Parttime Employee Paperwork Requirements

Introduction to Part-Time Employee Paperwork Requirements

When hiring part-time employees, it’s essential to understand the necessary paperwork requirements to ensure compliance with labor laws and regulations. As an employer, you must provide your part-time employees with the required documents and forms to maintain a smooth and lawful working relationship. In this article, we’ll discuss the essential paperwork requirements for part-time employees, including tax forms, employment contracts, and benefits documentation.

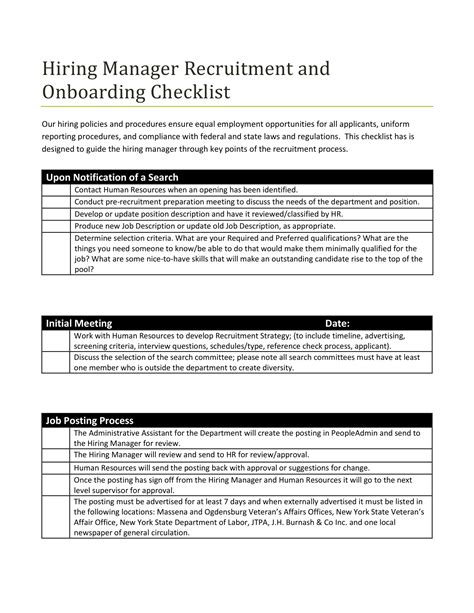

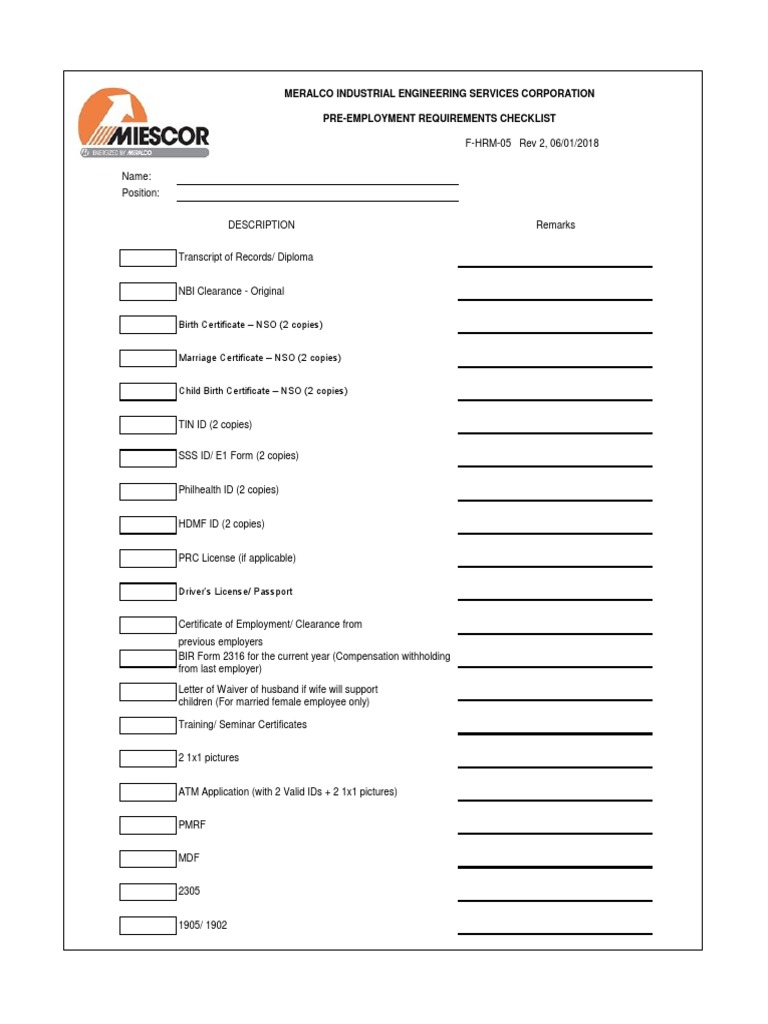

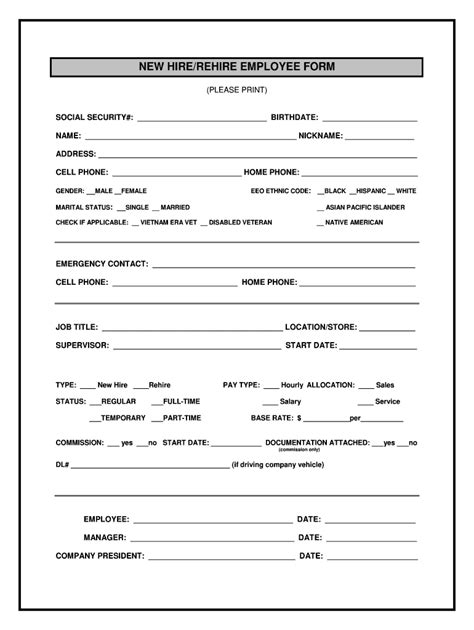

Pre-Employment Paperwork

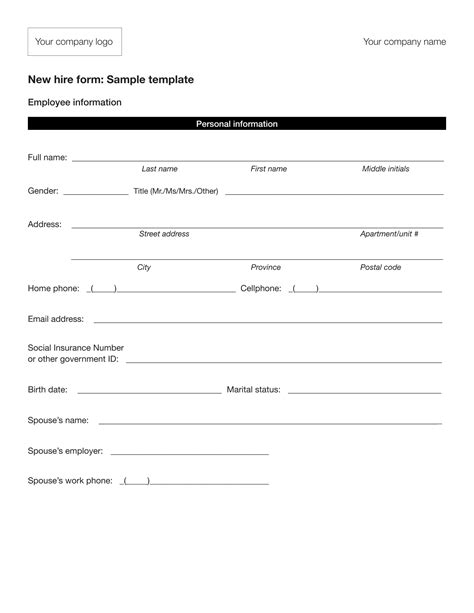

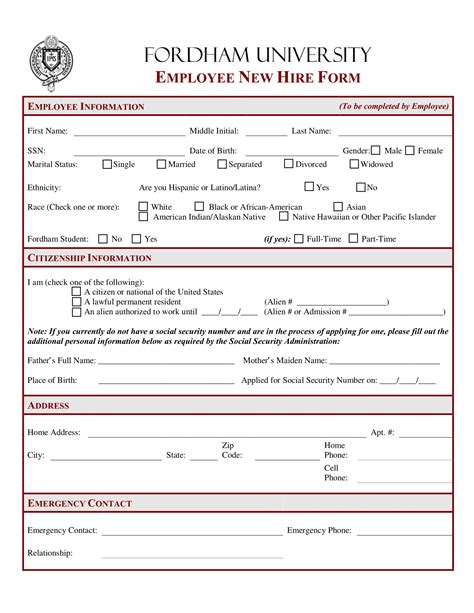

Before hiring a part-time employee, you must complete the necessary pre-employment paperwork. This includes:

