Paperwork

ETR Paperwork Requirements

Introduction to ETR Paperwork Requirements

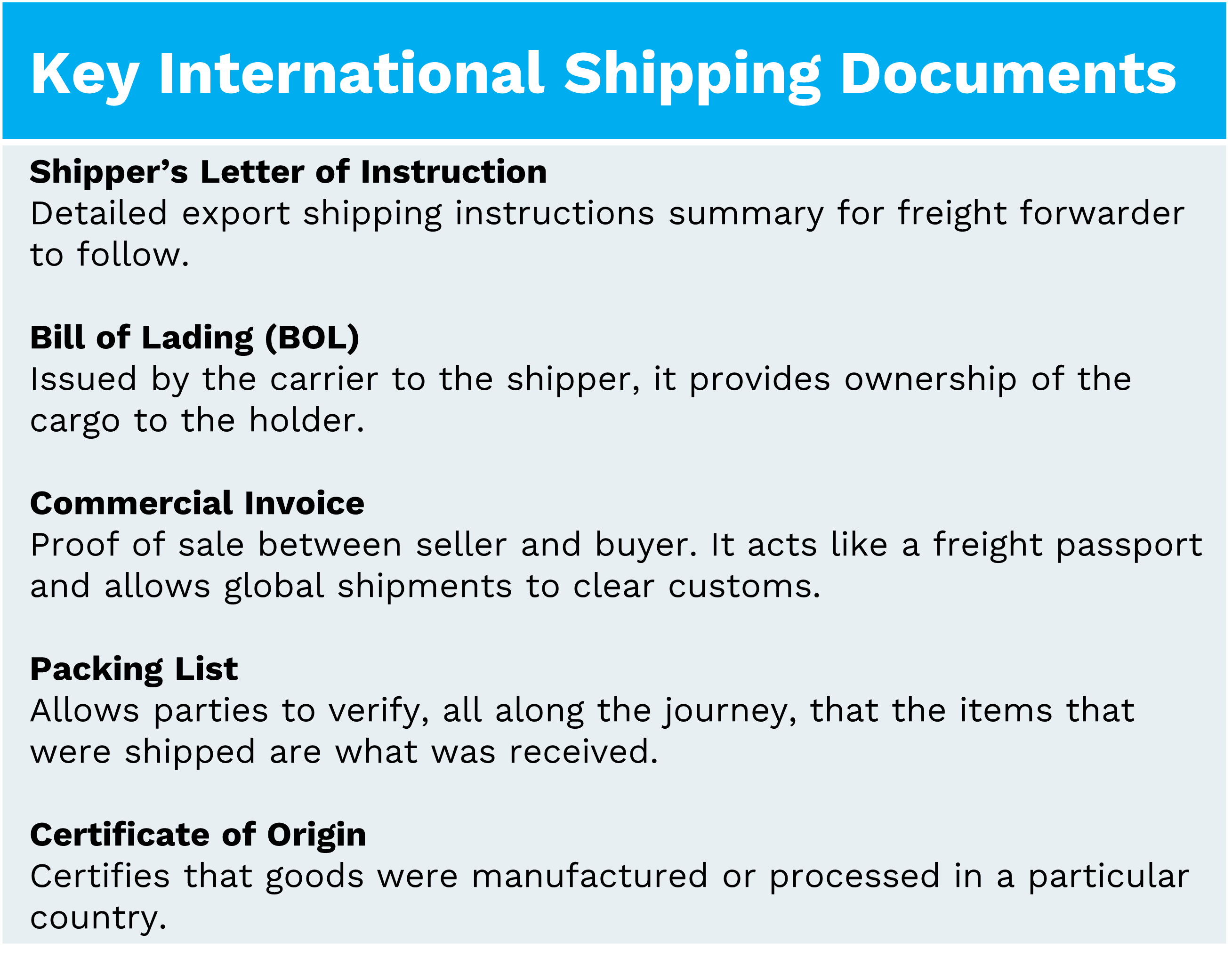

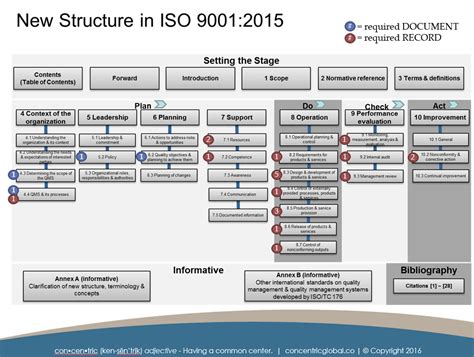

The process of buying or selling a property involves a significant amount of paperwork, and one crucial aspect of this process is the ETR, or Electronic Trust Receipt. This document is used to verify the transfer of funds for the purchase of a property. Understanding the ETR paperwork requirements is essential for a smooth and successful transaction. In this blog post, we will delve into the details of ETR paperwork, its importance, and the steps involved in completing it.

