Credit Card Paperwork Checklist

Introduction to Credit Card Paperwork

When applying for a credit card, it’s essential to understand the paperwork involved in the process. This includes various documents and information that you need to provide to the credit card issuer. In this article, we will guide you through the necessary paperwork and provide a checklist to ensure you have all the required documents.

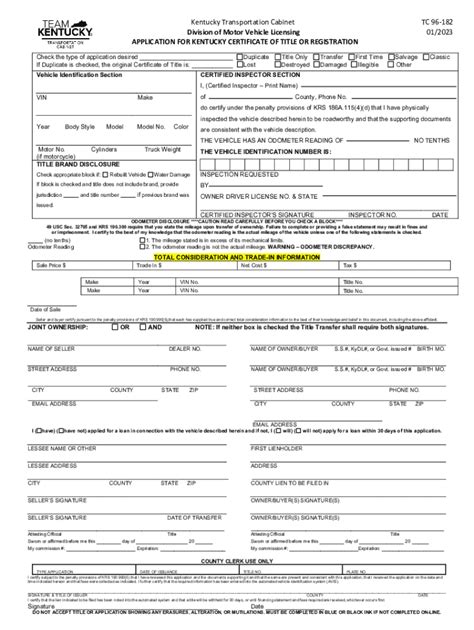

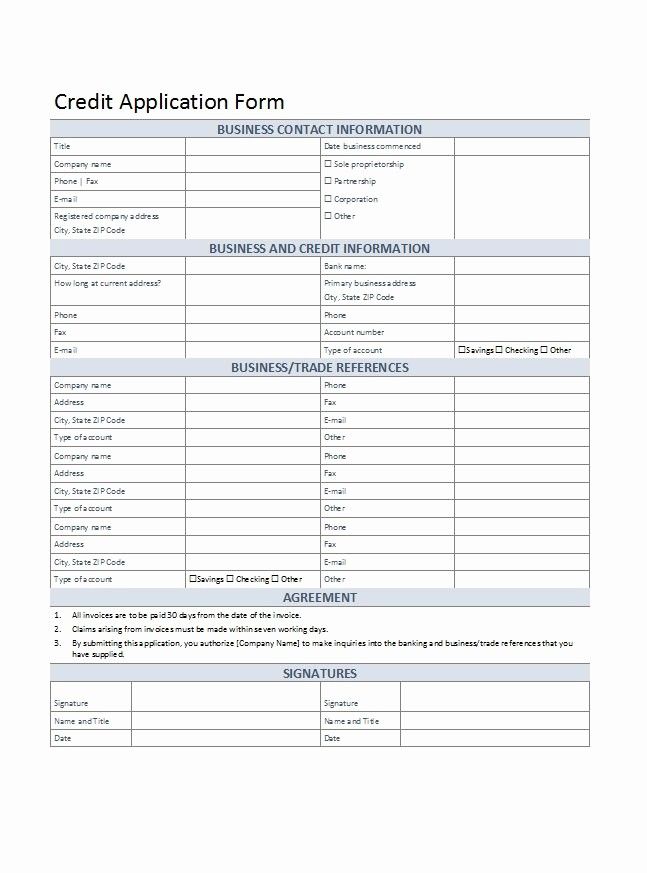

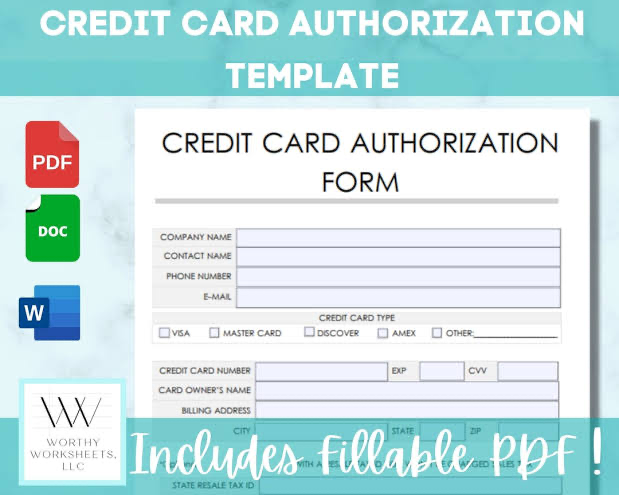

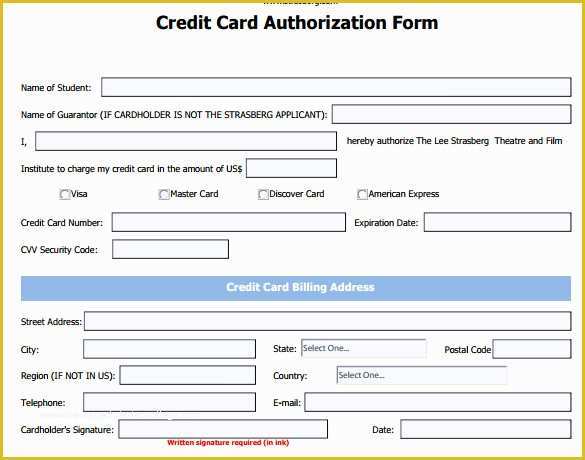

Understanding the Application Process

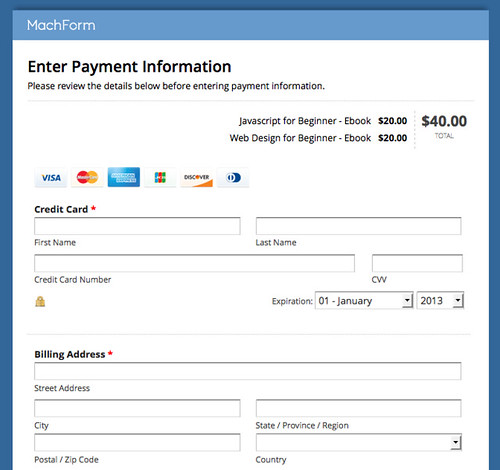

The application process for a credit card typically involves submitting an application form, either online or offline, along with supporting documents. These documents may include identification proof, income proof, address proof, and other relevant information. It’s crucial to ensure that you have all the necessary documents before applying for a credit card to avoid any delays or rejections.