- I-9 Form: Verify the employee’s identity and employment authorization

- W-4 Form: Determine the employee’s tax withholding

- State Tax Withholding Form: Determine the employee’s state tax withholding

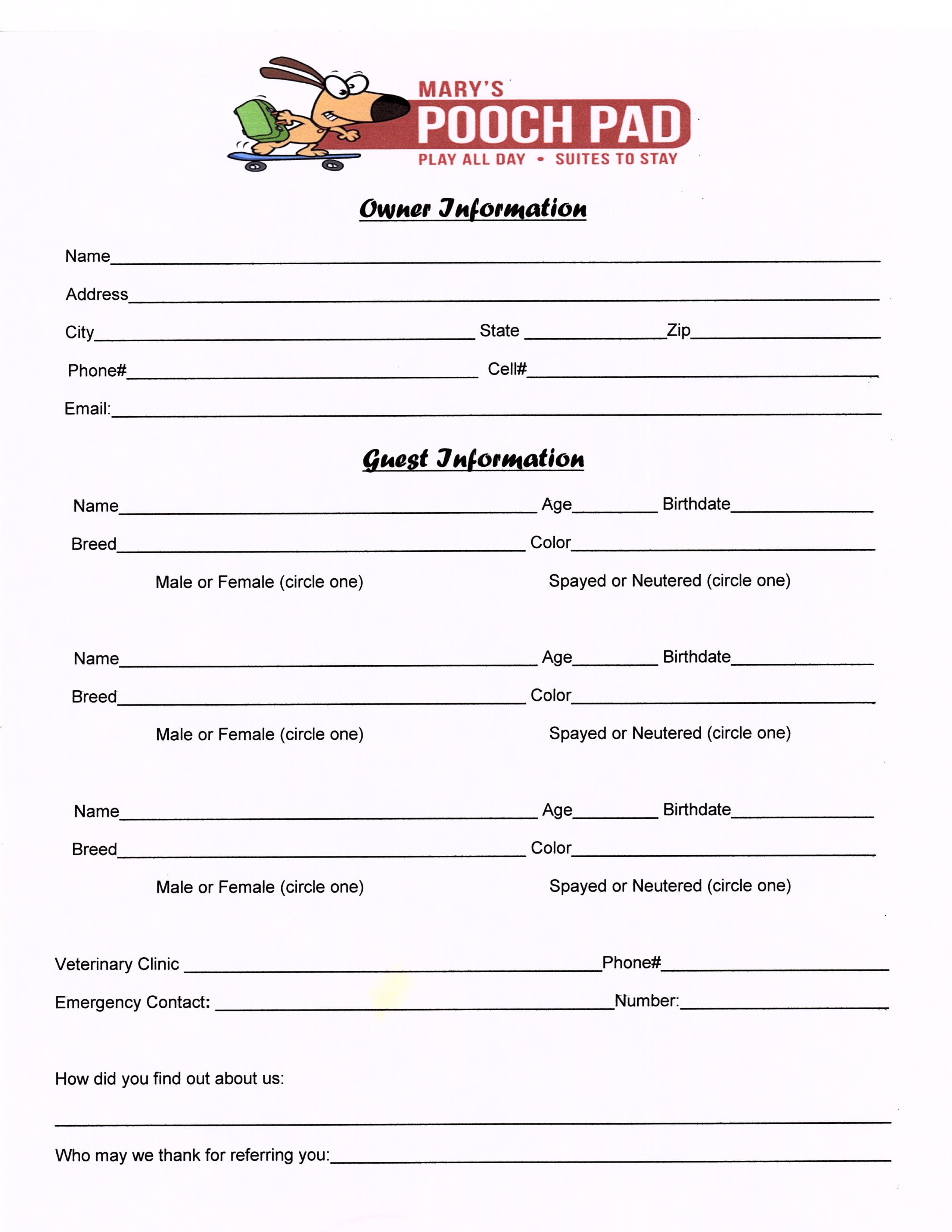

- Employee Information Form: Collect employee contact information, emergency contacts, and other relevant details

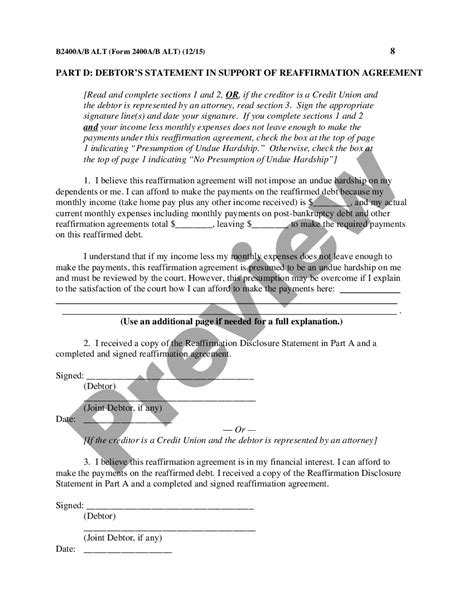

Employment Contract and Job Description

A part-time employment contract outlines the terms and conditions of the employee’s job, including job responsibilities, working hours, pay rate, and benefits. The contract should also include information about termination procedures and confidentiality agreements. A job description is also essential, as it provides a detailed outline of the employee’s duties and responsibilities.

