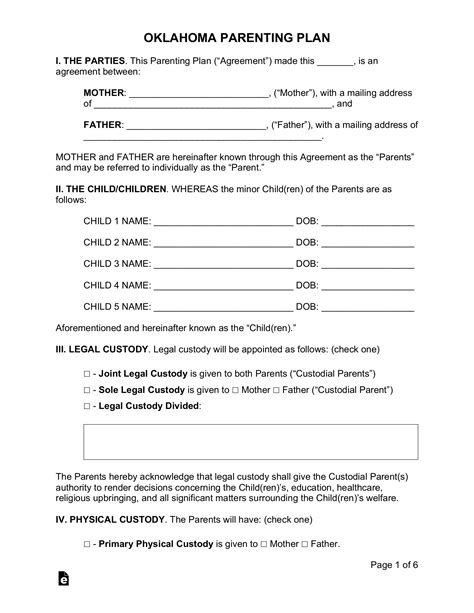

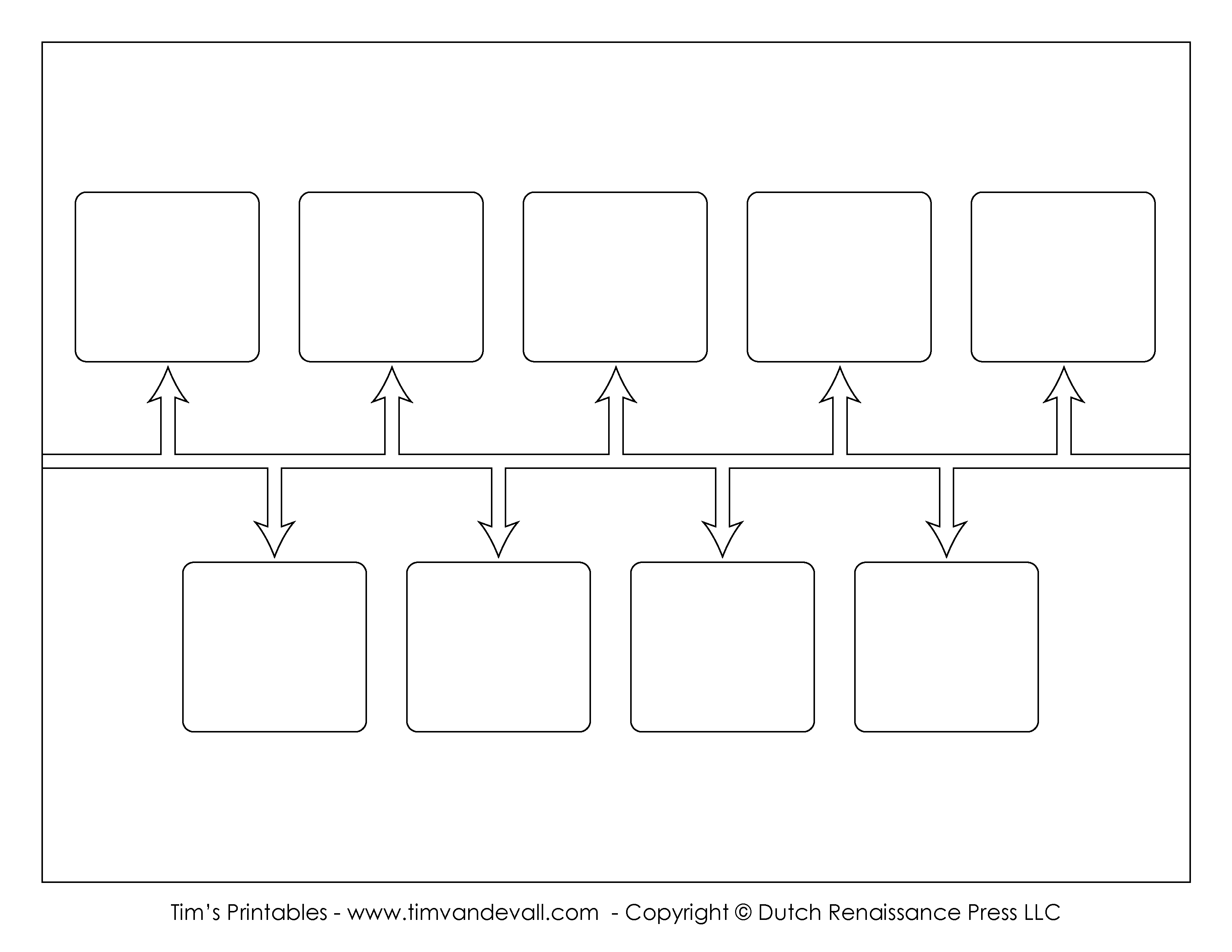

After Closing Paperwork Timeline

Understanding the After Closing Paperwork Timeline

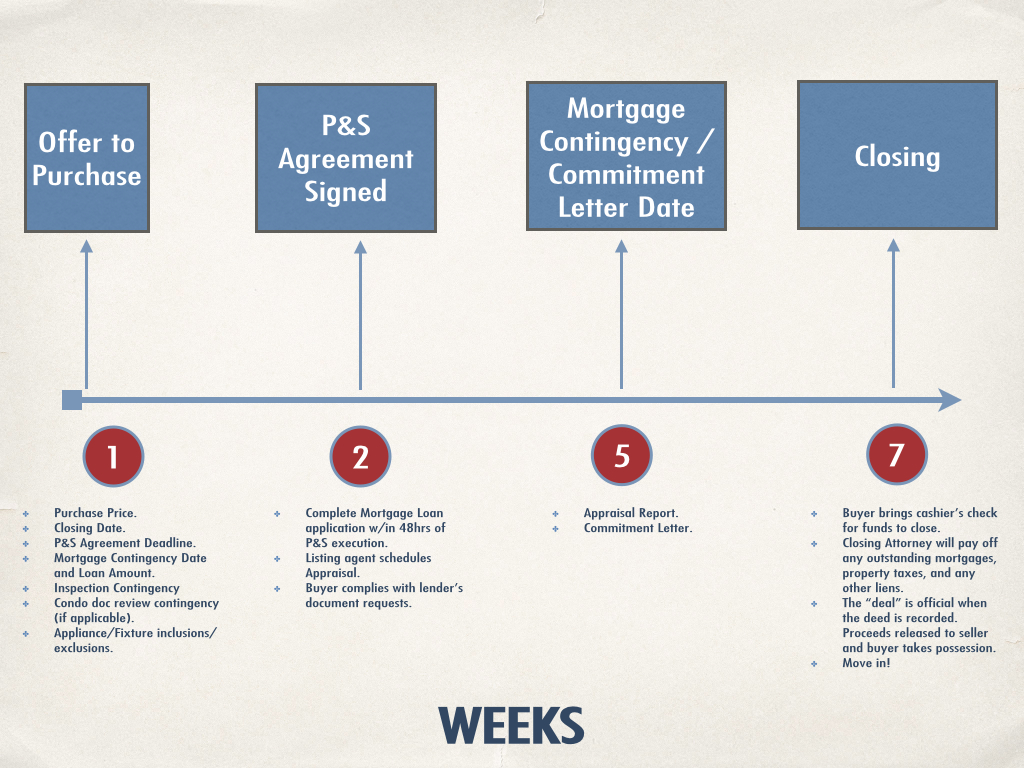

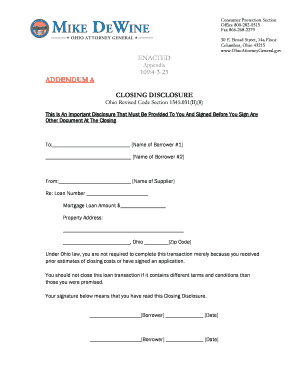

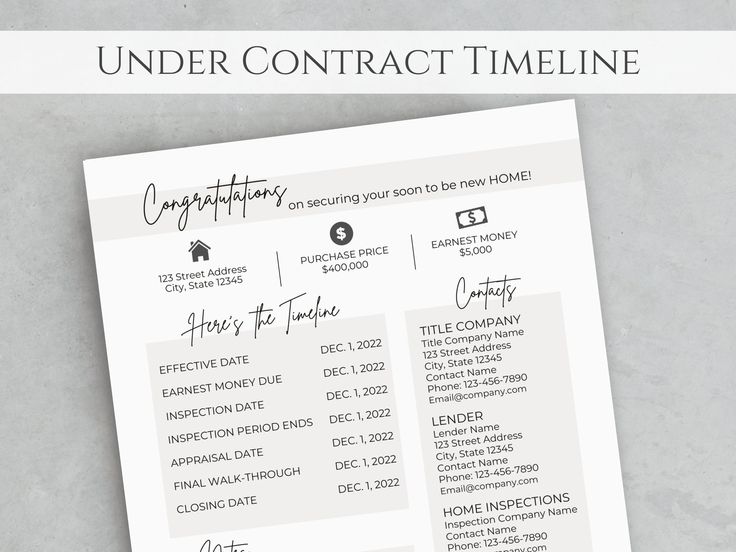

