401k Tax Paperwork Needed

Introduction to 401k Tax Paperwork

When it comes to managing your 401k plan, understanding the necessary tax paperwork is crucial to avoid any potential penalties or fines. The process involves various forms and documents that need to be submitted to the relevant authorities, ensuring compliance with tax regulations. In this article, we will delve into the world of 401k tax paperwork, exploring the key documents required and the steps to follow for a smooth and efficient process.

Understanding 401k Taxation

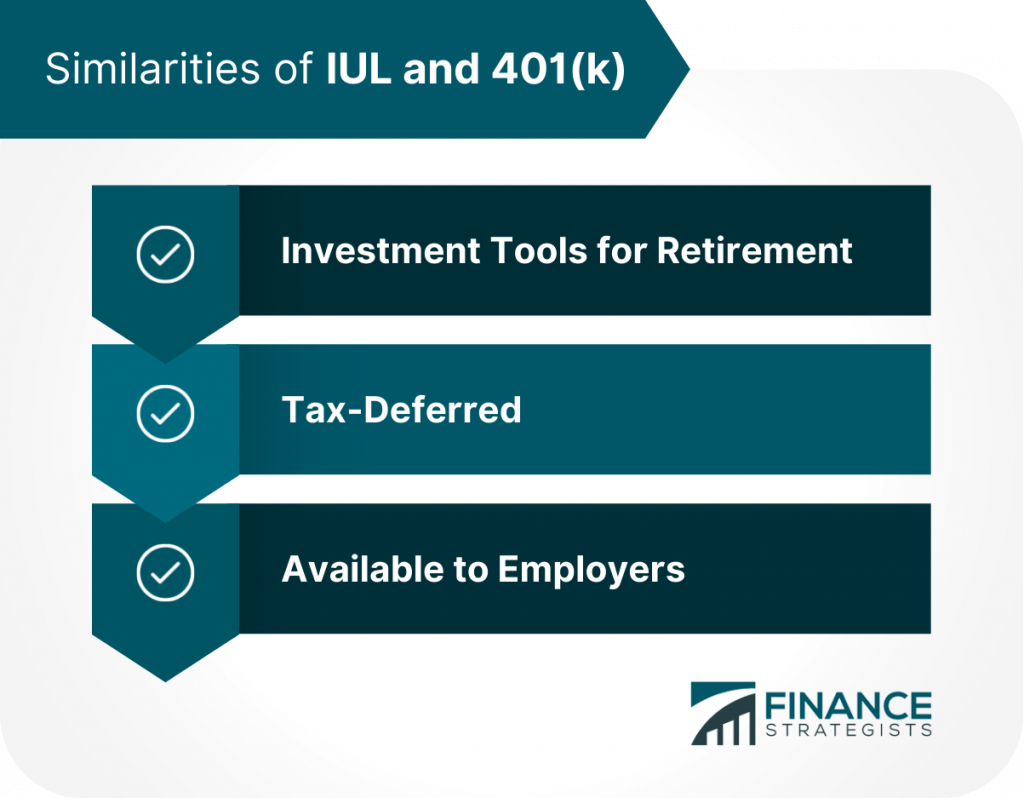

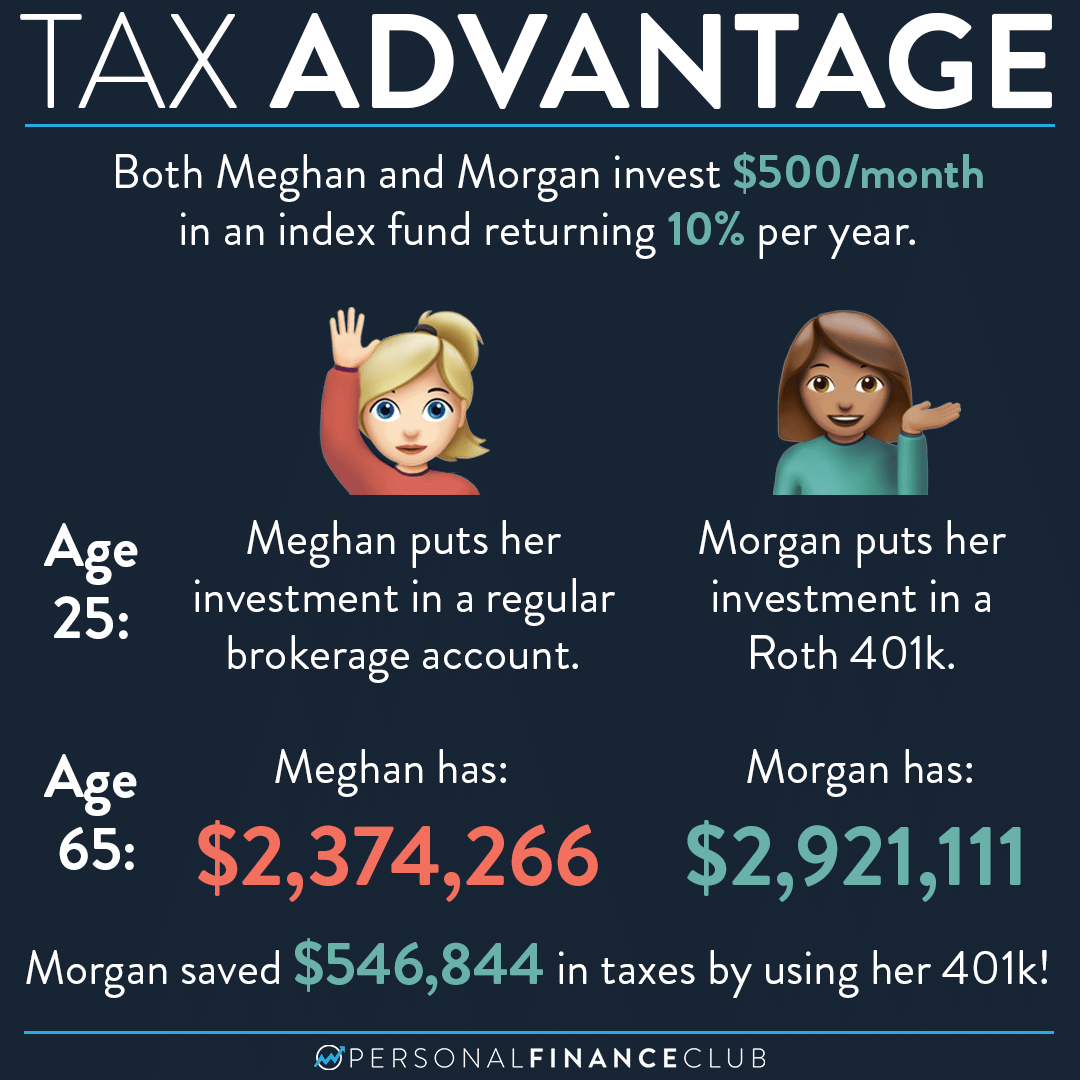

Before diving into the paperwork, it’s essential to comprehend how 401k plans are taxed. Contributions to a traditional 401k plan are made before taxes, reducing your taxable income for the year. However, withdrawals are taxed as ordinary income. In contrast, Roth 401k plans involve after-tax contributions, but the withdrawals are tax-free if certain conditions are met. Understanding these taxation rules is vital for navigating the tax paperwork requirements.

Necessary Tax Paperwork for 401k

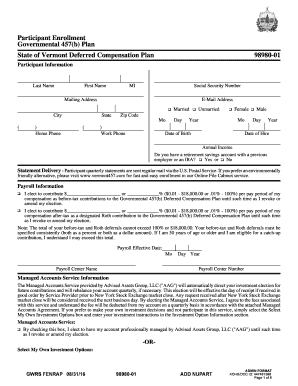

Several key documents are involved in the 401k tax paperwork process: - Form 1099-R: This form is used to report distributions from pensions, annuities, retirement or profit-sharing plans, IRAs, insurance contracts, etc. You will receive a 1099-R if you took a distribution from your 401k plan. - Form W-4P: Withholding Certificate for Pension or Annuity Payments. This form is used to determine the amount of federal income tax to withhold from certain pension or annuity payments. - Form 8606: Nondeductible IRAs. If you made nondeductible contributions to a traditional IRA, you’ll need this form to report these contributions and calculate the taxable portion of any distributions.

