FSA Tax Paperwork Requirements

Understanding FSA Tax Paperwork Requirements

The Flexible Spending Account (FSA) is a valuable employee benefit that allows individuals to set aside pre-tax dollars for healthcare and dependent care expenses. However, to take full advantage of the tax benefits associated with an FSA, it’s essential to understand the tax paperwork requirements. Failure to comply with these requirements can result in the loss of tax benefits, making it crucial for both employees and employers to be aware of the necessary documentation and filing procedures.

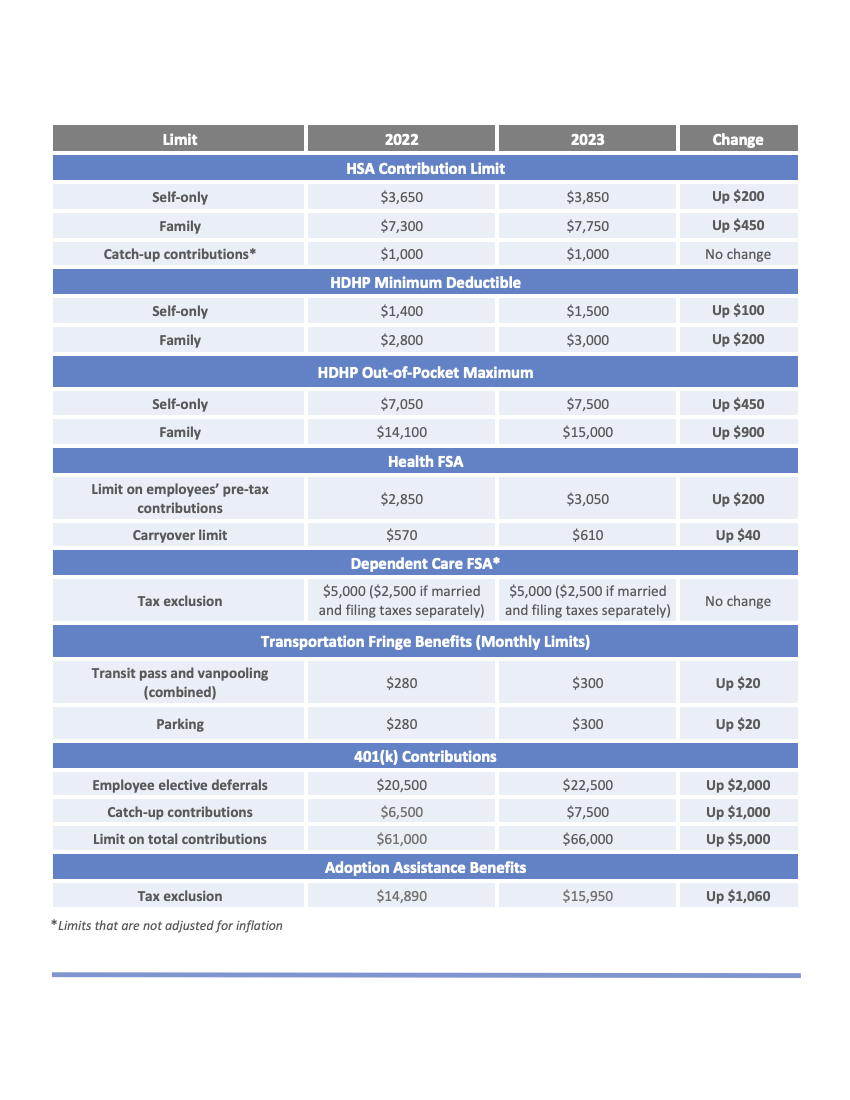

FSA Types and Tax Implications

There are several types of FSAs, including: * Healthcare FSA: Used for medical expenses not covered by insurance, such as copays, deductibles, and prescription medications. * Dependent Care FSA: Used for expenses related to the care of dependents, such as childcare or adult day care. * Limited Expense FSA: A combination of healthcare and dependent care expenses, often used for employees with a Health Savings Account (HSA). Each type of FSA has its own set of tax implications and paperwork requirements, making it essential to understand the specific rules and regulations associated with each.