What is an ETR?

An Electronic Trust Receipt (ETR) is a document used in real estate transactions to confirm the receipt of funds by the seller’s representative, usually a real estate agent or attorney. The ETR serves as proof that the buyer has transferred the purchase price to the seller, and it plays a critical role in ensuring that the transaction is legitimate and secure. The ETR paperwork requirements vary depending on the jurisdiction, but the basic principles remain the same.

Importance of ETR Paperwork

The ETR paperwork is vital in real estate transactions because it:

- Provides proof of payment: The ETR confirms that the buyer has paid the purchase price, which helps to prevent disputes and ensures that the transaction is completed smoothly.

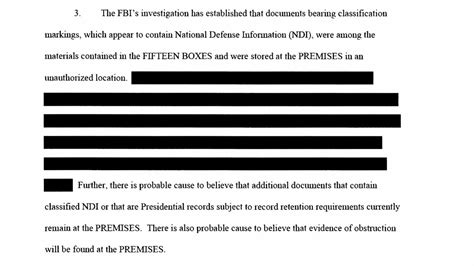

- Secures the transaction: The ETR ensures that the funds are held in trust until the transaction is completed, which protects both the buyer and the seller from potential fraud or misappropriation of funds.

- Complies with regulations: The ETR paperwork requirements are designed to comply with regulatory requirements, such as anti-money laundering laws and know-your-customer regulations.

