LaSalle Payroll Paperwork Explained

Introduction to LaSalle Payroll Paperwork

LaSalle payroll paperwork is an essential aspect of managing employee compensation and benefits. It involves a series of documents and forms that must be completed accurately and submitted on time to ensure compliance with relevant laws and regulations. In this article, we will delve into the world of LaSalle payroll paperwork, exploring its importance, key components, and best practices for management.

Understanding the Importance of LaSalle Payroll Paperwork

LaSalle payroll paperwork is crucial for several reasons. Firstly, it helps to ensure that employees are paid correctly and on time, which is essential for maintaining morale and productivity. Secondly, it provides a record of employee compensation and benefits, which can be useful for tax purposes and other compliance requirements. Finally, it helps to prevent errors and discrepancies that can lead to costly penalties and fines.

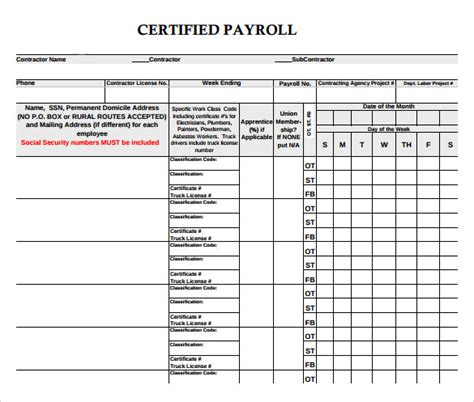

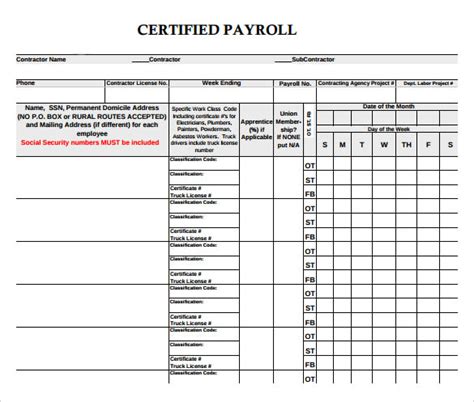

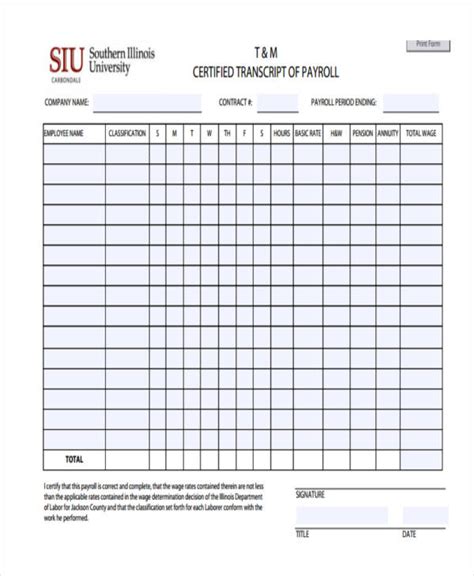

Key Components of LaSalle Payroll Paperwork

LaSalle payroll paperwork typically consists of several key components, including: * Payroll registers: These are records of employee payments, including gross pay, taxes, and deductions. * Pay stubs: These are documents that provide employees with a detailed breakdown of their pay, including earnings, taxes, and deductions. * W-2 forms: These are annual tax forms that provide a summary of employee compensation and taxes withheld. * W-4 forms: These are forms that employees complete to determine their tax withholding. * Benefits enrollment forms: These are forms that employees complete to enroll in benefits, such as health insurance and retirement plans.

Best Practices for Managing LaSalle Payroll Paperwork

To manage LaSalle payroll paperwork effectively, it is essential to follow best practices, including: * Accuracy and attention to detail: Payroll paperwork must be completed accurately and thoroughly to prevent errors and discrepancies. * Timeliness: Payroll paperwork must be submitted on time to ensure compliance with relevant laws and regulations. * Organization and record-keeping: Payroll paperwork must be organized and stored securely to prevent loss or damage. * Compliance with laws and regulations: Payroll paperwork must comply with relevant laws and regulations, including tax laws and labor laws.

Common Challenges and Solutions

LaSalle payroll paperwork can be challenging to manage, especially for small businesses or those with limited resources. Common challenges include: * Errors and discrepancies: Errors and discrepancies can occur due to inaccurate or incomplete payroll paperwork. * Compliance issues: Compliance issues can arise due to failure to comply with relevant laws and regulations. * Lost or damaged documents: Lost or damaged documents can lead to delays and penalties.

To overcome these challenges, it is essential to implement solutions, such as: * Automating payroll processes: Automating payroll processes can help to reduce errors and discrepancies. * Implementing a payroll software system: Implementing a payroll software system can help to streamline payroll processes and ensure compliance. * Providing training and support: Providing training and support can help to ensure that employees understand their roles and responsibilities in managing payroll paperwork.

💡 Note: It is essential to review and update payroll paperwork regularly to ensure compliance with changing laws and regulations.

LaSalle Payroll Paperwork and Tax Compliance

LaSalle payroll paperwork plays a critical role in tax compliance. Employers must withhold taxes from employee wages and submit tax payments to the relevant authorities. Failure to comply with tax laws and regulations can result in penalties and fines.

To ensure tax compliance, it is essential to: * Withhold taxes accurately: Withhold taxes accurately from employee wages to prevent underpayment or overpayment of taxes. * Submit tax payments on time: Submit tax payments on time to prevent penalties and fines. * File tax returns accurately: File tax returns accurately to prevent errors and discrepancies.

LaSalle Payroll Paperwork and Benefits Administration

LaSalle payroll paperwork also plays a critical role in benefits administration. Employers must administer benefits, such as health insurance and retirement plans, in accordance with relevant laws and regulations.

To ensure compliance, it is essential to: * Enroll employees in benefits: Enroll employees in benefits, such as health insurance and retirement plans, in accordance with relevant laws and regulations. * Administer benefits accurately: Administer benefits accurately to prevent errors and discrepancies. * Communicate benefits information: Communicate benefits information to employees to ensure they understand their benefits and how to access them.

| Payroll Paperwork Component | Description |

|---|---|

| Payroll registers | Records of employee payments, including gross pay, taxes, and deductions. |

| Pay stubs | Documents that provide employees with a detailed breakdown of their pay, including earnings, taxes, and deductions. |

| W-2 forms | Annual tax forms that provide a summary of employee compensation and taxes withheld. |

| W-4 forms | Forms that employees complete to determine their tax withholding. |

| Benefits enrollment forms | Forms that employees complete to enroll in benefits, such as health insurance and retirement plans. |

In summary, LaSalle payroll paperwork is a critical aspect of managing employee compensation and benefits. It involves a series of documents and forms that must be completed accurately and submitted on time to ensure compliance with relevant laws and regulations. By following best practices and implementing solutions, employers can ensure accurate and timely payroll paperwork, prevent errors and discrepancies, and maintain compliance with tax laws and regulations.

What is LaSalle payroll paperwork?

+

LaSalle payroll paperwork refers to the series of documents and forms that must be completed accurately and submitted on time to ensure compliance with relevant laws and regulations.

Why is LaSalle payroll paperwork important?

+

LaSalle payroll paperwork is important because it helps to ensure that employees are paid correctly and on time, provides a record of employee compensation and benefits, and helps to prevent errors and discrepancies that can lead to costly penalties and fines.

What are the key components of LaSalle payroll paperwork?

+

The key components of LaSalle payroll paperwork include payroll registers, pay stubs, W-2 forms, W-4 forms, and benefits enrollment forms.