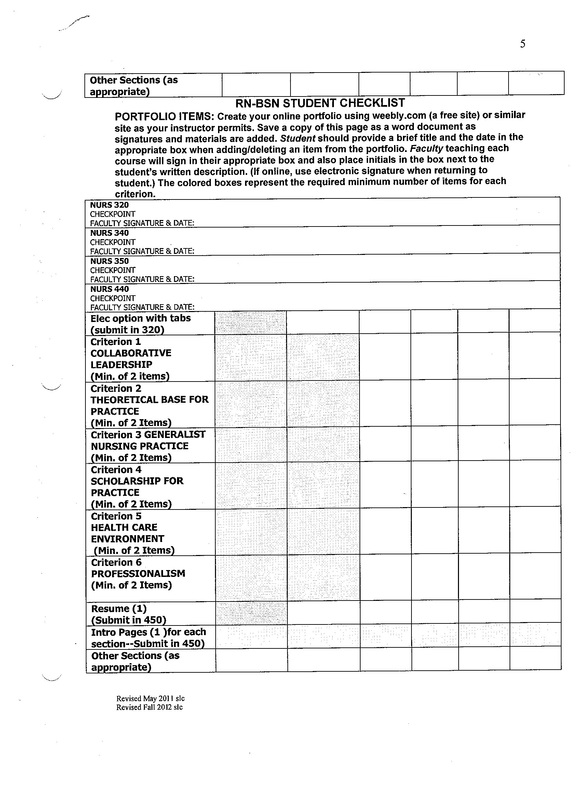

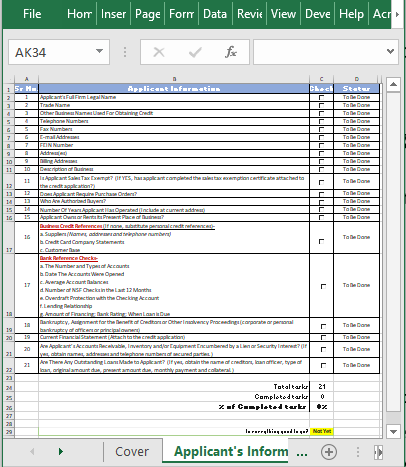

Checklist for Credit Card Paperwork

Here’s a comprehensive checklist of the documents you may need to provide when applying for a credit card: * Identification Proof: + Passport + Driver’s license + State ID + PAN card (for Indian citizens) * Income Proof: + Salary slip + Income tax return + Form 16 + Bank statement * Address Proof: + Utility bills (electricity, water, gas) + Rent agreement + Passport + Driver’s license * Employment Proof: + Employee ID card + Appointment letter + Offer letter * Other Documents: + Bank account statement + Investment documents (if applicable)

Importance of Accurate Information

It’s essential to provide accurate and complete information when applying for a credit card. Any discrepancies or incomplete information may lead to delays or rejection of your application. Make sure to double-check your application form and supporting documents before submitting them.

Submission and Verification Process

Once you’ve submitted your application and supporting documents, the credit card issuer will verify the information provided. This may involve a physical verification of your address, employment, or income. The verification process may take a few days to a few weeks, depending on the issuer’s policies.

Post-Approval Process

After your application is approved, you will receive your credit card within a few days. Make sure to read and understand the terms and conditions, including the interest rate, fees, and repayment terms. It’s also essential to activate your credit card and set up a repayment method to avoid any late payment charges.

📝 Note: Always keep a copy of your application form and supporting documents for future reference.

Maintaining a Good Credit Score

To maintain a good credit score, it’s essential to make timely payments, keep your credit utilization ratio low, and avoid applying for multiple credit cards in a short period. A good credit score can help you qualify for better credit card offers, loans, and other financial products.

| Document | Description |

|---|---|

| Application Form | The form you fill out to apply for a credit card |

| Identification Proof | Documents that prove your identity, such as a passport or driver's license |

| Income Proof | Documents that prove your income, such as a salary slip or income tax return |

In summary, applying for a credit card involves providing various documents and information to the credit card issuer. By following the checklist provided in this article, you can ensure that you have all the necessary documents and increase your chances of approval. Remember to provide accurate information, maintain a good credit score, and make timely payments to enjoy the benefits of your credit card.

What are the common documents required for a credit card application?

+

The common documents required for a credit card application include identification proof, income proof, address proof, and employment proof.

How long does it take to process a credit card application?

+

The processing time for a credit card application may vary depending on the issuer, but it typically takes a few days to a few weeks.

What is the importance of maintaining a good credit score?

+

Maintaining a good credit score is essential to qualify for better credit card offers, loans, and other financial products. It also helps you avoid high interest rates and fees.