5 Tips 2017 Tax Return

Understanding the 2017 Tax Return

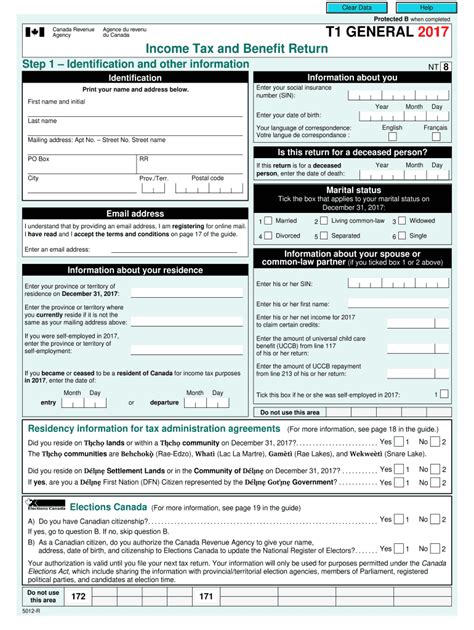

The 2017 tax return season was marked by several changes and updates to the tax code, including the introduction of new tax credits and deductions. As taxpayers navigated the complex landscape of tax law, it was essential to stay informed about the latest developments and requirements. In this blog post, we will provide an overview of the key aspects of the 2017 tax return and offer five valuable tips to help individuals and businesses maximize their refunds and minimize their tax liabilities.

Key Changes to the 2017 Tax Return

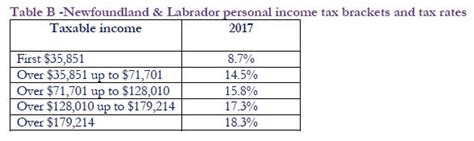

The 2017 tax return was affected by several key changes, including: * New tax credits: The 2017 tax year introduced new tax credits, such as the Child Tax Credit and the Earned Income Tax Credit. * Changes to tax deductions: The standard deduction was increased, and new limits were imposed on itemized deductions. * Updated tax brackets: The tax brackets were adjusted to reflect inflation and other economic factors.

5 Tips for the 2017 Tax Return

To ensure a smooth and successful tax filing experience, consider the following five tips: * Gather all necessary documents: Before starting the tax return process, gather all required documents, including W-2 forms, 1099 forms, and receipts for deductions. * Take advantage of tax credits: Claim all eligible tax credits, such as the Child Tax Credit and the Earned Income Tax Credit, to reduce tax liability. * Itemize deductions carefully: Itemize deductions only if they exceed the standard deduction, and be sure to keep accurate records of expenses. * Consider hiring a tax professional: If unsure about any aspect of the tax return process, consider hiring a tax professional to ensure accuracy and maximize refunds. * File electronically: File the tax return electronically to reduce errors and speed up the refund process.

💡 Note: The IRS offers free tax filing options for eligible taxpayers, including those with incomes below $66,000.

Additional Tips and Reminders

In addition to the five tips outlined above, keep the following points in mind when preparing the 2017 tax return: * Report all income: Report all income, including income from freelance work, investments, and other sources. * Keep accurate records: Keep accurate records of expenses, including receipts and invoices, to support deductions. * Meet the filing deadline: File the tax return by the deadline to avoid penalties and interest.

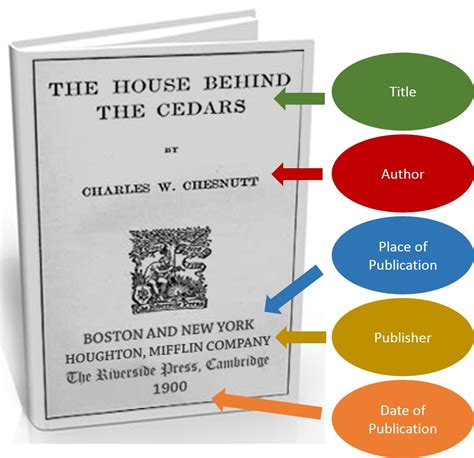

| Tax Filing Status | Standard Deduction |

|---|---|

| Single | $6,350 |

| Married Filing Jointly | $12,700 |

| Married Filing Separately | $6,350 |

| Head of Household | $9,350 |

As the tax return process can be complex and time-consuming, it is essential to stay informed and seek professional help when needed. By following these tips and staying up-to-date on the latest tax developments, individuals and businesses can ensure a successful and stress-free tax filing experience.

In final thoughts, the 2017 tax return season presented several challenges and opportunities for taxpayers. By understanding the key changes and updates to the tax code and following the five tips outlined above, individuals and businesses can maximize their refunds and minimize their tax liabilities. Remember to stay informed, keep accurate records, and seek professional help when needed to ensure a successful tax filing experience.

What is the deadline for filing the 2017 tax return?

+

The deadline for filing the 2017 tax return was April 18, 2017.

Can I still file the 2017 tax return if I missed the deadline?

+

Yes, you can still file the 2017 tax return, but you may be subject to penalties and interest.

How do I claim the Child Tax Credit on the 2017 tax return?

+

To claim the Child Tax Credit, complete Form 1040 and attach Schedule 8812.