Paperwork

Deceased Spouse Paperwork Requirements

Introduction to Deceased Spouse Paperwork

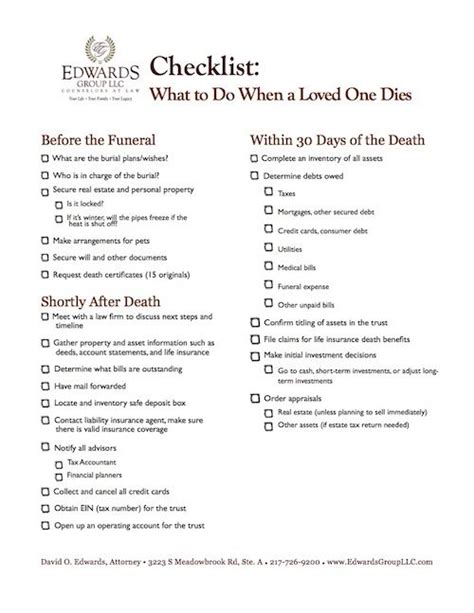

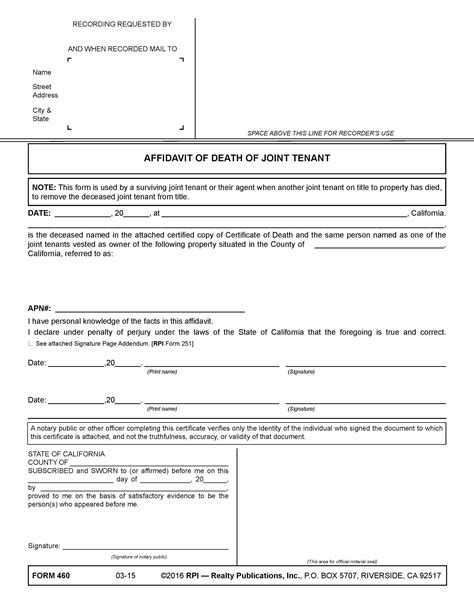

When a spouse passes away, the surviving spouse is left to navigate a complex and often overwhelming array of tasks, including managing the deceased spouse’s estate, notifying relevant parties, and completing various paperwork requirements. This process can be emotionally challenging and time-consuming, but it is essential to ensure that all necessary steps are taken to settle the estate and move forward. In this article, we will explore the various paperwork requirements that a surviving spouse may need to complete after the death of their partner.

Notifying Relevant Parties

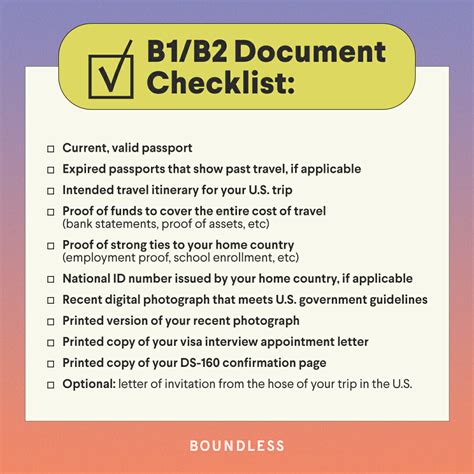

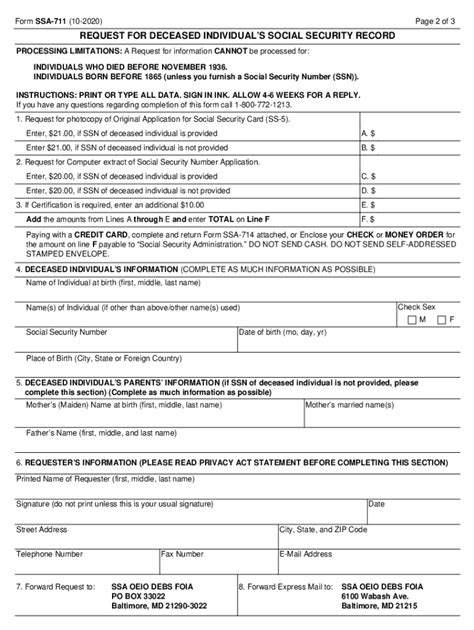

One of the first steps that a surviving spouse needs to take is to notify relevant parties of the deceased spouse’s passing. This may include: * Social Security Administration: The surviving spouse needs to notify the Social Security Administration of the deceased spouse’s death to stop their benefits and potentially apply for survivor benefits. * Insurance Companies: The surviving spouse needs to notify life insurance companies, health insurance companies, and any other insurance providers of the deceased spouse’s death to file claims and make changes to policies. * Banks and Financial Institutions: The surviving spouse needs to notify banks and financial institutions of the deceased spouse’s death to freeze accounts, settle debts, and transfer assets. * Credit Reporting Agencies: The surviving spouse needs to notify credit reporting agencies of the deceased spouse’s death to prevent identity theft and ensure that the deceased spouse’s credit report is updated.

