Onboarding Made Easy W4 I9 Paperwork Guide

Introduction to Onboarding Made Easy with W4 and I9 Paperwork Guide

The process of onboarding new employees can be a daunting task for any organization, especially when it comes to handling the necessary paperwork. Two of the most critical documents required for onboarding are the W4 and I9 forms. The W4 form, also known as the Employee’s Withholding Certificate, is used to determine the amount of federal income tax to withhold from an employee’s wages. The I9 form, or the Employment Eligibility Verification form, is used to verify the identity and employment eligibility of new hires. In this guide, we will walk you through the process of completing these forms, making onboarding easier and more efficient for both employers and employees.

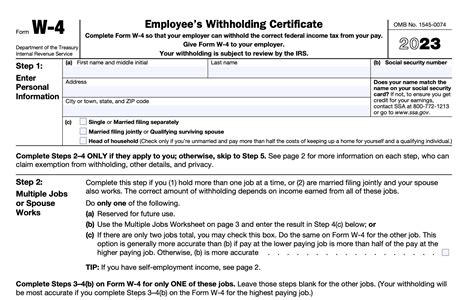

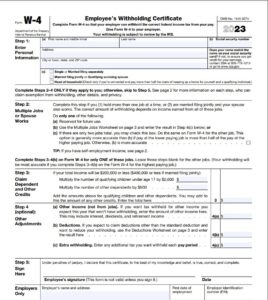

Understanding the W4 Form

The W4 form is a crucial document that helps employers determine the correct amount of federal income tax to withhold from an employee’s wages. It is essential to note that the W4 form is not a one-time submission; employees can update their withholding information at any time by submitting a new W4 form to their employer. The form requires employees to provide their personal and financial information, including their name, address, Social Security number, and filing status. Employers must also ensure that they have the most up-to-date version of the W4 form, as the IRS regularly updates the form to reflect changes in tax laws and regulations.

Step-by-Step Guide to Completing the W4 Form

To complete the W4 form, employees should follow these steps: * Step 1: Provide Personal Information: Employees must provide their name, address, and Social Security number. * Step 2: Claim Exemptions: Employees can claim exemptions from withholding if they had no tax liability for the previous tax year and expect to have no tax liability for the current tax year. * Step 3: Report Dependents: Employees can claim dependents, such as children or other qualifying individuals, to reduce their withholding. * Step 4: Claim Other Adjustments: Employees can claim other adjustments, such as deductions for student loan interest or education expenses. * Step 5: Sign and Date the Form: Employees must sign and date the form to certify that the information provided is accurate and true.