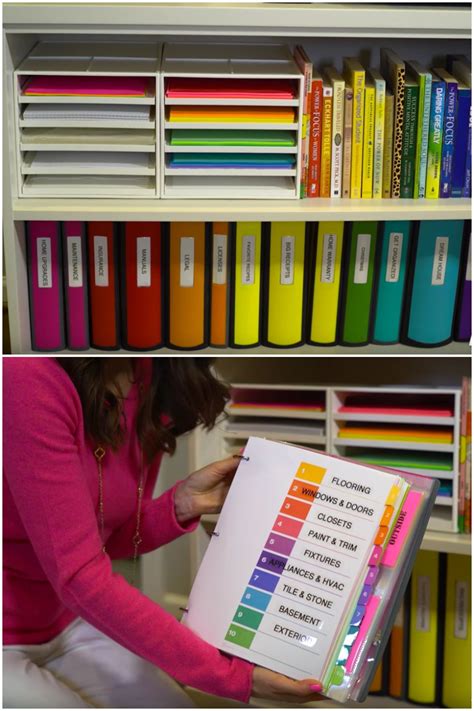

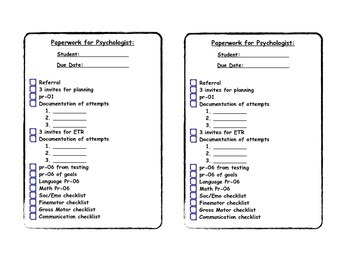

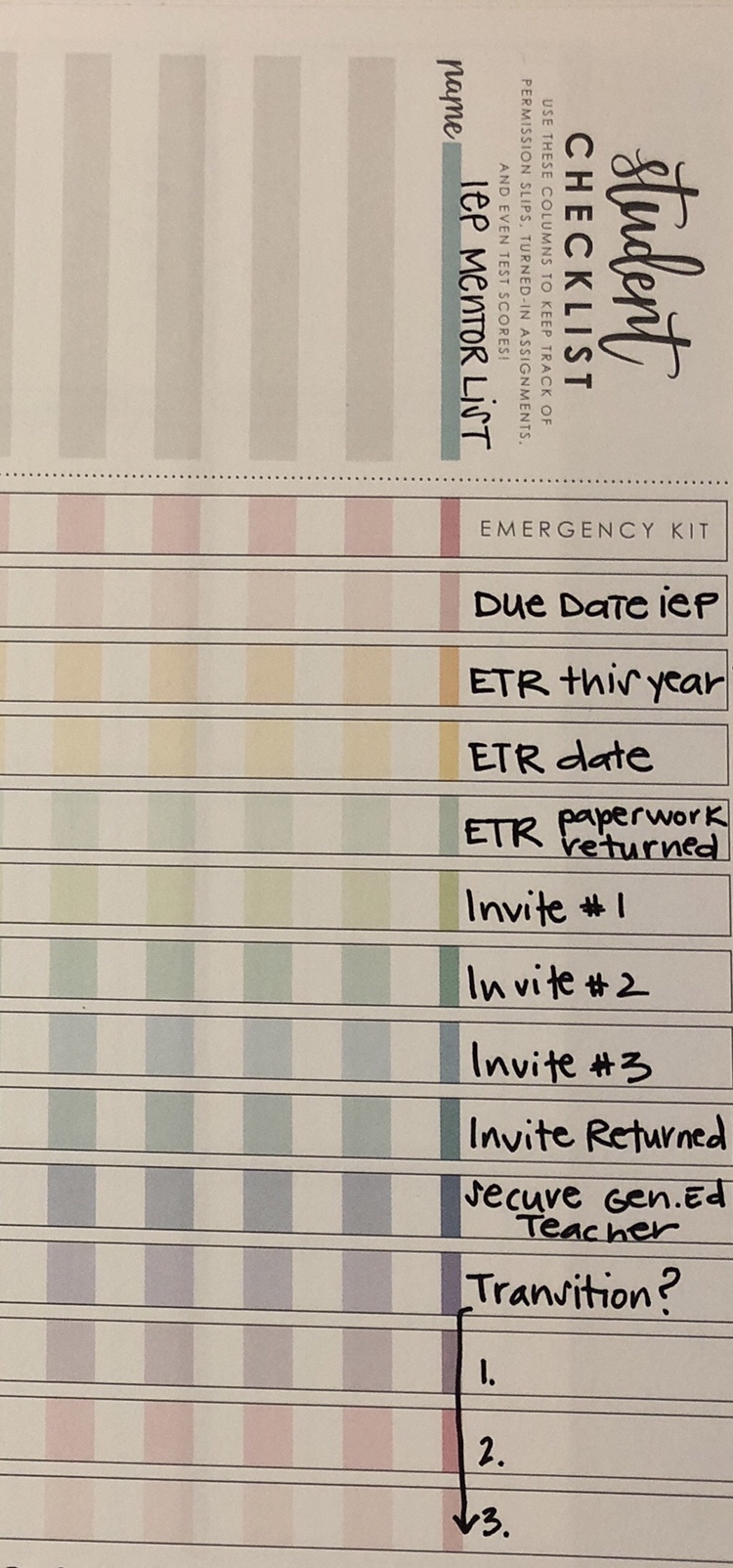

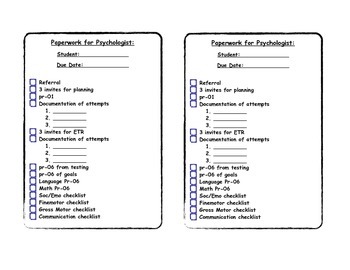

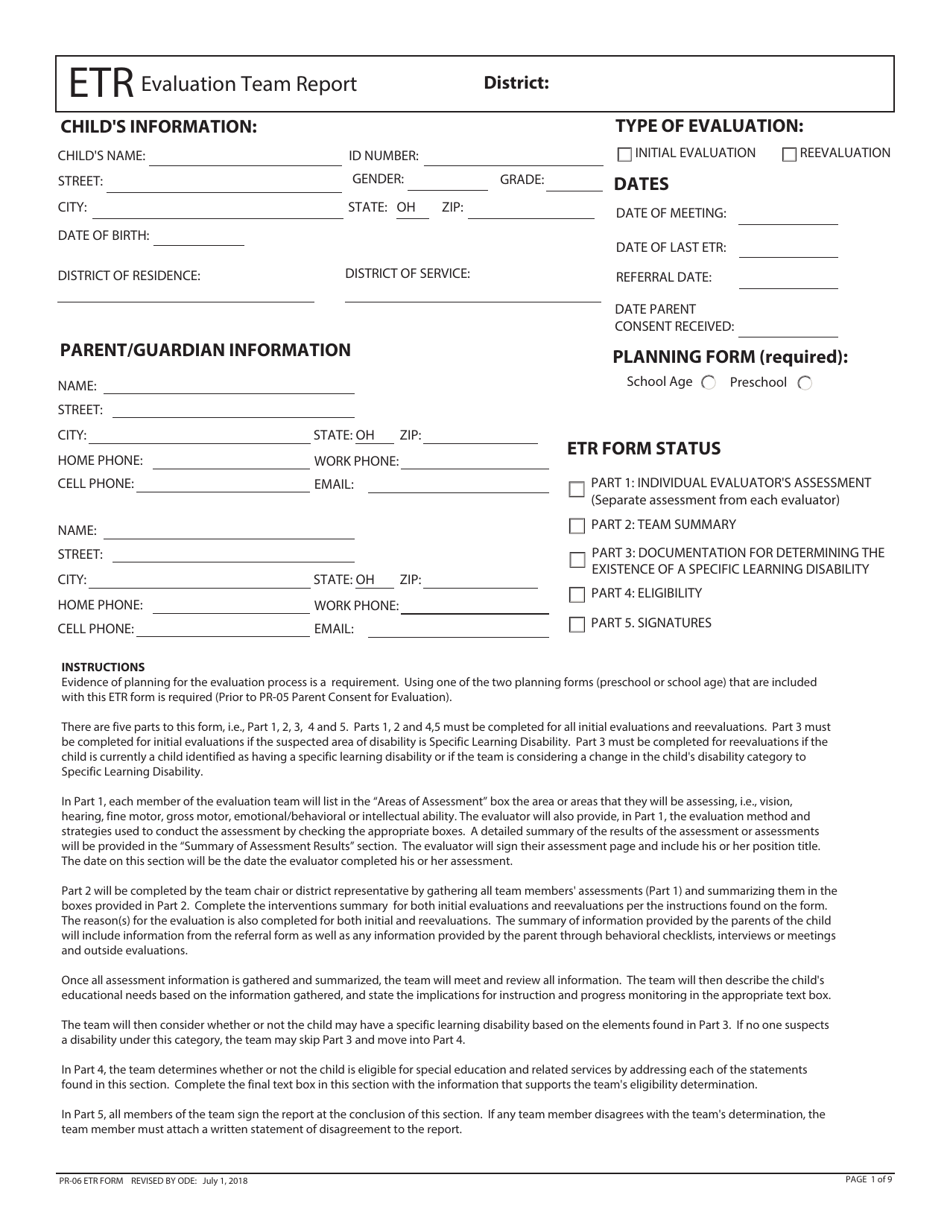