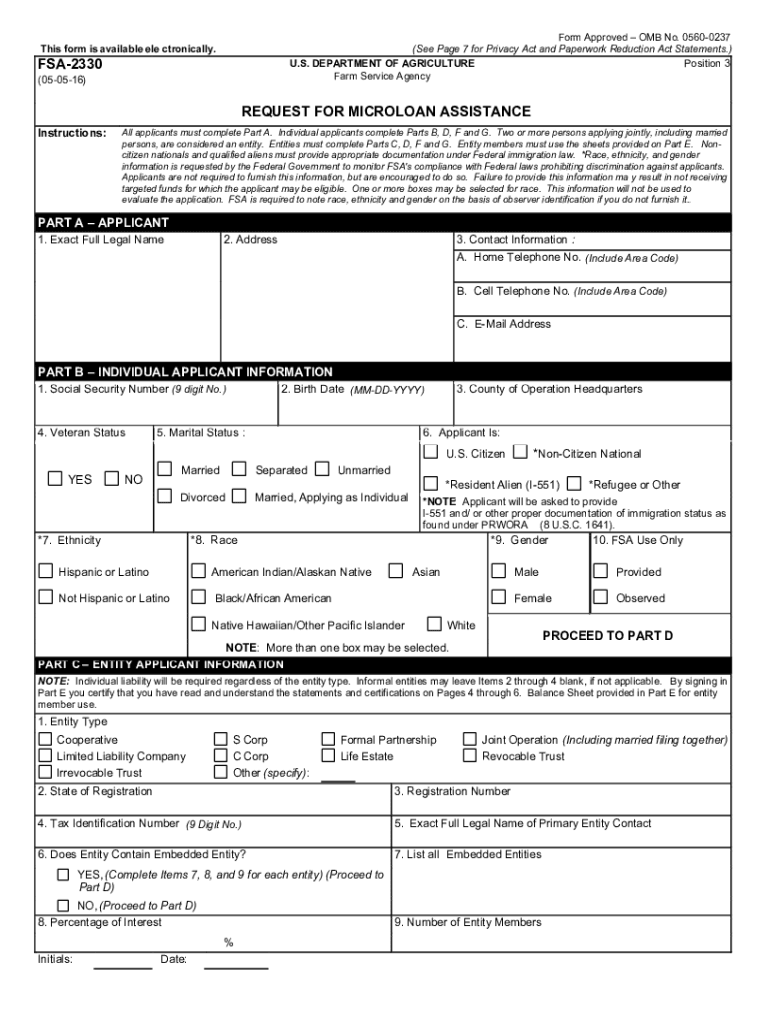

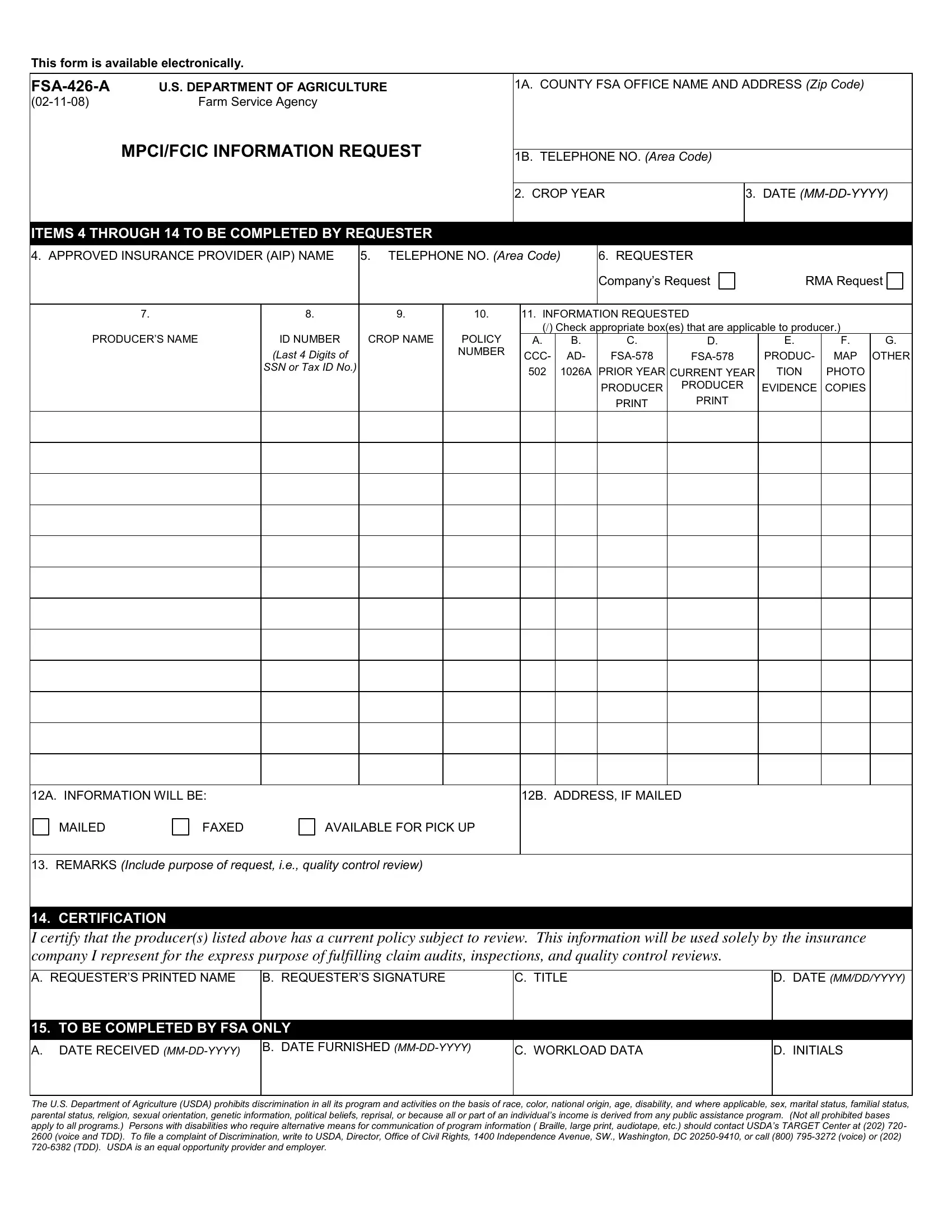

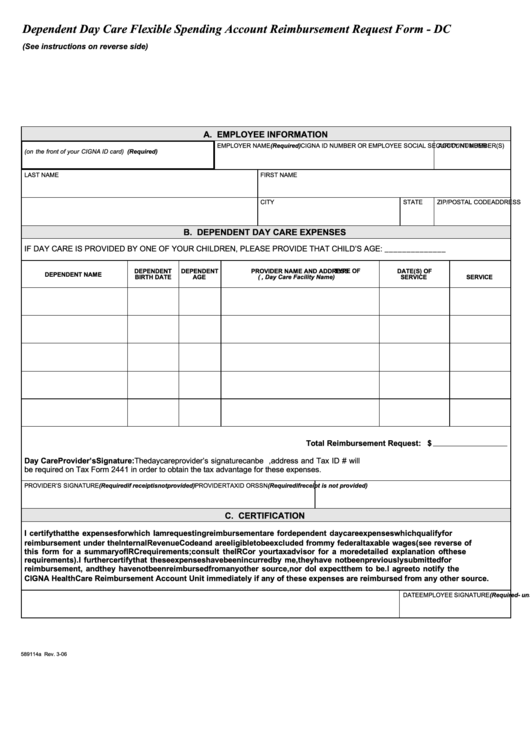

Tax Paperwork Requirements for FSAs

To comply with tax regulations, FSA participants must submit the following documentation: * Receipts and invoices: Itemized receipts for all expenses claimed through the FSA, including dates, amounts, and descriptions of services or products. * Claim forms: Completed claim forms, which can usually be obtained from the FSA administrator or employer. * Dependent care provider information: For dependent care FSAs, participants must provide the name, address, and tax identification number (TIN) of the care provider. * Medical expense documentation: For healthcare FSAs, participants may need to provide documentation from a medical provider to support the expense claim.

📝 Note: It's essential to keep accurate and detailed records of FSA expenses, as these may be subject to audit by the IRS.

FSA Administration and Employer Responsibilities

Employers who offer FSA benefits to their employees must also comply with certain tax paperwork requirements, including: * Plan documentation: Maintaining accurate and up-to-date plan documents, including the FSA plan description, summary plan description, and any amendments. * Annual reporting: Filing annual reports with the IRS, such as Form 5500, to disclose FSA plan information and compliance. * Employee communication: Providing employees with clear and concise information about FSA benefits, including eligibility, enrollment, and claims procedures.