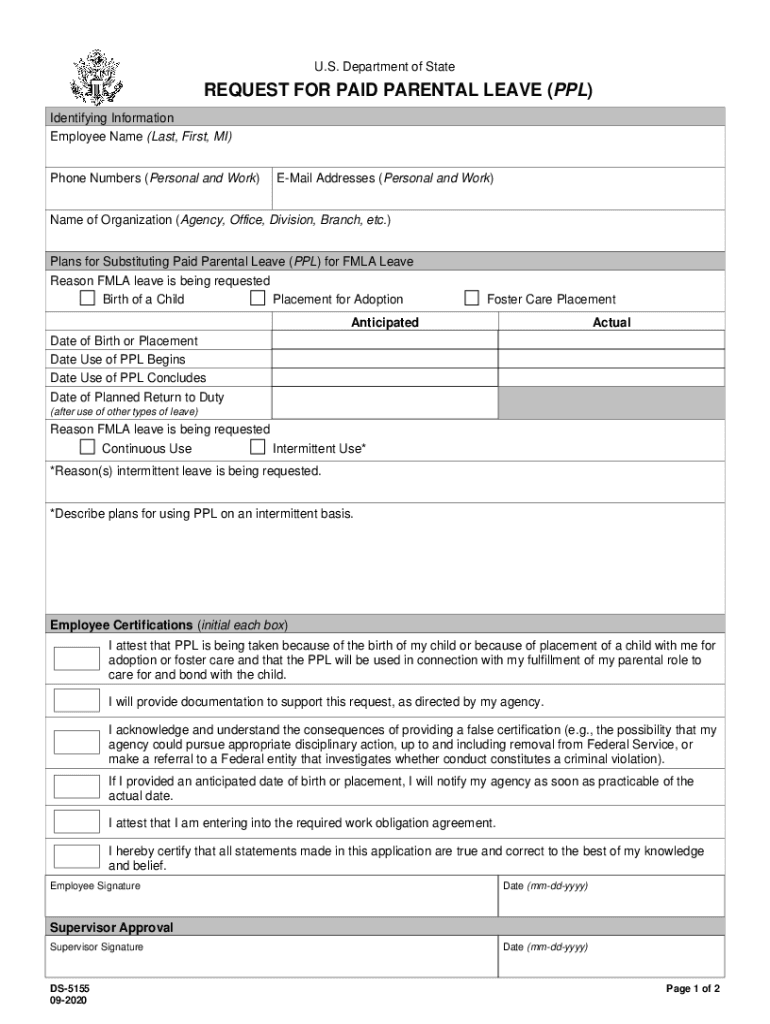

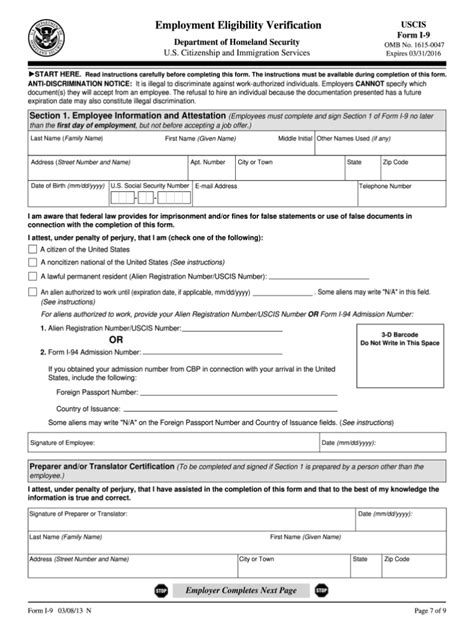

Understanding the I9 Form

The I9 form is used to verify the identity and employment eligibility of new hires. All U.S. employers are required to complete an I9 form for each new employee, regardless of the employee’s citizenship or national origin. The form requires employees to provide documentation that establishes their identity and employment eligibility, such as a U.S. passport, driver’s license, or Social Security card. Employers must also examine the documentation provided by the employee to ensure that it is genuine and relates to the employee.

Step-by-Step Guide to Completing the I9 Form

To complete the I9 form, employees and employers should follow these steps: * Step 1: Section 1: Employee Information: Employees must provide their personal and contact information, including their name, address, and date of birth. * Step 2: Section 2: Employer Review and Verification: Employers must review the employee’s documentation and verify its authenticity. * Step 3: Section 3: Reverification: If an employee’s employment eligibility is subject to expiration, the employer must reverify the employee’s eligibility on or before the expiration date.

📝 Note: Employers must ensure that they complete the I9 form for all new hires, including U.S. citizens, lawful permanent residents, and non-citizens, within three business days of the employee's first day of work.

