualified beneficiaries, explaining their rights and the procedures for electing COBRA coverage. - The COBRA Election Form: This form must be completed and returned by the qualified beneficiary to elect COBRA coverage. It typically includes information about the individual’s decision to accept or decline COBRA coverage, the type of coverage chosen (e.g., single, family), and payment arrangements.

Steps to Complete COBRA Paperwork

To complete the COBRA paperwork efficiently, follow these steps: 1. Review the COBRA Election Notice carefully: Ensure you understand your rights, the costs involved, and the deadline for making a decision. 2. Determine Your Eligibility: Confirm that you are eligible for COBRA based on the qualifying event and the type of health plan your employer offers. 3. Fill Out the COBRA Election Form: Make sure to complete all required sections accurately, including your personal details, the type of coverage you wish to elect, and any other requested information. 4. Submit the Form on Time: Return the completed form by the specified deadline to ensure you do not miss the opportunity to continue your health coverage. 5. Arrange for Payments: Once your COBRA coverage is in effect, make timely payments according to the agreed-upon terms to maintain your coverage.

Common Challenges and Solutions

Despite the benefits, navigating COBRA paperwork can be challenging. Common issues include: - Missing Deadlines: Ensure you are aware of all deadlines and submit your election form on time. - Cost Concerns: COBRA coverage can be expensive since you may be responsible for the full premium plus an administrative fee. Explore all options, including marketplace plans, which might offer more affordable alternatives. - Complexity of Forms: If you find the forms confusing, consider seeking help from your HR department or a professional insurance advisor.

💡 Note: Always keep a record of your COBRA paperwork, including notices, forms, and payment receipts, as these may be necessary for future reference or audits.

Conclusion and Next Steps

In summary, COBRA provides a vital lifeline for individuals facing health insurance uncertainties due to significant life events. By understanding the process, benefits, and potential challenges of COBRA paperwork, you can make informed decisions about your health coverage. Remember, the key to successfully navigating COBRA is timely action and thorough understanding of the process. If you are facing a situation where COBRA applies, take immediate steps to review your options, complete the necessary paperwork, and ensure continuity of your health insurance coverage.

What is the primary purpose of COBRA?

+

The primary purpose of COBRA is to allow individuals to continue their health insurance coverage after a qualifying event, such as job loss or divorce, ensuring continuity of health care without gaps in coverage.

How long do I have to elect COBRA coverage after a qualifying event?

+

Typically, you have 60 days from the date of the qualifying event or the date you receive the COBRA election notice, whichever is later, to decide whether to elect COBRA coverage.

Can I change my mind after electing COBRA coverage?

+

Once you elect COBRA coverage, you generally cannot change your mind. However, you may be able to disenroll if you experience another qualifying event or find alternative coverage. It’s essential to review your plan’s specifics and consult with your plan administrator or an insurance professional.