Best Practices for FSA Tax Paperwork Compliance

To ensure compliance with FSA tax paperwork requirements, consider the following best practices: * Establish a centralized record-keeping system: Maintain accurate and detailed records of FSA expenses, claims, and documentation. * Provide clear employee communication: Educate employees on FSA benefits, eligibility, and claims procedures to avoid errors and ensure compliance. * Conduct regular audits: Perform regular audits to ensure compliance with FSA regulations and identify areas for improvement.

| FSA Type | Tax Paperwork Requirements |

|---|---|

| Healthcare FSA | Receipts, claim forms, medical expense documentation |

| Dependent Care FSA | Receipts, claim forms, dependent care provider information |

| Limited Expense FSA | Receipts, claim forms, medical expense documentation (if applicable) |

Key Takeaways

In summary, FSA tax paperwork requirements are essential for both employees and employers to understand and comply with. By maintaining accurate records, providing clear employee communication, and conducting regular audits, individuals and organizations can ensure compliance with FSA regulations and maximize the tax benefits associated with these valuable employee benefits.

To recap, the key points to consider are: * Understand the different types of FSAs and their associated tax implications * Maintain accurate and detailed records of FSA expenses and documentation * Provide clear employee communication and education on FSA benefits and claims procedures * Conduct regular audits to ensure compliance with FSA regulations

What is the deadline for submitting FSA claims?

+

The deadline for submitting FSA claims varies depending on the employer and FSA administrator, but it's typically within 90 days of the plan year end.

Can I use my FSA funds for expenses incurred by my spouse or dependents?

+

Yes, you can use your FSA funds for expenses incurred by your spouse or dependents, as long as they are eligible expenses under the FSA plan.

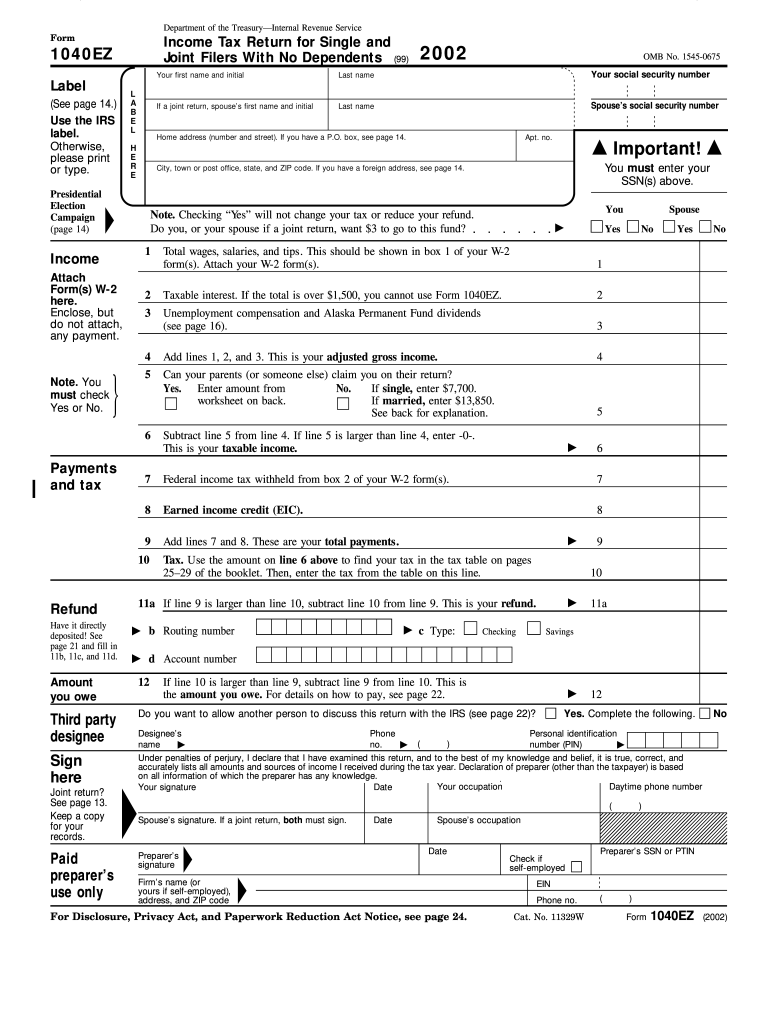

How do I report FSA income on my tax return?

+

You will not report FSA income on your tax return, as FSA contributions are made with pre-tax dollars and are not subject to income tax.

In the end, understanding and complying with FSA tax paperwork requirements is crucial for maximizing the benefits of these valuable employee benefits. By following the guidelines and best practices outlined above, individuals and organizations can ensure compliance and make the most of their FSA benefits.