📝 Note: It's crucial to keep accurate records of all contributions and distributions, as these will be necessary for completing the tax paperwork accurately.

Steps for Filing 401k Tax Paperwork

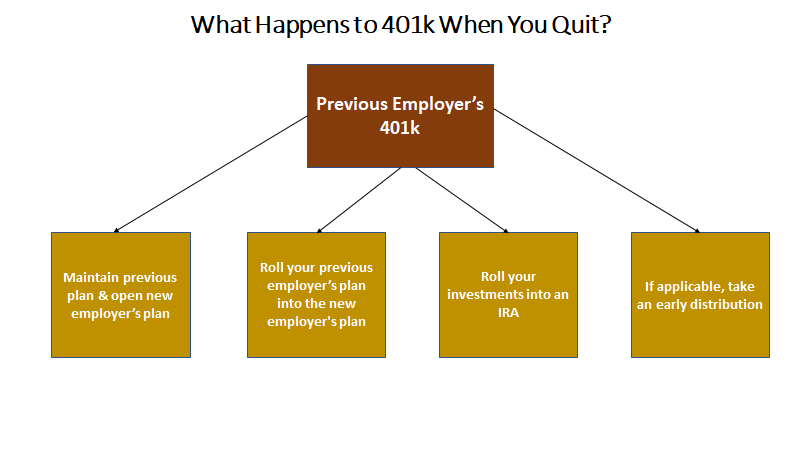

Filing the necessary tax paperwork for your 401k involves several steps: 1. Gather Required Documents: Ensure you have all the necessary forms, including 1099-R for distributions, and any other relevant tax documents. 2. Determine Your Tax Liability: Calculate the amount of taxes owed on any distributions taken from your 401k plan. 3. Complete Tax Forms: Fill out the tax forms accurately, reporting all income and deductions related to your 401k plan. 4. Submit Your Tax Return: File your tax return by the deadline to avoid any penalties.

Tax Implications and Strategies

Understanding the tax implications of your 401k plan can help you make informed decisions about contributions and withdrawals. Tax-deferred growth allows your retirement savings to grow without being reduced by taxes until withdrawal. Considering Roth conversions can also be a strategy to manage taxes in retirement, especially if you anticipate being in a higher tax bracket.

| Type of 401k | Contributions | Withdrawals |

|---|---|---|

| Traditional 401k | Pre-tax | Taxed as ordinary income |

| Roth 401k | After-tax | Tax-free if conditions are met |

Conclusion and Future Planning

In conclusion, navigating the world of 401k tax paperwork requires a thorough understanding of the necessary documents, tax implications, and strategies for optimization. By staying informed and proactive, you can ensure compliance with tax regulations and make the most of your retirement savings. It’s also important to consider seeking professional advice to tailor your approach to your specific financial situation and goals.

What is the deadline for filing tax paperwork related to 401k distributions?

+

The deadline for filing your tax return, which includes reporting any 401k distributions, is typically April 15th of each year. However, you may be eligible for an automatic six-month extension.

How do I avoid penalties on my 401k tax paperwork?

+

To avoid penalties, ensure you file your tax return on time and accurately report all 401k-related income and deductions. Consider consulting a tax professional if you’re unsure about any aspect of the process.

Can I deduct 401k contributions on my tax return?

+

Contributions to a traditional 401k plan are made pre-tax, which means they reduce your taxable income for the year. However, contributions to a Roth 401k plan are made after-tax, so they do not directly reduce your taxable income.