ETR Paperwork Requirements

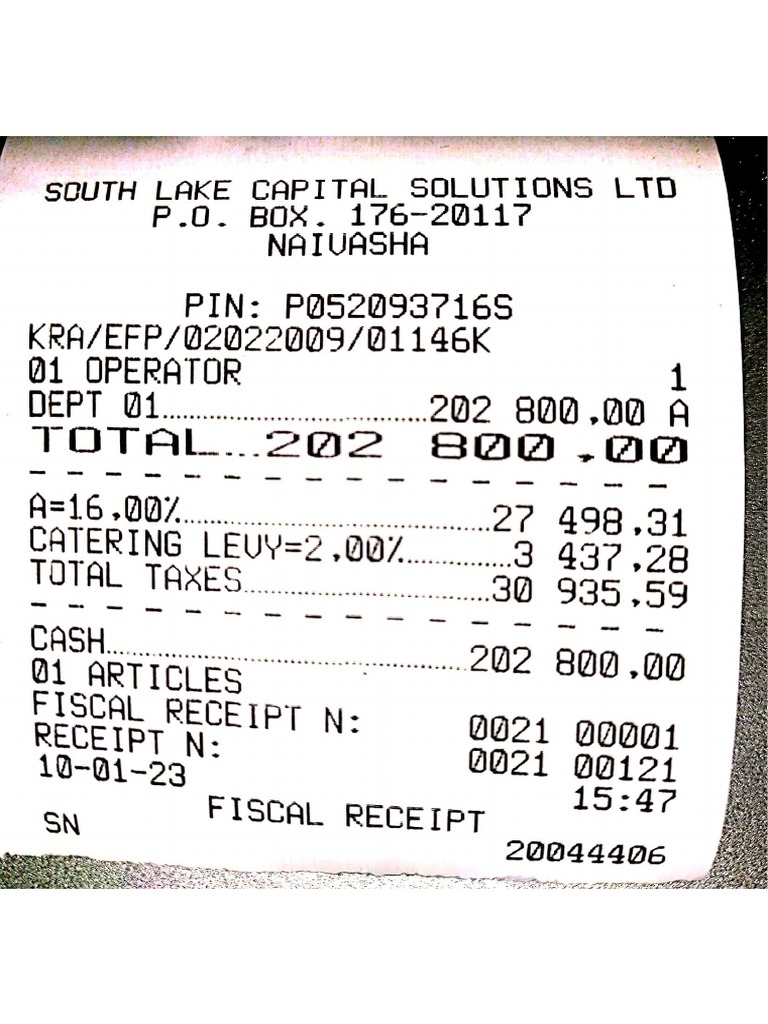

The ETR paperwork requirements typically include the following:

- Buyer’s information: The buyer’s name, address, and contact information.