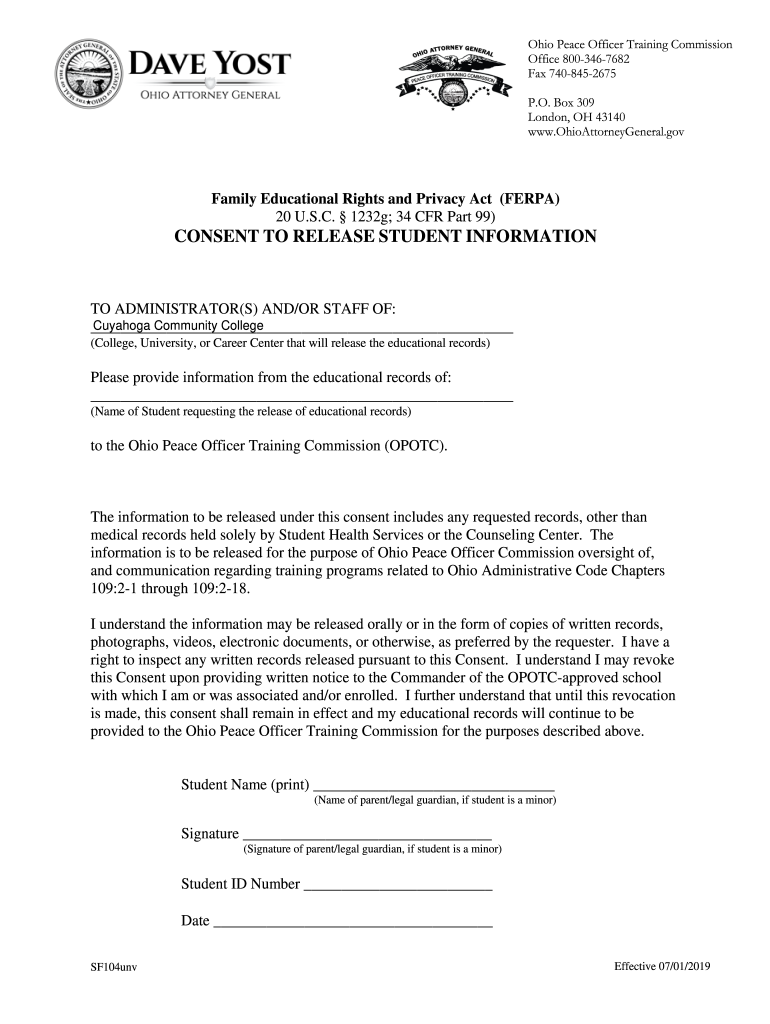

The process of buying or selling a property involves a significant amount of paperwork, and this continues even after the closing of the deal. The after-closing paperwork timeline is crucial for both buyers and sellers to ensure that all necessary documents are filed and recorded correctly. This period can be complex, involving various stakeholders, including lenders, attorneys, and government agencies. It’s essential to understand the steps involved and the timeline for each to avoid any potential issues.