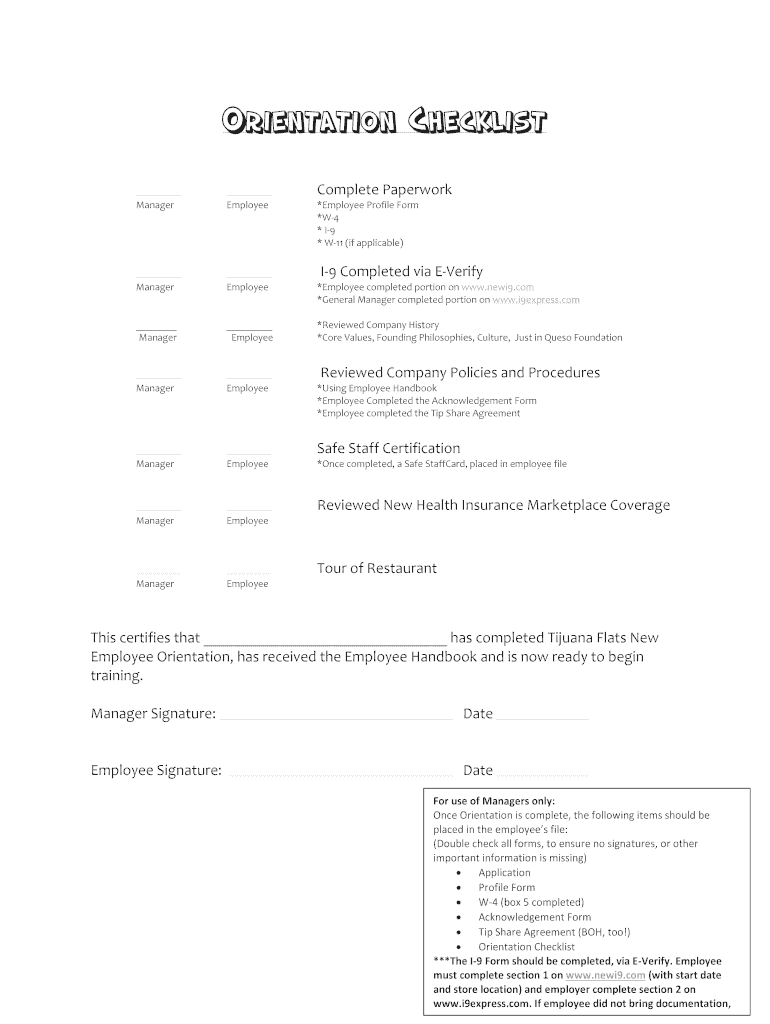

Best Practices for Onboarding with W4 and I9 Paperwork

To make onboarding easier and more efficient, employers should follow these best practices: * Use electronic onboarding systems to streamline the paperwork process and reduce errors. * Provide clear instructions to employees on how to complete the W4 and I9 forms. * Ensure compliance with all relevant laws and regulations, including the IRS and U.S. Citizenship and Immigration Services (USCIS). * Maintain accurate records of all employee paperwork, including the W4 and I9 forms.

Common Mistakes to Avoid

Employers should avoid the following common mistakes when handling W4 and I9 paperwork: * Incomplete or inaccurate forms: Ensure that all forms are complete and accurate to avoid delays or penalties. * Failure to verify documentation: Employers must verify the authenticity of employee documentation to ensure compliance with USCIS regulations. * Late or missing submissions: Employers must submit the W4 and I9 forms on time to avoid penalties and fines.

Table of Required Documents for I9 Form

The following table lists the required documents for the I9 form:

| Document Type | Acceptable Documents |

|---|---|

| Identity Documents | U.S. passport, driver’s license, state ID card |

| Employment Eligibility Documents | U.S. birth certificate, Social Security card, certificate of citizenship |

| Combination Documents | U.S. passport, permanent resident card, employment authorization document |

In summary, the W4 and I9 forms are critical components of the onboarding process, and employers must ensure that they are completed accurately and on time. By following the step-by-step guides and best practices outlined in this guide, employers can make onboarding easier and more efficient, while also ensuring compliance with all relevant laws and regulations.

What is the purpose of the W4 form?

+

The W4 form is used to determine the amount of federal income tax to withhold from an employee’s wages.

What documents are required for the I9 form?

+

The I9 form requires employees to provide documentation that establishes their identity and employment eligibility, such as a U.S. passport, driver’s license, or Social Security card.

How long do employers have to complete the I9 form?

+

Employers must complete the I9 form within three business days of the employee’s first day of work.