📝 Note: It’s essential to have a lawyer review your employment contract to ensure it complies with local laws and regulations.

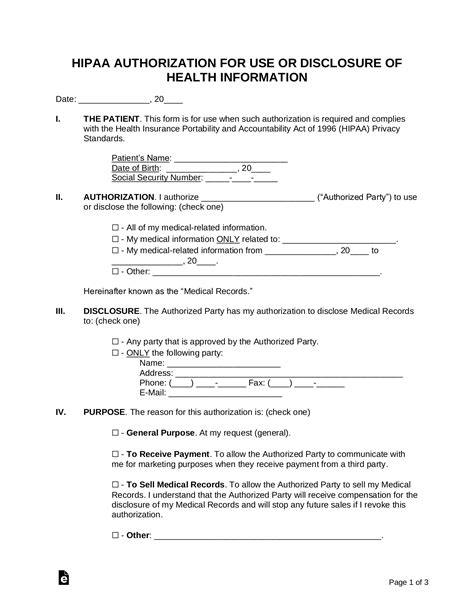

Tax Forms and Compliance

As an employer, you must comply with tax laws and regulations. This includes:

- Withholding Taxes: Withhold federal, state, and local taxes from the employee’s wages

- Reporting Taxes: Report the employee’s wages and taxes withheld to the relevant authorities

- Providing Tax Forms: Provide the employee with the necessary tax forms, such as the W-2 form, by the required deadline