Immediate Post-Closing Actions

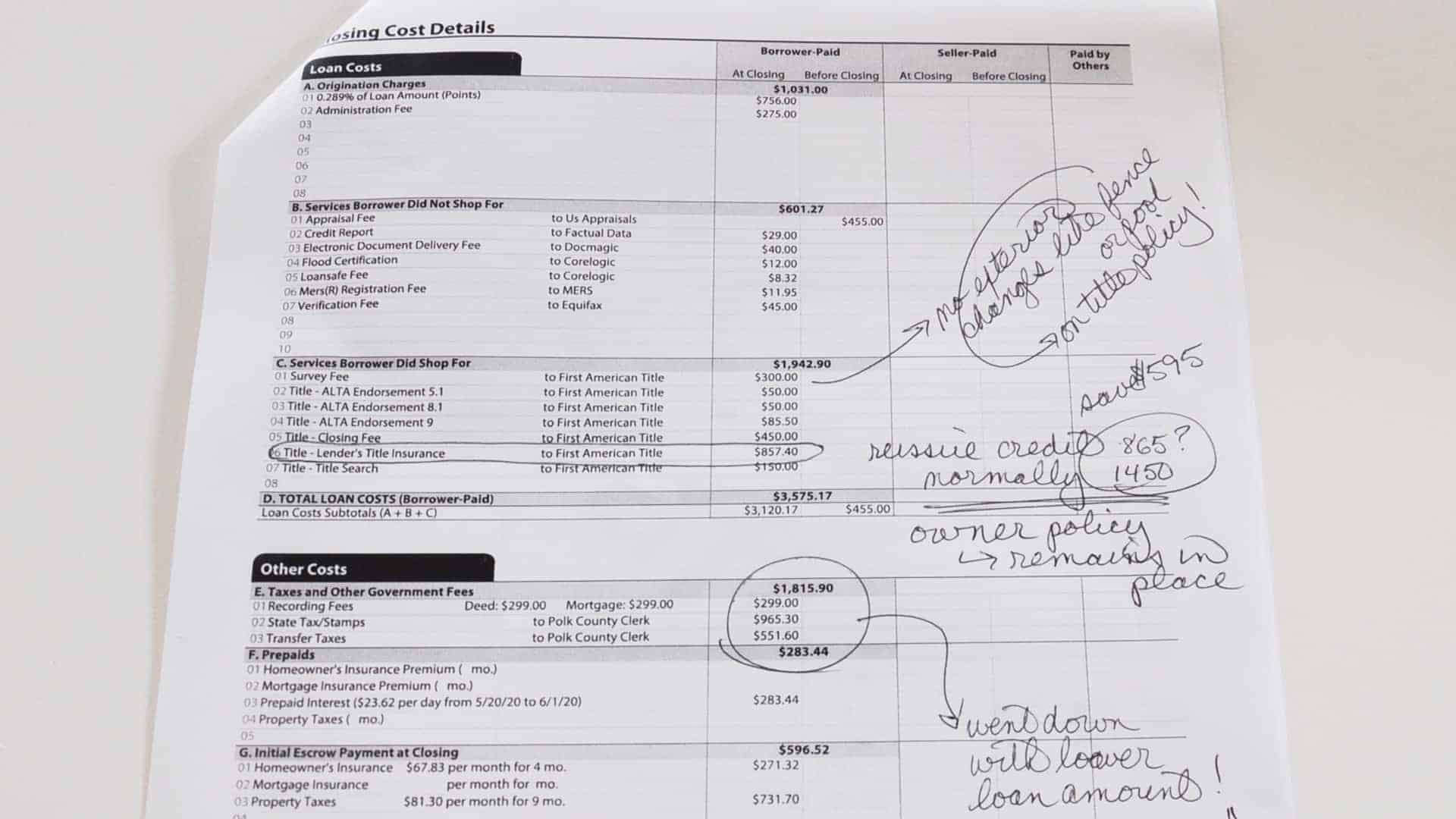

Immediately after closing, several actions need to be taken: - Recordation of Deed: The deed to the property needs to be recorded in the public records. This is typically done by the seller’s attorney or the title company. It’s a critical step as it provides public notice of the change in ownership. - Transfer of Funds: The transfer of funds from the buyer to the seller is completed. This includes the payment of the purchase price and any adjustments for taxes, insurance, and other expenses. - Notification of Utilities: The buyer should notify the utility companies (electricity, water, gas, etc.) of the change in ownership to ensure that services are not interrupted and that bills are sent to the correct party.

Short-Term Post-Closing Actions (1-30 Days)

In the short term, the following actions are typically taken: - Update Property Records: The local government updates its property records to reflect the new ownership. This may involve changing the tax billing address and updating the property tax records. - Notification of Insurance: The buyer should notify their insurance provider of the purchase to ensure continuous coverage. - Review and Understand Loan Terms: If the buyer has financed the purchase, they should review and understand the terms of their loan, including the interest rate, payment schedule, and any prepayment penalties.

Medium-Term Post-Closing Actions (30-90 Days)

Over the next few months, the following steps are usually undertaken: - Receipt of Title Insurance: The buyer receives their title insurance policy, which protects them against any defects in the title that may have been missed during the title search. - Review of Property Tax Assessment: The buyer should review their property tax assessment to ensure it’s accurate and reflects any exemptions they may be eligible for, such as a homestead exemption. - Familiarization with Homeowners Association (HOA) Rules: If the property is part of an HOA, the buyer should familiarize themselves with the community’s rules and regulations.

Long-Term Post-Closing Actions (After 90 Days)

In the long term: - Annual Review of Property Taxes and Insurance: The buyer should annually review their property taxes and insurance premiums to ensure they are taking advantage of all available deductions and exemptions. - Maintenance of Property Records: It’s essential to keep all property records, including the deed, title insurance policy, and loan documents, in a safe and accessible place. - Compliance with Local Ordinances: The buyer must comply with all local ordinances and regulations regarding property maintenance and use.