- Seller’s information: The seller’s name, address, and contact information.

- Property details: The property’s address, description, and purchase price.

- Payment details: The amount paid, payment method, and any other relevant payment information.

- Trust account information: The details of the trust account where the funds will be held until the transaction is completed.

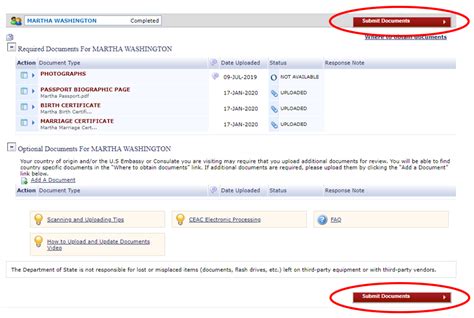

Steps Involved in Completing ETR Paperwork

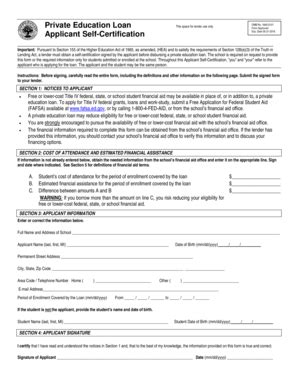

Completing the ETR paperwork involves the following steps:

- The buyer and seller agree on the terms of the sale, including the purchase price and payment method.

- The buyer transfers the purchase price to the seller’s representative, usually a real estate agent or attorney.

- The seller’s representative completes the ETR paperwork, including the buyer’s and seller’s information, property details, and payment details.

- The ETR is signed by the buyer and seller, and a copy is provided to both parties.

- The original ETR is retained by the seller’s representative until the transaction is completed.

Challenges and Solutions

Completing the ETR paperwork can be challenging, especially for those who are new to real estate transactions. Some common challenges include:

- Incomplete or inaccurate information: Ensuring that all required information is complete and accurate is crucial to avoid delays or disputes.

- Technical issues: Technical problems, such as software glitches or connectivity issues, can cause delays in completing the ETR paperwork.

- Work with experienced professionals, such as real estate agents or attorneys, who are familiar with the ETR paperwork requirements.

- Use reliable software and technology to complete the ETR paperwork efficiently and accurately.

Benefits of ETR Paperwork

The benefits of ETR paperwork include:

- Increased security: The ETR provides an additional layer of security for both the buyer and the seller, ensuring that the transaction is legitimate and secure.

- Improved efficiency: The ETR paperwork can be completed quickly and efficiently, reducing the time and effort required to complete the transaction.

- Reduced risk: The ETR helps to reduce the risk of disputes or misappropriation of funds, providing peace of mind for both parties.

📝 Note: It is essential to work with experienced professionals and use reliable software to complete the ETR paperwork efficiently and accurately.

Conclusion and Final Thoughts

In conclusion, understanding the ETR paperwork requirements is crucial for a smooth and successful real estate transaction. The ETR provides proof of payment, secures the transaction, and complies with regulatory requirements. By following the steps involved in completing the ETR paperwork and working with experienced professionals, buyers and sellers can ensure a secure and efficient transaction. It is essential to remember that the ETR paperwork requirements may vary depending on the jurisdiction, so it is crucial to consult with local authorities or professionals to ensure compliance.

What is an Electronic Trust Receipt (ETR)?

+

An Electronic Trust Receipt (ETR) is a document used in real estate transactions to confirm the receipt of funds by the seller’s representative.

What are the benefits of ETR paperwork?

+

The benefits of ETR paperwork include increased security, improved efficiency, and reduced risk of disputes or misappropriation of funds.

How do I complete the ETR paperwork?

+

To complete the ETR paperwork, work with experienced professionals, such as real estate agents or attorneys, and use reliable software to ensure efficiency and accuracy.