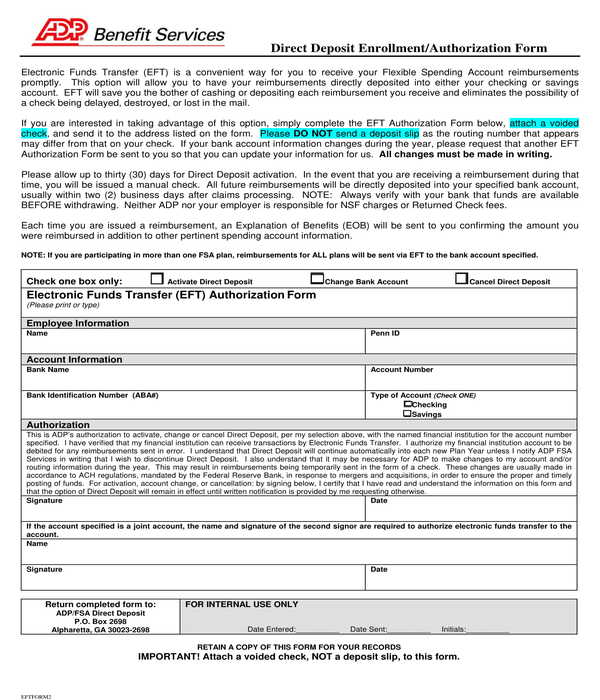

Benefits and Leave Documentation

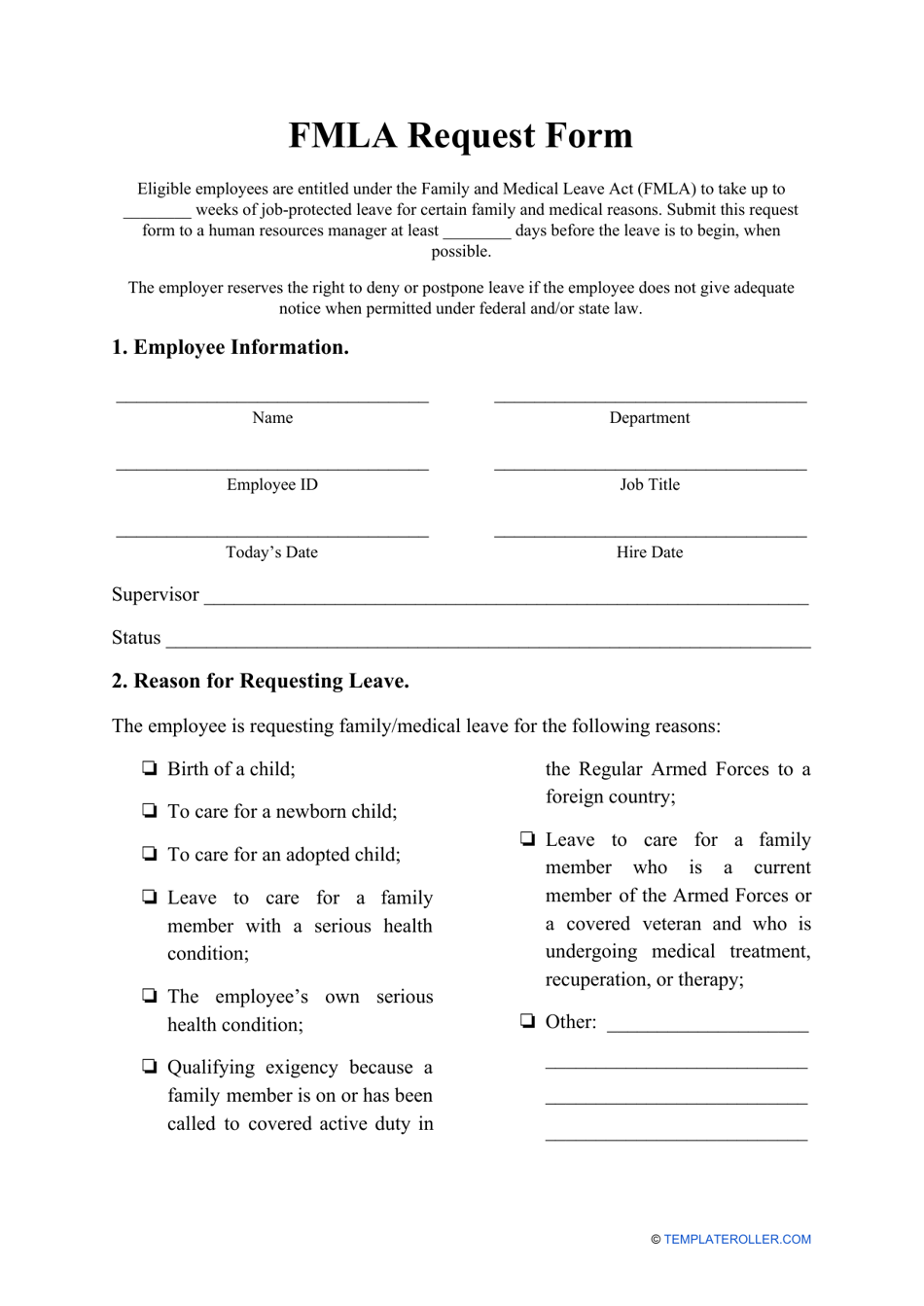

If you offer benefits to your part-time employees, such as health insurance or paid time off, you must provide the necessary documentation. This includes:

- Benefits Enrollment Forms: Enroll the employee in the benefits program

- Leave Request Forms: Allow the employee to request time off

- Benefits Termination Forms: Terminate benefits when the employee leaves the company

