Selling Home Tax Paperwork Deadline

Understanding the Tax Implications of Selling Your Home

When you decide to sell your home, it’s essential to consider the tax implications that come with it. The tax paperwork deadline for selling a home can be complex, and missing it can result in penalties and fines. In this article, we’ll guide you through the process of understanding the tax implications of selling your home and provide you with a comprehensive overview of the tax paperwork deadline.

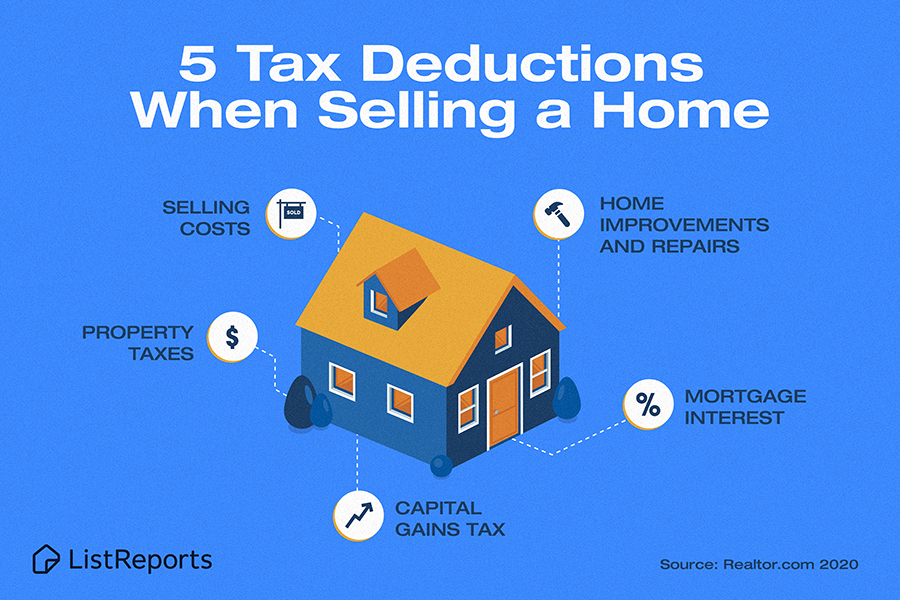

Capital Gains Tax

When you sell your primary residence, you may be subject to capital gains tax. This tax is applied to the profit you make from the sale of your home. The amount of tax you owe will depend on your tax filing status, the length of time you’ve owned the property, and the amount of profit you’ve made. It’s crucial to understand that capital gains tax can be a significant expense, and failing to report it correctly can lead to penalties.

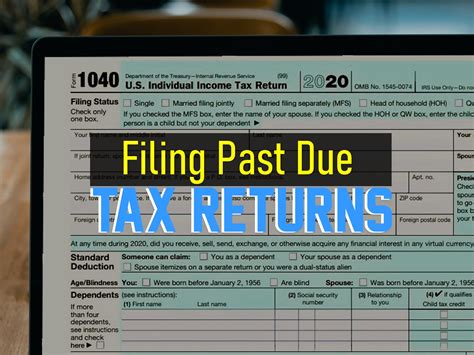

Tax Paperwork Deadline

The tax paperwork deadline for selling a home is typically the same as the deadline for filing your annual tax return. In the United States, this deadline is usually April 15th. However, if you’re selling a home, you may need to file additional forms, such as Form 8594, which is used to report the sale of your primary residence. It’s essential to consult with a tax professional to ensure you’re meeting all the necessary deadlines.

Forms You’ll Need to File

When selling a home, you’ll need to file the following forms: * Form 1040: This is the standard form used for personal income tax returns. * Form 8594: This form is used to report the sale of your primary residence. * Form 8828: This form is used to report the recapture of depreciation on a home office or rental property. * Schedule D: This form is used to report capital gains and losses.

📝 Note: It's essential to keep accurate records of your home sale, including the sale price, closing costs, and any improvements made to the property.

Exemptions and Deductions

There are several exemptions and deductions available to homeowners who sell their primary residence. These include: * Primary Residence Exemption: If you’ve lived in your home for at least two of the five years leading up to the sale, you may be eligible for a tax exemption of up to 250,000 (500,000 for married couples). * Home Office Deduction: If you’ve used a portion of your home for business purposes, you may be eligible for a home office deduction. * Improvement Deductions: If you’ve made improvements to your home, such as renovations or additions, you may be eligible for a deduction.

Consequences of Missing the Deadline

Missing the tax paperwork deadline for selling a home can result in penalties and fines. These can include: * Late filing penalties: These can range from 5% to 25% of the tax owed. * Late payment penalties: These can range from 0.5% to 1% of the tax owed per month. * Interest on unpaid taxes: This can accrue on the unpaid tax balance.

Table of Tax Forms and Deadlines

| Form | Description | Deadline |

|---|---|---|

| Form 1040 | Personal income tax return | April 15th |

| Form 8594 | Sale of primary residence | April 15th |

| Form 8828 | Recapture of depreciation | April 15th |

| Schedule D | Capital gains and losses | April 15th |

In summary, selling a home can have significant tax implications, and it’s essential to understand the tax paperwork deadline and the forms you’ll need to file. By consulting with a tax professional and keeping accurate records, you can ensure you’re meeting all the necessary deadlines and taking advantage of available exemptions and deductions. As you navigate the complex process of selling your home, remember to stay organized and seek professional advice to avoid any potential pitfalls.

What is the deadline for filing tax paperwork when selling a home?

+

The deadline for filing tax paperwork when selling a home is typically April 15th, which is the same as the deadline for filing your annual tax return.

What forms do I need to file when selling my primary residence?

+

You’ll need to file Form 1040, Form 8594, and Schedule D, as well as any other forms required for your specific situation.

Are there any exemptions or deductions available when selling a home?

+

Yes, there are several exemptions and deductions available, including the primary residence exemption, home office deduction, and improvement deductions.