📝 Note: The specific steps and timeline can vary significantly depending on the jurisdiction and the terms of the sale. It's crucial to work with experienced professionals, such as real estate attorneys and title companies, to ensure that all post-closing actions are handled correctly.

Importance of Timely Action

Timely action on these post-closing steps is vital to avoid potential legal and financial issues. For instance, failure to record the deed can lead to disputes over ownership, while neglecting to notify utilities can result in service interruptions. Similarly, not reviewing and understanding loan terms can lead to unexpected financial obligations.

| Action | Timeline | Responsibility |

|---|---|---|

| Recordation of Deed | Immediate | Seller's Attorney or Title Company |

| Transfer of Funds | Immediate | Escrow Company |

| Notification of Utilities | Immediate | Buyer |

| Update Property Records | Short-Term | Local Government |

| Receipt of Title Insurance | Medium-Term | Title Insurance Company |

In summary, the after-closing paperwork timeline is a critical phase in the property buying or selling process. It involves various steps and stakeholders, and understanding the timeline and responsibilities can help ensure a smooth transition of ownership. Whether you’re a buyer or a seller, being informed and proactive during this period can prevent potential issues and protect your interests.

To recap, the key to a successful post-closing process is attention to detail, timely action, and collaboration with the right professionals. By following the outlined steps and being aware of the timeline, individuals can navigate this complex phase with confidence, securing their investment and avoiding unnecessary complications.

What is the first step after closing a property deal?

+

The first step after closing a property deal is typically the recordation of the deed, which provides public notice of the change in ownership.

Who is responsible for notifying the utilities after a property sale?

+

The buyer is usually responsible for notifying the utility companies of the change in ownership to ensure continuous service and accurate billing.

Why is it important to review property tax assessments after purchasing a property?

+

Reviewing property tax assessments is crucial to ensure they are accurate and to take advantage of any exemptions the buyer may be eligible for, which can help reduce tax liabilities.