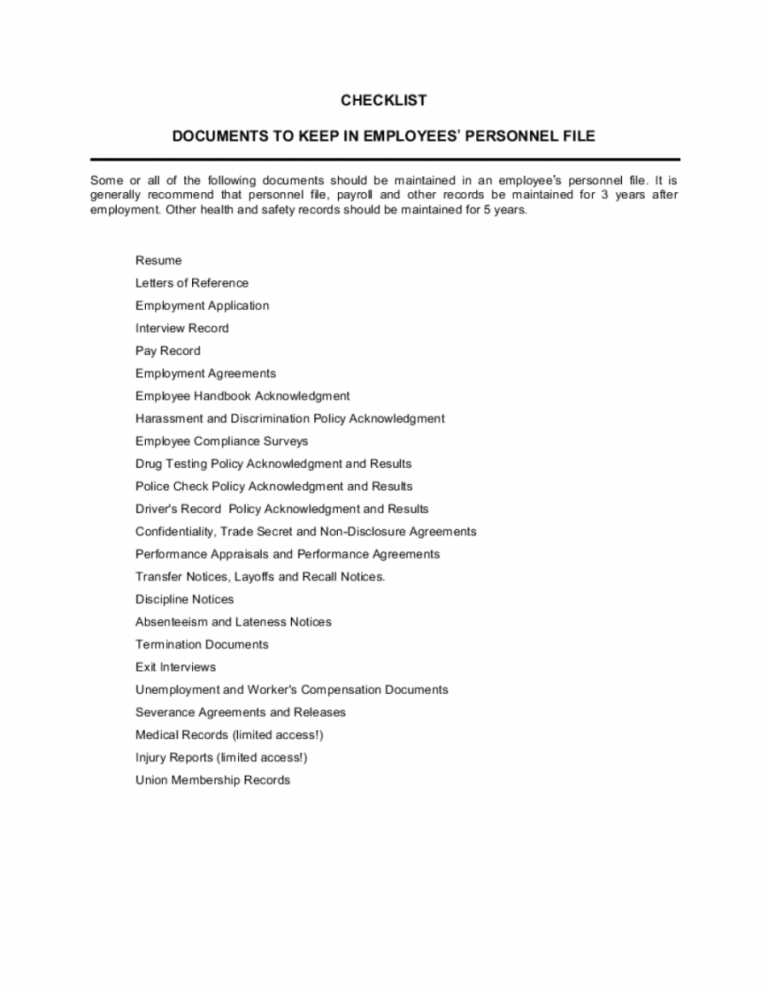

Record Keeping and Compliance

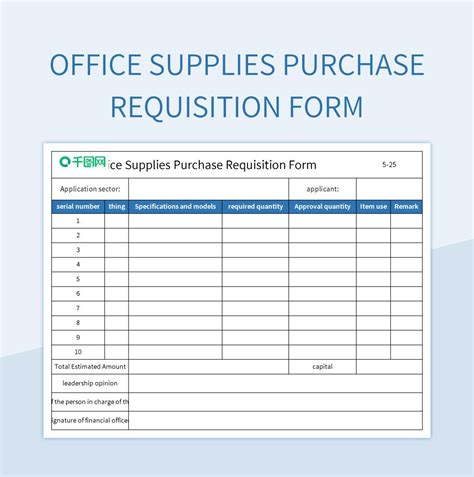

As an employer, you must maintain accurate and complete records of your part-time employees’ paperwork, including:

| Document | Description |

|---|---|

| I-9 Form | Verify employee identity and employment authorization |

| W-4 Form | Determine employee tax withholding |

| Employment Contract | Outline terms and conditions of employment |

| Job Description | Outline employee job responsibilities and duties |

Maintaining accurate records helps ensure compliance with labor laws and regulations.

In summary, hiring part-time employees requires careful attention to paperwork requirements, including tax forms, employment contracts, and benefits documentation. By understanding and complying with these requirements, you can ensure a smooth and lawful working relationship with your part-time employees. The key takeaways from this article include the importance of pre-employment paperwork, employment contracts, tax compliance, benefits documentation, and record keeping. By following these guidelines, you can minimize the risk of non-compliance and ensure a successful working relationship with your part-time employees.

What is the purpose of the I-9 form?

+

The I-9 form is used to verify the identity and employment authorization of new employees.

What is the difference between a W-4 form and a state tax withholding form?

+

The W-4 form determines the employee’s federal tax withholding, while the state tax withholding form determines the employee’s state tax withholding.

What is the importance of maintaining accurate records of employee paperwork?

+

Maintaining accurate records of employee paperwork helps ensure compliance with labor laws and regulations, and can help minimize the risk of non-compliance and associated penalties.