Estate Planning Documents

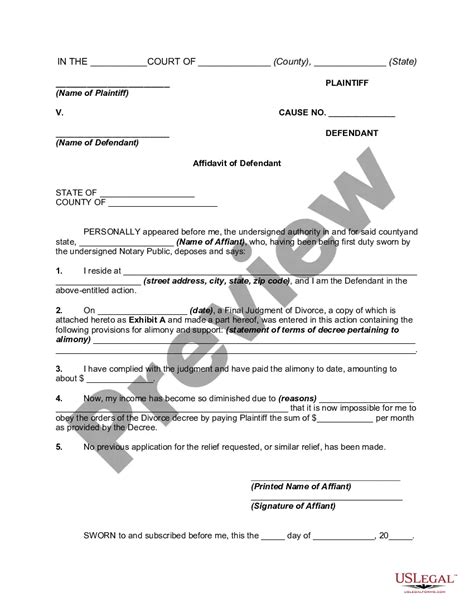

The surviving spouse will need to locate and review the deceased spouse’s estate planning documents, including: * Will: The surviving spouse needs to review the deceased spouse’s will to understand their wishes regarding the distribution of their assets. * Trusts: The surviving spouse needs to review any trusts that the deceased spouse may have established to understand how assets will be managed and distributed. * Power of Attorney: The surviving spouse needs to review any power of attorney documents that the deceased spouse may have established to understand who has been appointed to manage their affairs.

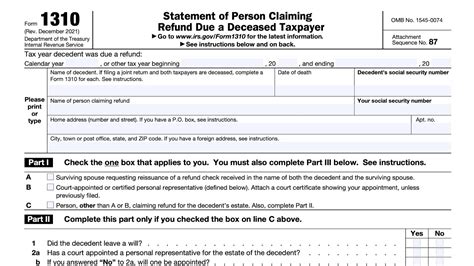

Tax-Related Paperwork

The surviving spouse will need to complete various tax-related paperwork, including: * Final Tax Return: The surviving spouse needs to file a final tax return for the deceased spouse to report their income and pay any taxes owed. * Estate Tax Return: The surviving spouse may need to file an estate tax return if the deceased spouse’s estate exceeds a certain threshold. * Inheritance Tax Return: The surviving spouse may need to file an inheritance tax return if the deceased spouse’s estate is subject to inheritance tax.

Benefit-Related Paperwork

The surviving spouse may be eligible for various benefits, including: * Survivor Benefits: The surviving spouse may be eligible for survivor benefits from the Social Security Administration or other government agencies. * Life Insurance Benefits: The surviving spouse may be eligible for life insurance benefits if the deceased spouse had a life insurance policy. * Pension Benefits: The surviving spouse may be eligible for pension benefits if the deceased spouse had a pension plan.

📝 Note: The surviving spouse should keep accurate records of all paperwork and correspondence related to the deceased spouse's estate, as this information may be needed for future reference.

Conclusion and Next Steps

In conclusion, the paperwork requirements for a deceased spouse can be complex and time-consuming, but it is essential to ensure that all necessary steps are taken to settle the estate and move forward. The surviving spouse should take their time, seek professional advice if needed, and prioritize their own well-being during this challenging period. By following the steps outlined in this article and seeking support when needed, the surviving spouse can navigate the paperwork requirements with confidence and ensure that the deceased spouse’s estate is settled in accordance with their wishes.

What is the first step I should take after my spouse passes away?

+

The first step you should take is to notify relevant parties, such as the Social Security Administration, insurance companies, banks, and credit reporting agencies, of your spouse’s passing.

Do I need to file a final tax return for my deceased spouse?

+

Yes, you will need to file a final tax return for your deceased spouse to report their income and pay any taxes owed.

Am I eligible for survivor benefits from the Social Security Administration?

+

You may be eligible for survivor benefits from the Social Security Administration, depending on your age, income, and other factors. You should contact the Social Security Administration to determine your eligibility.